Founded in 2021, Take Profit Trader operates out of Orlando, Florida, and has quickly established itself as a notable player in the proprietary trading landscape. The firm was created by James Sixsmith, a former professional hockey player, who sought to provide an accessible and supportive trading environment after facing significant losses in his own trading journey. Sixsmiths vision emphasizes trader empowerment, transparency in operations, and an educational foundation aimed at helping traders succeed in the complex world of futures trading.

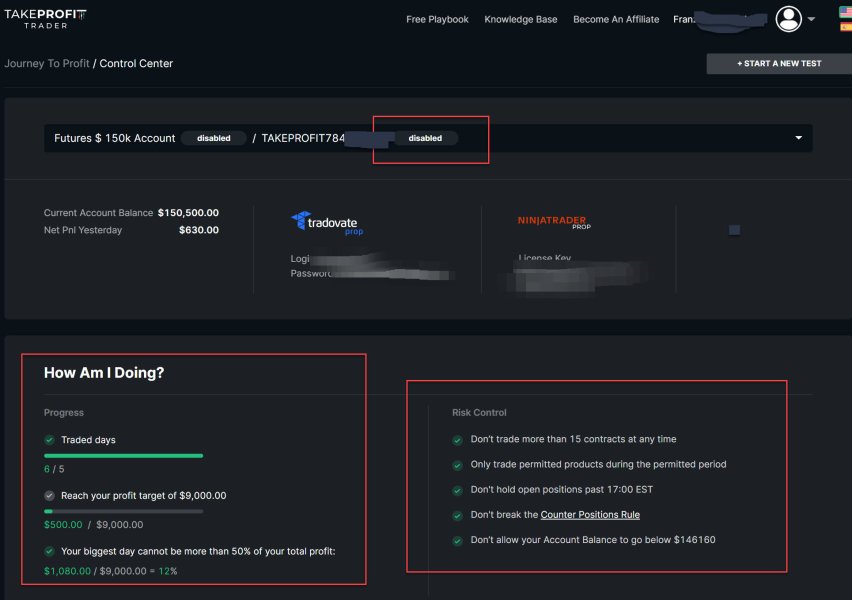

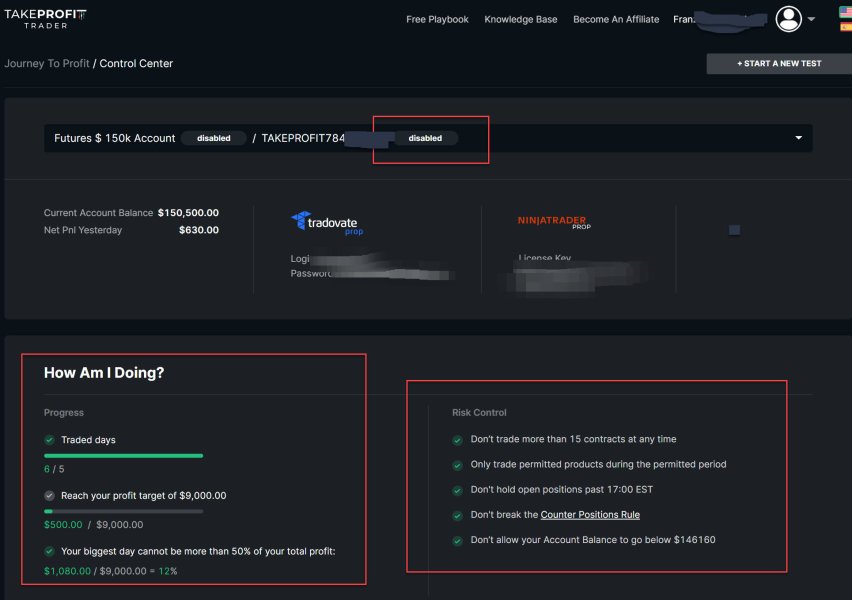

Take Profit Trader specializes exclusively in futures trading, providing various account sizes for traders ranging from $25,000 to $150,000. The firm operates on a unique model where traders demonstrate their skills to qualify for funding. Upon successful evaluation, traders can immediately manage real capital while adhering to a set of clearly defined risk rules. Take Profit Trader aims to create an environment conducive to profit generation through its educational resources, evaluation processes, and supportive community, although it currently lacks regulatory oversight from acknowledged financial authorities.

Take Profit Trader operates without regulatory oversight from prominent financial authorities such as the NFA or CFTC. This absence of regulation raises questions about fund safety, as there are no established mechanisms to protect investor funds or to ensure transparency in operations.

- Visit the NFA's BASIC database to determine if the firm is registered.

- Search for user reviews on Trustpilot or relevant trading forums.

- Engage with customer support to confirm operational practices.

Industry Reputation and Summary

The user feedback on Take Profit Trader is mixed but leans towards the positive side. Many users commend the fast withdrawal process and strong educational resources. However, criticisms arise surrounding communication issues and concerns over withdrawal limitations.

“The withdrawal was faster than I expected, usually within a day or two.”

Trading Costs Analysis

Advantages in Commissions

Take Profit Trader boasts a competitive commission structure, especially for futures trades. Standard round-trip commissions are around $3 per contract, while micro contracts attract lower fees, making it financially appealing for traders who actively engage in day trading.

The "Traps" of Non-Trading Fees

Despite its competitive commission rates, several users have complained about hidden or non-transparent fees, particularly associated with withdrawals and account resets.

“The fees for resetting an evaluation account are excessively high, which feels unfair after Ive paid for the initial evaluation.”

Cost Structure Summary

For traders who frequently withdraw profits, the fee structure can become burdensome. However, for those focused on accumulating profits without frequent withdrawals, the costs may be manageable.

Take Profit Trader supports a spectrum of platforms, including TradingView, NinjaTrader, and Tradovate, offering traders flexibility based on their personal preferences. However, it lacks compatibility with the widely-used MetaTrader platforms, limiting options for some users.

The firm provides extensive educational resources at no cost, designed to help traders refine their strategies and improve their overall trading capabilities. The educational approach emphasizes practical insights and a robust understanding of market dynamics.

The overall user experience on the platform is generally favorable, with traders appreciating the clarity and ease of navigating the various tools.

"I've used many platforms, but the simplicity and support from Take Profit Trader stand out."

User Experience Analysis

User experiences vary, but many highlight the supportive community and the fast response times of the customer service team. Nonetheless, some users wish for enhancements regarding trading fees and clearer guidelines on withdrawal processes.

Responsive Features

Most users report a positive interaction with the interface and educational sections, enabling traders to actively engage with the content and community. However, issues regarding the consistency of feedback from the community could benefit from improvement.

Summary of Feedback

Overall, traders report a satisfying experience, although nonelectronic trading can hinder some strategies. The absence of automation options makes the firm less appealing for algorithmic traders.

Customer Support Analysis

Availability and Responsiveness

A notable strength of Take Profit Trader is its customer support. Traders frequently mention the efficiency in addressing their issues and providing support during trading hours.

Direct Interaction

Customer service representatives are commended for their helpfulness in guiding users through troubleshooting and clarifying any confusing aspects about trading within the platform.

Summary of Service Quality

The commitment to quality customer service is well acknowledged, and this adds to the overall attractiveness of Take Profit Trader as a firm.

Account Conditions Analysis

Funding and Profit Targets

The structured account options make Take Profit Trader accessible to a wide range of traders. The requirement of a 6% profit target to qualify for funding after an evaluation, paired with a one-step evaluation process, is seen favorably by many users.

Withdrawal Requirements

The absence of a minimum trading period before the first withdrawal is cited as an attractive feature, allowing traders quick access to their funds.

Comparison with Competitors

When compared to other proprietary trading firms, the monthly fees associated with evaluations and conditions may put off some traders, especially when looking for lower costs or more varied asset classes.

Conclusion

Take Profit Trader positions itself as a noteworthy option within the prop trading landscape, particularly for those interested in futures trading. With its supportive training environment and a commitment to educational resources, it seeks to empower traders while promoting sustainable profitability. However, potential users must remain vigilant regarding its lack of regulation, withdrawal issues reported by some traders, and trading restrictions that come with its operational framework.

In essence, Take Profit Trader combines strengths in community engagement and educational resources but carries limitations in regulatory oversight and asset class diversity. It remains a suitable consideration for those aligned with its trading model and prepared to navigate the associated risks. Trading at Take Profit Trader could provide a balanced pathway toward building trading capabilities and managing financial growth, provided users approach with a thorough understanding of the firms conditions.