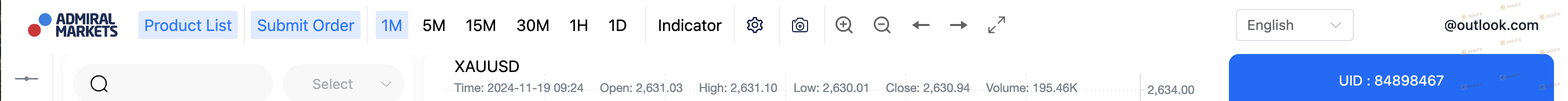

Regarding the legitimacy of admiral markets forex brokers, it provides FCA, CYSEC, FSA, ASIC and WikiBit, (also has a graphic survey regarding security).

Is admiral markets safe?

Pros

Cons

Is admiral markets markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Admiral Markets UK Ltd

Effective Date:

2013-06-12Email Address of Licensed Institution:

compliance.uk@admiralmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.admiralmarkets.comExpiration Time:

--Address of Licensed Institution:

Admiral Markets UK Ltd 8th Floor One Canada Square Canary Wharf London E14 5AA UNITED KINGDOMPhone Number of Licensed Institution:

+4402077264003Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 17

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Admirals Europe Ltd

Effective Date: Change Record

2013-06-14Email Address of Licensed Institution:

info@admiralmarkets.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.admiralmarkets.com.cy, www.admirals.comExpiration Time:

--Address of Licensed Institution:

Agias Zonis 63, 3090 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 770 074Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Admirals SC Ltd

Effective Date:

--Email Address of Licensed Institution:

info@aglobe.orgSharing Status:

No SharingWebsite of Licensed Institution:

https://www.admiralmarkets.com/scExpiration Time:

--Address of Licensed Institution:

Suite 202, Second Floor, Waterside Property, Eden Island, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4671940Licensed Institution Certified Documents:

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

PU PRIME TRADING PTY LTD

Effective Date: Change Record

2012-01-19Email Address of Licensed Institution:

cristian.moreno@puprime.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 10 17 CASTLEREAGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

+61 8 6616 0661Licensed Institution Certified Documents:

Is Admiral Markets A Scam?

Introduction

Admiral Markets, now rebranded as "Admirals," is a well-established forex and CFD broker that has been operational since 2001. With a presence in over 130 countries, it has positioned itself as a significant player in the online trading market, particularly appealing to both novice and experienced traders. However, the rise of online trading has also led to a proliferation of fraudulent brokers, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to analyze the legitimacy of Admiral Markets by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. The investigation is based on a comprehensive review of multiple sources, including regulatory filings, user reviews, and expert analyses.

Regulation and Legitimacy

When evaluating any broker, regulatory oversight is a critical factor that can significantly influence a trader's decision. Admiral Markets is regulated by several reputable authorities, which adds a layer of trustworthiness to its operations. Below is a summary of the key regulatory information regarding Admiral Markets:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| FCA | 595450 | United Kingdom | Verified |

| ASIC | 410681 | Australia | Verified |

| CySEC | 201/13 | Cyprus | Verified |

| EFSA | 4.1-1/46 | Estonia | Verified |

The presence of multiple tier-1 regulators such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) indicates that Admiral Markets adheres to stringent regulatory standards. These regulators enforce strict rules concerning client fund protection, requiring brokers to keep customer funds in segregated accounts. This regulatory framework is crucial for ensuring that traders' investments are safeguarded, particularly in the event of a broker's insolvency.

Admiral Markets has maintained a clean regulatory history, with no significant violations reported against it. This solid compliance record enhances its credibility in the competitive forex market. Traders can be reassured that they are dealing with a legitimate broker that operates within the regulatory frameworks of multiple jurisdictions.

Company Background Investigation

Admiral Markets was founded in 2001 in Tallinn, Estonia, and has since expanded its operations globally, establishing offices in various countries, including the UK, Australia, and Cyprus. The company has grown significantly over the years, now serving over 94,000 active clients worldwide. The ownership structure of Admiral Markets is transparent, with the parent company being publicly held, which allows for greater scrutiny and accountability.

The management team at Admiral Markets comprises seasoned professionals with extensive experience in the financial services industry. This expertise is reflected in the company's robust trading platform and customer service. The broker emphasizes transparency and provides comprehensive information about its operations, which is crucial for building trust with its clients.

Furthermore, Admiral Markets actively engages in corporate social responsibility initiatives, demonstrating its commitment to ethical practices. This proactive approach to governance and accountability contributes to a positive perception of the company within the trading community.

Trading Conditions Analysis

Admiral Markets offers a competitive trading environment, characterized by various account types, low spreads, and a diverse range of financial instruments. The broker's fee structure is transparent, with no hidden charges. However, it is essential to analyze the overall cost of trading to understand how it compares to industry standards.

| Fee Type | Admiral Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.6 pips | 0.8 pips |

| Commission Model | $3 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

Admiral Markets offers a range of account types, including standard and zero accounts, catering to different trading preferences. The zero accounts allow for tighter spreads but charge a commission, making them suitable for high-frequency traders. However, the broker charges an inactivity fee of €10 per month after 24 months of inactivity, which could be a concern for traders who may not trade regularly.

Overall, the trading conditions at Admiral Markets are competitive, but traders should be aware of the potential costs associated with inactivity and commissions, especially if they are not frequent traders.

Client Funds Security

The security of client funds is paramount in the online trading landscape. Admiral Markets employs several measures to ensure the safety of its clients' investments. Client funds are kept in segregated accounts, separate from the company's operational funds. This practice is crucial for protecting traders' money in the event of the broker facing financial difficulties.

In addition to fund segregation, Admiral Markets offers negative balance protection, which ensures that clients cannot lose more than their deposited amount. This feature is particularly beneficial in volatile market conditions, as it provides an additional safety net for traders.

Admiral Markets is also a member of the Investor Compensation Fund in Cyprus, which provides compensation to clients in the event of insolvency. This adds another layer of protection, ensuring that traders' investments are safeguarded.

Despite these robust security measures, it is essential to remain vigilant, as the trading environment can be unpredictable. Historical issues related to fund security have not been reported for Admiral Markets, reinforcing its reputation as a reliable broker.

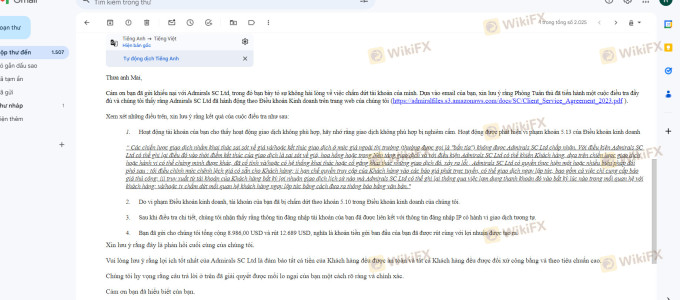

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Overall, Admiral Markets has garnered a positive reputation among its clients, with many highlighting its user-friendly platform and responsive customer support. However, like any broker, it has faced its share of complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Addressed promptly |

| Account Verification Issues | High | Ongoing improvement |

| Inactivity Fee Concerns | Medium | Clarified in T&Cs |

Common complaints include delays in withdrawals and issues related to account verification. While the company has made efforts to address these concerns, some users have reported feeling frustrated with the process. For instance, a few traders have expressed dissatisfaction with the time taken to verify their accounts and the subsequent withdrawal process.

Despite these complaints, Admiral Markets has a relatively high customer satisfaction rating on platforms like Trustpilot, where it has received numerous positive reviews. The broker's commitment to resolving issues and improving its services is evident in its proactive response to customer feedback.

Platform and Trade Execution

Admiral Markets provides access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their reliability and advanced trading features. The platforms are user-friendly, making them suitable for both beginners and experienced traders. The execution speed is generally fast, with low slippage reported by many users.

However, there have been occasional reports of order rejections, particularly during high volatility periods. While these instances are not common, they can be concerning for traders who rely on precise execution. Overall, the trading platform's performance is satisfactory, but traders should remain aware of potential execution issues during volatile market conditions.

Risk Assessment

Trading with Admiral Markets, like any broker, comes with inherent risks. Below is a summary of the key risk areas associated with using this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight from top-tier authorities. |

| Financial Risk | Medium | Leverage can amplify gains but also losses. |

| Operational Risk | Medium | Potential for execution delays during high volatility. |

| Customer Service Risk | Medium | Mixed reviews on complaint resolution and support responsiveness. |

To mitigate these risks, traders should consider using lower leverage, maintaining a diversified portfolio, and ensuring they fully understand the trading conditions before committing funds. Additionally, keeping communication lines open with customer support can help address any issues promptly.

Conclusion and Recommendations

In conclusion, Admiral Markets is not a scam. The broker is well-regulated, offering a range of trading instruments and competitive conditions. While there are areas for improvement, particularly concerning customer service and withdrawal processes, the overall assessment indicates that Admiral Markets is a reputable broker.

For traders considering Admiral Markets, it is advisable to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, those who may be concerned about potential withdrawal delays or account verification issues should ensure they have all required documentation ready before opening a live account.

If you are looking for alternatives, consider brokers like IG or OANDA, which also offer robust regulatory protection and a wide range of trading instruments. Ultimately, thorough research and careful consideration of trading conditions will help ensure a positive trading experience.

Is admiral markets a scam, or is it legit?

The latest exposure and evaluation content of admiral markets brokers.

admiral markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

admiral markets latest industry rating score is 7.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.