LCMFX 2025 Review: Everything You Need to Know

Executive Summary

LCMFX operates as a brand name of Lucror Ltd. This offshore brokerage firm is registered in Saint Vincent and The Grenadines. This lcmfx review reveals that the broker offers access to over 30 financial instruments across forex and metals markets with a minimum deposit of $100, but it lacks regulation from major financial authorities, which raises significant concerns about trader protection and fund security.

The broker operates as an STP provider. It uses MetaTrader 4 as its primary trading platform. LCMFX positions itself to serve both retail and institutional customers, offering 24/5 forex trading with 5-digit quotations. However, the absence of proper regulatory oversight from recognized authorities like the FCA, ASIC, or CySEC creates substantial risk factors that potential traders must carefully consider.

The platform primarily targets small to medium-sized investors. These investors seek diverse trading instruments with relatively low entry barriers. While the $100 minimum deposit makes it accessible to beginners, the regulatory concerns and limited transparency regarding trading conditions make it more suitable for experienced traders who understand the risks associated with offshore brokers.

Important Disclaimer

LCMFX operates as an offshore entity. It has no regulation from major financial authorities. This review is based on publicly available information and user feedback. Traders should be aware that offshore brokers may not provide the same level of protection as regulated entities. The lack of regulatory oversight means that standard investor protection measures, including compensation schemes and segregated client funds, may not be available.

Our evaluation methodology combines analysis of publicly available company information. It also includes trading conditions, platform features, and aggregated user experiences from various sources. All assessments are conducted objectively, though readers should verify current information directly with the broker before making any trading decisions.

Overall Rating Framework

Broker Overview

Company Background and Establishment

LCMFX was established as a trading brand of Lucror Ltd. Operations began around 2017. The company maintains its registered office in Saint Vincent and The Grenadines, operating as an offshore brokerage firm. According to available information, LCMFX positions itself as providing "superior level of service to both retail and institutional customers to maintain long-term relationships."

The broker's business model focuses on STP execution. This means client orders are passed directly to liquidity providers without dealing desk intervention. This approach theoretically reduces conflicts of interest between the broker and clients, though the lack of regulatory oversight means these claims cannot be independently verified through regulatory reporting.

Trading Infrastructure and Services

LCMFX offers trading services through the MetaTrader 4 platform. It provides access to over 30 financial instruments across two main asset classes: forex and precious metals. The broker claims its trade servers are located in the LD4 FX suite for low latency execution, positioned alongside major international banks and liquidity providers.

The platform operates with 5-digit pricing quotations. It offers 24/5 trading availability during forex market hours. However, specific details about spreads, commission structures, and execution policies are not clearly disclosed in available materials, which raises transparency concerns for potential traders evaluating this lcmfx review.

Detailed Specifications

Regulatory Status: LCMFX operates without regulation from major financial authorities. The company is registered in Saint Vincent and The Grenadines, a jurisdiction known for minimal regulatory requirements for financial services providers.

Deposit and Withdrawal Methods: Specific information about supported payment methods is not detailed in available materials. The minimum deposit requirement is set at $100.

Minimum Deposit Requirements: The broker requires a minimum deposit of $100. This makes it accessible to small-scale investors and beginners with limited capital.

Promotional Offers: Available materials do not mention specific bonus promotions. No incentive programs offered by LCMFX are detailed.

Available Trading Assets: LCMFX provides access to 30+ financial instruments across forex pairs and precious metals markets. The complete list of available instruments is not specified in available documentation.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not clearly disclosed in publicly available materials. This raises concerns about pricing transparency.

Leverage Options: Specific leverage ratios offered by LCMFX are not mentioned in available information. This is concerning given that leverage is a critical factor for forex traders.

Platform Options: The primary trading platform is MetaTrader 4. The broker claims low latency execution through LD4 FX suite infrastructure.

Geographic Restrictions: Available materials do not specify which countries or regions are restricted. No information about account opening limitations is provided.

Customer Support Languages: The range of languages supported by LCMFX customer service is not detailed. Available materials lack this important information.

This lcmfx review highlights significant information gaps. Potential traders should address these directly with the broker before considering opening an account.

Account Conditions Analysis

LCMFX's account structure appears simplified compared to many established brokers. Specific details about different account types are not clearly outlined in available materials. The $100 minimum deposit requirement positions the broker as accessible to small-scale traders and those beginning their forex trading journey. This relatively low barrier to entry is one of the few clearly positive aspects identified in this evaluation.

However, the lack of detailed information about account features raises significant concerns. Trading conditions and tier-based benefits are not clearly explained. Most reputable brokers provide comprehensive documentation about account types, including standard, premium, or VIP accounts with varying conditions. The absence of such information makes it difficult for traders to understand what they're signing up for.

The account opening process details are not specified in available materials. Required documentation, verification procedures, and processing timeframes are not mentioned. This lack of transparency is particularly concerning given the offshore regulatory status, as traders cannot rely on standardized regulatory requirements to ensure proper know-your-customer procedures.

Special account features are not mentioned in available information. Islamic accounts for Muslim traders, demo accounts for practice trading, and institutional accounts for larger clients are not detailed. The absence of such details in this lcmfx review suggests either limited account options or poor communication of available services to potential clients.

LCMFX offers access to over 30 financial instruments. These span forex and precious metals markets, providing reasonable diversity for traders interested in these asset classes. The focus on forex pairs and metals is relatively narrow compared to brokers offering stocks, indices, commodities, and cryptocurrencies, but may suit traders who prefer to specialize in traditional forex markets.

The MetaTrader 4 platform provides standard technical analysis tools. These include various chart types, timeframes, and technical indicators commonly used by forex traders. MT4's built-in features include automated trading capabilities through Expert Advisors, though the extent of LCMFX's support for algorithmic trading is not clearly specified.

Research and market analysis resources are not detailed in available materials. This is a significant limitation for traders who rely on broker-provided market insights, economic calendars, or trading signals. Most established brokers provide daily market analysis, economic event calendars, and educational content to support their clients' trading decisions.

Educational resources are not mentioned in available information. Trading guides, webinars, and tutorial materials are absent from the documentation. This absence is particularly concerning for a broker with a low minimum deposit that might attract novice traders who would benefit from educational support. The lack of educational content suggests LCMFX may not prioritize client development and success.

Customer Service and Support Analysis

Customer service quality appears to be a significant weakness. Limited information is available about LCMFX's support infrastructure. The absence of clearly stated customer service channels, response time commitments, or support availability hours raises concerns about the broker's commitment to client service.

Professional forex brokers typically provide multiple contact methods. These include phone, email, live chat, and sometimes social media support. They also clearly communicate their support hours and expected response times. The lack of such information in available materials suggests either inadequate support infrastructure or poor communication of available services.

Multi-language support details are not specified. This could be problematic for international clients. Given that LCMFX appears to target global markets, the absence of clear language support information may indicate limited international service capabilities.

The quality of support staff training and expertise cannot be assessed. Available materials provide no information about this crucial aspect. However, the overall lack of transparency about customer service suggests potential issues with support quality and responsiveness. Traders considering LCMFX should directly test the responsiveness and helpfulness of customer support before committing funds.

Response time expectations and problem resolution procedures are not documented. Available materials lack this critical information, making it impossible for potential clients to understand what level of service they can expect when issues arise.

Trading Experience Analysis

The trading experience with LCMFX centers around the MetaTrader 4 platform. This platform is widely recognized and used throughout the forex industry. MT4 provides reliable charting capabilities, technical analysis tools, and order management features that most forex traders find familiar and functional. The platform's stability and feature set are generally well-regarded in the industry.

However, LCMFX's specific implementation and server performance cannot be fully assessed. Available materials provide limited information about actual performance metrics. While the broker claims to utilize LD4 FX suite infrastructure for low latency execution, independent verification of execution speeds, slippage rates, or requote frequency is not available through publicly accessible performance data.

The 5-digit quotation system mentioned by LCMFX is standard in modern forex trading. It allows for more precise pricing and potentially tighter spreads. However, without specific spread information or execution statistics, traders cannot properly evaluate the actual trading costs they would face.

Order execution quality is not detailed in available materials. The handling of market orders during volatile conditions, stop-loss and take-profit execution, and partial fills are not explained. These factors are crucial for traders to understand, particularly those employing scalping or other time-sensitive trading strategies.

Mobile trading capabilities through MT4 mobile applications are likely available. However, LCMFX's specific mobile trading features and performance are not detailed in this lcmfx review. Most MT4 implementations include mobile access, but broker-specific customizations and support quality can vary significantly.

Trust and Security Analysis

The most significant concern in this evaluation is LCMFX's regulatory status. Operating without oversight from major financial authorities represents a fundamental risk. This means traders have limited recourse if problems arise. This regulatory gap represents the primary risk factor for potential clients considering LCMFX.

Saint Vincent and The Grenadines registration provides minimal regulatory oversight. This contrasts sharply with major financial centers that have strict requirements. This jurisdiction is known for having relatively relaxed requirements for financial services providers, which means standard investor protections such as segregated client funds, compensation schemes, or mandatory reporting may not apply.

Fund security measures are not detailed in available materials. Client money segregation, bank deposit protection, and insurance coverage information is absent. Reputable brokers typically provide clear information about how client funds are protected and where they are held. The absence of such information raises serious concerns about capital safety.

Company transparency is limited. Minimal publicly available information exists about company ownership, financial statements, or operational details. The lack of transparency makes it difficult for traders to assess the broker's financial stability and long-term viability.

Third-party audits are not mentioned in available materials. Regulatory reporting and independent verification of business practices are also absent, further limiting traders' ability to assess the broker's credibility and operational standards.

User Experience Analysis

Overall user satisfaction with LCMFX cannot be comprehensively assessed. Limited publicly available user feedback and reviews make evaluation difficult. The absence of substantial user testimonials or independent review data makes it difficult to gauge real-world client experiences with the platform.

The MetaTrader 4 interface is generally user-friendly. Most forex traders find it familiar, which likely provides a reasonable user experience from a platform perspective. However, broker-specific implementations, custom tools, and support quality can significantly impact the overall user experience beyond the basic platform functionality.

Account registration and verification processes are not detailed in available materials. This makes it impossible to assess the convenience and efficiency of getting started with LCMFX. Modern traders expect streamlined onboarding processes with clear documentation requirements and reasonable processing times.

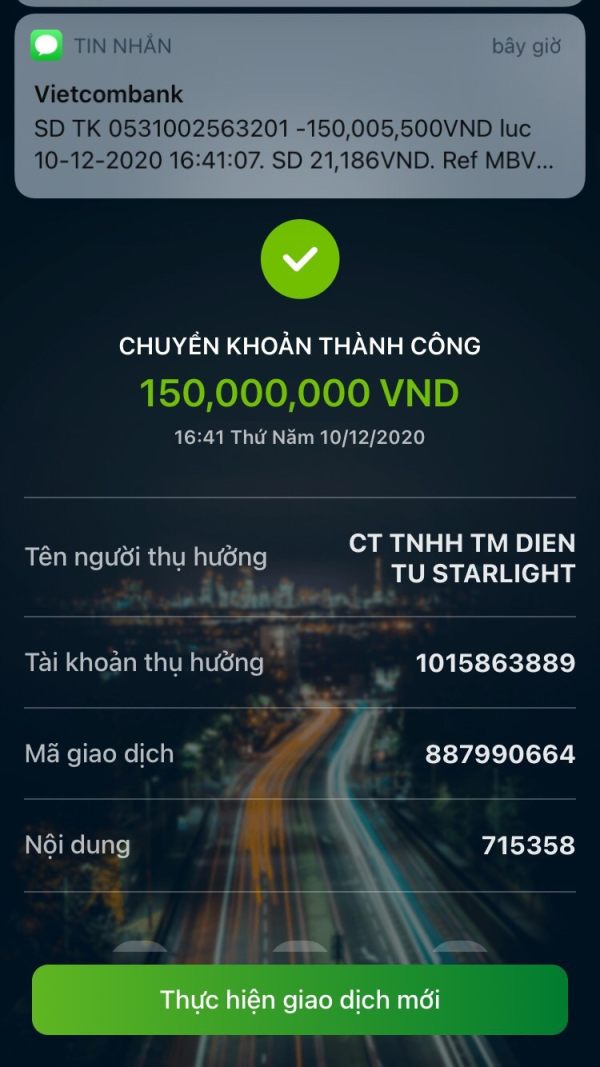

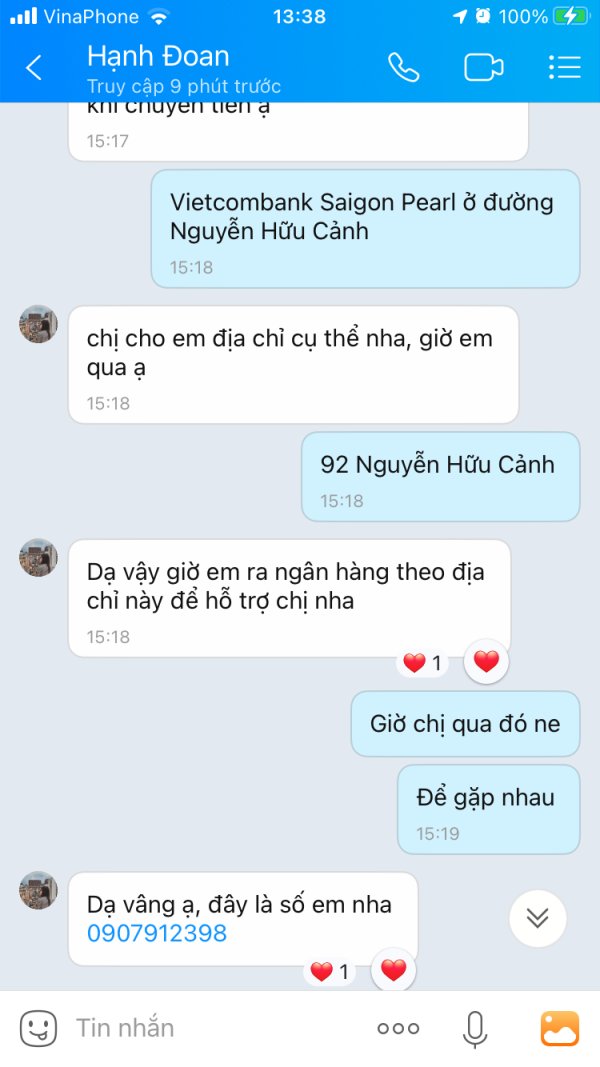

Funding and withdrawal experiences represent critical aspects of user satisfaction. Specific information about processing times, fees, and supported methods is not available in this review. Withdrawal problems are often the most significant source of trader dissatisfaction with brokers, making this information gap particularly concerning.

Common user complaints or praise patterns cannot be identified. Available materials lack substantial user feedback, limiting the ability to provide balanced insights into typical client experiences. The lack of substantial user feedback may itself be indicative of limited market presence or client base.

Conclusion

This lcmfx review reveals a broker with significant limitations and risk factors. Potential traders must carefully consider these issues before proceeding. While LCMFX offers access to multiple trading instruments through the familiar MT4 platform with a low $100 minimum deposit, the lack of proper regulatory oversight represents a fundamental concern that overshadows these potential benefits.

The broker may be suitable for experienced traders. These traders must understand the risks associated with offshore, unregulated entities and prioritize low entry barriers over regulatory protection. However, the limited transparency regarding trading conditions, costs, and company operations makes it difficult to recommend LCMFX for most retail traders.

The absence of clear information about spreads raises too many questions. Commissions, customer service capabilities, and fund protection measures are also poorly documented. Traders seeking reliable, transparent, and properly regulated forex trading services would likely find better options among established brokers with proper regulatory oversight and comprehensive disclosure of trading conditions.