Regarding the legitimacy of LegacyFX forex brokers, it provides CYSEC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is LegacyFX safe?

Business

Risk Control

Is LegacyFX markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 18

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Foris Capital CY Ltd

Effective Date:

2017-11-27Email Address of Licensed Institution:

Compliance.cy@crypto.comSharing Status:

No SharingWebsite of Licensed Institution:

www.legacyfx.eu, www.xeprime.euExpiration Time:

--Address of Licensed Institution:

47 Ioanni Kondylaki Street, Q Tower, CY 6042, LarnacaPhone Number of Licensed Institution:

+357 25030673Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

ZYNERIX INNOVATIONS LTD

Effective Date: Change Record

2022-12-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is LegacyFX A Scam?

Introduction

LegacyFX is an online forex and CFD broker that has been operating since 2012 and is primarily based in Cyprus. It offers a range of trading instruments, including forex pairs, commodities, and cryptocurrencies, and is known for its use of the MetaTrader 5 platform. In the highly competitive forex market, traders must exercise caution when selecting a broker, as the risk of encountering scams is prevalent. This article aims to provide an objective assessment of LegacyFX, examining its regulatory status, company background, trading conditions, client fund security, customer experience, and overall risk profile. The investigation draws on multiple credible sources and reviews to deliver a comprehensive evaluation of whether LegacyFX is safe or a potential scam.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and legitimacy of a forex broker. LegacyFX claims to be regulated by several authorities, which adds a layer of credibility. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 344/17 | Cyprus | Verified |

| Financial Conduct Authority (FCA) | 797343 | United Kingdom | Verified |

| Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) | 348194 | Germany | Verified |

| Vanuatu Financial Services Commission (VFSC) | 14579 | Vanuatu | Verified |

| National Bank of the Republic of Belarus (NBRB) | 193180778 | Belarus | Verified |

The presence of multiple regulatory licenses from reputable authorities such as CySEC and FCA suggests that LegacyFX adheres to strict operational standards. However, the VFSC is considered a lower-tier regulator with less stringent oversight, which raises concerns about the overall safety of trading with this broker. Historical compliance records indicate that LegacyFX has maintained its licenses but has faced scrutiny regarding its practices, particularly in the Vanuatu jurisdiction.

Company Background Investigation

LegacyFX is operated by A.N. All New Investments Ltd., a company that has expanded its services to cater to a global audience. Since its inception, the broker has aimed to provide a transparent trading environment, but the lack of detailed information about its ownership and management structure raises questions about its transparency. The management team reportedly has experience in financial markets, yet specific details about their professional backgrounds are sparse. This lack of information can hinder a trader's ability to assess the broker's reliability fully.

Moreover, the company has received various awards for its services, including recognition for its educational resources. However, the overall transparency of its operations and the clarity of its information disclosure remain areas for improvement. This lack of clarity could potentially lead to mistrust among traders, especially those new to the forex market who may rely heavily on the information provided by their broker.

Trading Conditions Analysis

When evaluating whether LegacyFX is safe, it's essential to analyze its trading conditions, including fees, spreads, and commissions. The broker offers several account types, each with different minimum deposit requirements and trading conditions. The overall fee structure is as follows:

| Fee Type | LegacyFX | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.6 pips (Silver) | 1.2 pips |

| Commission Model | No commission (except stocks) | Varies |

| Overnight Interest Range | Varies by account type | Varies |

While LegacyFX's spreads are on the higher end of the spectrum, particularly for the Silver account, the absence of commission fees for most trades can be appealing. However, traders should be cautious of hidden fees or unfavorable trading conditions that may arise during periods of high volatility. The broker's minimum deposit requirement is also higher than many competitors, which may deter novice traders.

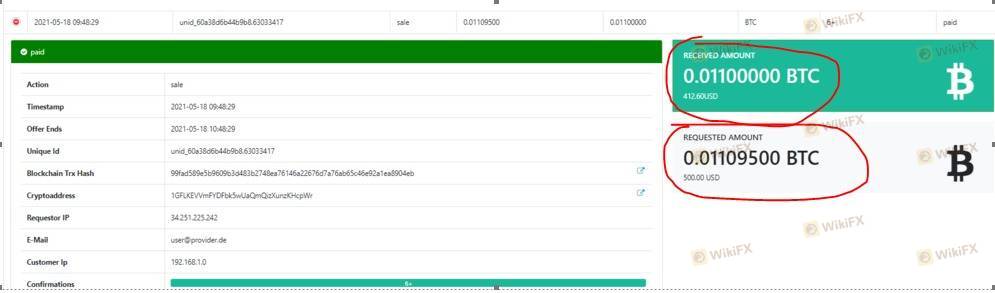

Client Fund Security

Client fund security is paramount in assessing whether LegacyFX is safe for trading. The broker claims to implement several measures to protect client funds, including segregation of accounts and negative balance protection. Client funds are held in separate accounts, ensuring they are not used for the broker's operational expenses. This practice is a positive indicator of the broker's commitment to safeguarding client investments.

However, there have been instances where clients reported difficulties in withdrawing funds, raising concerns about the broker's reliability. Historical disputes regarding fund security can significantly impact a broker's reputation, and potential clients should be aware of these issues before committing their capital.

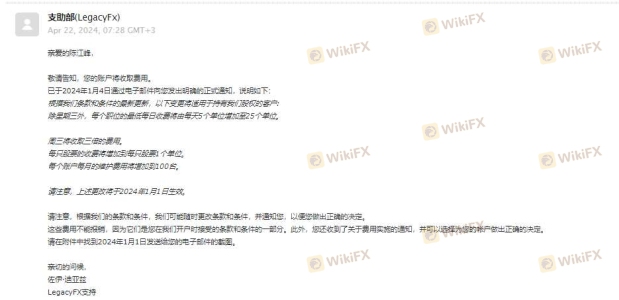

Customer Experience and Complaints

Analyzing customer feedback is crucial to understanding the overall experience with LegacyFX. Many users report mixed experiences, with some praising the broker's educational resources and customer support, while others express frustration over withdrawal processes and communication issues. Below is a summary of common complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Poor Customer Service | Medium | Slow response |

| Misleading Marketing | High | Unclear |

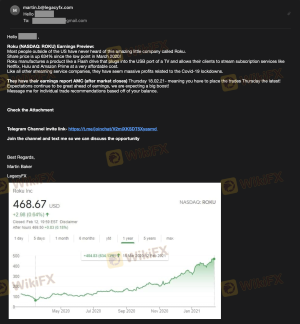

A few notable cases highlight the challenges faced by clients. One trader reported a negative experience with their account manager, who allegedly provided poor trading advice, leading to significant losses. Another client expressed frustration over the lack of timely responses from customer support when attempting to withdraw funds. These patterns of complaints warrant caution, as they may indicate systemic issues within the broker's operations.

Platform and Trade Execution

The performance and reliability of the trading platform are critical in determining whether LegacyFX is safe. The broker uses MetaTrader 5, a well-regarded platform known for its advanced features and user-friendly interface. However, some users have reported issues with order execution, including slippage and rejected orders, which can adversely affect trading outcomes.

The overall trading experience on the platform is generally positive, but any signs of manipulation or technical issues should be closely monitored. Traders should be aware of the potential risks associated with platform performance, especially during high-impact news events when volatility can lead to execution delays.

Risk Assessment

Using LegacyFX comes with inherent risks that traders must consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory oversight |

| Withdrawal Risk | High | Complaints about withdrawal delays |

| Trading Cost Risk | Medium | Higher spreads compared to industry |

| Platform Reliability | Medium | Reports of execution issues |

To mitigate these risks, traders are advised to conduct thorough research, start with a demo account, and consider diversifying their investments across multiple brokers.

Conclusion and Recommendations

In conclusion, while LegacyFX is a regulated broker with several licenses, including from CySEC and FCA, potential clients should approach with caution. The mixed reviews, particularly concerning withdrawal processes and customer service, raise concerns about the broker's reliability.

For traders seeking a safe trading environment, it may be prudent to consider alternatives that offer lower minimum deposits, better spreads, and a more transparent operational history. Reliable options could include brokers like XM, IG, or Pepperstone, which have established reputations and favorable trading conditions. Ultimately, whether LegacyFX is safe or potentially a scam depends on individual risk tolerance and trading preferences.

Is LegacyFX a scam, or is it legit?

The latest exposure and evaluation content of LegacyFX brokers.

LegacyFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LegacyFX latest industry rating score is 4.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.