Regarding the legitimacy of HUATAI SECURITIES forex brokers, it provides CFFEX, SFC and WikiBit, (also has a graphic survey regarding security).

Is HUATAI SECURITIES safe?

Risk Control

Software Index

Is HUATAI SECURITIES markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

华泰期货有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Huatai (Hong Kong) Futures Limited

Effective Date:

2016-09-14Email Address of Licensed Institution:

ac@htfc.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.htfc.com.hkExpiration Time:

--Address of Licensed Institution:

香港中環皇后大道中99號中環中心2101-02室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Hua Tai Safe or Scam?

Introduction

Hua Tai, officially known as Hua Tai Securities Co., Ltd., is a prominent player in the forex and financial trading market, primarily based in China. Established in 1991, the company has built a reputation for offering a variety of trading services, including stocks, options, and futures. However, with the proliferation of online trading platforms, traders must exercise caution when selecting a broker. The forex market, while lucrative, is also fraught with risks, including potential scams. This article aims to provide a comprehensive evaluation of whether Hua Tai is a safe trading platform or a potential scam. The assessment is based on a thorough investigation of regulatory compliance, company background, trading conditions, client safety measures, and user experiences.

Regulation and Legitimacy

One of the most critical factors in determining whether a broker is safe is its regulatory status. Regulatory bodies enforce rules and standards that protect investors and ensure fair trading practices. Hua Tai is regulated by the China Financial Futures Exchange (CFFEX), which plays a significant role in overseeing the operations of financial institutions in China.

Heres a summary of the core regulatory information for Hua Tai:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| China Financial Futures Exchange (CFFEX) | 0011 | China | Verified |

Regulatory quality is paramount, as it establishes a broker's credibility. CFFEX is recognized for its rigorous standards, which means that brokers under its jurisdiction must adhere to strict operational protocols. During our investigation, no negative regulatory disclosures were found against Hua Tai, which is a positive indicator of its compliance history. However, it is essential to note that not all regulators are equally stringent, and traders should always verify the credibility of the regulatory body.

Company Background Investigation

Hua Tai has a rich history dating back to its founding in 1991. Over the years, it has evolved into a comprehensive financial services provider, offering a range of products and services. The company is publicly traded, which adds a layer of transparency to its operations. The management team possesses extensive experience in the financial sector, which is crucial for maintaining high operational standards.

The companys ownership structure is publicly available, allowing investors to assess its financial health and governance. Transparency is a critical factor in evaluating whether Hua Tai is a safe choice for trading. The firm regularly publishes financial reports, demonstrating its commitment to disclosure and accountability.

In conclusion, Hua Tai's long-standing presence in the market and its adherence to regulatory standards contribute positively to its reputation. However, potential investors should remain vigilant and conduct their own due diligence.

Trading Conditions Analysis

When assessing whether Hua Tai is safe, it is essential to examine its trading conditions and fee structures. The broker offers a variety of trading instruments, including stocks, options, and futures. However, it does not support some popular trading platforms like MetaTrader 4 or 5, which may be a drawback for some traders.

The overall fee structure is competitive, but there are some costs that traders should be aware of. Heres a comparison of core trading costs:

| Fee Type | Hua Tai | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.03% | 0.1% |

| Commission Model | Varies by account type | 0.05% |

| Overnight Interest Range | Up to 2x leverage | Varies |

The fee structure appears reasonable, but traders should be cautious of any hidden fees that may not be immediately apparent. Overall, the trading conditions at Hua Tai are competitive, but potential traders should carefully review the fee schedule and ensure they understand all costs involved.

Client Fund Safety

The safety of client funds is a paramount concern when evaluating any trading platform. Hua Tai implements several measures to ensure the security of its clients' investments. Client funds are typically held in segregated accounts, which means they are kept separate from the company's operational funds. This practice is crucial for protecting client assets in the event of financial difficulties faced by the broker.

Moreover, Hua Tai adheres to investor protection regulations, which provide an additional layer of security. However, it is essential to note that while the broker claims to have these protections in place, traders should verify the specifics of these policies, including any limits on investor compensation in case of insolvency.

Historically, there have been no significant incidents reported regarding fund safety at Hua Tai, which is a positive indicator. Nonetheless, traders should remain aware of the risks involved in trading and consider the financial stability of the broker.

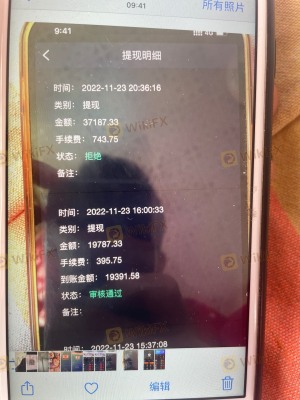

Customer Experience and Complaints

Understanding customer experiences is critical in determining whether Hua Tai is safe. Overall, user feedback has been mixed, with some traders praising the platform's ease of use and customer service, while others have raised concerns about withdrawal processes and responsiveness.

Heres a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Delay | Medium | Generally responsive |

| Platform Stability | Low | Mostly stable |

One notable case involved a trader who experienced delays in withdrawing funds, leading to frustration and dissatisfaction. The companys response was slow, which exacerbated the issue. However, it is important to consider that such experiences may not be representative of all users.

Platform and Execution

The trading platform offered by Hua Tai is generally stable, but it lacks some of the advanced features available on more popular platforms like MetaTrader. Users have reported satisfactory order execution quality, but there have been occasional instances of slippage, particularly during high volatility periods.

The overall user experience on the platform has been rated positively, with many users appreciating the intuitive interface. However, traders should remain vigilant for any signs of platform manipulation or unfair practices, although no significant evidence has been reported.

Risk Assessment

Using Hua Tai carries certain risks, as with any trading platform. Heres a risk assessment summarizing key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | Strong regulatory oversight |

| Fund Safety | Medium | Segregated accounts in place |

| Customer Service | Medium | Mixed feedback on responsiveness |

| Platform Stability | Low | Generally stable, but some slippage |

To mitigate these risks, traders should conduct thorough research, start with a small investment, and ensure they understand the platform's operational procedures.

Conclusion and Recommendations

In conclusion, while Hua Tai presents several positive indicators of safety, including regulatory oversight and a long-standing presence in the market, there are aspects that warrant caution. Issues related to customer service responsiveness and withdrawal processes could pose risks for traders.

Based on the evidence presented, Hua Tai is not a scam, but potential users should exercise due diligence before engaging with the platform. It is advisable for traders, especially beginners, to consider alternative brokers that may offer more robust customer support and trading conditions. Some reputable alternatives include brokers like IG, OANDA, and Forex.com, which have established strong reputations in the market.

In summary, while there are no clear signs of fraud associated with Hua Tai, traders should remain cautious and informed, ensuring a safe trading experience.

Is HUATAI SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of HUATAI SECURITIES brokers.

HUATAI SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HUATAI SECURITIES latest industry rating score is 8.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.