Moneta Markets 2025 Review: Everything You Need to Know

Executive Summary

Our comprehensive moneta markets review shows that Moneta Markets is a South African forex and CFD broker. The company has gained attention for its diverse trading options and global reach. The broker stands out by giving access to over 1,000 trading instruments across multiple asset classes, including forex, indices, commodities, shares, ETFs, and bonds.

Multiple sources confirm that Moneta Markets offers three main trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView. These platforms serve traders with different preferences and experience levels. The broker has made itself a complete solution for traders who want diverse investment opportunities in global financial markets.

The platform works especially well for traders who value platform variety and asset diversification. However, potential users should carefully check all aspects of the service before making investment decisions. This includes regulatory compliance, fee structures, and customer support quality.

Important Notice

This review uses publicly available information and user feedback collected from various sources as of 2025. Moneta Markets operates from South Africa and may offer different services across various regions due to local regulatory requirements.

Traders should know that regulatory frameworks can vary greatly between regions. This can affect available services, leverage ratios, and investor protections. We recommend that prospective clients verify current regulatory status and service availability in their specific location before opening an account.

This evaluation focuses on general platform features. It should not be considered as personalized investment advice.

Rating Framework

Based on available information and user feedback, here are our ratings for Moneta Markets across six key dimensions:

Broker Overview

Moneta Markets operates as an online forex and CFD broker providing global trading services from its South African headquarters. According to [BrokersWay], the company has established itself in the competitive online trading landscape by focusing on platform diversity and comprehensive asset coverage.

The broker's business model centers on providing retail and potentially institutional clients with access to international financial markets through sophisticated trading platforms. The company's approach emphasizes technological integration, offering traders access to industry-standard platforms while maintaining a focus on emerging markets accessibility.

[AZ Forex Brokers] reports that Moneta Markets has gained increased popularity in recent years. The broker has positioned itself as "one of the most discussed CFD brokers" in certain trading communities.

Moneta Markets provides trading services across multiple asset classes. [BrokersWay] confirms access to over 1,000 trading instruments. The broker's portfolio includes traditional forex pairs, global indices, commodities, individual shares, ETFs, and bonds, making it a comprehensive solution for traders seeking portfolio diversification.

The platform supports three main trading environments: MetaTrader 4 for traditional forex trading, MetaTrader 5 for more advanced features, and TradingView for chart analysis and social trading capabilities. While specific regulatory information requires verification, the broker's South African base suggests operations under local financial services regulations, though international service provision may involve additional regulatory considerations.

Regulatory Status: Current sources do not provide specific details about Moneta Markets' regulatory authorization or licensing bodies. Given the South African headquarters, potential clients should verify current regulatory status with local authorities.

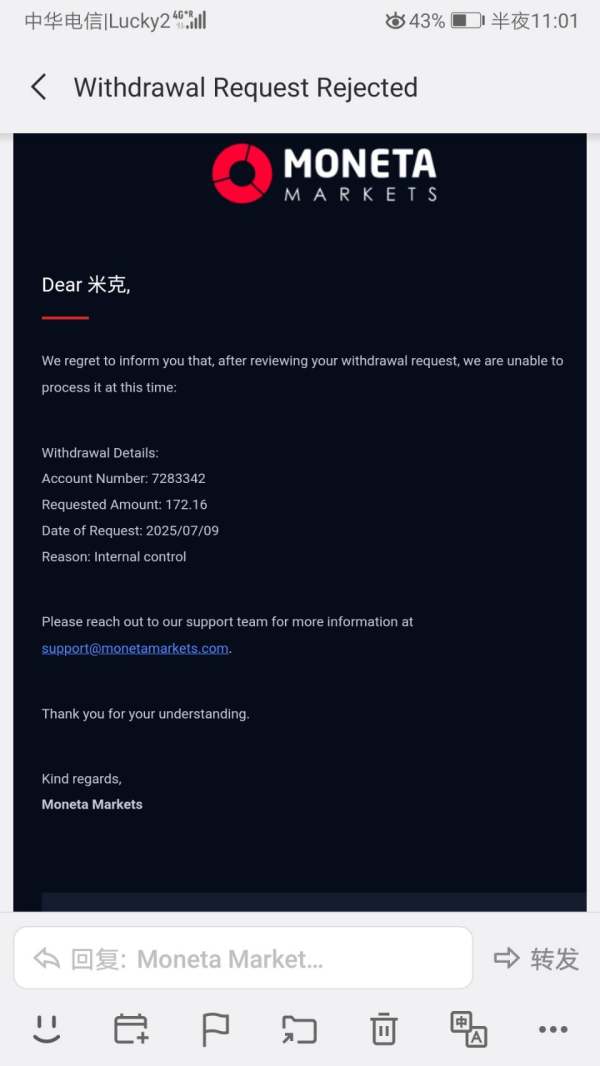

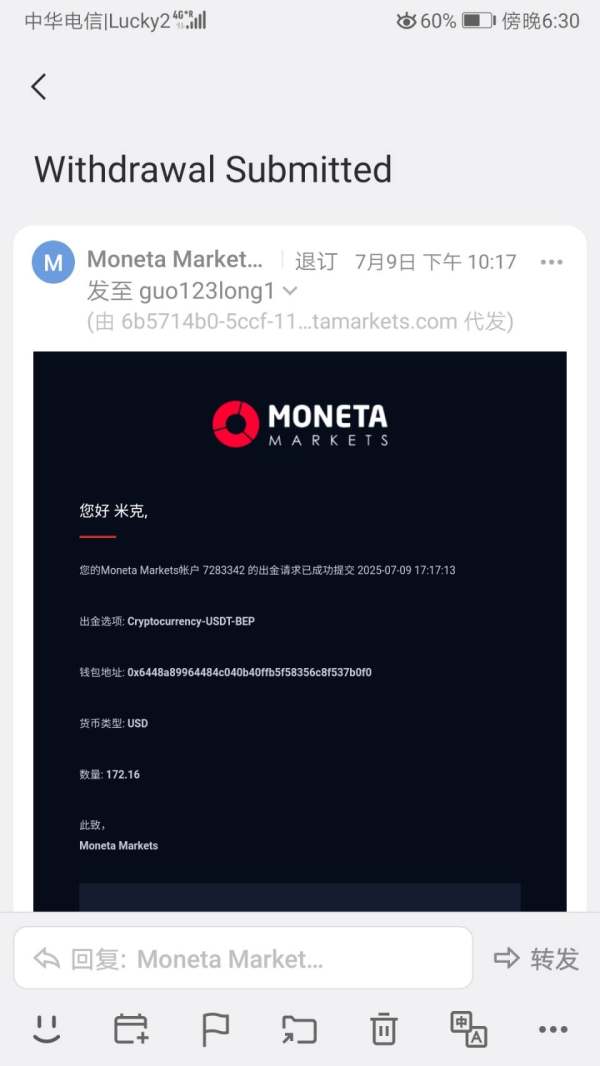

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees for deposits and withdrawals was not detailed in available sources. This information requires direct verification with the broker.

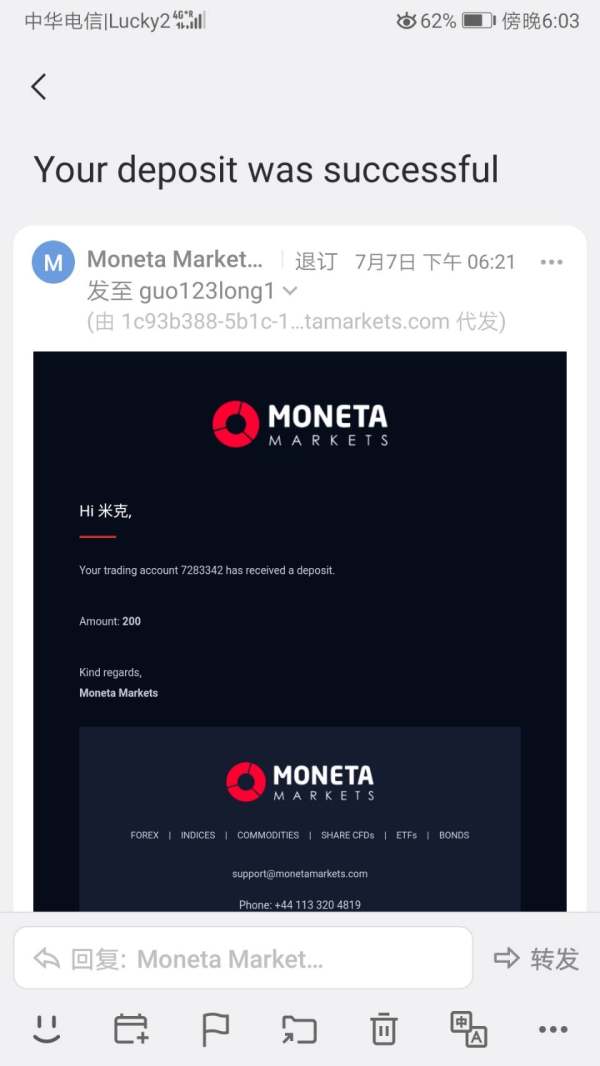

Minimum Deposit Requirements: Current sources do not specify minimum deposit amounts for different account types. This information should be confirmed directly with Moneta Markets.

Promotional Offers: Some sources reference bonus offers. One mentions a "50% Cashback" promotion for certain visitors, though terms and conditions require direct verification.

Available Assets: [BrokersWay] confirms access to 1000+ trading instruments across multiple categories. These include Forex pairs, global indices, commodities, individual shares, ETFs, and bonds, providing comprehensive market exposure.

Cost Structure: While sources indicate competitive positioning, specific spreads, commission rates, and overnight financing charges require direct verification from current rate schedules. Maximum leverage amounts and variations by asset class were not specified in available sources and should be confirmed based on current regulatory requirements and account types.

Platform Options: Three primary platforms confirmed: MetaTrader 4, MetaTrader 5, and TradingView integration. The broker offers both downloadable and web-based trading solutions.

Geographic Restrictions: Specific information about service availability in different countries was not provided in current sources. Available support languages were not specified in the reviewed materials.

This moneta markets review section highlights the need for direct verification of many operational details with the broker.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Moneta Markets' account structure appears designed to accommodate different trader profiles. However, specific details about account tiers and their respective benefits require direct verification. The broker's offering of 1000+ trading instruments across multiple asset classes suggests a comprehensive account setup that could appeal to both novice and experienced traders.

The platform's integration with three major trading environments (MT4, MT5, and TradingView) indicates flexibility in account access methods. However, critical details such as minimum deposit requirements, account maintenance fees, and specific features for different account levels were not clearly outlined in available sources.

According to available information, the broker appears to focus on accessibility and instrument variety rather than complex account hierarchies. This approach could benefit traders who prioritize straightforward account management over tiered privilege systems.

The absence of detailed fee structures in public information suggests potential clients should request comprehensive account documentation before committing. The account opening process specifics, including required documentation and verification timeframes, were not detailed in current sources.

Similarly, information about specialized account types, such as Islamic accounts for Sharia-compliant trading, was not available in the reviewed materials.

Moneta Markets demonstrates strong performance in the tools and resources category, primarily through its multi-platform approach. [BrokersWay] confirms the broker offers access to MetaTrader 4, MetaTrader 5, and TradingView platforms, providing traders with industry-standard tools for analysis and execution.

The MetaTrader suite integration suggests access to Expert Advisors (EAs), custom indicators, and automated trading capabilities. MT5's advanced features, including additional timeframes and improved strategy testing, complement MT4's widespread familiarity among forex traders.

TradingView integration adds social trading elements and advanced charting capabilities. With over 1,000 available instruments across forex, indices, commodities, shares, ETFs, and bonds, traders have substantial diversification opportunities within a single platform environment.

This comprehensive asset coverage supports various trading strategies and risk management approaches. However, specific information about proprietary research tools, economic calendars, market analysis resources, or educational materials was not detailed in available sources.

The absence of information about copy trading features, signal services, or advanced analytics tools represents areas where additional verification would be beneficial for potential clients.

Customer Service and Support Analysis (6/10)

Customer service evaluation for Moneta Markets faces limitations due to sparse specific feedback in available sources. While some references suggest the broker has gained popularity, detailed customer service experiences, response times, and support quality metrics were not extensively documented in the reviewed materials.

The absence of specific information about available support channels (live chat, phone, email), operating hours, or multilingual support capabilities makes comprehensive evaluation challenging. For a broker serving global markets from a South African base, customer service accessibility across different time zones would be particularly relevant.

Available sources do not provide user testimonials or detailed feedback about problem resolution processes, account management support, or technical assistance quality. The lack of documented customer service awards, certifications, or third-party evaluations further limits assessment capabilities.

Given the broker's positioning in international markets, the quality and accessibility of customer support could significantly impact user experience. This is particularly true for traders in regions with different business hours than South Africa.

Potential clients should prioritize testing customer service responsiveness during their evaluation process.

Trading Experience Analysis (7/10)

The trading experience at Moneta Markets appears well-supported by its multi-platform infrastructure. Access to MT4, MT5, and TradingView provides traders with options ranging from traditional forex trading to advanced multi-asset strategies and social trading features.

Platform reliability and execution quality data were not specifically detailed in available sources. However, the use of established platforms like MetaTrader suggests industry-standard performance expectations.

The broker's offering of 1000+ instruments across multiple asset classes provides substantial opportunity for strategy diversification. TradingView integration particularly enhances the trading experience by offering advanced charting capabilities, social trading features, and cross-device synchronization.

This combination with traditional MetaTrader platforms creates a comprehensive trading environment suitable for various trading styles. However, specific information about order execution speeds, slippage rates, requote frequency, or platform uptime statistics was not available in current sources.

Mobile trading capabilities, while likely available through standard MetaTrader mobile apps, were not specifically detailed in terms of feature completeness or user experience quality. This moneta markets review section emphasizes the importance of testing platform performance during evaluation periods to assess execution quality and overall trading experience.

Trust and Safety Analysis (5/10)

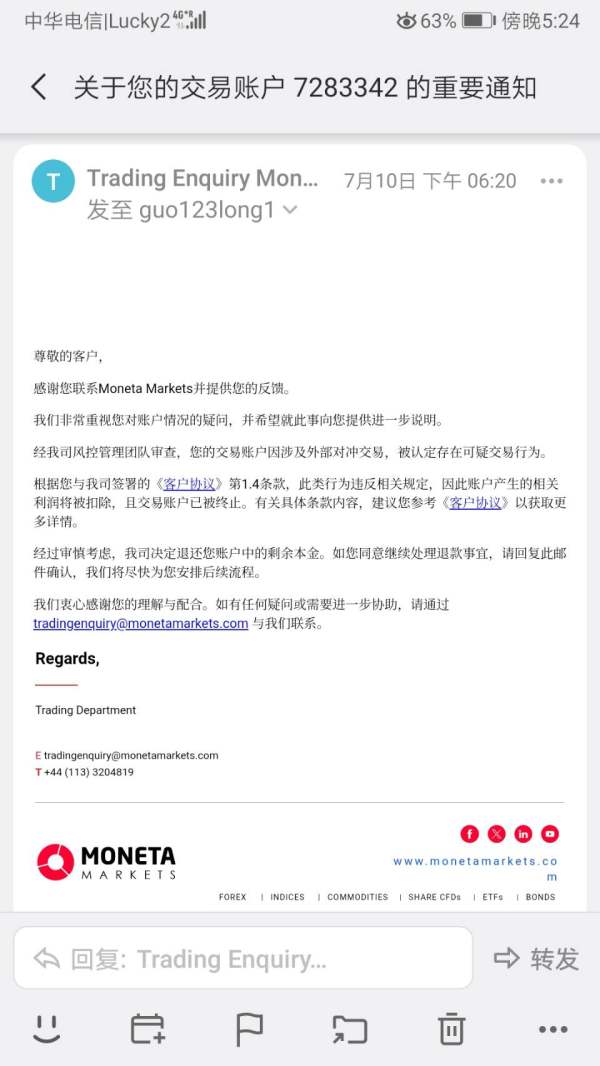

Trust and safety evaluation for Moneta Markets faces significant limitations due to insufficient regulatory and safety information in available sources. While the broker's South African headquarters is established, specific regulatory authorization details, licensing numbers, and oversight bodies were not clearly documented.

The absence of detailed information about client fund protection measures, segregated accounts, investor compensation schemes, or insurance coverage creates uncertainty about safety protocols. For international traders, understanding how funds are protected under South African regulations versus their home country protections becomes crucial.

Third-party audits, financial reporting transparency, and regulatory compliance history were not available in reviewed sources. The lack of information about negative balance protection, margin call procedures, or crisis management protocols further complicates safety assessment.

Company ownership structure, operational history, and any regulatory actions or awards were not detailed in available materials. For traders prioritizing security and regulatory oversight, these information gaps represent significant evaluation challenges that require direct investigation with relevant regulatory bodies.

The limited transparency in available public information about safety measures and regulatory compliance contributes to the conservative rating in this category.

User Experience Analysis (7/10)

User experience assessment for Moneta Markets shows promise through its platform variety and instrument accessibility. However, detailed user feedback was limited in available sources.

The broker's offering of three distinct platform options (MT4, MT5, TradingView) suggests attention to different user preferences and experience levels. The comprehensive asset coverage of 1000+ instruments could enhance user satisfaction by reducing the need for multiple broker relationships.

This consolidation potential appeals to traders seeking simplified portfolio management across various asset classes. Platform accessibility through web-based and downloadable options, particularly with TradingView integration, suggests modern user experience considerations.

However, specific feedback about interface design, navigation ease, or mobile experience quality was not extensively documented in available sources. Account management features, reporting capabilities, and administrative process efficiency were not detailed in current materials.

User onboarding experience, including account opening simplicity and verification processes, requires direct evaluation. The absence of detailed user testimonials or satisfaction surveys in available sources limits comprehensive user experience assessment.

Potential clients should prioritize hands-on platform testing and direct user feedback research when evaluating Moneta Markets for their trading needs.

Conclusion

This comprehensive moneta markets review reveals a broker with notable strengths in platform diversity and asset coverage. The company offers access to over 1,000 instruments through industry-standard MT4, MT5, and TradingView platforms.

The South African-based broker appears well-positioned for traders seeking comprehensive market access within a single platform environment. However, significant information gaps regarding regulatory details, specific fee structures, and detailed customer service capabilities require careful consideration.

Potential clients should prioritize direct verification of regulatory status, account terms, and safety measures before committing funds. Moneta Markets appears most suitable for experienced traders who value platform flexibility and asset diversification, while those prioritizing transparent regulatory information and detailed public documentation may need additional research.

The broker's growing popularity suggests positive user experiences. However, comprehensive due diligence remains essential for prospective clients.