Regarding the legitimacy of Donghai Futures forex brokers, it provides CFFEX and WikiBit, .

Is Donghai Futures safe?

Risk Control

Software Index

Is Donghai Futures markets regulated?

The regulatory license is the strongest proof.

CFFEX Derivatives Trading License (AGN)

China Financial Futures Exchange

China Financial Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

东海期货有限责任公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Donghai Futures Safe or Scam?

Introduction

Donghai Futures is a brokerage firm based in China, specializing in offering various financial services including forex trading, futures, options, and asset management. As the forex market continues to grow, it becomes increasingly important for traders to carefully evaluate the brokers they choose to work with. This is due to the inherent risks involved in trading, including potential scams and fraudulent activities. Therefore, this article aims to provide a comprehensive analysis of Donghai Futures, assessing its safety and legitimacy. Our investigation will utilize a combination of regulatory data, company background, trading conditions, and customer feedback to form a well-rounded view of the broker's reliability.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of any brokerage firm. Donghai Futures is regulated by the China Financial Futures Exchange (CFFEX), which is a significant regulatory body overseeing futures trading in China. The presence of regulation suggests that the broker is subject to strict oversight, which can enhance the safety of customer funds and ensure fair trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0008 | China | Verified |

The importance of regulation cannot be overstated, as it adds a layer of security for traders. Regulated brokers are required to adhere to specific standards, which include maintaining adequate capital reserves, ensuring transparency in operations, and protecting customer funds through segregation. However, while Donghai Futures is regulated, it is essential to consider the quality of that regulation and the broker's historical compliance. Reports indicate that there have been instances of severe losses and failed withdrawals associated with this broker, raising concerns about its operational integrity. Therefore, while Donghai Futures is regulated, traders should remain cautious and conduct thorough due diligence.

Company Background Investigation

Donghai Futures has been operational for several years, with its foundation tracing back to the mid-1990s. The company has developed a reputation in the Chinese market, primarily focusing on futures and forex trading. Its ownership structure appears to be stable, with a management team comprising individuals with relevant experience in finance and trading. However, transparency regarding the management team's backgrounds and the company's operational history is somewhat limited.

The management team is crucial in shaping the firm's policies and operational strategies. The professional experience of the team members can significantly influence a broker's reliability and customer service quality. Despite the lack of detailed public information about the management team, their presence in the industry suggests a level of expertise that may benefit clients. Nonetheless, the overall transparency of the company regarding its operations and financial health remains questionable, which could be a red flag for potential investors.

Trading Conditions Analysis

When evaluating whether Donghai Futures is safe, it is crucial to analyze its trading conditions, including fees, spreads, and commissions. The overall cost structure can significantly impact a trader's profitability. Reports indicate that while Donghai Futures offers competitive spreads, there are also complaints about hidden fees and unclear commission structures.

| Fee Type | Donghai Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | Unclear | $5 - $10 per lot |

| Overnight Interest Range | 0.5% - 1.5% | 0.5% - 1.0% |

The fee structure at Donghai Futures may not be as straightforward as it appears. Some traders have reported unexpected costs, which could be indicative of a less-than-transparent pricing model. This lack of clarity raises concerns about the broker's overall integrity and whether it operates in the best interest of its clients. Therefore, potential traders should carefully review all fee-related information and seek clarification before opening an account.

Customer Funds Security

The safety of customer funds is paramount when assessing a broker's reliability. Donghai Futures claims to implement various measures to protect client funds, including segregation of accounts and investor protection policies. However, the effectiveness of these measures is often put to the test during market volatility.

Traders should be aware of the broker's policies regarding fund security, including whether they offer negative balance protection. Such protections can prevent traders from losing more than their initial investment, which is particularly important in the highly volatile forex market. Additionally, any historical issues related to fund security or disputes should be thoroughly investigated before committing to a broker.

Customer Experience and Complaints

Customer feedback provides valuable insight into a broker's reliability. Reviews of Donghai Futures indicate a mixed bag of experiences. While some users report satisfactory service and trading conditions, others have raised serious concerns regarding withdrawal issues and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Hidden Fees | High | No clear response |

Several users have reported difficulties in withdrawing their funds, with some stating that they were required to deposit additional funds before they could access their existing balance. Such practices can be alarming and suggest potential issues with the broker's operational practices. It is crucial for potential clients to weigh these experiences against any positive feedback before making a decision.

Platform and Execution

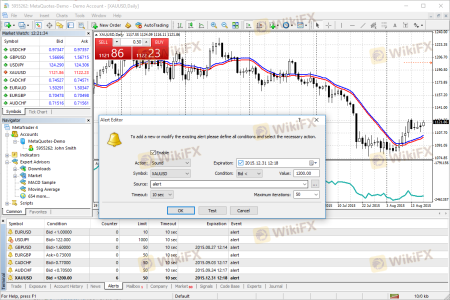

The trading platform provided by Donghai Futures is another critical aspect of its offering. A reliable platform should be stable, intuitive, and capable of executing orders efficiently. Users have reported mixed experiences with the platform's performance, including concerns about slippage and order rejections.

In assessing whether Donghai Futures is safe, it is essential to consider the overall user experience on the trading platform. Factors such as execution speed, downtime, and the presence of any signs of manipulation can significantly impact a trader's success. Traders should test the platform through a demo account to gauge its performance before committing real funds.

Risk Assessment

Using Donghai Futures carries certain risks that potential traders should be aware of. These risks range from regulatory concerns to trading conditions and customer service issues.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulated but with concerns about operational integrity. |

| Trading Conditions | High | Reports of hidden fees and withdrawal issues. |

| Customer Support | Medium | Inconsistent response times and quality. |

To mitigate these risks, traders should conduct thorough research and consider starting with a small investment. Engaging with customer support prior to opening an account can also provide insight into the broker's responsiveness and reliability.

Conclusion and Recommendations

In conclusion, while Donghai Futures is regulated by the CFFEX, there are several red flags that potential traders should consider. Reports of severe losses, withdrawal issues, and inconsistent customer support raise questions about the broker's overall safety. Therefore, it is essential for traders to exercise caution and conduct thorough due diligence before investing.

For those seeking alternatives, brokers with a strong reputation for reliability and customer service, such as Shengda Futures or Ruida Futures, may be worth considering. Ultimately, the decision to trade with Donghai Futures should be based on a careful evaluation of all available information, including personal risk tolerance and investment goals.

Is Donghai Futures a scam, or is it legit?

The latest exposure and evaluation content of Donghai Futures brokers.

Donghai Futures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Donghai Futures latest industry rating score is 7.91, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.91 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.