Is Binarycent safe?

Pros

Cons

Is Binarycent A Scam?

Introduction

Binarycent is an online trading platform that specializes in binary options, forex, and CFDs (Contracts for Difference). Established in 2017, it has gained attention for its low minimum deposit requirements and high potential returns, attracting both novice and experienced traders alike. However, the rapid growth of online trading platforms has also raised concerns about their legitimacy and safety. As such, traders need to exercise caution and thoroughly evaluate any forex broker before committing their funds. This article aims to investigate whether Binarycent is a safe trading option or a potential scam. Our evaluation will be based on a combination of regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

One of the most critical factors in determining the safety of a trading platform is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. Binarycent claims to be regulated by the Vanuatu Financial Services Commission (VFSC), which is considered a low-tier regulatory body compared to more established authorities like the FCA in the UK or ASIC in Australia.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | N/A | Vanuatu | Not Verified |

While being regulated by the VFSC provides some level of oversight, it does not offer the same level of protection as higher-tier regulators. Furthermore, there have been reports indicating that the VFSC does not regulate binary options brokers effectively, raising questions about Binarycent's compliance with industry standards. The lack of a solid regulatory framework can be a red flag for potential investors, as it may expose them to higher risks.

Company Background Investigation

Binarycent operates under the ownership of Finance Group Corp, with its headquarters located in Vanuatu. The company has positioned itself as a broker primarily targeting beginner traders, offering a user-friendly platform and various account types. However, there is limited information available about the management team and their qualifications, which raises concerns about the company's transparency.

The absence of detailed information about the company's history and the lack of independent verification of its claims further contribute to the skepticism surrounding Binarycent. A transparent company typically provides information about its ownership structure, management team, and operational history, which Binarycent seems to lack.

Trading Conditions Analysis

When evaluating a trading platform, understanding the cost structure and trading conditions is essential. Binarycent offers a relatively low minimum deposit requirement of $250, which is appealing for new traders. However, the trading fees and commissions are not explicitly disclosed, which can lead to confusion and unexpected charges.

| Fee Type | Binarycent | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not Specified | 1.0 - 2.0 pips |

| Commission Model | Not Specified | Varies by broker |

| Overnight Interest Range | Not Specified | 0.5% - 1% |

The lack of transparency regarding fees may indicate potential hidden costs that could affect traders' profitability. Moreover, traders should be aware of the potential for high overnight interest rates and other fees that may not be immediately apparent.

Client Fund Security

The safety of client funds is a paramount concern for any trading platform. Binarycent claims to implement various security measures, including SSL encryption and segregated accounts to protect client funds. However, the lack of regulatory oversight raises questions about the efficacy of these measures. Additionally, there is no information available regarding investor protection schemes or compensation funds in case of broker insolvency.

Historically, unregulated brokers have been associated with fund mismanagement and fraudulent activities, making it imperative for traders to scrutinize the security measures in place. While Binarycent touts its security protocols, the absence of a robust regulatory framework makes it difficult to ascertain the true safety of client funds.

Customer Experience and Complaints

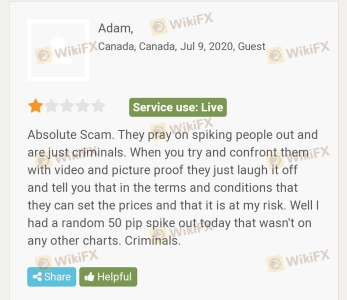

Customer feedback plays a significant role in evaluating a broker's reliability. Reviews of Binarycent reveal a mixed bag of experiences, with some users praising its user-friendly platform and quick withdrawal processes, while others report difficulties in accessing their funds and poor customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Customer Support | Medium | Limited availability |

| Transparency Concerns | High | Lack of information |

Common complaints include withdrawal delays and unresponsive customer service, which can be particularly concerning for traders looking to access their funds promptly. Additionally, some users have expressed frustration over the platform's lack of transparency regarding fees and trading conditions.

Platform and Trade Execution

Binarycent offers a proprietary web-based trading platform, which is designed to be user-friendly and accessible. The platform includes various tools for market analysis and trade execution. However, there are concerns regarding order execution quality, with reports of slippage and rejected orders during peak trading times.

The absence of established trading platforms like MetaTrader 4 or 5 may limit traders' options for advanced trading strategies and tools. Furthermore, the potential for platform manipulation has been a concern raised by some users, highlighting the need for caution when trading on Binarycent.

Risk Assessment

Using Binarycent presents several risks that traders should consider. The lack of regulatory oversight, potential hidden fees, and mixed customer feedback all contribute to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with low-tier oversight |

| Financial Risk | Medium | Potential hidden fees and high trading costs |

| Operational Risk | Medium | Mixed customer feedback regarding platform reliability |

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and avoid relying solely on bonuses or promotional offers that may have stringent turnover requirements.

Conclusion and Recommendations

In conclusion, while Binarycent presents itself as a legitimate trading platform, several red flags warrant caution. The lack of robust regulatory oversight, transparency issues regarding fees, and mixed customer experiences suggest that traders should proceed with caution.

For those considering trading with Binarycent, it is crucial to be aware of the potential risks and to conduct thorough due diligence. If you are a novice trader or someone seeking a regulated trading environment, it may be wise to explore alternatives such as IQ Option or eToro, which offer more robust regulatory protections and a better overall trading experience.

Ultimately, the question remains: Is Binarycent safe? While it may not be a scam in the traditional sense, the risks involved may outweigh the potential benefits for many traders.

Is Binarycent a scam, or is it legit?

The latest exposure and evaluation content of Binarycent brokers.

Binarycent Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Binarycent latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.