CMC Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive cmcmarkets review evaluates one of the most established names in the forex and CFD trading industry. CMC Markets stands out as a well-regulated broker offering diverse trading opportunities across multiple asset classes, making it suitable for traders of varying experience levels. The broker's most compelling features include spreads as low as under 1 pip and no minimum deposit requirement. These features significantly lower the barrier to entry for new traders.

Founded in 1989, CMC Markets has built a solid reputation through consistent regulatory compliance with major authorities including BaFin and FCA. The platform caters to individual traders seeking diversified trading opportunities across forex, stocks, indices, bonds, and commodities. With its proprietary trading platform alongside MT4 support, CMC Markets provides flexibility in trading execution while maintaining competitive cost structures. This approach appeals to both conservative and active trading strategies.

The broker eliminates minimum deposit requirements, demonstrating its commitment to accessibility. The low commission structure of $2 for certain account types enhances its appeal for cost-conscious traders.

Important Notice

CMC Markets operates across multiple jurisdictions, and trading conditions may vary depending on your regional entity. Regulatory oversight differs between regions, with BaFin governing European operations and FCA overseeing UK services. These regulatory differences can impact available trading conditions, leverage limits, and service offerings.

This review is based on publicly available information and user feedback compiled from various sources. Market conditions and broker offerings are subject to change, and information may experience update delays. Traders should verify current terms and conditions directly with CMC Markets before making trading decisions. Regulatory changes and policy updates may affect the accuracy of this assessment.

Rating Framework

Broker Overview

CMC Markets was established in 1989 and represents one of the pioneering forces in the online trading industry. Headquartered in London, this UK-based financial services company has evolved from a traditional market maker into a comprehensive trading platform provider specializing in CFDs and forex trading. The company's longevity in the market reflects its ability to adapt to changing regulatory environments and technological advances while maintaining a focus on providing diverse financial products to retail and institutional clients.

The broker's business model centers on offering multi-asset trading services. According to industry reports, CMC Markets has successfully positioned itself as a bridge between traditional financial services and modern online trading, serving clients across multiple continents while maintaining strict adherence to regional regulatory requirements.

CMC Markets operates through its proprietary trading platform alongside the popular MetaTrader 4 platform, providing traders with choice and flexibility in their trading environment. The asset coverage spans forex pairs, individual stocks, market indices, government bonds, and various commodities, creating a comprehensive trading ecosystem. Regulatory oversight comes primarily from BaFin in Germany and the Financial Conduct Authority (FCA) in the United Kingdom. This ensures that operations meet stringent financial service standards. This cmcmarkets review finds that the broker's regulatory standing provides a solid foundation for trader confidence and operational transparency.

Regulatory Jurisdictions: CMC Markets operates under dual regulatory oversight from BaFin and FCA. This regulatory framework ensures compliance with capital adequacy requirements and client fund segregation protocols.

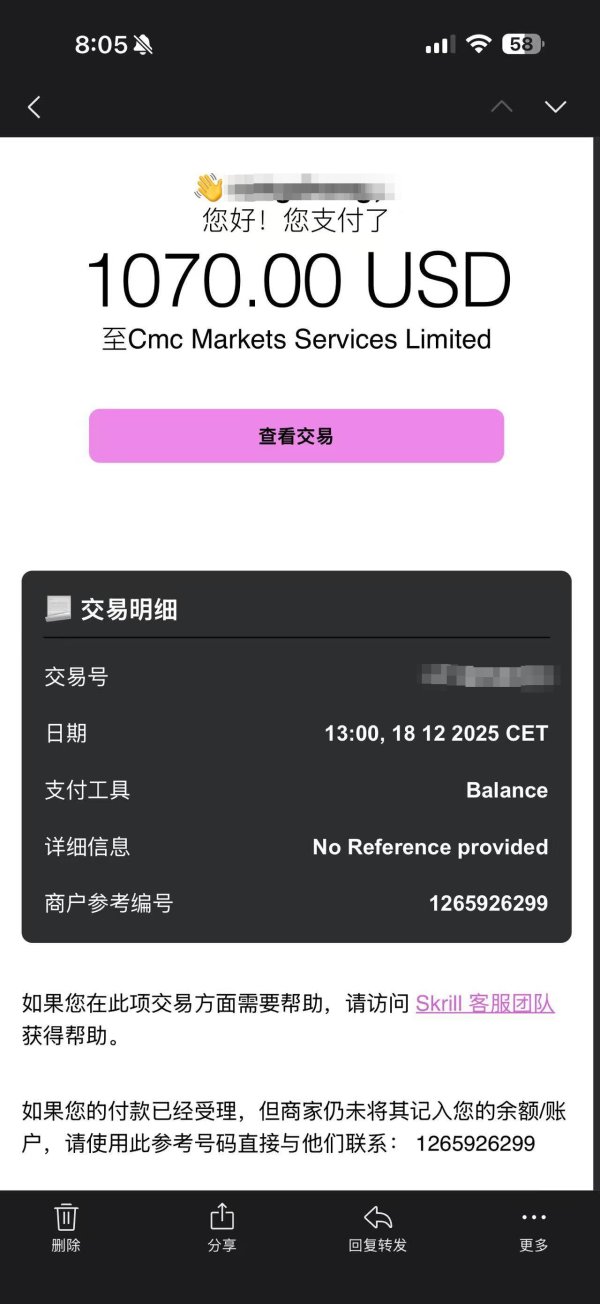

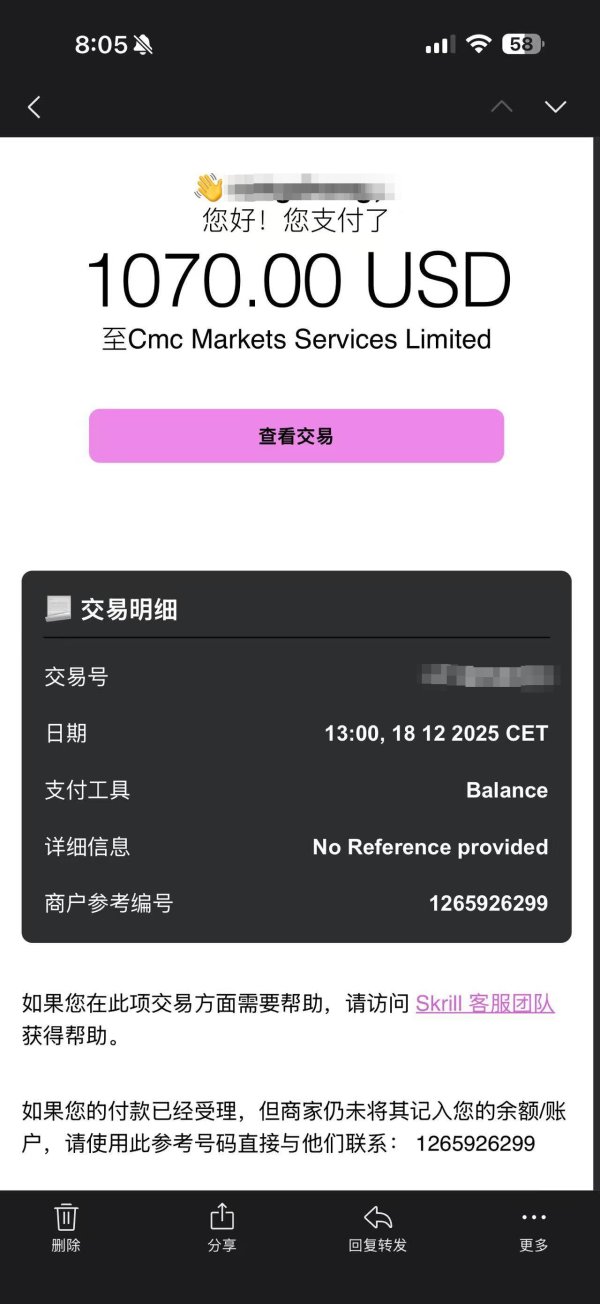

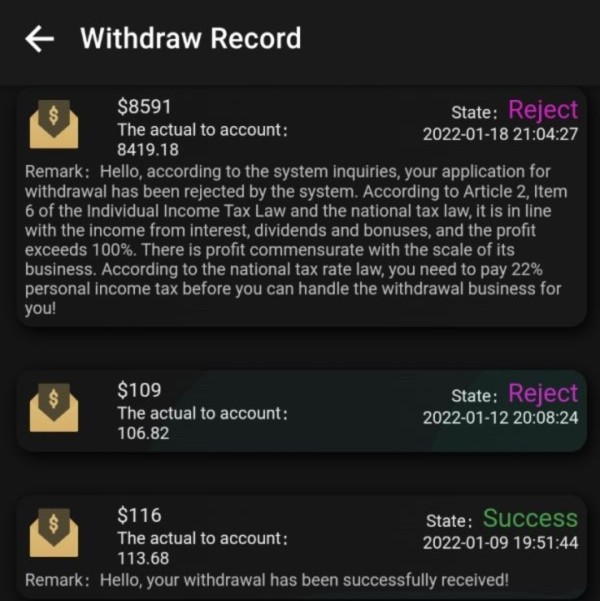

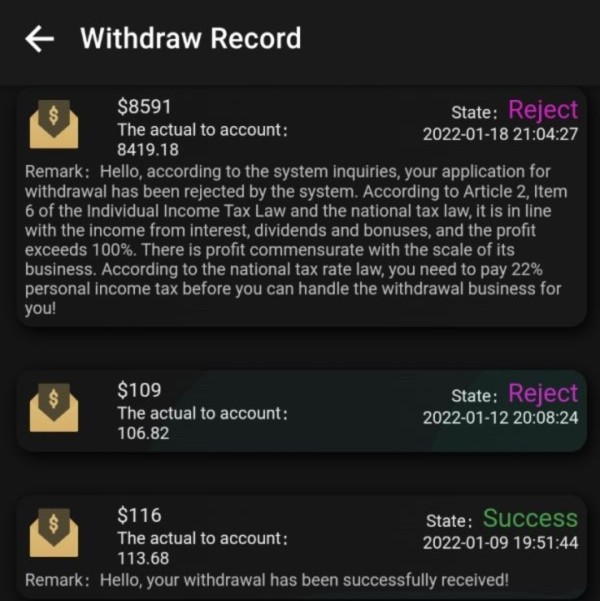

Deposit and Withdrawal Methods: Specific deposit and withdrawal options are not detailed in available documentation. Industry standards suggest support for major payment methods including bank transfers and electronic payment systems.

Minimum Deposit Requirements: CMC Markets eliminates barriers to entry by requiring no minimum deposit. This allows traders to begin with any amount they deem appropriate for their trading strategy and risk tolerance.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available materials. This suggests the broker may focus on competitive trading conditions rather than promotional incentives.

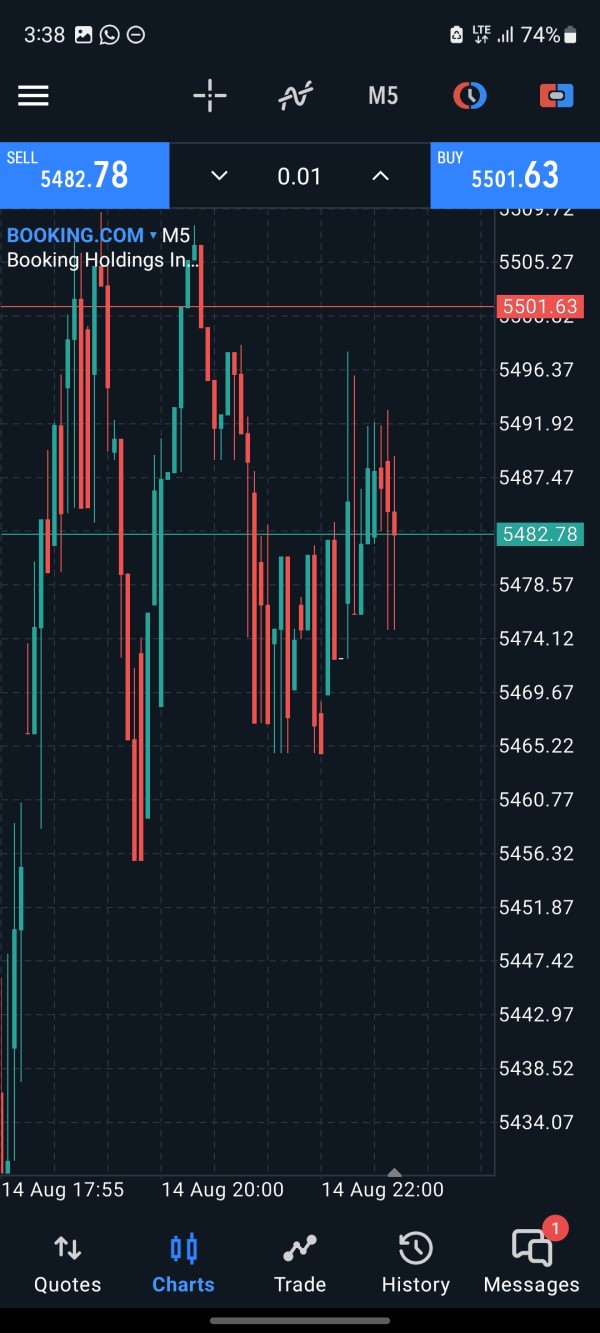

Tradeable Assets: The platform provides access to forex pairs, CFDs on stocks, ETFs, market indices, government bonds, and commodity markets. This offers comprehensive coverage for portfolio diversification strategies.

Cost Structure: Trading costs feature spreads beginning below 1 pip for major currency pairs. Commission charges are $2 for specific account configurations. This pricing structure positions CMC Markets competitively within the industry standard range.

Leverage Ratios: Specific leverage information is not detailed in current documentation. Regulatory compliance suggests adherence to regional leverage limits established by BaFin and FCA guidelines.

Platform Options: Traders can choose between CMC Markets' proprietary platform and MetaTrader 4. This accommodates different trading preferences and technical analysis requirements.

Geographic Restrictions: US residents are prohibited from opening accounts. Traders from other jurisdictions can generally access services subject to local regulatory approval.

Customer Support Languages: Available customer service language options are not specified in current materials. International operations suggest multi-language support capabilities. This cmcmarkets review notes that language support details should be confirmed directly with the broker.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

CMC Markets excels in account accessibility by eliminating minimum deposit requirements. This is a significant advantage that distinguishes it from many competitors requiring substantial initial investments. This approach democratizes access to forex and CFD trading, particularly benefiting new traders who prefer to start with smaller amounts while learning market dynamics.

The broker offers multiple account configurations designed to accommodate different trading styles and experience levels. According to available information, commission structures remain competitive with $2 charges for certain account types. Specific details about premium account features and benefits require direct verification with the broker.

Account opening procedures, while not detailed in current documentation, likely follow industry standards for identity verification and regulatory compliance. The absence of minimum deposit barriers suggests a streamlined onboarding process focused on accessibility rather than excluding smaller traders.

Compared to industry competitors, CMC Markets' no-minimum-deposit policy provides a clear competitive advantage. Many established brokers require deposits ranging from $100 to $1,000, making CMC Markets particularly attractive for conservative traders or those testing new strategies with limited capital. This cmcmarkets review recognizes this feature as a key differentiator in the retail trading space.

CMC Markets demonstrates exceptional strength in trading tool variety and asset coverage. The platform provides access to CFDs, individual stocks, ETFs, and multiple asset classes. This creates comprehensive trading opportunities within a single account structure. This diversity allows traders to implement sophisticated portfolio strategies and capitalize on various market conditions across different sectors.

The availability of both proprietary platform technology and MetaTrader 4 integration showcases the broker's commitment to meeting diverse trader preferences. MT4's popularity among technical analysts and automated trading enthusiasts complements the proprietary platform's specialized features. This provides flexibility in trading execution and analysis capabilities.

Research and analysis resources, while not specifically detailed in available documentation, likely accompany the comprehensive asset offering. Industry standards suggest that brokers with extensive asset coverage typically provide corresponding market analysis and research tools to support trading decisions.

Educational resources and automated trading support capabilities are not explicitly outlined in current materials. This represents areas where direct broker consultation would provide clarity. The platform's technical infrastructure appears robust based on user feedback regarding stability and performance, suggesting adequate support for various trading strategies and resource requirements.

Customer Service and Support Analysis (6/10)

Customer service information represents a significant gap in available documentation. This limits this assessment's depth. Specific customer service channels, availability hours, and response time metrics are not detailed in current materials, preventing comprehensive evaluation of support quality and accessibility.

The absence of detailed customer service information in public documentation suggests either limited transparency in this area or potential gaps in service communication. For a broker of CMC Markets' established status, comprehensive customer support details would typically be prominently featured in marketing materials and regulatory disclosures.

Multi-language support capabilities, while not explicitly confirmed, would be expected given the broker's international operations across multiple regulatory jurisdictions. However, without specific language availability confirmation, traders requiring non-English support should verify capabilities directly with the broker.

Response time metrics and service quality assessments cannot be adequately evaluated without user feedback data or official service level agreements. This represents a notable limitation in evaluating CMC Markets' overall service proposition and suggests areas where additional transparency would benefit potential clients.

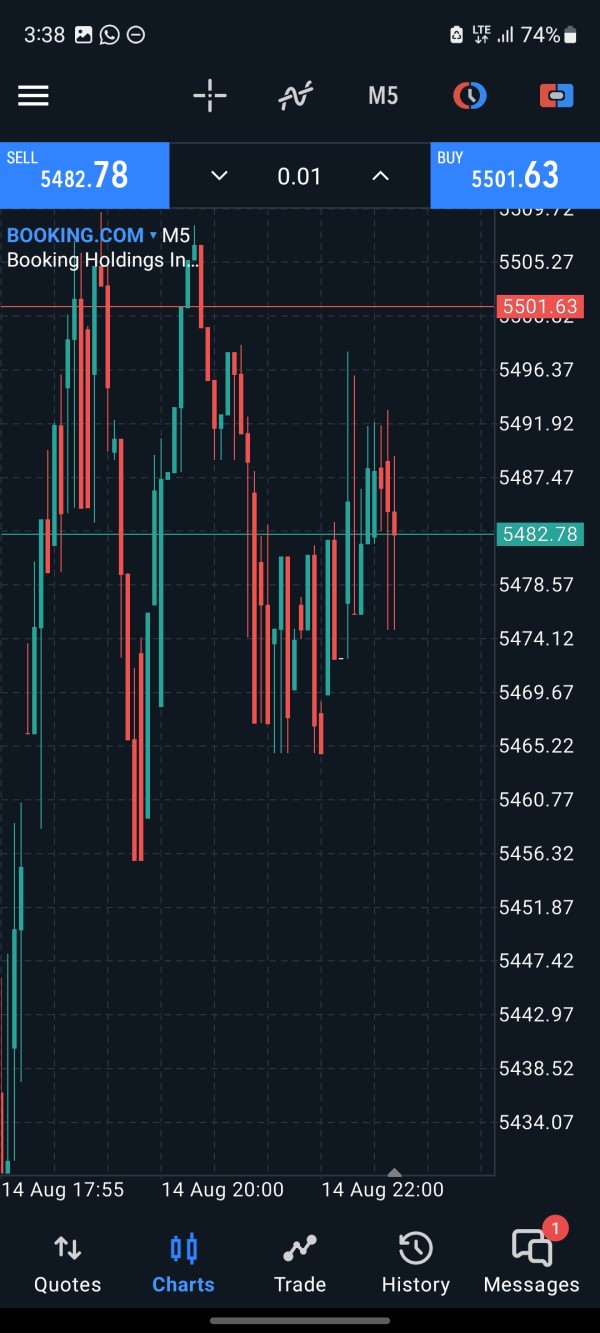

Trading Experience Analysis (7/10)

Platform stability receives positive user feedback according to available information. This indicates reliable technical infrastructure supporting consistent trading execution. This stability factor proves crucial for active traders requiring dependable platform performance during volatile market conditions.

Order execution quality details are not specifically outlined in current documentation. The broker's established market presence suggests adequate execution standards. The availability of multiple asset classes and platform options indicates sophisticated backend infrastructure capable of handling diverse trading requirements.

Platform functionality appears comprehensive based on the range of available trading instruments and platform options. The combination of proprietary technology and MT4 integration suggests robust feature sets accommodating both basic and advanced trading strategies.

Mobile trading experience details are not specified in available materials. This represents an important consideration for modern traders requiring mobile access capabilities. Given industry standards, mobile platform availability would be expected, though specific features and functionality require direct verification.

Trading environment quality, including spread stability and liquidity provision, appears competitive based on the advertised sub-1-pip spreads. This pricing structure suggests access to quality liquidity sources and efficient price discovery mechanisms supporting favorable trading conditions. This cmcmarkets review finds the technical foundation adequate for most trading strategies.

Trust and Reliability Analysis (9/10)

Regulatory compliance with BaFin and FCA provides exceptional trust foundations through oversight by two of the world's most respected financial regulatory authorities. These regulatory relationships ensure adherence to strict capital adequacy requirements, client fund protection protocols, and operational transparency standards.

BaFin regulation covers European operations, while FCA oversight governs UK services. This creates comprehensive regulatory coverage across major markets. Both authorities maintain rigorous licensing requirements and ongoing supervision, providing traders with confidence in operational integrity and financial stability.

Company transparency appears adequate through regulatory compliance. Specific details about financial reporting and corporate governance are not elaborated in available materials. The broker's longevity since 1989 demonstrates sustained regulatory compliance and market adaptation capabilities.

Fund safety measures, while not explicitly detailed, are implied through regulatory compliance requirements mandating client fund segregation and institutional-grade financial protections. Both BaFin and FCA require comprehensive client protection measures as licensing conditions.

Industry reputation and third-party evaluations are not specifically referenced in current documentation. The broker's sustained regulatory standing and market presence suggest positive industry recognition. Negative event handling and resolution procedures are not outlined, representing areas where additional transparency would enhance trust assessment.

User Experience Analysis (7/10)

Overall user satisfaction metrics are not provided in available documentation. This limits comprehensive user experience evaluation. However, platform stability feedback suggests positive user experiences regarding technical performance and reliability.

Interface design and usability appear adequate based on the availability of multiple platform options and comprehensive asset coverage. The choice between proprietary platform technology and MT4 integration indicates attention to different user preferences and technical requirements.

Registration and verification processes are not detailed in current materials. Regulatory compliance suggests standard industry procedures for identity verification and account approval. The absence of minimum deposit requirements likely simplifies the initial account funding process.

Fund operation experiences and common user complaints are not documented in available materials. This prevents assessment of practical user challenges and satisfaction levels. This represents a significant information gap for potential users evaluating the platform's practical usability.

User demographic analysis suggests suitability for diverse trader types, from beginners benefiting from no minimum deposits to experienced traders requiring comprehensive asset access. The platform's flexibility in accommodating different trading styles appears adequate. Specific user feedback would provide better insight into practical satisfaction levels.

Conclusion

CMC Markets emerges as a credible and well-regulated forex and CFD broker suitable for traders seeking diversified trading opportunities across multiple asset classes. The broker's strongest attributes include robust regulatory oversight from BaFin and FCA, elimination of minimum deposit barriers, and competitive cost structures featuring sub-1-pip spreads and reasonable commission rates.

The platform particularly appeals to new traders who appreciate the accessibility provided by no minimum deposit requirements. Experienced traders benefit from comprehensive asset coverage and platform flexibility. The dual regulatory framework provides exceptional trust foundations, positioning CMC Markets among the more reliable options in the retail trading space.

However, this evaluation reveals notable information gaps regarding customer service capabilities, user feedback, and specific procedural details that potential traders should investigate directly with the broker. While the technical infrastructure and regulatory standing appear solid, the limited transparency in customer service and user experience areas suggests room for improved communication and documentation.

CMC Markets best serves traders prioritizing regulatory compliance, cost efficiency, and asset diversity over extensive educational resources or promotional incentives. The broker's straightforward approach to trading access and competitive pricing makes it particularly suitable for self-directed traders comfortable with independent market research and analysis.