Regarding the legitimacy of DPS forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is DPS safe?

Business

License

Is DPS markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Deriv Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Deriv Trading License (STP)

Licensed Entity:

BINFINITY SECURITIES LTD

Effective Date:

2006-11-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

GARRY WYATT, Level 16, 115 PiTT STreeT SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is DPS Safe or a Scam?

Introduction

DPS, a broker operating in the forex market, has made its mark since its inception in 2017. With the growing popularity of online trading, it is essential for traders to thoroughly evaluate the credibility and safety of their chosen brokers. The forex market, while lucrative, is rife with risks, including potential scams and unregulated entities. Therefore, understanding the regulatory landscape, company background, trading conditions, and user experiences is crucial for ensuring safe trading practices. This article employs a comprehensive investigative approach, utilizing data from multiple sources to assess whether DPS is safe or if it raises red flags as a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A broker that is regulated by reputable authorities is generally considered safer for traders. DPS claims to operate under the auspices of the Australian Securities and Investments Commission (ASIC), a well-respected regulatory body. However, multiple sources have raised concerns about DPS being a suspicious clone of a legitimate entity, which complicates its regulatory standing.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 298464 | Australia | Suspicious Clone |

The importance of regulation cannot be overstated; it provides a framework for investor protection, ensuring that brokers adhere to strict operational standards. However, DPS's low score of 1.59 on WikiFX raises questions about its compliance history. While no negative regulatory disclosures have been found, the lack of transparency surrounding its licensing and the suspicion of being a clone firm necessitate caution. Therefore, it is crucial to delve deeper into the company's background to understand the potential risks involved.

Company Background Investigation

DPS was founded in 2017 and has since positioned itself as a forex and CFD broker. However, the details surrounding its ownership and management remain opaque. There is limited information available about the management team, which is a significant concern for potential investors. A transparent broker typically provides details about its leadership and their professional backgrounds, fostering trust among clients.

The company's history is also murky. While established brokers often have a track record of navigating through market challenges, DPS's relative newness, combined with its questionable regulatory status, raises concerns about its operational stability. Furthermore, the broker's website lacks comprehensive information about its services and operational practices, further diminishing transparency. Thus, potential traders must approach DPS with caution and consider the implications of its unclear background.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. DPS offers two types of accounts: a commission-free standard account and an ECN account with raw spreads. While the absence of a minimum initial deposit requirement might seem attractive, the spreads offered by DPS are reportedly higher than industry averages, which could significantly impact trading profitability.

| Fee Type | DPS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The higher spreads could indicate that traders may end up paying more in costs over time, which is a critical factor to consider. Additionally, the lack of clarity regarding any hidden fees or unusual costs should raise concerns. Traders must be vigilant and conduct thorough research to ensure that the overall cost structure aligns with their trading strategies and financial goals.

Client Fund Security

Client fund security is paramount when assessing whether DPS is safe. DPS claims to implement several security measures, including segregated accounts for client funds, which is a standard practice among reputable brokers. However, the effectiveness of these measures is questionable due to the broker's unclear regulatory status and the suspicion of being a clone firm.

Investors should also consider whether DPS offers negative balance protection, a feature that prevents clients from losing more than their initial investment. While there is no explicit mention of such protections on their website, the absence of negative balance protection could expose traders to significant financial risks, especially during volatile market conditions.

Historically, there have been no major incidents reported regarding fund security with DPS, but the lack of transparency surrounding its operational practices necessitates a cautious approach. Traders should ensure that they are fully aware of the risks involved before committing their funds.

Customer Experience and Complaints

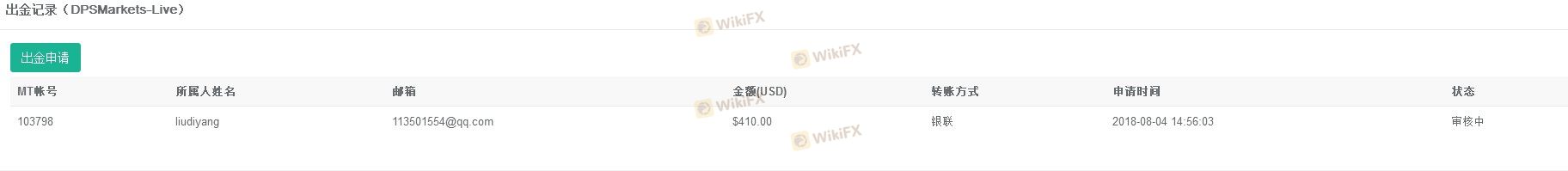

Customer feedback is a valuable indicator of a broker's reliability. Analyzing user experiences can reveal patterns of complaints and the company's responsiveness. Many users have reported issues with withdrawal processes and customer service delays, which are common red flags in the forex trading industry.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Average |

| Account Verification Issues | High | Unresolved |

Typical complaints include difficulty in withdrawing funds and long wait times for customer support responses. For instance, several users have reported that their withdrawal requests took significantly longer than promised, leading to frustrations. These patterns of complaints raise concerns about the overall customer experience and suggest that potential traders should be cautious when dealing with DPS.

Platform and Trade Execution

The trading platform is another essential aspect to evaluate. DPS utilizes the popular MetaTrader 4 (MT4) platform, known for its robust features and user-friendly interface. However, traders have reported issues related to order execution quality, including slippage and rejections.

These issues can severely impact trading performance, especially for those employing high-frequency trading strategies. If traders frequently encounter slippage or rejected orders, it could indicate potential platform manipulation or technical shortcomings. Therefore, it is essential to assess the platform's performance before committing significant capital.

Risk Assessment

When considering whether DPS is safe, it is vital to evaluate the overall risk profile associated with trading through this broker. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unclear regulatory status and clone suspicions. |

| Financial Risk | Medium | Higher spreads and potential hidden fees. |

| Operational Risk | Medium | Reports of withdrawal delays and poor customer service. |

| Platform Risk | High | Issues with order execution and slippage. |

To mitigate these risks, traders should consider starting with a minimal investment, ensuring they fully understand the broker's terms and trading conditions. Additionally, utilizing demo accounts to test the platform before trading with real funds can provide valuable insights into the broker's operational integrity.

Conclusion and Recommendations

In conclusion, while DPS presents itself as a forex broker with appealing trading conditions, the evidence suggests that potential traders should exercise caution. The broker's questionable regulatory status, combined with reports of customer complaints and operational issues, raises significant concerns about its safety and reliability.

For traders seeking a trustworthy broker, it is advisable to explore alternatives that are regulated by top-tier authorities and have a proven track record of transparency and customer satisfaction. Some reliable alternatives include brokers like OANDA and IG, which offer robust regulatory oversight and positive user experiences. Ultimately, thorough research and due diligence are essential for ensuring a safe trading environment in the forex market.

Is DPS a scam, or is it legit?

The latest exposure and evaluation content of DPS brokers.

DPS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DPS latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.