GCG Asia 2025 Review: Everything You Need to Know

Summary

Our comprehensive GCG Asia review reveals significant concerns about this trading platform. Potential investors should carefully consider these issues before making any decisions. Based on extensive analysis of available information and user feedback, GCG Asia presents substantial risks. This makes it unsuitable for most traders who want safe and reliable trading conditions.

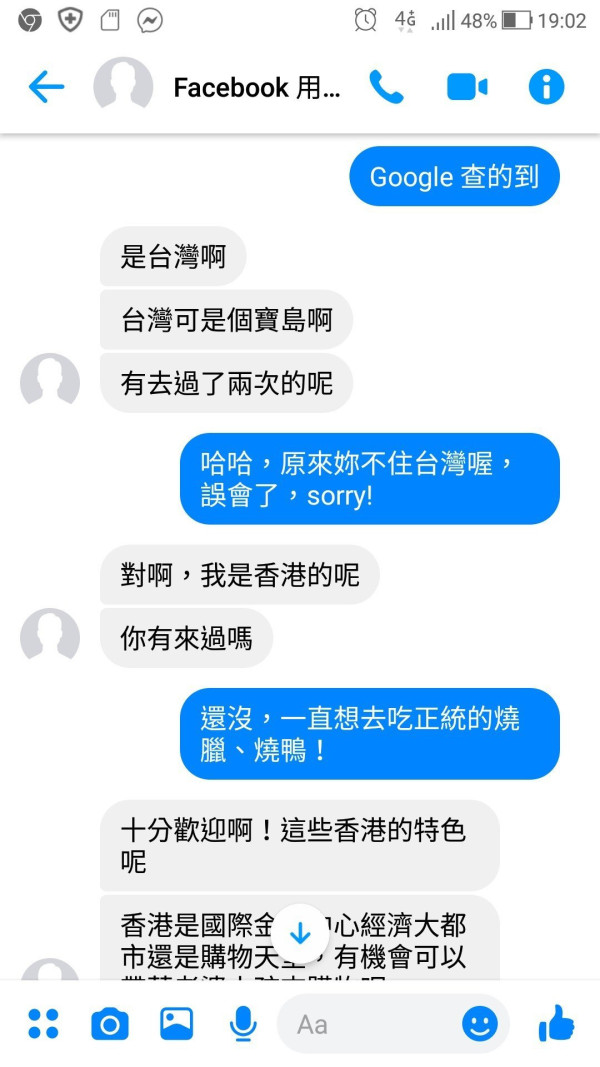

The broker claims to be regulated by the Swiss Financial Market Supervisory Authority and offers multiple trading assets. These include forex, precious metals, energy, and cryptocurrencies through the MT4 platform. However, critical red flags emerge when examining the company's regulatory status and user experiences. The Hong Kong Securities and Futures Commission has placed GCG Asia on its alert list, raising serious questions about the broker's legitimacy.

User reviews consistently report negative experiences. Many suggest that traders should avoid this platform entirely. The company operates under Guardian Capital AG and claims Swiss headquarters while actually functioning as a Malaysian entity. This creates additional transparency concerns that should worry potential clients.

This GCG Asia review targets traders with high risk tolerance. We strongly recommend that even experienced investors exercise extreme caution when considering this broker. The combination of regulatory warnings, poor user feedback, and allegations of operating as a Ponzi scheme make this broker particularly unsuitable for retail investors. Most people should look for brokers that offer reliable trading conditions and proper regulatory oversight.

Important Notice

Regional Entity Differences: GCG Asia presents conflicting information about its operational structure. While the company claims to be headquartered in Switzerland under Guardian Capital AG, evidence suggests it operates primarily as a Malaysian company. This discrepancy raises concerns about transparency and regulatory compliance across different jurisdictions. Traders should be aware of these inconsistencies when evaluating the broker's credibility.

Review Methodology: This evaluation is based on publicly available information, regulatory alerts, and user feedback compiled from various financial review platforms. Given the limited transparency provided by GCG Asia regarding company ownership and operational details, our assessment relies heavily on third-party sources. We also consider regulatory warnings from established financial authorities when forming our conclusions.

Rating Framework

Broker Overview

GCG Asia operates under Guardian Capital AG and positions itself as a fintech company. The company develops forex trading and investment applications for Asian markets. GCG Asia claims Swiss origins while functioning primarily in the Malaysian market, creating confusion about its actual regulatory jurisdiction and operational base. This confusion should concern potential clients who value transparency and clear regulatory oversight.

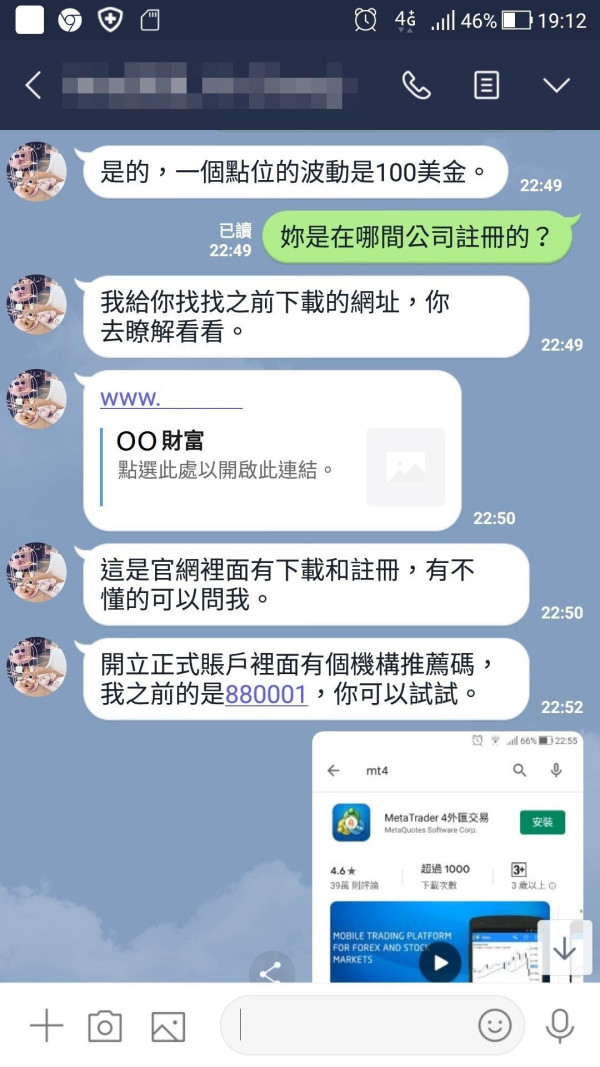

According to available information, GCG Asia offers trading services across multiple asset classes. The broker targets investors interested in forex, commodities, and cryptocurrency markets. The company's business model centers on providing access to international financial markets through the MetaTrader 4 platform. This platform supports trading in approximately 30 currency pairs, precious metals, energy products, and several major cryptocurrencies including Bitcoin and Ethereum.

However, the lack of clear information about company ownership and management raises significant transparency concerns. Potential clients should carefully consider these issues before opening accounts. GCG Asia's regulatory status presents perhaps the most concerning aspect of this GCG Asia review. The Hong Kong Securities and Futures Commission has specifically flagged this entity, while the company's claims of Swiss regulation remain unverified through official channels.

This regulatory uncertainty creates substantial risk factors that overshadow any potential trading benefits. The platform might offer some useful features, but the risks are too high for most traders. Allegations of operating as a Ponzi scheme add another layer of concern that makes this broker particularly unsuitable for retail investors.

Regulatory Status: The Hong Kong Securities and Futures Commission has placed GCG Asia on its alert list. This indicates potential regulatory violations or unauthorized operations that should concern potential clients. The company's claimed Swiss regulation lacks verification through official channels. This creates uncertainty about the broker's actual regulatory oversight and compliance status.

Deposit and Withdrawal Methods: Specific information about funding options is not detailed in available sources. This creates uncertainty about transaction processes and potential restrictions that traders might face. The lack of clear funding information represents a transparency issue that should concern potential clients.

Minimum Deposit Requirements: The platform does not provide clear information about minimum deposit amounts. This makes it difficult for potential clients to assess entry requirements and plan their trading activities. Transparency about deposit requirements is standard practice among legitimate brokers.

Bonuses and Promotions: Available materials do not specify current promotional offers or bonus structures. This limits transparency about additional trading incentives that might be available to new clients. The absence of clear promotional information adds to the overall transparency concerns.

Tradeable Assets: GCG Asia offers approximately 30 currency pairs, precious metals including gold and silver, energy commodities, and several cryptocurrencies. The selection includes Bitcoin and Ethereum, providing moderate asset diversity for traders interested in multiple markets. However, the limited transparency about trading conditions affects the overall appeal of these assets.

Cost Structure: The broker does not clearly disclose spread information, commission rates, or other trading costs. This makes it impossible to accurately assess the total cost of trading with this platform. Transparent cost disclosure is essential for traders to make informed decisions about broker selection.

Leverage Ratios: Maximum leverage reaches 1:100, which falls within standard industry ranges. This level may still pose significant risk for inexperienced traders who are not familiar with leveraged trading. Proper risk management becomes essential when using any leverage in trading activities.

Platform Options: The company provides MetaTrader 4 trading terminal for client trading activities. User feedback regarding platform performance varies significantly across different review sources. Some traders report functionality issues while others find the basic features adequate for their needs.

Geographic Restrictions: Specific information about regional trading restrictions is not clearly outlined in available documentation. This lack of clarity creates uncertainty for potential clients in different jurisdictions. Clear geographic restrictions help traders understand whether they can legally access the platform.

Customer Support Languages: The range of supported languages for customer service is not specified in current materials. This information gap affects international clients who may need support in their native languages. Quality customer support typically includes multiple language options for diverse client bases.

This GCG Asia review emphasizes the concerning lack of transparency across multiple operational aspects. These transparency issues significantly impact the broker's overall credibility and user confidence.

Account Conditions Analysis

The account conditions offered by GCG Asia present significant concerns for potential traders. Our evaluation gives these conditions a low rating of 3 out of 10 based on multiple deficiencies. The broker fails to provide clear information about account types, minimum deposit requirements, or specific features. This lack of transparency represents a major red flag when compared to established brokers who offer detailed specifications.

User feedback consistently indicates dissatisfaction with account-related services. Many reviewers specifically recommend that traders avoid GCG Asia entirely due to poor account conditions. The absence of detailed account information makes it impossible to assess whether the broker offers competitive conditions or adequate protection for client funds. This uncertainty creates additional risks for potential clients who need clear terms and conditions.

Additionally, the account opening process lacks clear documentation about verification requirements and timeline expectations. The regulatory concerns surrounding GCG Asia further compound account condition issues since clients face increased risks regarding fund safety. Without proper regulatory oversight, dispute resolution becomes problematic for clients who encounter account-related problems. The combination of poor user feedback, lack of transparency, and regulatory warnings makes the account conditions particularly unsuitable for traders.

This GCG Asia review strongly emphasizes these deficiencies as primary reasons for recommending alternative brokers. Most traders should seek brokers with clearer terms and better regulatory standing for their trading activities.

GCG Asia receives a moderate rating of 6 out of 10 for tools and resources. This rating is primarily based on its provision of the MetaTrader 4 platform, which remains a widely recognized and functional trading terminal. The MT4 platform offers standard charting capabilities, technical analysis tools, and automated trading support that many traders find familiar. These features provide adequate functionality for basic trading operations across multiple asset classes.

However, the overall tools and resources offering lacks comprehensive educational materials and advanced analytical resources. Leading brokers typically provide extensive research tools, market analysis, and educational content that help traders improve their skills. The platform supports trading across multiple asset classes, including forex, precious metals, energy commodities, and cryptocurrencies. This provides reasonable diversification opportunities for traders interested in various markets and trading strategies.

Specific information about additional research tools, market analysis, or educational resources is notably absent from available materials. This limits the broker's appeal to traders who rely on comprehensive market insights and learning materials for their trading decisions. User feedback regarding the platform's performance presents mixed results, with some traders reporting functionality issues while others find the basic features adequate. The absence of detailed information about platform updates, additional trading tools, or proprietary resources suggests that GCG Asia offers a relatively basic trading environment.

Most established competitors provide extensive educational content, market research, and advanced analytical tools that enhance the trading experience. The limited resources available through GCG Asia may not meet the needs of serious traders who require comprehensive support.

Customer Service and Support Analysis

Customer service and support represents one of GCG Asia's weakest areas. Our evaluation gives this aspect a concerning rating of 2 out of 10 based on consistently negative user feedback. Multiple user reviews specifically highlight poor customer service experiences, with many traders reporting unresponsive support teams and inadequate problem resolution. These service quality issues create significant problems for traders who need reliable assistance.

The lack of clear information about available support channels, response times, and service hours further compounds these concerns. User testimonials consistently recommend avoiding GCG Asia due to customer service deficiencies, suggesting systemic issues with support quality and availability. The absence of detailed contact information, multiple communication channels, or guaranteed response times indicates that the broker does not prioritize customer support. This becomes particularly problematic when traders encounter account issues, technical problems, or withdrawal difficulties that require immediate attention.

The regulatory uncertainties surrounding GCG Asia create additional customer service concerns for clients who may face problems. Without proper regulatory oversight, traditional complaint resolution mechanisms may not be available, leaving traders with few options for addressing service-related problems. Legitimate brokers typically offer multiple support channels, clear response time commitments, and escalation procedures for complex issues. The combination of poor user feedback, limited support transparency, and regulatory concerns makes customer service a significant liability for this broker.

Most traders should seek brokers that prioritize customer support and provide clear communication channels for problem resolution.

Trading Experience Analysis

The trading experience with GCG Asia receives a below-average rating of 4 out of 10. This rating reflects user concerns about platform performance, execution quality, and overall trading conditions. While the broker offers the familiar MT4 platform, user feedback indicates problems with order execution, including reports of slippage and requoting. These execution issues can significantly impact trading profitability, especially for active traders who rely on precise entry and exit points.

Platform stability appears inconsistent based on available user reports. Some traders experience connectivity issues and system downtime that can disrupt trading activities at critical moments. The lack of detailed information about server locations, execution speeds, and liquidity providers makes it difficult to assess the technical infrastructure. Additionally, the absence of comprehensive trading statistics or performance metrics limits traders' ability to evaluate execution quality objectively.

These technical limitations become particularly problematic for traders employing scalping strategies or those requiring fast execution speeds. The regulatory concerns surrounding GCG Asia create additional trading experience challenges since uncertain oversight may impact dispute resolution. User feedback consistently points to trading difficulties and recommends seeking alternative brokers with better execution quality and more reliable platform performance. The combination of technical issues, execution problems, and regulatory uncertainties significantly detracts from the overall trading experience.

Most serious traders should consider brokers that offer transparent execution statistics, reliable platform performance, and proper regulatory oversight.

Trust and Reliability Analysis

Trust and reliability represent GCG Asia's most critical weakness. Our evaluation gives this aspect an unacceptable rating of 1 out of 10 due to severe regulatory concerns and allegations of fraudulent operations. The Hong Kong Securities and Futures Commission has specifically placed GCG Asia on its alert list, indicating potential unauthorized operations or regulatory violations. This official regulatory warning represents a fundamental trust issue that should concern any potential investor.

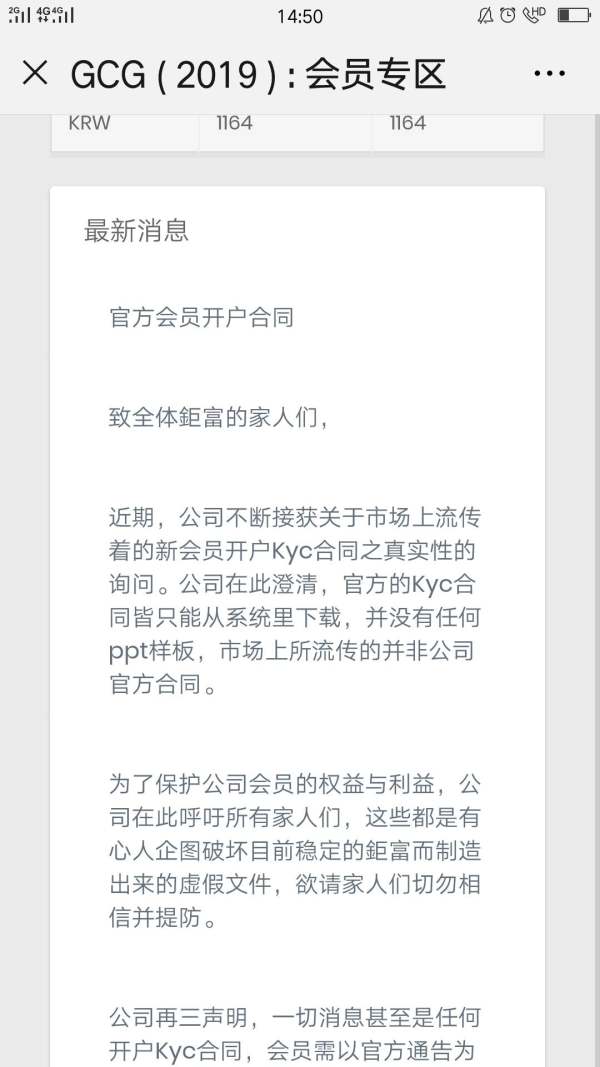

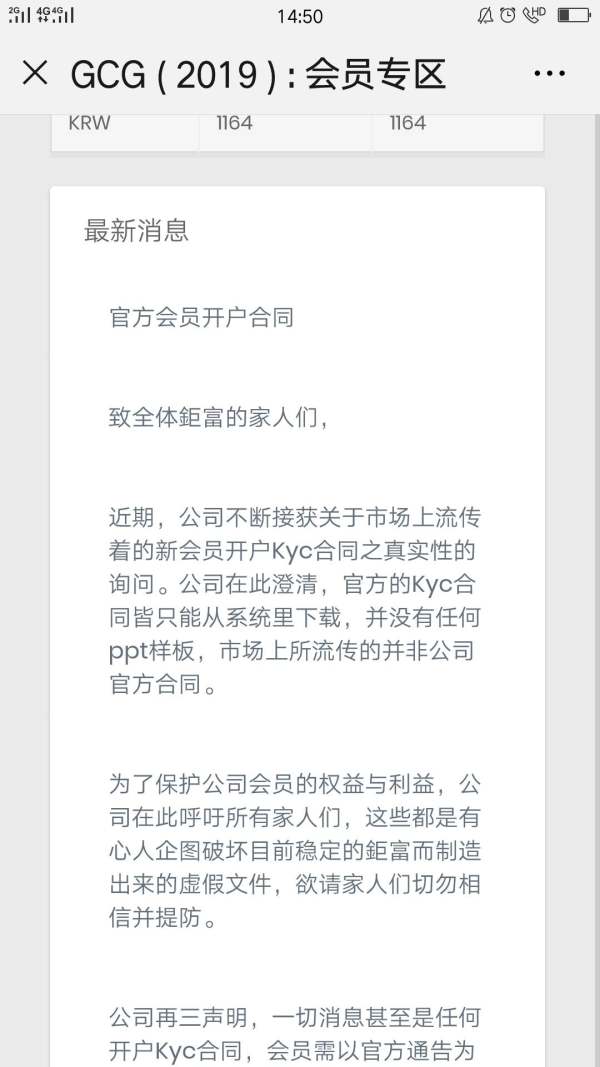

The allegations of operating as a Ponzi scheme create additional credibility concerns that extend beyond typical broker evaluation criteria. Financial review platforms have reported these allegations, which should alarm potential clients considering this broker. The lack of clear information about company ownership, management structure, and operational transparency further undermines trust in the organization. These factors combine to create a risk profile that exceeds acceptable levels for retail investors.

The discrepancy between claimed Swiss headquarters and actual Malaysian operations raises questions about the company's honesty. Without verified regulatory oversight from claimed authorities, clients face significant risks regarding fund safety, dispute resolution, and legal recourse options. Third-party evaluations consistently recommend avoiding GCG Asia, with financial analysts expressing serious concerns about the company's legitimacy. The overwhelming evidence suggests that trust and reliability issues make this broker unsuitable for any serious trading consideration.

Most investors should seek brokers with clear regulatory oversight, transparent operations, and positive reputation in the trading community.

User Experience Analysis

User experience with GCG Asia receives a poor rating of 3 out of 10. This rating reflects widespread negative feedback from traders who have interacted with the platform and services. Overall user satisfaction appears extremely low, with consistent recommendations from the trading community to avoid this broker entirely. The negative feedback spans multiple aspects of the user journey, from initial registration concerns to ongoing trading difficulties.

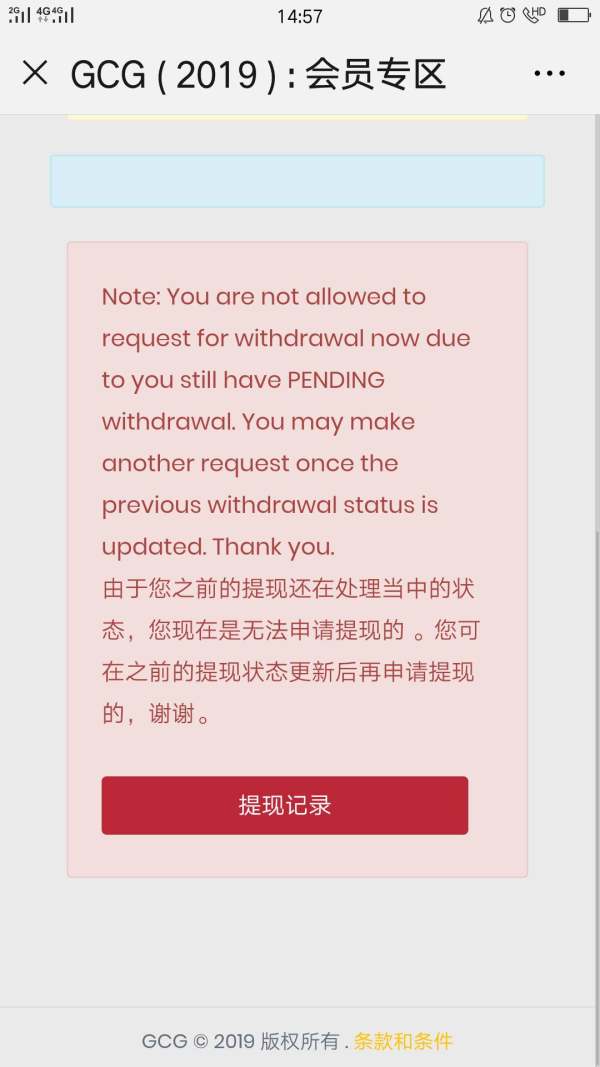

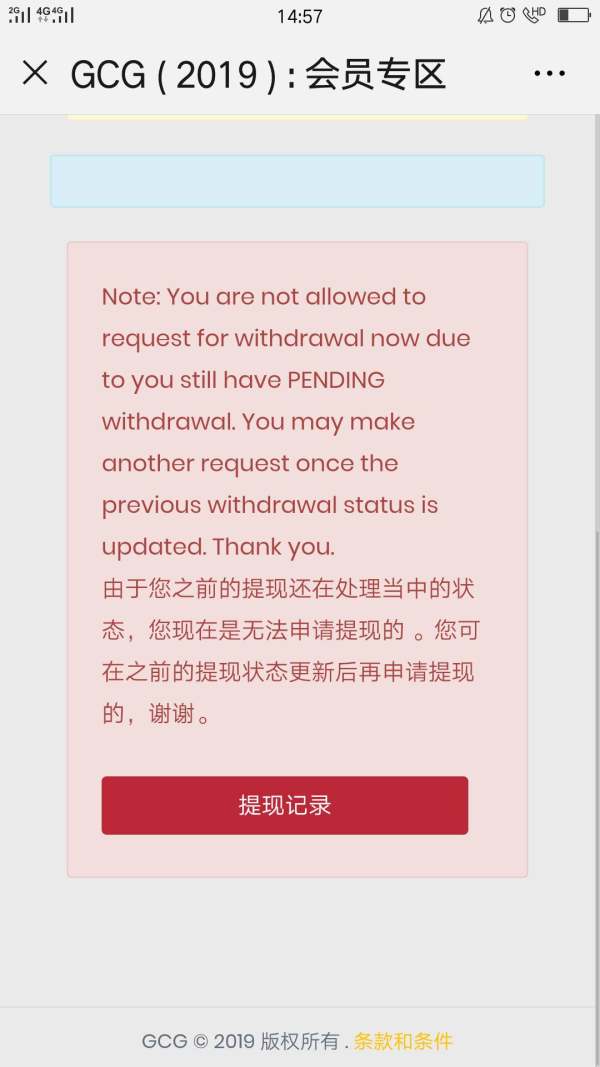

Interface design and platform usability information is limited in available sources. User reports suggest that technical issues and functionality problems detract from the overall experience for many clients. The registration and verification processes lack clear documentation, creating uncertainty for potential users about account setup requirements and timelines. Additionally, users report dissatisfaction with funding operations, indicating potential problems with deposit and withdrawal processes.

These funding issues can significantly impact the trading experience since reliable money management is essential for successful trading. Common user complaints center on service quality, trading execution problems, and concerns about fund safety. These issues reflect systemic problems that affect multiple aspects of the user experience and create frustration for clients. The regulatory warnings and allegations of fraudulent operations create additional user experience concerns since traders worry about platform legitimacy.

User feedback consistently suggests that the platform is unsuitable for ordinary investors. Most reviews recommend seeking alternative brokers with better service records and clearer regulatory standing for improved user experience.

Conclusion

This comprehensive GCG Asia review reveals numerous serious concerns that make this broker unsuitable for most traders. The combination of regulatory warnings from the Hong Kong Securities and Futures Commission, consistently negative user feedback, and allegations of operating as a Ponzi scheme create unacceptable risk levels. These issues should concern any retail investor considering this platform for their trading activities.

While the broker claims to offer diverse trading assets and the familiar MT4 platform, these potential benefits are overshadowed by fundamental trust and reliability issues. The lack of transparency regarding company ownership, operational structure, and regulatory compliance represents major red flags. Experienced traders should recognize these warning signs and avoid platforms that present such significant risks to their capital and trading success.

Even traders with high risk tolerance should exercise extreme caution when considering GCG Asia. The regulatory uncertainties and user feedback suggest systemic problems that extend beyond typical broker evaluation criteria. The platform's deficiencies across customer service, trading execution, and transparency make it particularly unsuitable for ordinary investors. Most people should seek reliable trading conditions and regulatory protection from established brokers with clear oversight and positive user feedback.