Is NCL safe?

Business

License

Is NCL Safe or Scam?

Introduction

NCL, or NCL Financial Group Ltd., positions itself as a player in the forex market, promising traders access to various financial instruments. However, with the rise of online trading platforms, it is imperative for traders to exercise caution and conduct thorough evaluations before committing their capital. The foreign exchange market is notorious for its risks, and choosing the wrong broker can lead to significant financial losses. This article aims to provide an objective analysis of NCLs safety and legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. Our investigation is based on comprehensive online research and reviews, focusing on key indicators of broker reliability.

Regulatory and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety. NCL claims to operate under the auspices of the National Futures Association (NFA), but it is essential to note that it holds an unauthorized NFA license. This raises serious concerns regarding its compliance with industry standards and regulations. Below is a summary of NCL's regulatory information:

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| NFA | 0505983 | United States | Unauthorized |

The lack of valid regulatory oversight significantly elevates the risk associated with trading through NCL. Moreover, the broker's official website is currently non-functional, making it nearly impossible for potential clients to verify its legitimacy or obtain crucial information. The absence of a reliable regulatory framework suggests that traders may be exposed to potential scams, making it imperative to tread carefully when considering NCL as a trading partner.

Company Background Investigation

NCL Financial Group Ltd. has been in operation for approximately 5 to 10 years, but its history and ownership structure remain opaque. Limited information is available regarding its founding, evolution, and management team. The lack of transparency raises red flags about the company's credibility. A thorough background check on the management team reveals that there is little to no publicly available professional history or qualifications, which is concerning for potential investors.

In addition, NCL's overall transparency and information disclosure are inadequate. A reputable broker typically provides comprehensive details about its operations, regulatory compliance, and management. The inability to access such information can be indicative of deeper issues within the company, leading to questions about its commitment to maintaining professional standards and accountability. Given these factors, traders must be cautious when assessing whether NCL is safe for their trading activities.

Trading Conditions Analysis

Understanding the trading conditions offered by NCL is crucial for evaluating its overall appeal. The broker's fee structure appears to be opaque, with no clear information on spreads, commissions, or overnight interest rates. Such lack of clarity is often a warning sign, as reputable brokers typically provide transparent fee schedules. Here is a comparison of NCL's trading costs against industry averages:

| Fee Type | NCL | Industry Average |

|---|---|---|

| Spread on Major Pairs | Unknown | 1.0 - 2.0 pips |

| Commission Model | Unknown | Varies |

| Overnight Interest Range | Unknown | 0.5% - 3.0% |

The absence of defined trading costs can lead to unexpected fees, which may significantly impact a trader's profitability. Traders should be wary of any broker that does not clearly outline its fee structure, as this could indicate potential hidden charges. The overall lack of transparency in trading conditions is another factor contributing to the concerns about whether NCL is safe for trading.

Client Funds Security

The safety of client funds is paramount in the forex trading landscape. NCL's measures for safeguarding client funds are currently unclear. A reputable broker typically implements stringent security protocols, including segregated accounts for client funds, investor protection schemes, and negative balance protection. However, there is no evidence that NCL adheres to these essential security measures.

The absence of information regarding fund segregation and protection raises concerns about the potential risks traders may face when using NCL. Historical disputes or incidents involving fund security could further exacerbate these risks. Therefore, it is essential for potential traders to conduct thorough due diligence regarding NCL's security measures and consider whether their funds would be safe in the broker's hands.

Customer Experience and Complaints

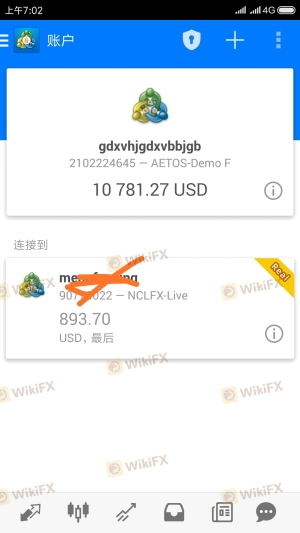

Customer feedback is a vital component in assessing a broker's reliability. Reviews and reports about NCL indicate a pattern of negative experiences, particularly concerning withdrawal difficulties and poor customer support. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Inconsistent |

| Lack of Transparency | High | Non-responsive |

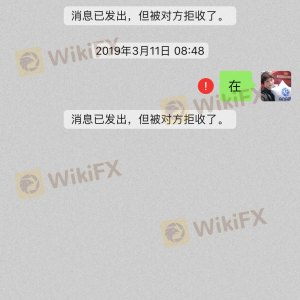

Many users have reported challenges in accessing their funds, which is a significant red flag for any trading platform. Additionally, the quality of customer service appears to be lacking, with numerous complaints about unresponsive support channels. The combination of these complaints strongly suggests that traders should approach NCL with caution, as these issues could indicate deeper operational problems.

Platform and Execution

Evaluating the performance of NCLs trading platform is essential for understanding the overall trading experience. Reports indicate that the platform may suffer from stability issues, leading to delayed order executions and potential slippage. Such concerns are critical, as they can directly impact a trader's ability to capitalize on market opportunities. Furthermore, any signs of platform manipulation could raise serious ethical questions about the broker's practices.

The lack of detailed information regarding execution quality and platform performance further compounds the uncertainty surrounding NCL. Traders must consider whether they are comfortable using a platform with such ambiguous performance metrics, as this could lead to unfavorable trading experiences.

Risk Assessment

The overall risk associated with using NCL is substantial. Below is a risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unauthorized NFA license |

| Fund Security | High | Lack of transparent security measures |

| Customer Service | Medium | Poor response to complaints |

| Trading Conditions | High | Opaque fee structure |

Given these risks, potential traders should carefully consider their risk tolerance before engaging with NCL. Recommendations for risk mitigation include seeking alternative, regulated brokers with transparent practices and robust customer support systems.

Conclusion and Recommendations

In conclusion, the evidence suggests that NCL raises several red flags that warrant caution. The unauthorized regulatory status, lack of transparency in trading conditions, and numerous customer complaints indicate that NCL may not be a safe choice for traders. Therefore, it is advisable for potential investors to approach this broker with extreme caution.

For traders seeking reliable alternatives, consider brokers that are fully regulated, have transparent fee structures, and provide robust customer support. Some reputable options in the forex market include established names with a proven track record of reliability and customer satisfaction. Ultimately, the decision to trade with NCL should be made with careful consideration of the associated risks and the broker's overall safety profile.

Is NCL a scam, or is it legit?

The latest exposure and evaluation content of NCL brokers.

NCL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NCL latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.