Is LCMFX safe?

Pros

Cons

Is LCMFX Safe or a Scam?

Introduction

LCMFX is a forex brokerage that positions itself as a provider of trading services across various financial instruments, including currency pairs, commodities, and indices. Established with a promise of competitive trading conditions and a user-friendly platform, LCMFX aims to attract both novice and experienced traders. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. Regulatory compliance, company history, and customer feedback are critical factors that can influence a trader's decision. This article aims to provide a comprehensive analysis of LCMFX, evaluating its legitimacy and safety for potential investors. The findings are based on a detailed review of various online sources, user testimonials, and regulatory information.

Regulation and Legitimacy

The regulatory environment is crucial for any financial service provider, especially in the forex market, where the risk of fraud is prevalent. LCMFX claims to operate under the jurisdiction of Saint Vincent and the Grenadines (SVG), which is known for its lax regulatory framework. Currently, LCMFX does not hold a license from any recognized financial authority, raising significant concerns about its legitimacy and the safety of client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | N/A | Saint Vincent and Grenadines | Unregulated |

The absence of a valid regulatory license is a major red flag. Reputable brokers are typically regulated by tier-1 authorities such as the FCA (UK) or ASIC (Australia), which impose stringent requirements to ensure the protection of client funds. In contrast, the SVG FSA does not offer the same level of oversight, leaving traders vulnerable to potential scams. Historical compliance issues further exacerbate the situation, as many brokers operating in SVG have faced allegations of fraud.

Company Background Investigation

Understanding the company behind a brokerage is vital for assessing its reliability. LCMFX is operated by Lucror Ltd, a company that has been in operation since 2017. However, the lack of transparency regarding its ownership structure and management team raises concerns. Many online reviews indicate that the broker has not established a solid reputation in the industry, which further complicates the assessment of its trustworthiness.

The management teams background is often a good indicator of a broker's reliability. Unfortunately, LCMFX does not provide sufficient information about its leaders, making it difficult for potential clients to gauge their expertise and experience in the financial markets. Transparency in operations, including clear information about the company's history and ownership, is essential for building trust with clients. The absence of such information is a significant drawback for LCMFX.

Trading Conditions Analysis

The trading conditions offered by LCMFX are another critical aspect to consider. The broker provides two account types: Standard and Pro, with varying minimum deposit requirements. While the minimum deposit starts at $100, which is relatively low, the overall cost structure is not as competitive as it may seem.

| Fee Type | LCMFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.8 pips | From 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by LCMFX are higher than the industry average, which could significantly impact trading profitability. Moreover, the lack of a commission structure may initially appear appealing, but it often compensates through wider spreads, which can be detrimental to traders. Additionally, the broker's policies regarding fees for withdrawals and deposits are not clearly defined, leading to potential hidden costs that could arise during transactions.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. LCMFX claims to prioritize the security of client funds by holding them in reputable financial institutions; however, this assertion lacks verification. The absence of regulatory oversight raises concerns about the effectiveness of these safety measures.

LCMFX does not provide clear information regarding fund segregation, investor protection schemes, or negative balance protection. These elements are crucial for ensuring that traders are shielded from significant losses, especially in volatile market conditions. The historical context of LCMFX's operations suggests that it has not faced any major financial security issues, but the lack of regulatory backing leaves clients exposed to risks.

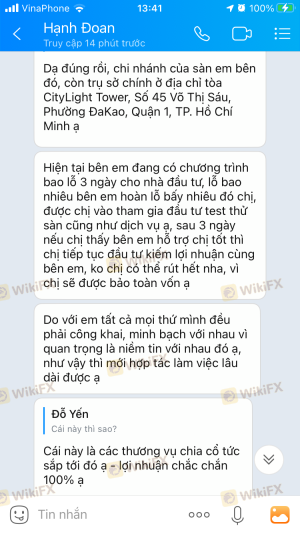

Customer Experience and Complaints

Customer feedback is an essential metric for evaluating a broker's reliability. Reviews for LCMFX are mixed, with a significant number of complaints focusing on withdrawal issues and poor customer service. Many users report difficulties in accessing their funds, indicating potential operational inefficiencies.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

Typical complaints include delays in processing withdrawal requests and inadequate responses from customer support representatives. For instance, one trader reported waiting weeks for a withdrawal to be processed, only to receive vague explanations from the company. Such patterns of behavior are concerning and suggest that LCMFX may not prioritize customer satisfaction.

Platform and Execution

The trading platform is a critical component of the trading experience. LCMFX offers the widely-used MetaTrader 4 platform, which is known for its robust features and user-friendly interface. However, several reviews indicate that the platform may suffer from stability issues, impacting overall user experience.

Order execution quality is another area of concern. Reports of slippage and rejected orders have surfaced, which can significantly affect trading outcomes. Any signs of platform manipulation or irregularities in order execution should raise alarms for prospective traders.

Risk Assessment

Using LCMFX poses several risks that potential clients should consider. The overall risk profile of this broker is elevated due to its unregulated status and the lack of transparency regarding its operations.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No legitimate regulatory oversight |

| Fund Safety Risk | High | Lack of investor protection mechanisms |

| Operational Risk | Medium | Complaints about withdrawal processes |

To mitigate these risks, prospective traders should conduct thorough research and consider using regulated brokers that offer better security and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that LCMFX is not a safe option for forex trading. The lack of regulatory oversight, combined with numerous customer complaints and operational inefficiencies, indicates potential risks for traders. Therefore, it is advisable for investors to exercise caution and consider alternative brokers that are well-regulated and have a proven track record of reliability.

For those seeking safer trading options, consider brokers regulated by tier-1 authorities such as the FCA or ASIC. These brokers typically offer better security for client funds and a more transparent trading environment. Overall, while LCMFX may present attractive trading conditions, the associated risks outweigh the potential benefits, making it a broker to approach with caution.

Is LCMFX a scam, or is it legit?

The latest exposure and evaluation content of LCMFX brokers.

LCMFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LCMFX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.