Regarding the legitimacy of DLSM forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is DLSM safe?

Pros

Cons

Is DLSM markets regulated?

The regulatory license is the strongest proof.

ASIC Derivatives Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

DLS MARKETS (AUST) PTY LTD

Effective Date: Change Record

2006-02-07Email Address of Licensed Institution:

compliance@dlsm.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 21 207 KENT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0452639886Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

DLS Markets Limited

Effective Date:

2023-06-13Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is DLSM Safe or Scam?

Introduction

DLSM, a forex broker operating in the global financial markets, has attracted attention due to its competitive trading conditions and regulatory framework. As with any financial service, it is crucial for traders to thoroughly assess the legitimacy and safety of the broker they choose. The forex market is rife with opportunities, but it also harbors risks, including scams and unregulated entities that can jeopardize traders' investments. This article aims to provide an objective analysis of DLSM by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and potential risks. The investigation is based on various online sources, user reviews, and regulatory data to form a comprehensive view of whether DLSM is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a crucial factor in determining its legitimacy. DLSM claims to be regulated by two entities: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). ASIC is known for its stringent regulatory standards, providing a layer of security for traders. Conversely, VFSC is often criticized for its less rigorous oversight, which can lead to higher risks for traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 296805 | Australia | Verified |

| VFSC | 700455 | Vanuatu | Verified |

The presence of ASIC regulation is a positive aspect, as it suggests that DLSM adheres to certain operational standards and investor protections. However, the VFSC's offshore status raises questions about the quality of oversight and the potential for regulatory arbitrage. Historically, brokers regulated in Vanuatu have been associated with higher risks, making it essential for traders to exercise caution.

Company Background Investigation

DLSM is positioned as a global multi-asset CFD broker, with its parent company registered in Australia. Established approximately 15 to 20 years ago, DLSM has undergone various developments in its operational framework. The company's ownership structure is not extensively detailed in available sources, which raises concerns about transparency.

The management team behind DLSM consists of industry veterans, but specific details regarding their backgrounds and professional experiences are scarce. This lack of information could hinder traders' ability to assess the broker's credibility fully. Transparency is vital in the financial sector, and potential clients should be wary of brokers that do not provide comprehensive information about their management and ownership.

Trading Conditions Analysis

DLSM offers various trading conditions that are competitive compared to industry standards. The broker provides multiple account types, including standard and ECN accounts, with leverage options ranging from 1:500 to 1:1000. However, it's essential to evaluate the fee structure carefully.

| Fee Type | DLSM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 pips |

| Commission Structure | $0 - $4 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While DLSM's spreads appear attractive, the commission structure might be less appealing for some traders, especially those who trade frequently. Additionally, the broker's fee policies should be scrutinized for any hidden charges or unusual practices that could affect trading profitability.

Customer Funds Safety

The safety of customer funds is paramount in establishing a broker's credibility. DLSM claims to implement measures such as segregated accounts to protect client funds. However, the specifics of these measures are not clearly outlined in available resources.

Investor protection schemes are often a hallmark of reputable brokers, especially those regulated by ASIC. DLSM's adherence to such protections remains to be fully verified. Moreover, any past controversies or issues regarding fund security should be closely examined.

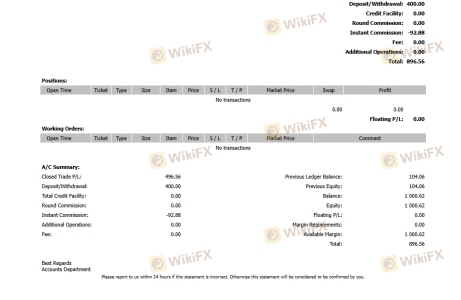

Customer Experience and Complaints

User feedback plays a vital role in assessing a broker's reliability. DLSM has received mixed reviews from clients, with some praising its trading platform and customer service, while others have reported issues with fund withdrawals and account access.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Access Problems | Medium | Unresolved queries |

One notable case involved a user who reported difficulties withdrawing funds, claiming that the broker required excessive documentation and verification processes. Such complaints can indicate potential operational issues and should be taken seriously by prospective clients.

Platform and Execution

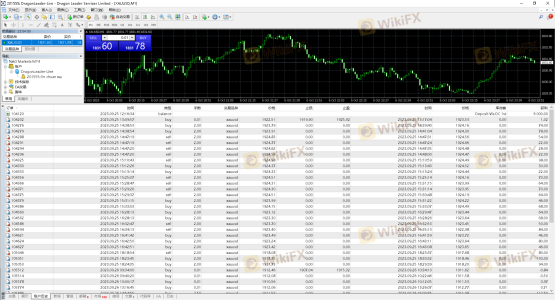

DLSM offers trading on popular platforms such as MetaTrader 4 and MetaTrader 5. The performance and stability of these platforms are crucial for traders who rely on them for executing trades. Overall, user experiences have been generally positive regarding platform performance, although there are reports of occasional slippage and execution delays.

Traders should be cautious about any indications of platform manipulation, which can compromise trading integrity. Monitoring execution quality and responsiveness is essential for maintaining trust in the broker.

Risk Assessment

Engaging with DLSM involves certain risks that traders should be aware of. The combination of offshore regulation, mixed user experiences, and potential issues related to fund withdrawals contributes to an overall risk profile that warrants caution.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may imply less oversight. |

| Operational Risk | High | Reports of withdrawal issues and account access problems. |

| Market Risk | Medium | Standard forex market risks apply. |

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a demo account, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, DLSM presents a mixed picture as a forex broker. While it boasts regulatory oversight from ASIC, the presence of offshore regulation from VFSC introduces potential risks. User experiences vary significantly, with notable complaints regarding fund withdrawals and account access.

Traders should approach DLSM with caution, particularly if they are risk-averse or new to forex trading. It may be prudent to explore alternative brokers with stronger regulatory frameworks and more transparent operations, such as those regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC). Overall, conducting thorough research and considering personal risk tolerance is essential before engaging with DLSM or any forex broker.

Is DLSM a scam, or is it legit?

The latest exposure and evaluation content of DLSM brokers.

DLSM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DLSM latest industry rating score is 6.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.