Regarding the legitimacy of CCC forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is CCC safe?

Regulation

License

Is CCC markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

City Credit Capital (UK) Ltd

Effective Date:

2004-11-10Email Address of Licensed Institution:

compliance@cccapital.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

https://www.cccapital.co.uk/Expiration Time:

--Address of Licensed Institution:

12th Floor Heron Tower, 110 - Bishopsgate, London EC2N 4AY UNITED KINGDOMPhone Number of Licensed Institution:

+4402076144600Licensed Institution Certified Documents:

Is CCC Safe or Scam?

Introduction

City Credit Capital (CCC) is a forex brokerage that has positioned itself as a reputable player in the online trading market since its establishment in 2001. Specializing in forex and CFDs, CCC has garnered attention from both retail and institutional traders. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before entrusting their funds. The forex market is rife with scams, and identifying a trustworthy broker can be challenging. In this article, we will explore the legitimacy of CCC by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. This comprehensive investigation aims to provide traders with a clear understanding of whether CCC is safe or a potential scam.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the financial services industry. CCC operates under the oversight of the Financial Conduct Authority (FCA) in the United Kingdom, which is known for its stringent regulatory framework. This regulatory status is significant as it implies a level of protection for clients, including the segregation of client funds and adherence to strict operational guidelines.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 232015 | United Kingdom | Active |

The FCA's role is to ensure that brokers maintain transparency and fairness in their operations. However, it's important to note that while CCC is regulated, there have been reports of negative disclosures related to its operations, raising questions about its compliance history. The broker has faced scrutiny for its practices, and while it holds a valid license, the quality of regulation can vary. The FCA's oversight does provide a level of security, but potential traders should remain vigilant regarding any historical compliance issues that may affect their decision to engage with CCC.

Company Background Investigation

City Credit Capital has a rich history, having been established over two decades ago. The company operates under the ownership structure of City Credit Capital (UK) Ltd, with a management team comprising experienced professionals from top financial institutions. This background lends credibility to the brokerage, as the teams expertise can positively influence operational standards and client service.

However, transparency is a critical factor in evaluating a broker's reliability. While CCC provides basic information about its operational history and management, some users have noted a lack of detailed disclosures regarding ownership and financial health. This opacity can be a red flag for prospective clients, as it may indicate potential issues with accountability and governance. A broker's willingness to provide comprehensive information about its operations and management team is essential for building trust with clients.

Trading Conditions Analysis

When evaluating whether CCC is safe or a scam, the trading conditions offered by the broker play a significant role. CCC has a structured fee model, but traders should be aware of the overall cost of trading. The following table summarizes key trading costs associated with CCC:

| Cost Type | CCC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Low | Low |

While CCC does not charge commissions, the spreads on major currency pairs are notably higher than the industry average. This can significantly impact trading profitability, especially for high-frequency traders. Traders should also be cautious of any hidden fees that may apply to deposits or withdrawals, as these can further erode potential profits. Understanding the fee structure is vital in determining the overall cost of trading with CCC, and traders should carefully consider whether these costs align with their trading strategies.

Client Funds Safety

The safety of client funds is paramount when assessing whether CCC is safe. The broker claims to implement several measures to protect client assets, including segregating client funds from the company‘s operational funds. This practice is essential as it ensures that traders’ money is safeguarded even in the event of the broker's financial difficulties.

Moreover, CCC is subject to the Financial Services Compensation Scheme (FSCS) in the UK, which protects clients up to £85,000 in case of the broker's insolvency. This regulatory framework provides an additional layer of security for clients, making it a safer option compared to unregulated brokers. However, it is important to investigate any historical issues related to fund safety that might have arisen in the past, as these can impact the trustworthiness of the brokerage.

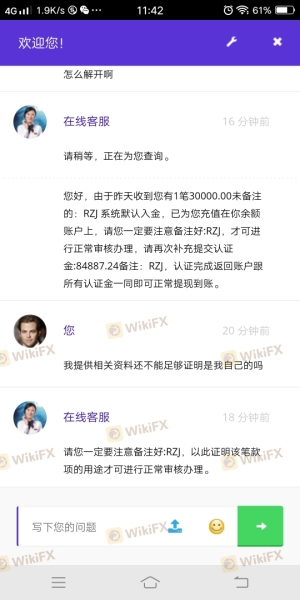

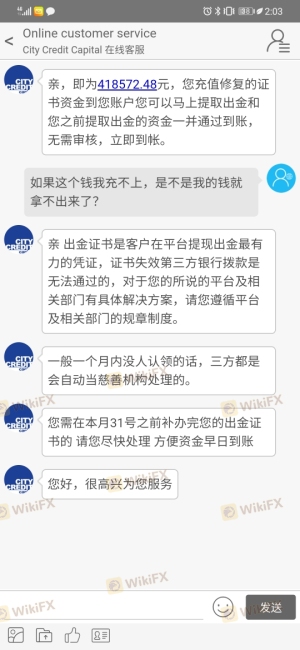

Customer Experience and Complaints

Customer feedback is a crucial indicator of a brokerage's reliability. An analysis of reviews and complaints regarding CCC reveals a mixed picture. While some clients report positive experiences, others have raised concerns about withdrawal issues and customer service responsiveness.

The following table outlines the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Quality | Medium | Mixed feedback |

Typical complaints include difficulties in withdrawing funds, which is a common issue among many brokers. Delays in processing withdrawals can be particularly alarming for traders, as they may indicate deeper operational issues. In some cases, clients have reported that customer service representatives were unresponsive or unhelpful, which can exacerbate frustrations. Addressing these concerns promptly is crucial for maintaining client trust and satisfaction.

Platform and Trade Execution

The trading platform offered by CCC plays a significant role in the overall trading experience. CCC provides access to popular platforms such as MetaTrader 4, known for its user-friendly interface and advanced analytical tools. However, the performance and reliability of the platform are critical factors to consider.

Users have reported varying experiences regarding order execution quality, with some noting instances of slippage and re-quotes during volatile market conditions. These issues can hinder trading effectiveness and lead to unexpected losses. Potential clients should assess the platform's performance through demo accounts to gauge its reliability before committing real funds.

Risk Assessment

Engaging with any broker carries inherent risks, and CCC is no exception. A comprehensive risk assessment reveals several key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | FCA oversight but with historical compliance issues. |

| Financial Stability | Medium | Segregated funds and FSCS protection, but historical concerns exist. |

| Trading Cost | High | Higher spreads compared to industry norms can impact profitability. |

| Customer Service | Medium | Mixed feedback regarding responsiveness and issue resolution. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts, and start with smaller investments to test the brokers reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, while City Credit Capital (CCC) is regulated by the FCA and offers a range of trading services, there are several factors that potential traders should consider before engaging with the broker. The higher-than-average trading costs, mixed customer feedback, and historical compliance concerns highlight the need for caution.

For traders seeking to engage with CCC, it is advisable to start with a demo account to assess the platform's performance and customer service quality. Additionally, traders may want to consider alternative brokers with stronger reputations and more favorable trading conditions. Some recommended alternatives include brokers with robust regulatory frameworks and competitive pricing structures, ensuring a safer trading environment.

In summary, while CCC is not outright a scam, potential clients should remain vigilant and conduct thorough research to ensure their trading experience is both safe and profitable.

Is CCC a scam, or is it legit?

The latest exposure and evaluation content of CCC brokers.

CCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CCC latest industry rating score is 2.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.