Is Bulutun Wealth safe?

Business

License

Is Bulutun Wealth Safe or a Scam?

Introduction

Bulutun Wealth is a relatively new player in the forex market, claiming to offer a range of trading instruments including currency pairs, cryptocurrencies, and commodities. With a minimum deposit requirement of $200 and leverage of up to 1:500, it targets both novice and experienced traders. However, as the forex market is rife with scams and unregulated brokers, it is crucial for traders to carefully assess the legitimacy and safety of any broker before committing their funds. This article investigates whether Bulutun Wealth is safe or a scam by evaluating its regulatory status, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

Regulation is a critical aspect of any brokerage firm, as it ensures that the broker adheres to industry standards and protects clients' funds. Bulutun Wealth claims to be regulated by the National Futures Association (NFA), but upon further investigation, it becomes evident that it is not listed as a member of the NFA. This raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| National Futures Association | 0550279 | United States | Not a member |

The lack of regulation means that Bulutun Wealth does not have to comply with any oversight, making it difficult for clients to seek recourse in case of disputes. Furthermore, the broker has received multiple complaints regarding withdrawal issues, which is often a red flag in the forex industry. The absence of regulatory oversight suggests that Bulutun Wealth is not safe for traders looking to protect their investments.

Company Background Investigation

Bulutun Wealth was established approximately 1-2 years ago, operating under the name Bulutun Wealth Ltd. The company claims to be based in the United Kingdom, but its lack of transparency regarding ownership and management raises questions about its credibility. Information about the management team is sparse, and there are no clear indicators of their professional backgrounds or expertise in the financial industry.

The overall transparency of Bulutun Wealth is concerning. The company's website lacks detailed information about its operations, and it does not provide clear contact details or customer support information. This opacity can be alarming for potential investors, as it indicates a lack of accountability. In a market where trust is paramount, the uncertainty surrounding Bulutun Wealth's background makes it difficult to conclude that it is a safe option for traders.

Trading Conditions Analysis

When it comes to trading conditions, Bulutun Wealth offers a competitive entry point with a minimum deposit of $200 and leverage of up to 1:500. However, the overall fee structure remains ambiguous, which can lead to unexpected costs for traders.

| Fee Type | Bulutun Wealth | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Model | Not specified | Varies (usually $5-10 per lot) |

| Overnight Interest Range | Not specified | 0.5-2% |

The absence of clear information on spreads, commissions, and overnight interest rates raises concerns about hidden fees that could erode profitability. Additionally, the broker's claims of "low spreads" are not substantiated by any concrete data, further complicating the assessment of its trading conditions. This lack of clarity can be detrimental for traders, as they may not fully understand the costs associated with their trades. Therefore, it is prudent to approach Bulutun Wealth with caution, as the ambiguity surrounding trading conditions suggests it may not be a safe choice.

Customer Funds Security

The security of customer funds is another vital aspect to consider when evaluating whether Bulutun Wealth is safe. The broker does not provide clear information about its fund segregation policies or investor protection measures. In regulated environments, brokers are typically required to keep client funds in separate accounts to ensure they are not misused. However, Bulutun Wealth's lack of transparency in this regard raises alarm bells.

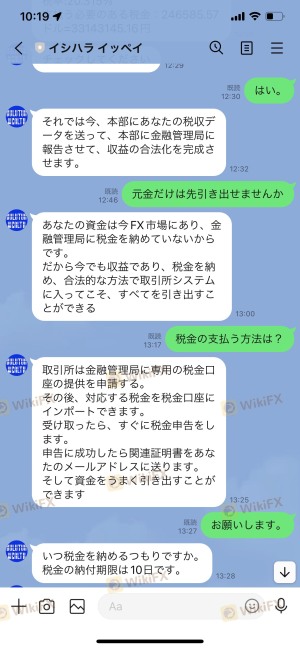

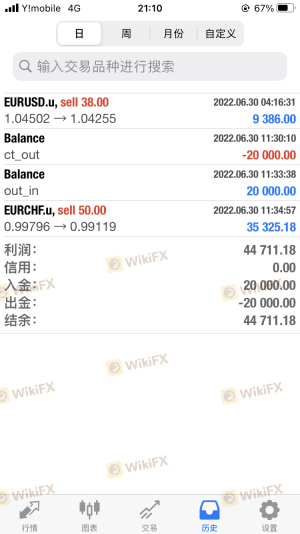

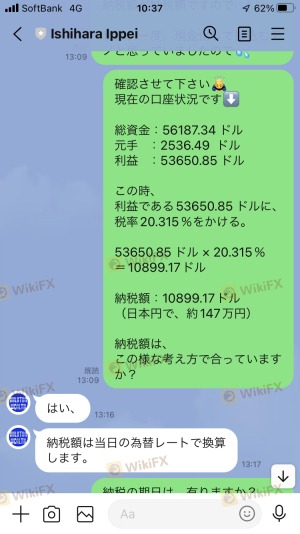

Moreover, there have been numerous complaints from users who have experienced difficulties withdrawing their funds. Reports indicate that clients were told they could not withdraw their profits until they paid a tax, which is an unusual and suspicious practice in the trading industry. This has led many to question the integrity of Bulutun Wealth's operations. The absence of robust security measures and the troubling history of withdrawal issues suggest that Bulutun Wealth is not safe for investors looking to protect their capital.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing the reliability of a broker. Reviews of Bulutun Wealth reveal a mixed bag of experiences, with many users reporting severe issues related to withdrawals and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Poor |

| Customer Support | High | Poor |

Common complaints include being unable to withdraw funds, poor customer service, and a lack of transparency regarding fees. For instance, several clients reported that their withdrawal requests were denied or delayed indefinitely, often citing tax payments as a reason. This pattern of complaints indicates a troubling trend that could suggest Bulutun Wealth operates more like a scam than a legitimate broker. The overall negative sentiment surrounding customer experiences underscores the importance of exercising caution when considering Bulutun Wealth as a trading partner.

Platform and Trade Execution

The trading platform offered by Bulutun Wealth is the widely recognized MetaTrader 4 (MT4), which is known for its user-friendly interface and robust trading capabilities. However, the platform's performance and execution quality have come under scrutiny. Users have reported instances of slippage and issues with order execution, which can significantly impact trading outcomes.

Moreover, there are concerns about potential platform manipulation, as some users have described experiences where their orders were not executed as expected. This raises questions about the reliability of the trading environment provided by Bulutun Wealth. Given the critical nature of trade execution in forex trading, the issues surrounding platform performance further suggest that Bulutun Wealth may not be a safe choice for traders.

Risk Assessment

Overall, the assessment of Bulutun Wealth reveals several risks that potential clients should consider before engaging with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated and claims of false licensing |

| Financial Security | High | Numerous complaints about withdrawal issues |

| Transparency | High | Lack of information on fees and operations |

| Customer Support | High | Poor response to client inquiries |

Given these risk factors, it is clear that engaging with Bulutun Wealth presents significant challenges. To mitigate these risks, it is advisable for traders to conduct thorough research, consider alternative regulated brokers, and remain vigilant about their trading activities.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Bulutun Wealth is not safe for traders. The lack of regulation, transparency issues, poor customer experiences, and withdrawal problems all point to a broker that may not have the best interests of its clients at heart.

For traders seeking a reliable and secure trading environment, it is recommended to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Such brokers typically offer better protection for client funds and more transparent trading conditions, ensuring a safer trading experience.

Ultimately, while Bulutun Wealth may present itself as a viable option, the risks associated with it far outweigh any potential benefits. Therefore, it is crucial for traders to exercise caution and seek safer alternatives in the forex market.

Is Bulutun Wealth a scam, or is it legit?

The latest exposure and evaluation content of Bulutun Wealth brokers.

Bulutun Wealth Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bulutun Wealth latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.