Hua Tai 2025 Review: Everything You Need to Know

Executive Summary

Hua Tai is a regulated financial services provider. The company has built a strong position in the competitive forex and financial trading world. This hua tai review looks at a company that works under the watch of the United States Commodity Futures Trading Commission and maintains membership with the National Futures Association, giving traders the regulatory credentials they need for legitimate financial services.

The company sees itself as an integrated financial platform. It offers diverse investment opportunities across multiple product lines. Hua Tai provides services that span stocks, derivatives, over-the-counter trading, asset management, investment banking, and international commodities trading based on available information. This comprehensive approach makes the platform especially good for investors who want diversified portfolio options.

The main target audience for Hua Tai seems to be small to medium-sized investors and traders. These clients focus on regulatory compliance while seeking access to multiple asset classes. The company's regulatory standing with both CFTC and NFA membership shows a commitment to maintaining industry standards, though specific details about trading conditions and user experience metrics stay limited in publicly available documentation.

Important Notice

Traders should know that Hua Tai may operate through different entities across various jurisdictions. This could result in varying regulatory frameworks and service offerings depending on the client's location. Users are strongly advised to verify the specific regulatory status and available services in their respective regions before engaging with the platform.

This review is compiled based on publicly available regulatory information, official company communications, and available user feedback sources. We work to maintain objectivity while acknowledging that comprehensive evaluation requires access to detailed trading specifications and user experience data that may not be fully disclosed in public documentation.

Rating Framework

Broker Overview

Hua Tai emerged in the financial services sector with a focus on providing comprehensive investment solutions to both domestic and international clients. The organization operates as part of a broader group structure that has established significant presence in the financial services industry according to available company information. The company's business model centers on functioning as an introducing broker, facilitating access to various financial markets through its integrated platform approach.

The broker's operational framework covers multiple financial product categories. It positions itself as a one-stop solution for investors seeking exposure to diverse asset classes. This comprehensive approach reflects the company's strategy to serve clients with varying investment objectives and risk tolerances, from conservative portfolio management to more aggressive trading strategies.

Hua Tai operates under the supervision of the United States Commodity Futures Trading Commission and maintains active membership with the National Futures Association from a regulatory perspective. These regulatory affiliations provide essential oversight and compliance frameworks that govern the company's operations. The company offers services across stocks, derivatives, OTC markets, asset management, investment banking, international commodities, and basis trading, demonstrating significant breadth in its service portfolio. This hua tai review notes that while the regulatory foundation appears solid, specific details about trading platforms and execution technology are not extensively documented in available public sources.

Regulatory Jurisdiction: Hua Tai operates under United States regulatory oversight through CFTC supervision and NFA membership. This provides clients with established regulatory protections and compliance standards that meet US financial industry requirements.

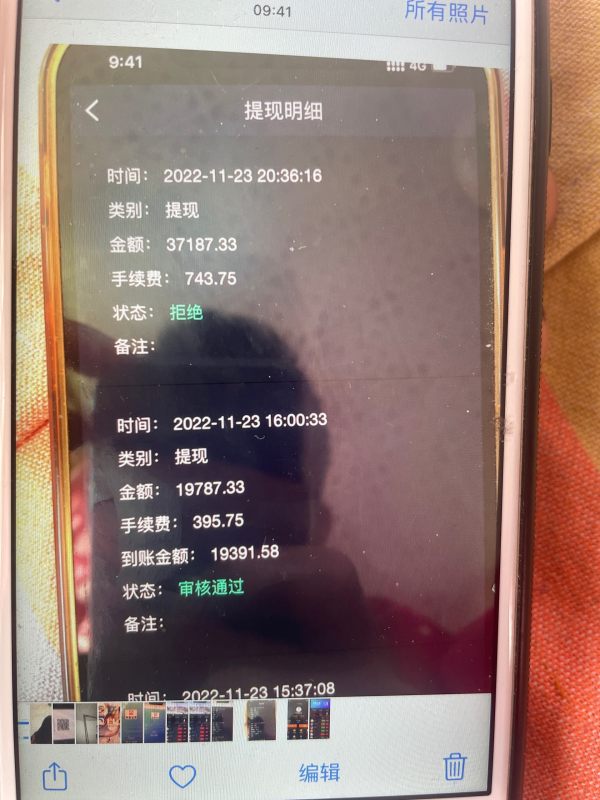

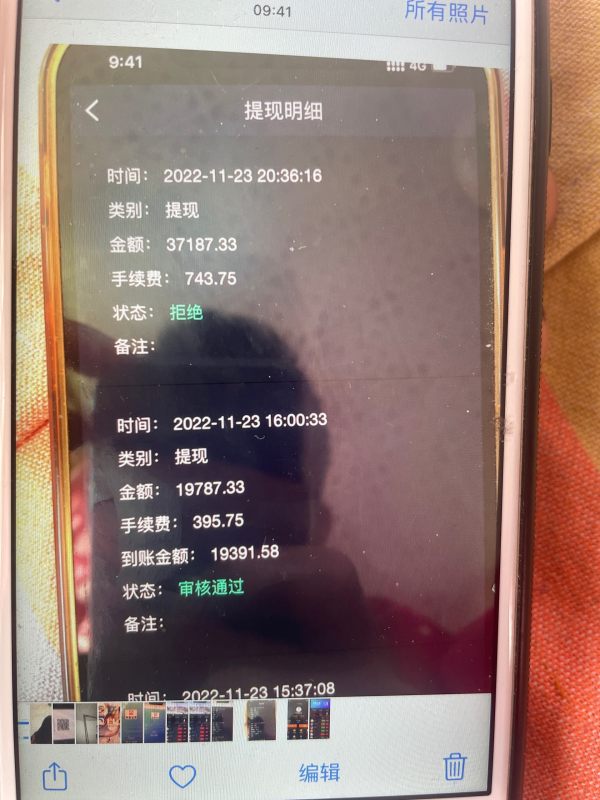

Deposit and Withdrawal Methods: Specific information regarding funding methods, processing times, and associated fees for deposits and withdrawals is not detailed in currently available documentation. This requires direct inquiry with the company for comprehensive details.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in accessible public information. This suggests potential variation based on account category and client classification.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not outlined in available company materials. This indicates either absence of such programs or limited public disclosure of promotional activities.

Tradeable Assets: The platform provides access to multiple asset classes including stocks, derivatives, over-the-counter instruments, managed assets, and international commodities. This offers significant diversification opportunities for portfolio construction.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs is not comprehensively available in public documentation. This requires direct consultation for specific pricing details.

Leverage Ratios: Maximum leverage offerings and margin requirements across different asset classes are not specified in current accessible information. US regulatory constraints would typically apply though.

Platform Options: Specific trading platform technologies, software providers, and platform features are not detailed in available sources. This represents a significant information gap for potential users.

Geographic Restrictions: Regional availability and jurisdiction-specific limitations are not clearly outlined in current documentation. This requires verification based on individual circumstances.

Customer Support Languages: Available support languages and communication channels are not specified in accessible company information. Multilingual support might be expected given the international scope of services though.

This hua tai review identifies significant gaps in publicly available operational details. This suggests the need for direct communication with the company to obtain comprehensive trading specifications.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Hua Tai's account conditions faces significant limitations due to the absence of detailed public information about account types, minimum deposit requirements, and specific account features. Without access to comprehensive account specifications, it becomes challenging to assess the competitiveness and suitability of the broker's offerings compared to industry standards.

Available information suggests that the company operates under US regulatory frameworks. These typically impose certain minimum capital requirements and client protection measures. The specific implementation of these requirements in terms of account structures, tiered service levels, and client categorization remains unclear from public documentation however.

The account opening process, verification requirements, and timeline for account activation are not detailed in accessible sources. This lack of transparency regarding fundamental account operations represents a significant information gap that potential clients would need to address through direct inquiry. Special account features such as Islamic accounts, professional trader classifications, or institutional account options are not documented in available materials additionally.

This hua tai review cannot provide a meaningful rating for account conditions due to insufficient publicly available information. This highlights the importance of direct consultation with the company for prospective clients seeking specific account details.

The assessment of Hua Tai's trading tools and resources encounters substantial limitations due to the absence of detailed information about platform capabilities, analytical tools, and educational resources in publicly available documentation. Without access to specific details about trading software, charting capabilities, or research provisions, a comprehensive evaluation of the broker's technological offerings becomes impossible.

One might expect a range of professional-grade tools and resources to support various trading strategies and investment approaches given the company's positioning as an integrated financial services provider. The specific technologies, third-party integrations, or proprietary tools that may be available to clients are not documented in accessible sources however.

Educational resources, market analysis, research reports, and trading guides that might be provided to clients are not detailed in current public information. This absence of information extends to automated trading support, API access, or advanced order types that sophisticated traders often require.

The lack of detailed information about trading tools and resources represents a significant transparency gap. Potential clients would need to address this through direct communication with the company to understand the full scope of available trading infrastructure and support materials.

Customer Service and Support Analysis

Evaluating Hua Tai's customer service capabilities proves challenging due to the limited availability of specific information about support channels, response times, and service quality metrics in public documentation. The absence of detailed customer service specifications makes it difficult to assess how well the broker serves its client base or handles various support requirements.

Fundamental aspects of customer support such as available communication channels, operating hours, and multilingual support capabilities are not clearly outlined in accessible company materials. This lack of transparency extends to response time commitments, escalation procedures, and specialized support for different client categories.

The quality of customer service, as measured through client satisfaction surveys, resolution rates, or third-party evaluations, is not documented in available sources. Specific support for technical issues, account-related inquiries, or trading assistance is not detailed in public information additionally.

Without access to user testimonials, service level agreements, or documented support procedures, this evaluation cannot provide meaningful insights into the actual customer service experience. Clients might expect this when engaging with Hua Tai's support infrastructure.

Trading Experience Analysis

The analysis of Hua Tai's trading experience faces significant constraints due to the absence of detailed information about platform performance, execution quality, and user interface characteristics in publicly available sources. Without access to specific technical specifications, performance metrics, or user experience data, a comprehensive assessment of the trading environment becomes impossible.

Critical aspects of trading experience such as platform stability, execution speeds, order fill rates, and slippage statistics are not documented in accessible materials. The absence of information about trading platform technology, server infrastructure, or connectivity options represents a substantial gap in understanding the actual trading conditions that clients might experience.

Mobile trading capabilities, platform customization options, and user interface design elements that significantly impact daily trading activities are not detailed in current public documentation. Information about order types, risk management tools, and real-time data provisions is not available in accessible sources additionally.

This hua tai review cannot provide a meaningful evaluation of trading experience quality due to insufficient publicly available technical and performance information. This emphasizes the need for potential clients to conduct thorough testing and inquiry before committing to the platform.

Trust and Regulation Analysis

Hua Tai demonstrates a solid regulatory foundation through its oversight by the United States Commodity Futures Trading Commission and membership with the National Futures Association. These regulatory affiliations provide essential credibility and suggest adherence to established industry standards for client protection and operational compliance.

The CFTC oversight ensures that the company operates within the framework of US financial regulations. These include specific requirements for capital adequacy, client fund segregation, and operational transparency. NFA membership further reinforces the regulatory compliance structure, providing additional oversight and industry standard adherence.

Specific details about client fund protection measures, insurance coverage, or segregated account structures are not comprehensively detailed in available public information however. The absence of information about third-party audits, financial strength ratings, or independent compliance assessments represents a limitation in fully evaluating the company's trustworthiness beyond its regulatory standing.

The regulatory foundation provides a strong basis for trust. The limited availability of detailed operational transparency information prevents a more comprehensive assessment of the company's overall reliability and client protection measures though. The regulatory credentials earn a solid rating, though additional transparency would strengthen the overall trust profile.

User Experience Analysis

The evaluation of Hua Tai's user experience encounters significant limitations due to the absence of detailed information about user interface design, platform usability, and client satisfaction metrics in publicly available documentation. Without access to specific user feedback, interface screenshots, or usability studies, assessing the overall user experience becomes challenging.

Critical elements of user experience such as platform navigation, account management interfaces, and mobile application functionality are not detailed in accessible sources. The registration and verification process, which significantly impacts initial user experience, lacks comprehensive documentation regarding required steps, timeline, and user-friendly features.

Funding and withdrawal experiences, including process clarity, transaction tracking, and user communication during financial operations, are not specified in available materials. Common user complaints, satisfaction ratings, or improvement initiatives are not documented in public sources additionally.

The absence of user testimonials, experience surveys, or independent usability assessments prevents meaningful evaluation of how well the platform serves its client base. Without access to detailed user experience data, potential clients would need to rely on direct testing and consultation to understand the practical aspects of using Hua Tai's services.

Conclusion

Hua Tai presents itself as a regulated financial services provider with solid regulatory credentials through CFTC oversight and NFA membership. This establishes a foundation of legitimacy within the competitive financial services landscape. This review reveals significant gaps in publicly available information about essential trading conditions, platform specifications, and user experience details however.

The broker appears most suitable for investors seeking diversified investment opportunities across multiple asset classes. These are particularly those who prioritize regulatory compliance and comprehensive financial services over specific trading platform features. The company's broad service portfolio spanning stocks, derivatives, OTC markets, and asset management suggests potential value for clients with diverse investment objectives.

The primary advantages include strong regulatory oversight and a comprehensive service offering across multiple financial sectors. The notable disadvantages center on limited transparency regarding trading conditions, platform capabilities, and specific user experience metrics however. Potential clients should conduct thorough due diligence and direct consultation with the company to obtain essential operational details before making investment decisions.