DPS Review 1

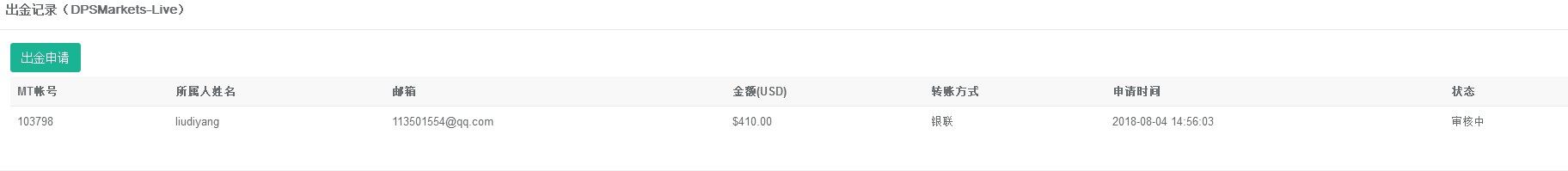

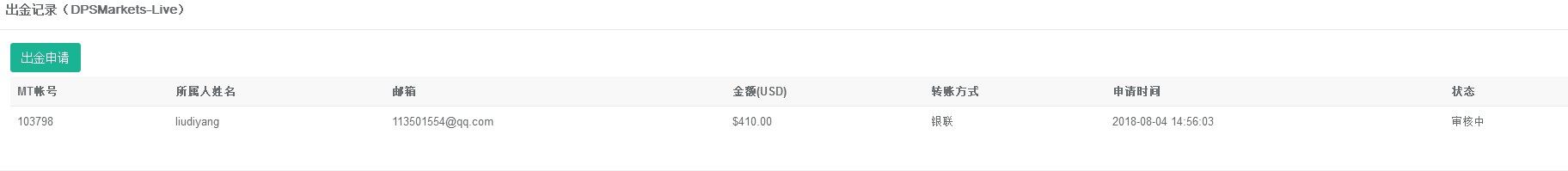

I lost a lot of money and earned a little on DPS. Can you help me to take the lost money back. Difficulty and unable to get in touch

DPS Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

I lost a lot of money and earned a little on DPS. Can you help me to take the lost money back. Difficulty and unable to get in touch

DPS, an Australian forex and CFD broker established in 2017, has garnered a mixed reputation among traders and analysts. While it offers competitive trading conditions such as high leverage and a user-friendly platform, concerns regarding its regulatory status and potential classification as a clone firm have raised significant red flags. This review will delve into the various aspects of DPS, including user experiences, advantages and disadvantages, and expert opinions.

Note: It is crucial to recognize that DPS operates under different entities in various jurisdictions, which may influence its regulatory compliance and user experience. The following analysis aims for fairness and accuracy based on the latest available data.

| Category | Score (out of 10) |

|---|---|

| Account Conditions | 5 |

| Tools and Resources | 6 |

| Customer Service and Support | 4 |

| Trading Experience | 5 |

| Trustworthiness | 3 |

| User Experience | 4 |

We rate brokers based on a combination of user feedback, expert analysis, and available data.

DPS, officially known as DPS Global Markets, is a forex and CFD broker based in Australia. Founded in 2017, it operates using the popular MetaTrader 4 (MT4) trading platform, which is favored for its robust features and user-friendly interface. DPS offers trading in approximately 30 currency pairs and various CFDs, although it notably lacks offerings in cryptocurrencies. The broker claims to be regulated by the Australian Securities and Investments Commission (ASIC), but many sources indicate that it may be operating as a clone firm, casting doubt on its legitimacy.

DPS claims to be regulated by ASIC, but several sources, including WikiFX, have labeled it a suspicious clone, suggesting that it may not comply with the necessary regulatory standards. This lack of transparency raises concerns for potential investors, as trading with an unregulated broker poses significant risks. Investors are advised to conduct thorough research and consider the regulatory status of any broker before committing funds.

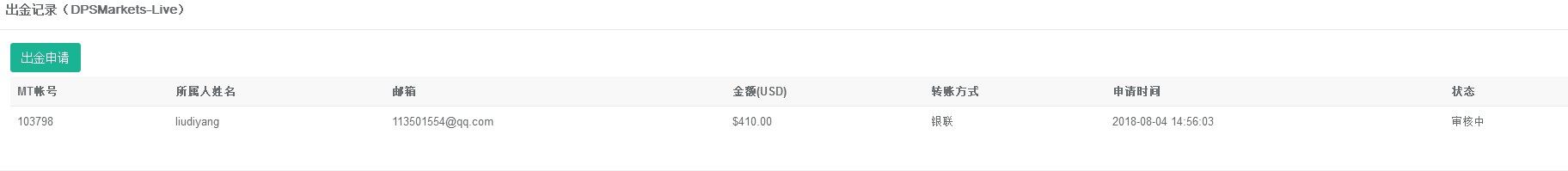

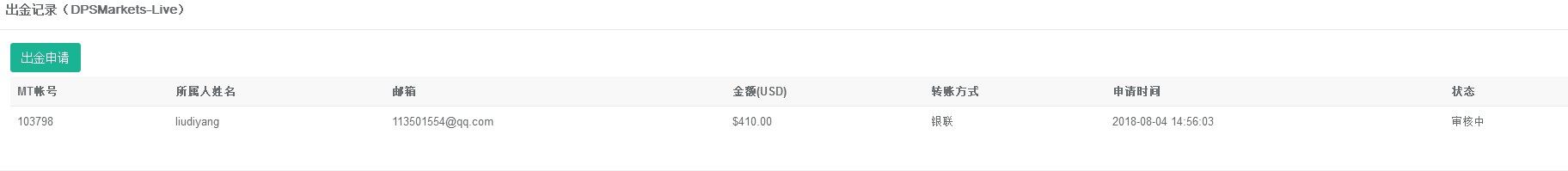

DPS allows deposits and withdrawals in multiple currencies, including AUD and USD, but does not support cryptocurrencies. The minimum deposit requirement is relatively low, making it accessible for new traders. However, the absence of clear information regarding withdrawal processing times and fees adds to the uncertainty surrounding this broker.

DPS offers two account types: a commission-free standard account with slightly higher spreads and an ECN account that requires a larger initial investment but provides raw spreads. The leverage offered can go up to 1:400, which is appealing to many traders but also comes with increased risk, particularly for inexperienced investors.

The spreads at DPS are reported to be around 1.6 pips, which is on the higher side compared to other brokers in the market. Additionally, the lack of transparency regarding hidden fees or commissions may lead to unexpected costs for traders.

Customer service at DPS is available in English and Simplified Chinese, with support accessible via phone and email. However, user reviews indicate that response times can be slow, and the overall quality of customer support is lacking. This is a crucial area where DPS needs improvement to enhance user satisfaction.

User experiences with DPS are varied. While some traders appreciate the low minimum deposit and the MT4 platform, others express frustration over the regulatory ambiguities and customer service issues. The overall sentiment leans towards caution, with many recommending potential users to be vigilant and conduct thorough due diligence before engaging with this broker.

| Category | Score (out of 10) | Comments |

|---|---|---|

| Account Conditions | 5 | Competitive but lacks clarity on fees. |

| Tools and Resources | 6 | MT4 is a strong platform, but limited asset offerings. |

| Customer Service and Support | 4 | Slow response times and inadequate support. |

| Trading Experience | 5 | High leverage is attractive but risky. |

| Trustworthiness | 3 | Regulatory concerns raise significant red flags. |

| User Experience | 4 | Mixed reviews suggest caution is warranted. |

In conclusion, while DPS presents some attractive features for traders, significant concerns regarding its regulatory status and customer service should not be overlooked. Potential users are encouraged to weigh these factors carefully before deciding to engage with this broker. As the DPS review indicates, thorough research and a cautious approach are essential when considering trading with this entity.

FX Broker Capital Trading Markets Review