Tradovate 2025 Review: Everything You Need to Know

Executive Summary

Tradovate is an NFA-registered introducing broker that focuses on innovative trading experiences for active futures traders. This tradovate review looks at a platform that offers unlimited commission-free trading through a clear pricing model, designed specifically for traders who want straightforward access to futures and options markets.

The broker operates under NFA registration (NFA ID# 0484683). This shows regulatory compliance within the United States market. Tradovate's main appeal comes from its fixed-price model that removes traditional commission structures, making it especially attractive for high-frequency traders and those seeking cost-effective futures trading solutions.

The platform serves active futures and options traders through its cloud-based infrastructure. It supports trading across indices, interest rates, metals, energy, and agricultural products. While the platform offers advanced tools for experienced traders, feedback suggests it may create complexity challenges for those who prefer simplified trading experiences.

Tradovate's position in the competitive futures brokerage space shows its commitment to innovation and transparency. However, traders should carefully evaluate whether the platform's feature set matches their specific trading requirements and experience level.

Important Notice

Tradovate is an NFA-registered broker operating under NFA ID# 0484683. This shows regulatory compliance within the United States market. However, traders should note that regulatory frameworks may vary across different jurisdictions, and this registration specifically applies to U.S. operations.

This review method includes comprehensive analysis of platform functionality, available user feedback, and publicly accessible market information. The evaluation presented here reflects information available at the time of writing and should be considered alongside current market conditions and individual trading requirements.

Traders should conduct their own research and consider their specific circumstances before making any trading platform decisions.

Rating Framework

Broker Overview

Tradovate has built itself as a specialized futures brokerage operating under United States regulatory oversight through its NFA registration. The company focuses only on delivering innovative trading experiences for futures and options traders, positioning itself as an alternative to traditional commission-based brokerage models.

The broker's business model centers on providing unlimited commission-free trading through a fixed-price structure. This eliminates traditional per-trade fees that can significantly impact active traders' profits. This approach especially appeals to high-frequency traders and those executing multiple positions across various futures markets.

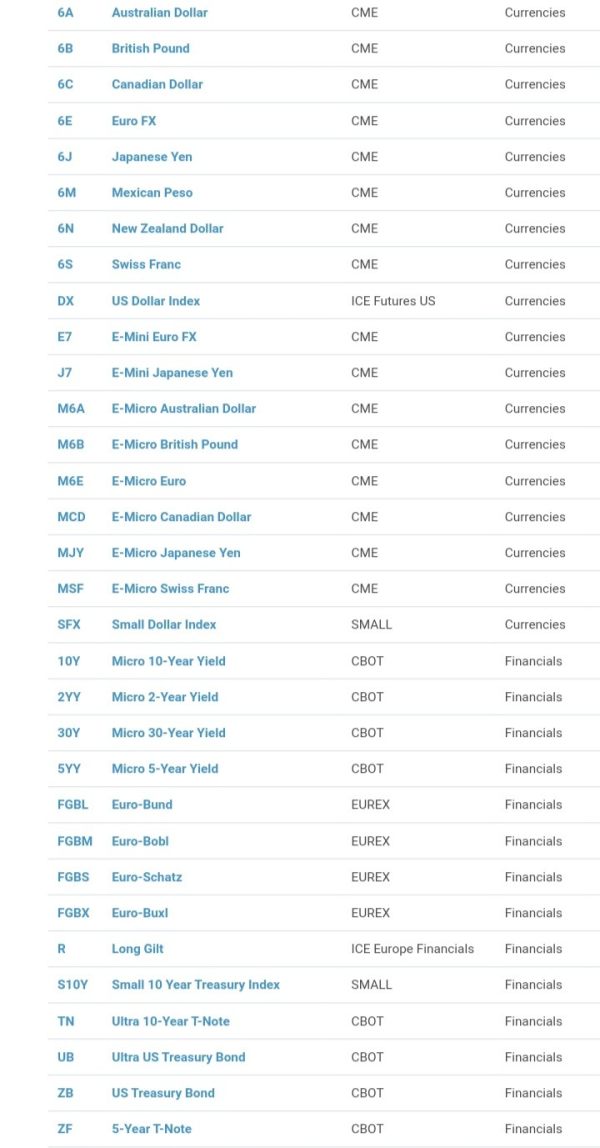

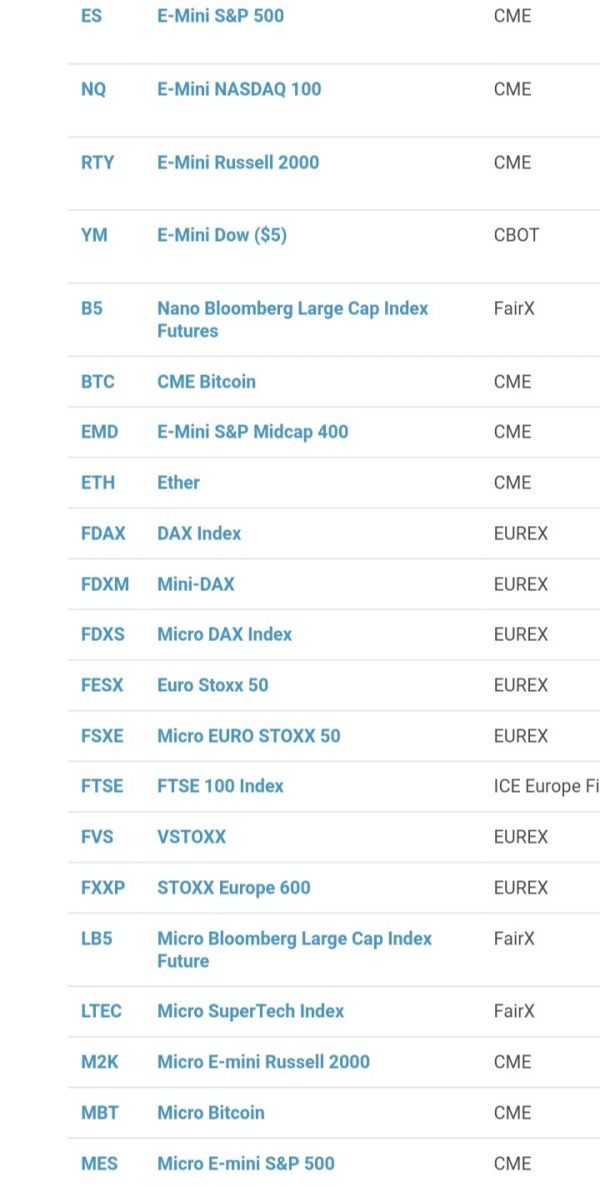

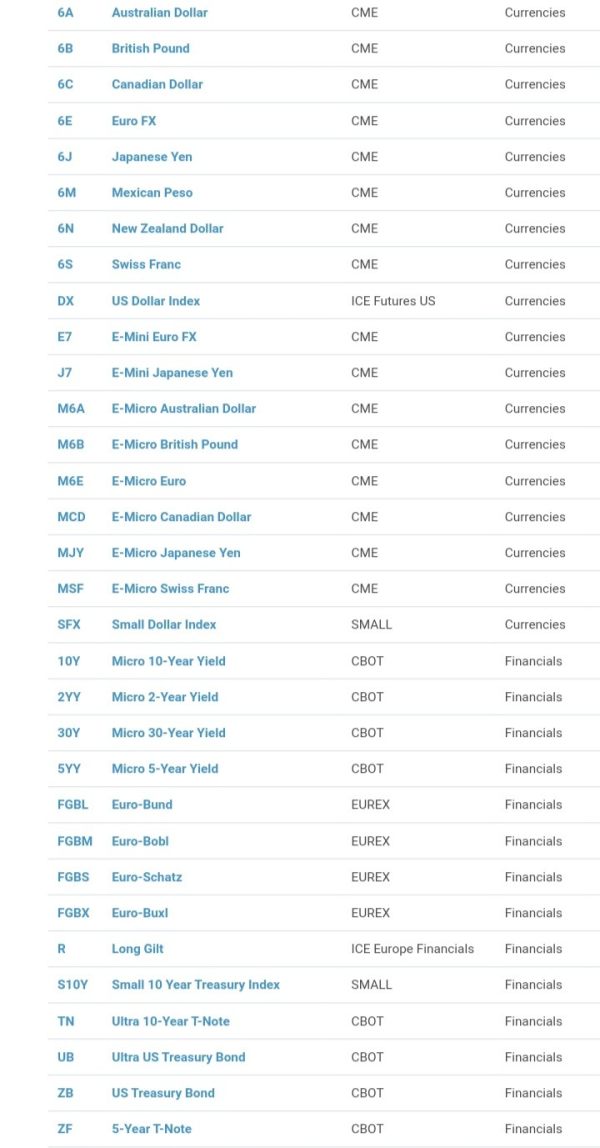

Tradovate's platform uses cloud-based technology, enabling traders to access markets through PC and Mac systems without requiring complex software installations. The platform covers comprehensive futures and options markets, including major indices, interest rates, precious and base metals, energy commodities, and agricultural products.

The company's regulatory standing through NFA registration (NFA ID# 0484683) gives traders confidence in operational compliance within the U.S. market. This tradovate review notes that while the broker maintains this regulatory oversight, traders should verify current registration status and understand the scope of regulatory protection applicable to their specific trading activities.

Regulatory Jurisdiction: Tradovate operates under NFA registration within the United States market. This provides regulatory oversight for domestic trading activities. The NFA registration shows compliance with U.S. futures trading regulations.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available materials. Prospective traders should contact the broker directly for current payment processing options.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available documentation. Traders interested in account opening should verify current requirements directly with Tradovate.

Bonus and Promotional Offers: Available materials do not detail specific promotional offers or bonus programs. Current promotional activities should be confirmed through direct broker contact.

Tradeable Assets: The platform provides access to comprehensive futures and options markets. This covers major asset classes including stock indices, interest rate products, precious and industrial metals, energy commodities, and agricultural products.

Cost Structure: Tradovate uses a fixed-price model offering commission-free trading with transparent pricing structures. This approach eliminates traditional per-trade commissions, though traders should verify current pricing details and any applicable fees for specific trading activities.

Leverage Ratios: Specific leverage information was not detailed in available materials. Futures trading leverage typically varies by contract type and regulatory requirements.

Platform Options: The broker provides cloud-based trading platforms supporting multiple devices. These are designed specifically for active futures and options trading without requiring complex software installations.

This tradovate review emphasizes the importance of verifying current terms and conditions directly with the broker. Specific details may evolve based on market conditions and regulatory requirements.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Tradovate's account structure centers on its innovative commission-free trading model. This represents a significant departure from traditional futures brokerage fee structures. The fixed-price approach eliminates per-trade commissions, potentially offering substantial cost savings for active traders who execute multiple positions across various futures markets.

However, this tradovate review notes that specific account type variations, minimum deposit requirements, and detailed fee structures remain unclear from available documentation. The lack of transparent information about account opening procedures and specific terms may create uncertainty for prospective traders evaluating the platform.

The broker's focus on active traders suggests account conditions are optimized for high-frequency trading activities. However, specific features such as Islamic accounts, professional trader classifications, or specialized account types are not detailed in available materials.

While the commission-free model presents clear advantages for cost-conscious traders, the absence of detailed account specifications prevents a more comprehensive evaluation of overall account conditions relative to industry standards.

The platform's cloud-based architecture represents a modern approach to futures trading technology. It eliminates the need for complex software installations while providing multi-device accessibility. This technological foundation supports active traders who require reliable platform access across different environments and devices.

Tradovate's focus on futures and options markets suggests specialized tools designed for these specific asset classes. However, detailed information about research capabilities, analytical tools, and educational resources was not available in source materials. The platform's design appears optimized for experienced traders familiar with futures market dynamics.

The cloud-based infrastructure potentially offers advantages in terms of platform reliability and accessibility. However, specific performance metrics, uptime statistics, and technical support capabilities require direct verification with the broker.

The absence of detailed information about automated trading support, advanced charting capabilities, and third-party integrations limits the ability to fully assess the platform's comprehensive tool offerings relative to competitor platforms.

Customer Service and Support Analysis (Not Rated)

Available materials do not provide sufficient information about Tradovate's customer service capabilities, support channels, or service quality metrics. Essential details such as available contact methods, support hours, response time expectations, and multilingual capabilities remain unspecified.

Customer service quality represents a critical factor for futures traders who may require immediate assistance during active market conditions. The absence of detailed support information prevents meaningful evaluation of this important service dimension.

Prospective traders should directly verify current customer service capabilities. This includes available contact methods, support hours, and response time expectations before committing to the platform.

The lack of available user feedback about customer service experiences further limits the ability to assess actual service quality and effectiveness in resolving trader concerns and technical issues.

Trading Experience Analysis (Score: 6/10)

User feedback indicates that Tradovate's platform may present complexity challenges for traders seeking simplified trading experiences. This suggests the platform is designed with sophisticated features that may require significant learning curves for less experienced traders.

The cloud-based platform architecture should theoretically provide reliable access and consistent performance. However, specific metrics about execution speed, platform stability, and order processing capabilities are not detailed in available materials.

This tradovate review notes that the platform's focus on active futures traders suggests optimization for high-frequency trading activities. However, the complexity concerns raised by users may impact overall trading experience satisfaction for certain trader segments.

The absence of detailed information about mobile trading capabilities, order execution quality, slippage statistics, and platform downtime incidents prevents comprehensive assessment of the actual trading environment quality.

Trust and Reliability Analysis (Score: 8/10)

Tradovate's NFA registration (NFA ID# 0484683) provides regulatory credibility within the United States market. This demonstrates compliance with established futures trading oversight requirements. This regulatory standing offers traders confidence in operational legitimacy and adherence to industry standards.

However, available materials do not detail additional trust and security measures such as client fund segregation policies, insurance coverage, or third-party auditing practices. These elements represent important considerations for traders evaluating broker reliability and fund security.

The broker's specialized focus on futures trading and transparent pricing model suggests operational transparency. However, comprehensive information about company background, ownership structure, and industry reputation requires additional verification.

The absence of detailed information about negative incidents, regulatory actions, or dispute resolution procedures limits the ability to fully assess long-term reliability and operational risk factors.

User Experience Analysis (Score: 6/10)

Available feedback suggests that Tradovate's platform complexity may challenge traders who prefer streamlined, simplified trading experiences. This indicates a potential disconnect between platform capabilities and user accessibility preferences among certain trader segments.

The platform appears designed for active futures and options traders who require sophisticated functionality. However, this focus may create usability barriers for traders seeking more intuitive interfaces and simplified workflows.

Registration and account verification processes, funding procedures, and overall platform navigation experiences are not detailed in available materials. This prevents comprehensive evaluation of end-to-end user experience quality.

The balance between platform sophistication and user accessibility represents a critical consideration for traders evaluating whether Tradovate's approach aligns with their experience level and trading requirements.

Conclusion

This tradovate review reveals a specialized futures brokerage offering innovative commission-free trading through a fixed-price model. It is particularly suitable for active futures and options traders. The platform's NFA registration provides regulatory credibility within the U.S. market, while its cloud-based infrastructure offers modern technological advantages.

However, platform complexity concerns and limited detailed information about specific account conditions, customer support capabilities, and comprehensive feature sets present evaluation challenges. Traders seeking simplified experiences may find the platform's sophisticated design overwhelming, while active traders may appreciate the advanced functionality.

Tradovate appears best suited for experienced futures traders who value cost-effective trading through commission-free structures and can navigate more complex platform environments. Prospective users should carefully evaluate their experience level and trading requirements against the platform's specialized focus before making commitment decisions.