Regarding the legitimacy of MONETA MARKETS forex brokers, it provides FCA, FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is MONETA MARKETS safe?

Pros

Cons

Is MONETA MARKETS markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

MONETA MARKETS CAPITAL LTD

Effective Date: Change Record

2014-11-17Email Address of Licensed Institution:

compliance@monetamarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.monetamarkets.co.ukExpiration Time:

--Address of Licensed Institution:

Token House 11-12 Tokenhouse Yard London EC2R 7AS UNITED KINGDOMPhone Number of Licensed Institution:

+4402077092038Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MONETA MARKETS (PTY) LTD

Effective Date: Change Record

2016-11-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

18 CAVENDISH ROAD CLAREMONT CAPE TOWN 7708Phone Number of Licensed Institution:

021 0201540Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Moneta Markets Ltd

Effective Date:

--Email Address of Licensed Institution:

support@monetamarkets.scSharing Status:

No SharingWebsite of Licensed Institution:

https://www.monetamarkets.scExpiration Time:

--Address of Licensed Institution:

Office 2, Room B11, First Floor, Providence Complex, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4374725Licensed Institution Certified Documents:

Is Moneta Markets A Scam?

Introduction

Moneta Markets is an online trading platform that has emerged in the Forex and CFD trading landscape, positioning itself as a broker catering to both novice and experienced traders. Founded in 2019, it claims to offer access to a wide range of financial instruments, including Forex, commodities, indices, and share CFDs. However, the online trading environment is fraught with risks, and traders must exercise caution when selecting a broker. With numerous reports of scams and fraudulent activities in the Forex market, it is essential for traders to thoroughly evaluate the legitimacy and reliability of any broker before committing their funds.

This article aims to provide an objective analysis of Moneta Markets, assessing its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks. The evaluation is based on a comprehensive review of available information from credible sources, including regulatory filings, user reviews, and expert analyses.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and legitimacy of a trading platform. Moneta Markets operates under several regulatory jurisdictions, which is a positive sign for potential traders. However, the quality and strictness of these regulations vary significantly.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Sector Conduct Authority (FSCA) | 47490 | South Africa | Verified |

| Seychelles Financial Services Authority (FSA) | SD144 | Seychelles | Verified |

| Australian Securities and Investments Commission (ASIC) | 001298177 | Australia | Verified |

Moneta Markets is primarily regulated by the FSCA in South Africa, which is generally considered a reliable regulatory body, although it does not have the same level of strictness as Tier-1 regulators like the FCA in the UK or ASIC in Australia. The presence of multiple licenses, including one from the Seychelles, which is often viewed as a less stringent regulatory environment, raises some concerns about the overall regulatory oversight of Moneta Markets.

The broker's compliance history appears to be relatively clean, with no major regulatory infractions reported. However, the offshore license from Seychelles can be a red flag for some traders, as it may indicate a lack of robust investor protection. It is crucial for traders to understand that while regulation provides a layer of security, it does not eliminate all risks associated with trading.

Company Background Investigation

Moneta Markets is a subsidiary of Vantage International Group, which has been involved in the financial markets for over a decade. The company was established to provide retail clients with access to various trading instruments and platforms. This background suggests a level of experience in the industry, which can be reassuring for potential clients.

The management team at Moneta Markets comprises professionals with extensive backgrounds in finance and trading. However, detailed information about individual team members is limited, which can affect the perceived transparency of the broker. Transparency is vital in the financial industry, as it builds trust and confidence among clients.

Moneta Markets claims to maintain a high level of operational transparency, providing clients with information about its services, fees, and trading conditions. However, the lack of comprehensive disclosures regarding its ownership structure and management team may raise concerns for some traders. A broker's willingness to provide detailed information about its operations and management is often indicative of its commitment to client safety and satisfaction.

Trading Conditions Analysis

Understanding the trading conditions offered by Moneta Markets is essential for evaluating its competitiveness in the market. The broker provides various account types, including STP and ECN accounts, each with different fee structures.

Moneta Markets employs a commission-based model for its ECN accounts, while its STP accounts operate with no commissions but higher spreads. This structure is fairly standard in the industry, but traders should be aware of any hidden costs that may arise.

| Fee Type | Moneta Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 - 1.2 pips | 0.2 - 1.5 pips |

| Commission Model | $1 - $3 per lot | $5 - $8 per lot |

| Overnight Interest Range | Varies | Varies |

While Moneta Markets offers competitive spreads, especially on its ECN accounts, the commission fees can add up, particularly for high-frequency traders. Additionally, the broker does not charge deposit or withdrawal fees, which is a positive aspect for cost-conscious traders. However, it is essential to read the fine print regarding any potential fees that may be charged by third-party payment processors.

Overall, the trading conditions at Moneta Markets appear to be reasonable, but traders should conduct further research to ensure they fully understand the costs involved in their trading strategies.

Customer Fund Security

The security of client funds is a paramount concern for any trader. Moneta Markets takes several measures to protect client funds, including segregating client accounts from its operational funds. This practice ensures that client money is not used for the broker's business activities and is protected in the event of insolvency.

The broker claims to hold client funds in a segregated account with a reputable bank, which adds a layer of security. Additionally, Moneta Markets offers negative balance protection, meaning clients cannot lose more than their deposited funds, even in volatile market conditions.

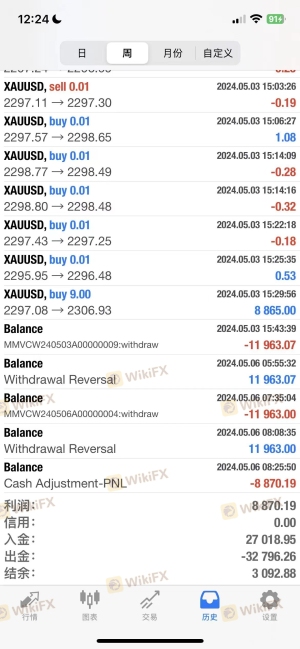

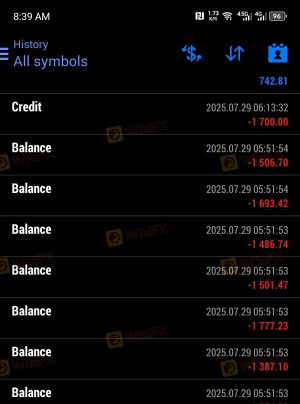

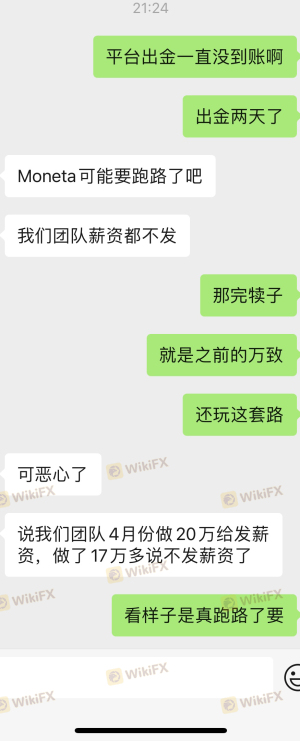

Despite these security measures, there have been some historical concerns regarding the safety of funds at Moneta Markets. Traders have reported difficulties in withdrawing funds and issues related to account management. While these incidents may not reflect the overall reliability of the broker, they serve as a reminder for traders to remain vigilant and conduct thorough due diligence before depositing significant amounts of capital.

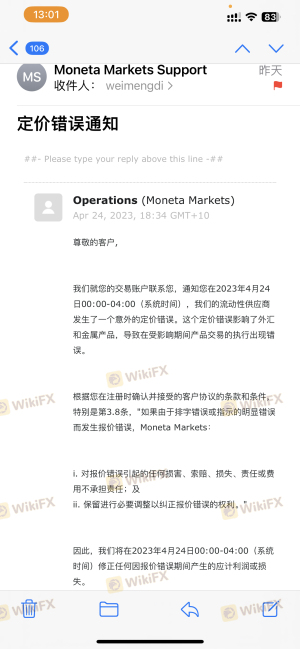

Customer Experience and Complaints

Customer feedback is an invaluable resource when evaluating a broker's reliability. Moneta Markets has received mixed reviews from clients, with some praising its trading platform and customer support, while others have raised concerns over withdrawal processes and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | Moderate response |

| Platform Performance | Low | Quick resolution |

Common complaints include withdrawal delays, particularly when clients attempt to access their profits. Some users have reported that their withdrawal requests were not processed promptly, leading to frustration and concern over the broker's reliability. However, the company has generally responded to these issues, albeit not always in a timely manner.

A few notable case studies highlight these concerns. For instance, a trader reported difficulties in withdrawing profits after a successful trading period, claiming that their request was met with vague explanations and delays. In contrast, another user praised the broker for its responsive customer support and efficient platform performance, indicating that experiences can vary significantly among clients.

Platform and Trade Execution

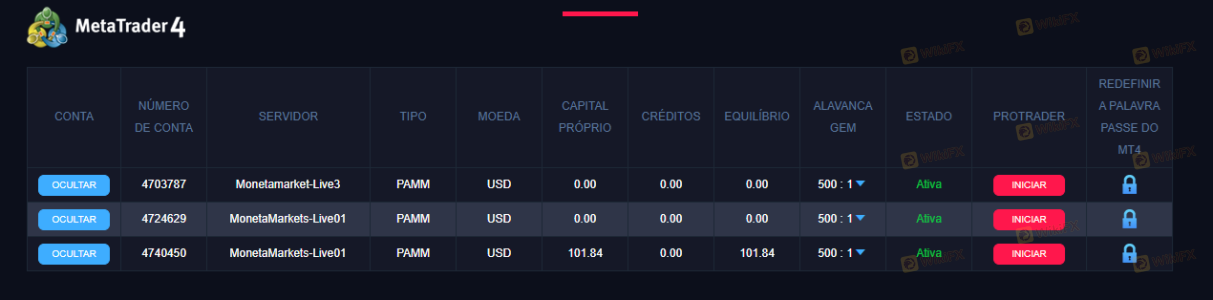

The trading platform's performance is critical for a seamless trading experience. Moneta Markets offers multiple trading platforms, including MetaTrader 4, MetaTrader 5, and its proprietary ProTrader platform. These platforms are generally well-received, with users appreciating their user-friendly interfaces and advanced charting tools.

However, some traders have reported issues with order execution, including slippage and re-quotes during volatile market conditions. While these issues are not uncommon in the industry, they can significantly impact a trader's profitability. Moneta Markets claims to provide fast execution speeds, but user experiences suggest that there may be occasional discrepancies.

Overall, the platform's stability and execution quality appear satisfactory, but traders should remain cautious and monitor their trades closely, especially during periods of high volatility.

Risk Assessment

Trading with Moneta Markets entails various risks, as with any financial trading platform. Understanding these risks is essential for making informed decisions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory oversight; offshore licenses may pose risks. |

| Operational Risk | Medium | Issues with withdrawals and account management reported by clients. |

| Market Risk | High | High volatility in Forex and CFD markets can lead to significant losses. |

To mitigate these risks, traders should employ sound risk management practices, including setting stop-loss orders, diversifying their portfolios, and only trading with funds they can afford to lose. Additionally, conducting thorough research and remaining informed about market conditions can help traders navigate potential pitfalls.

Conclusion and Recommendations

In conclusion, Moneta Markets appears to be a legitimate broker with several regulatory licenses and a range of trading instruments. However, there are some concerns regarding its offshore regulation, historical complaints related to fund withdrawals, and the overall transparency of its operations. While the broker offers competitive trading conditions and a user-friendly platform, potential clients should proceed with caution.

For traders considering Moneta Markets, it is advisable to start with a small investment and closely monitor their trading activities. Additionally, exploring alternative brokers with stronger regulatory oversight and more robust customer support may provide greater peace of mind. Brokers such as IG, OANDA, and FXTM are reputable alternatives that offer comprehensive trading services and investor protection. Ultimately, the decision to trade with Moneta Markets should be based on individual risk tolerance and investment objectives.

Is MONETA MARKETS a scam, or is it legit?

The latest exposure and evaluation content of MONETA MARKETS brokers.

MONETA MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MONETA MARKETS latest industry rating score is 7.10, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.10 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.