Regarding the legitimacy of CMC MARKETS forex brokers, it provides ASIC, MAS, FCA, FCA, ASIC, FMA, CIRO and WikiBit, (also has a graphic survey regarding security).

Is CMC MARKETS safe?

Pros

Cons

Is CMC MARKETS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

CMC MARKETS STOCKBROKING LIMITED

Effective Date: Change Record

2004-03-01Email Address of Licensed Institution:

external.dispute.resolution@cmcmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cmcmarkets.com.au/stockbrokingExpiration Time:

--Address of Licensed Institution:

'TOWER 3, INTERNATIONAL TOWERS' LEVEL 20 300 BARANGAROO AVENUE SYDNEY NSW 2000Phone Number of Licensed Institution:

0289159335Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

CMC MARKETS SINGAPORE PTE LTD

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.cmcmarkets.comExpiration Time:

--Address of Licensed Institution:

2 CENTRAL BOULEVARD #25-03 IOI CENTRAL BOULEVARD TOWERS 018916Phone Number of Licensed Institution:

+65 65596000Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

CMC Markets UK plc

Effective Date:

2001-12-01Email Address of Licensed Institution:

compliance.team.uk@cmcmarkets.com, complaintsteamuk@cmcmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cmcmarkets.comExpiration Time:

--Address of Licensed Institution:

133 Houndsditch London EC3A 7BX UNITED KINGDOMPhone Number of Licensed Institution:

+4402071708200Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

CMC Spreadbet Plc

Effective Date: Change Record

2001-12-01Email Address of Licensed Institution:

compliance.team.uk@cmcmarkets.com, complaintsteamuk@cmcmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cmcmarkets.comExpiration Time:

2026-02-05Address of Licensed Institution:

133 Houndsditch London EC3A 7BX UNITED KINGDOMPhone Number of Licensed Institution:

+4402071708200Licensed Institution Certified Documents:

ASIC Derivatives Trading License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

CMC MARKETS ASIA PACIFIC PTY LTD

Effective Date: Change Record

2004-02-24Email Address of Licensed Institution:

external.dispute.resolution@cmcmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cmcmarkets.com.auExpiration Time:

--Address of Licensed Institution:

'TOWER 3, INTERNATIONAL TOWERS', LEVEL 20 300 BARANGAROO AVENUE SYDNEY NSW 2000Phone Number of Licensed Institution:

0289159335Licensed Institution Certified Documents:

FMA Market Making License (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

CMC MARKETS NZ LIMITED

Effective Date:

2014-12-12Email Address of Licensed Institution:

d.atkinson@cmcmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 39, 23 Albert Street, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

+61434613469Licensed Institution Certified Documents:

CIRO Derivatives Trading License (EP)

Canadian Investment Regulatory Organization

Canadian Investment Regulatory Organization

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

CMC Markets Canada Inc.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.cmcmarkets.comExpiration Time:

--Address of Licensed Institution:

3550 - 81 Bay Street Toronto ON M5J0E7Phone Number of Licensed Institution:

416-682-5000Licensed Institution Certified Documents:

Is CMC Markets A Scam?

Introduction

CMC Markets, a prominent player in the global forex and CFD trading landscape, was founded in 1989 and has since established a strong reputation for providing a wide array of trading instruments and services. With its headquarters in London and a significant presence in various financial hubs, CMC Markets is known for its proprietary Next Generation trading platform and its commitment to delivering competitive trading conditions. However, the forex market is fraught with risks, making it crucial for traders to conduct thorough evaluations of their brokers. This article aims to assess the legitimacy and safety of CMC Markets by analyzing its regulatory status, company background, trading conditions, customer fund security, and user experiences. The investigation is based on a comprehensive review of multiple sources, including regulatory filings, customer feedback, and industry analysis.

Regulation and Legitimacy

The regulatory framework governing a broker is paramount in determining its trustworthiness and operational integrity. CMC Markets operates under the supervision of several tier-1 regulatory authorities, which ensures a high level of oversight and protection for traders. The following table summarizes the core regulatory information for CMC Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 173730 | United Kingdom | Verified |

| ASIC | 238054 | Australia | Verified |

| BaFin | 154814 | Germany | Verified |

| MAS | 200605050E | Singapore | Verified |

| IIROC | N/A | Canada | Verified |

CMC Markets is regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS), among others. This multi-jurisdictional regulation is crucial, as it provides a safety net for clients, ensuring that their funds are kept in segregated accounts and that the broker adheres to strict operational standards. The FCA, in particular, is known for its rigorous regulatory framework, which includes the requirement for brokers to maintain a certain level of capital and to implement measures that protect client funds. Historically, CMC Markets has maintained a good compliance record, with no significant breaches reported, further enhancing its credibility in the industry.

Company Background Investigation

Founded by Peter Cruddas, CMC Markets has evolved significantly since its inception. Initially operating as a foreign exchange market maker under the name Currency Management Corporation, the company rebranded to CMC Markets in 2005. Over the years, CMC Markets has expanded its offerings to include CFDs and spread betting, becoming a key player in these markets. The company is publicly traded on the London Stock Exchange under the ticker symbol CMCX, which adds a layer of transparency and accountability, as it is required to disclose financial reports regularly.

The management team at CMC Markets is composed of experienced professionals with backgrounds in finance and trading. Their expertise is reflected in the broker's robust trading platform and comprehensive educational resources. CMC Markets has consistently received accolades for its innovative trading technology and customer service, showcasing its commitment to providing a high-quality trading experience. Transparency is a core value for CMC Markets; they provide detailed information about their services, fees, and trading conditions on their website, allowing potential clients to make informed decisions.

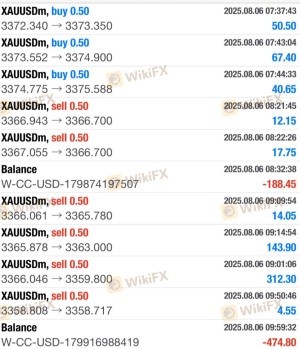

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider their fee structure, spreads, and overall cost of trading. CMC Markets offers a competitive pricing model, which includes both spread and commission-based trading options. Below is a comparison of core trading costs:

| Cost Type | CMC Markets | Industry Average |

|---|---|---|

| Average Spread (EUR/USD) | 0.5 pips | 1.0 pips |

| Commission Model | $2.50 per lot | $5.00 per lot |

| Overnight Interest Range | Varies by asset | Varies by asset |

CMC Markets provides tight spreads, particularly on major currency pairs, making it an attractive option for active traders. The FX Active account offers spreads starting from 0.0 pips on select pairs, with a fixed commission of $2.50 per lot. However, it is important to note that while the spreads for forex trading are competitive, the fees for trading stock CFDs can be relatively high, often starting at $10 for U.S. shares. This discrepancy in fees could be a concern for traders focusing on stock CFDs, as it may significantly affect their overall trading costs.

Customer Fund Security

The safety of customer funds is a critical consideration when choosing a broker. CMC Markets employs several measures to ensure the security of client assets. Client funds are held in segregated accounts at reputable banks, which means that they are kept separate from the broker's operational funds. This segregation is crucial in the event of financial difficulties faced by the broker, as it ensures that clients' funds remain protected.

Additionally, CMC Markets offers negative balance protection, which means that traders cannot lose more than their deposited amount. This feature is particularly beneficial for retail traders who may not have extensive experience in managing risk. Furthermore, CMC Markets is a member of the Financial Services Compensation Scheme (FSCS) in the UK, which protects eligible clients up to £85,000 in the event of the broker's insolvency. Overall, the combination of segregated accounts, negative balance protection, and compensation schemes positions CMC Markets as a safe option for traders concerned about fund security.

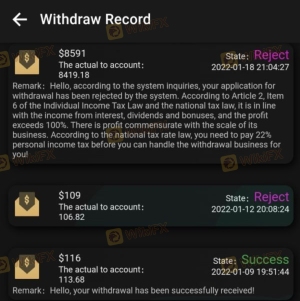

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. CMC Markets generally receives positive reviews, particularly for its trading platform and customer support. However, as with any broker, there are common complaints that have been reported by users. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| High Fees on Stock CFDs | High | Acknowledged but no changes |

| Platform Issues | Moderate | Ongoing improvements |

One typical case involved a trader experiencing delays in withdrawals, which is a common concern among clients of many brokers. While CMC Markets generally processes withdrawals within 1-2 business days, some users reported delays extending up to 5 days, leading to frustration. The company has acknowledged these issues and is working on improving its processes.

Another notable complaint pertains to the high fees associated with stock CFDs, which some traders found to be prohibitive. While CMC Markets has communicated its rationale for these fees, it has yet to implement significant changes in this area.

Platform and Trade Execution

The performance of a broker's trading platform is pivotal to the overall trading experience. CMC Markets offers two primary platforms: the Next Generation platform and MetaTrader 4 (MT4). The Next Generation platform is known for its speed, stability, and user-friendly interface, equipped with advanced charting tools and a variety of technical indicators. Traders have reported high satisfaction levels with the platform's execution speed, which averages around 66 milliseconds.

However, there are concerns regarding execution quality during volatile market conditions, where slippage can occur. While CMC Markets aims for a high fill rate, traders should remain vigilant during major news events when market volatility can lead to unexpected price movements.

Risk Assessment

Trading with any broker involves inherent risks, and CMC Markets is no exception. Below is a summary of key risk areas associated with trading through CMC Markets:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by multiple tier-1 authorities. |

| Market Risk | High | Exposure to volatile markets can lead to significant losses. |

| Fee Transparency | Medium | Some fees, particularly for stock CFDs, may be higher than expected. |

| Platform Stability | Medium | While generally stable, issues can arise during peak trading times. |

To mitigate these risks, traders should familiarize themselves with the broker's fee structure and utilize risk management tools such as stop-loss orders. Additionally, maintaining a diversified portfolio can help manage exposure to market volatility.

Conclusion and Recommendations

In conclusion, CMC Markets is a well-established broker with a strong regulatory framework and a long history in the trading industry. The broker offers a wide range of trading instruments, competitive spreads, and robust security measures to protect client funds. While there are some concerns regarding high fees for stock CFDs and occasional withdrawal delays, the overall evidence suggests that CMC Markets is a reliable and trustworthy option for both novice and experienced traders.

For traders seeking a reputable broker with no minimum deposit requirement and a comprehensive trading platform, CMC Markets is highly recommended. However, those primarily interested in trading stock CFDs may want to explore alternative brokers that offer more favorable fee structures. Overall, CMC Markets stands out as a solid choice for traders looking to engage in forex and CFD trading in a secure and regulated environment.

Is CMC MARKETS a scam, or is it legit?

The latest exposure and evaluation content of CMC MARKETS brokers.

CMC MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CMC MARKETS latest industry rating score is 8.15, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.15 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.