DLSM 2025 Review: Everything You Need to Know

Executive Summary

DLSM is a developing broker in the competitive forex landscape. It offers multiple financial instruments and competitive trading conditions that need careful examination. This dlsm review reveals a broker positioned in both Australia and Vanuatu, presenting traders with high leverage opportunities up to 1:500 and a relatively accessible minimum deposit requirement of 200 USD. The broker operates under dual regulatory frameworks through ASIC and VFSC. However, specific license details require further verification.

Key highlights include the upcoming launch of the DLSM GO mobile application and support for popular trading platforms MT4 and MT5. Our analysis uncovers concerning user feedback regarding fund security, with reported incidents of initial deposits being compromised. DLSM primarily targets traders seeking high leverage capabilities and multi-asset CFD trading opportunities. It positions itself as a global multi-asset CFD broker committed to providing superior trading environments for diverse investor profiles.

The broker's regulatory status and market reputation present mixed signals. This necessitates thorough due diligence from potential clients before engagement.

Important Notice

DLSM operates through multiple jurisdictions with entities registered in Australia and Vanuatu. This creates potential variations in regulatory standards and client protection measures between regions. Traders should carefully verify which entity serves their jurisdiction and understand the corresponding regulatory protections available.

This review is based on available public information, user feedback, and regulatory data as of 2025. Given the dynamic nature of the forex industry, some information may experience update delays or changes. Potential clients are advised to verify current terms, conditions, and regulatory status directly with DLSM before making trading decisions.

Rating Framework

Broker Overview

DLSM positions itself as a global multi-asset CFD broker headquartered in Vanuatu. It is dedicated to providing superior trading environments for every trader category. While the exact founding date remains unspecified in available documentation, the broker has established a presence in multiple jurisdictions to serve international clients. The company's business model centers on providing contract for difference (CFD) trading across various financial instruments. It caters to different investor types from retail traders to more sophisticated market participants.

The broker operates under a multi-jurisdictional regulatory framework, maintaining oversight from both the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). This dual regulatory approach aims to provide broader market access while maintaining compliance standards. DLSM supports MT4 and MT5 trading platforms, offering traders access to industry-standard tools for market analysis and trade execution. The broker's multi-asset CFD offering includes forex pairs among other financial instruments. It positions itself within the competitive online trading sector. This comprehensive dlsm review examines how these foundational elements translate into practical trading conditions for end users.

Regulatory Jurisdiction: DLSM operates under dual regulatory oversight from ASIC in Australia and VFSC in Vanuatu. However, specific license numbers are not readily available in public documentation, requiring direct verification with the broker.

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available information. This represents a transparency gap that potential clients should address during account opening discussions.

Minimum Deposit Requirement: The broker sets a minimum deposit threshold of 200 USD. This positions itself as accessible to retail traders with moderate capital requirements.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available documentation. This suggests either limited promotional activity or insufficient public disclosure.

Tradeable Assets: DLSM provides access to multiple CFD instruments including forex pairs. However, the complete asset catalog requires direct inquiry with the broker for comprehensive details.

Cost Structure: Spread and commission information remains undisclosed in public materials. User feedback indicates potential concerns regarding trading costs that require clarification during the account evaluation process.

Leverage Ratios: The broker offers leverage up to 1:500. This provides significant capital amplification opportunities for experienced traders while requiring careful risk management.

Platform Options: Trading is facilitated through MT4 and MT5 platforms. These provide access to professional-grade trading tools and analytical capabilities. This dlsm review notes the upcoming DLSM GO mobile application as an additional platform option.

Geographic Restrictions: Specific regional limitations are not detailed in available information. This requires direct confirmation based on trader location.

Customer Service Languages: Supported communication languages are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

DLSM's account conditions present a mixed picture for potential traders. The 200 USD minimum deposit requirement positions the broker competitively within the retail trading space. It makes account access relatively affordable for new traders entering the forex market. However, the lack of detailed information regarding different account types significantly limits our ability to fully assess the broker's offerings. Most established brokers provide multiple account tiers with varying features, minimum deposits, and trading conditions.

The absence of specific information about Islamic accounts, VIP tiers, or professional account categories raises questions about the broker's commitment to serving diverse client needs. Additionally, the account opening process details are not readily available. This creates uncertainty about verification requirements, documentation needs, and time frames for account activation.

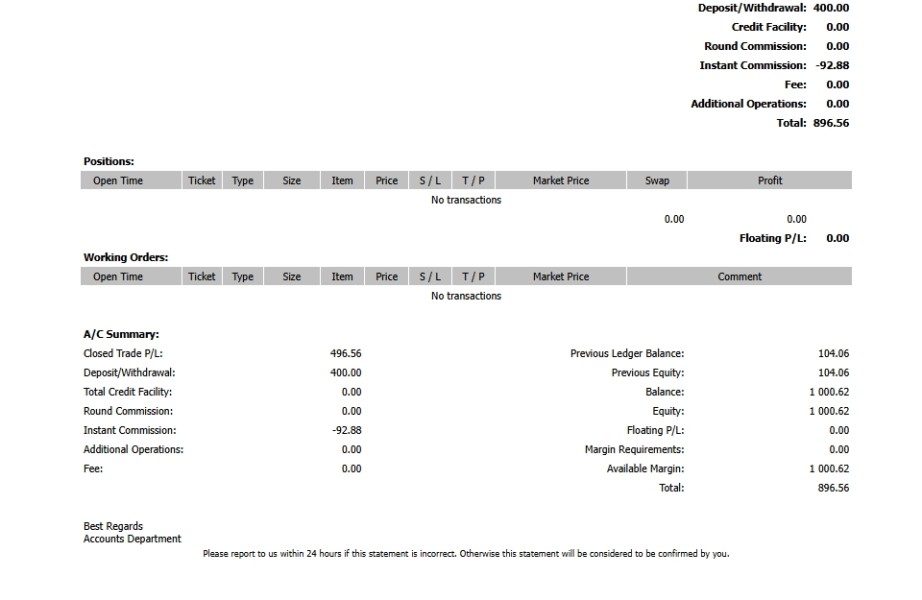

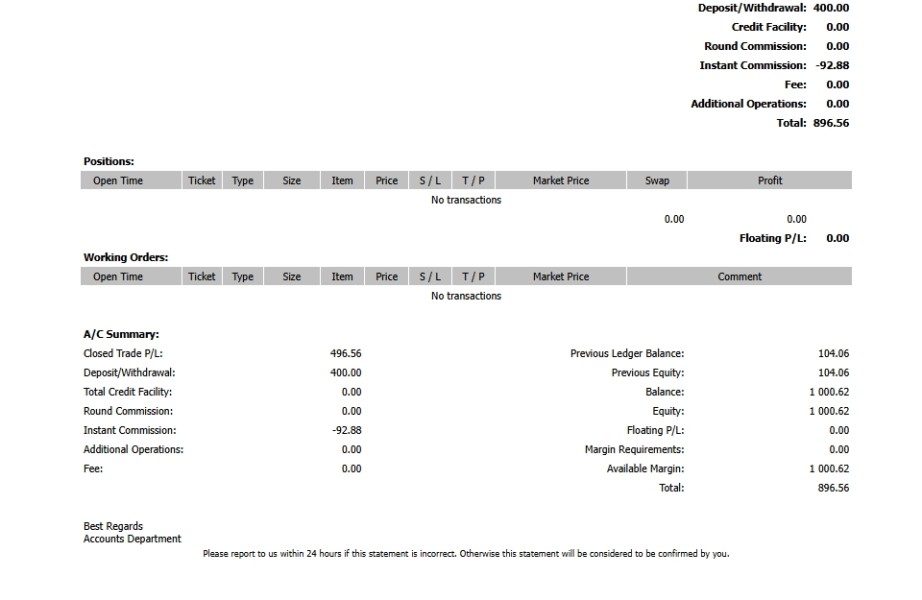

User feedback reveals concerning issues, with reports of initial deposits being compromised. This includes one specific complaint about 500 USDT being stolen from an initial deposit. This represents a serious red flag regarding account security and fund protection measures. Without clear information about segregated client funds, deposit insurance, or compensation schemes, traders face uncertainty about their capital protection. This dlsm review emphasizes the critical importance of verifying security measures before depositing funds.

DLSM's trading infrastructure centers around the industry-standard MT4 and MT5 platforms. These provide traders with access to professional-grade trading tools and analytical capabilities. These platforms offer comprehensive charting packages, technical indicators, and automated trading support through Expert Advisors. The upcoming DLSM GO mobile application represents a positive development for traders requiring mobile trading flexibility.

However, the broker's offering appears limited beyond basic platform access. There is no available information regarding proprietary trading tools, advanced market analysis software, or specialized trading calculators that many brokers provide to enhance the trading experience. The lack of detailed information about research and analysis resources significantly impacts the overall value proposition for traders who rely on broker-provided market insights.

Educational resources appear absent from current documentation. This represents a significant gap for new traders who typically require learning materials, webinars, and educational content to develop their trading skills. Most reputable brokers invest heavily in trader education as both a service differentiator and client retention strategy. The absence of information about automated trading support, while MT4/MT5 inherently support Expert Advisors, suggests limited broker-specific enhancement or support for algorithmic trading strategies.

Customer Service and Support Analysis (4/10)

Customer service represents a critical weakness in DLSM's current offering based on available information and user feedback. The absence of detailed information about customer service channels, availability hours, and response time commitments creates uncertainty about support accessibility when traders encounter issues or require assistance.

User feedback contains concerning reports about fund security, with specific complaints about initial deposits being stolen. This type of feedback suggests either inadequate security measures or poor handling of client concerns when issues arise. The lack of visible complaint resolution processes or customer protection protocols raises questions about the broker's commitment to client welfare.

The absence of information about multilingual support capabilities limits accessibility for international traders who may require assistance in their native languages. Most global brokers provide support in multiple languages to serve their international client base effectively. Additionally, there is no available information about dedicated account managers, educational support, or technical assistance programs that established brokers typically offer.

Without clear communication about customer service standards, escalation procedures, or client protection measures, traders face uncertainty about support quality when problems arise. This represents a significant risk factor for potential clients considering DLSM for their trading activities.

Trading Experience Analysis (6/10)

The trading experience with DLSM centers around the MT4 and MT5 platforms. These provide robust functionality for market analysis and trade execution. These industry-standard platforms offer comprehensive charting capabilities, technical analysis tools, and support for automated trading strategies. The upcoming DLSM GO mobile application should enhance accessibility for traders requiring mobile trading capabilities.

However, critical information about trading conditions remains unavailable, significantly impacting our ability to assess the overall trading experience. Spread information, commission structures, and execution quality details are not provided in available documentation. This creates uncertainty about actual trading costs and execution standards. These factors directly impact trader profitability and satisfaction.

The lack of information about platform stability, server uptime, and execution speeds represents another significant gap. Traders require reliable platform performance, especially during high-volatility market conditions when rapid execution becomes critical. Without specific performance metrics or user testimonials about platform reliability, potential clients cannot adequately assess the technical quality of the trading environment.

Order execution quality, including slippage rates, requote frequency, and fill rates, remains unspecified. These factors significantly impact trading outcomes, particularly for scalping strategies or during news events when market conditions become volatile. This dlsm review notes that while platform selection appears adequate, the lack of transparency about execution conditions creates uncertainty about practical trading experiences.

Trust Factor Analysis (5/10)

DLSM's trust profile presents mixed signals that require careful consideration from potential clients. The broker operates under dual regulatory oversight from ASIC in Australia and VFSC in Vanuatu. This provides some level of regulatory framework. However, the absence of specific license numbers in public documentation creates uncertainty about verification and regulatory compliance status.

Fund security measures remain largely unspecified, representing a critical concern given user reports of deposit theft. Without clear information about client fund segregation, deposit insurance, or compensation schemes, traders face uncertainty about capital protection. Established brokers typically provide detailed information about fund security measures and regulatory protections as key trust-building elements.

Company transparency appears limited, with insufficient information about corporate structure, financial reporting, ownership details, or operational history. Most reputable brokers provide comprehensive corporate information to build client confidence and demonstrate operational legitimacy. The lack of detailed company background information creates uncertainty about corporate stability and operational track record.

Industry reputation shows concerning elements, particularly user complaints about fund security and deposit theft. These types of complaints, if unresolved, significantly impact broker credibility and raise questions about operational integrity. Without evidence of effective complaint resolution or customer protection measures, the trust factor remains questionable for potential clients.

User Experience Analysis (5/10)

Overall user satisfaction with DLSM appears mixed based on available feedback, with both positive and negative experiences reported. The presence of serious complaints about fund security significantly impacts the overall user experience assessment. Financial safety represents the fundamental requirement for any trading relationship.

Platform interface and usability center around MT4 and MT5, which provide familiar environments for experienced traders. However, there is no available information about platform customization options, user interface enhancements, or broker-specific features that might improve the overall user experience beyond standard platform functionality.

The registration and verification process details remain unspecified, creating uncertainty about account opening convenience and time requirements. Modern traders expect streamlined onboarding processes with clear documentation requirements and reasonable verification timeframes. The lack of information about these processes suggests either limited process optimization or insufficient transparency about account opening procedures.

Fund operation experiences show concerning feedback, with specific reports of deposit theft that directly impact user confidence and satisfaction. These types of experiences, regardless of frequency, create significant negative impressions and raise questions about operational security and client protection measures. Common user complaints appear to center around fund security issues. These represent the most serious type of broker-related concern for traders.

Conclusion

DLSM presents as a developing broker with potential opportunities but requiring significant caution from prospective clients. While the broker offers competitive elements such as a reasonable 200 USD minimum deposit and high leverage up to 1:500, serious concerns about fund security and limited transparency create substantial risk factors.

The broker appears most suitable for experienced traders who can thoroughly evaluate security measures and are comfortable with higher-risk broker relationships. High leverage traders and multi-asset investors may find some appeal in the offering. However, they must carefully weigh the risks against potential benefits.

Key advantages include accessible minimum deposits and high leverage availability, while major disadvantages encompass incomplete regulatory information transparency and concerning user complaints about fund security. Potential clients should conduct extensive due diligence and consider these factors carefully before engagement.