Admiral Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Admiral Markets review evaluates one of the established players in the online trading industry. Founded in 2001 in Estonia, Admiral Markets has grown into a globally recognized forex and CFD broker. The company offers access to over 4,000 financial instruments across multiple asset classes including forex, CFDs, stocks, commodities, cryptocurrencies, ETFs, and bonds.

Admiral Markets stands out for its strong regulatory framework. The company operates under the supervision of top authorities including the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), and Cyprus Securities and Exchange Commission (CySEC). The broker provides competitive trading conditions with spreads starting from 0 pips and leverage up to 1:1000. This makes it accessible to both retail and professional traders.

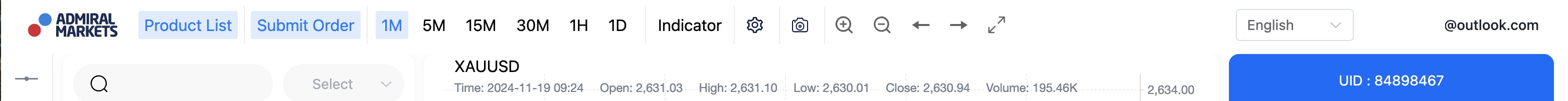

The platform supports the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms come enhanced with special tools and Supreme plugins for advanced trading functionality. According to available user feedback, Admiral Markets maintains a rating of 3/5 stars. This indicates room for improvement while still providing essential trading services. The broker particularly appeals to traders seeking educational resources and diverse investment opportunities, though some aspects of their service offering require closer examination for potential clients.

Important Notice

Admiral Markets operates through different regional entities. Each entity is regulated by distinct financial authorities. The FCA-regulated entity serves UK clients, while ASIC oversees Australian operations, and CySEC manages European Union jurisdictions.

Trading conditions, available instruments, and investor protection schemes may vary depending on your geographical location and the specific Admiral Markets entity serving your region. This review is based on publicly available information, user feedback from various trading communities, and analysis of the broker's official disclosures. Regulatory requirements and trading conditions are subject to change. Prospective clients should verify current terms directly with Admiral Markets before opening an account. The evaluation presented here reflects the broker's offerings as of 2025 and may not capture all recent developments or regional variations in service provision.

Rating Framework

Broker Overview

Admiral Markets began its journey in 2001. Founder Alexander Tsikhilov established the company in Tallinn, Estonia. Originally focused on the Baltic region, the broker has systematically expanded its global footprint over more than two decades.

The company registered as a security and commodity contracts broker in 2003. This marked its formal entry into regulated financial services. By 2017, Admiral Markets had grown sufficiently to issue public bonds, though the offering raised only 鈧

The broker's business model centers on providing access to over 4,000 financial instruments across multiple asset classes. Clients can trade forex pairs, CFDs on various underlying assets, individual stocks, commodities, market indices, cryptocurrencies, ETFs, and bonds. This strategy positions Admiral Markets as a comprehensive trading destination rather than a specialized forex-only provider.

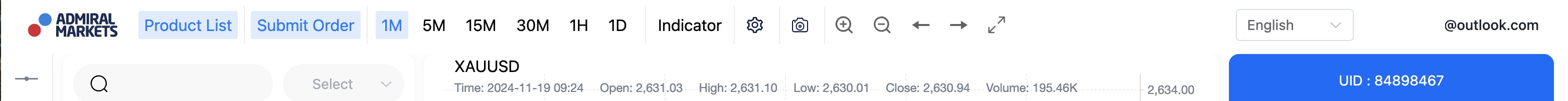

The company emphasizes transparency and uses advanced technology to deliver what it describes as award-winning retail brokerage services. Admiral Markets operates on the MetaTrader ecosystem, offering both MT4 and MT5 platforms enhanced with special Supreme plugins. These additions provide advanced charting capabilities, additional technical indicators, and enhanced order management tools.

The broker maintains regulatory compliance across multiple jurisdictions. FCA authorization covers UK operations, ASIC licensing serves Australian clients, and CySEC regulation handles European Union markets. This multi-jurisdictional approach ensures broad market access while maintaining regulatory standards appropriate to each region's requirements.

Regulatory Jurisdictions: Admiral Markets maintains authorizations from three tier-one regulatory bodies. The FCA provides oversight for UK operations, ensuring compliance with British financial standards.

ASIC regulation covers Australian clients with appropriate investor protections. CySEC authorization enables service provision throughout the European Union under MiFID II frameworks.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available materials. Industry standards typically include bank transfers, credit/debit cards, and electronic payment processors.

Minimum Deposit Requirements: The exact minimum deposit requirement was not specified in available documentation. This indicates this information may vary by account type or regional entity.

Bonuses and Promotions: Current promotional offerings and bonus structures were not detailed in the available information. This suggests either no active promotions or region-specific availability.

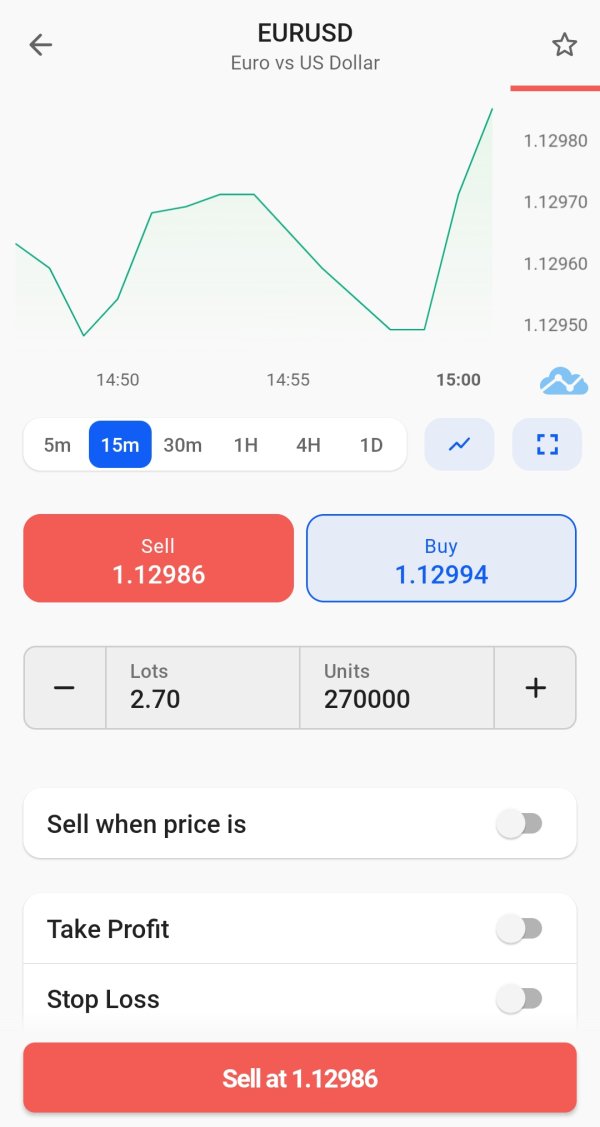

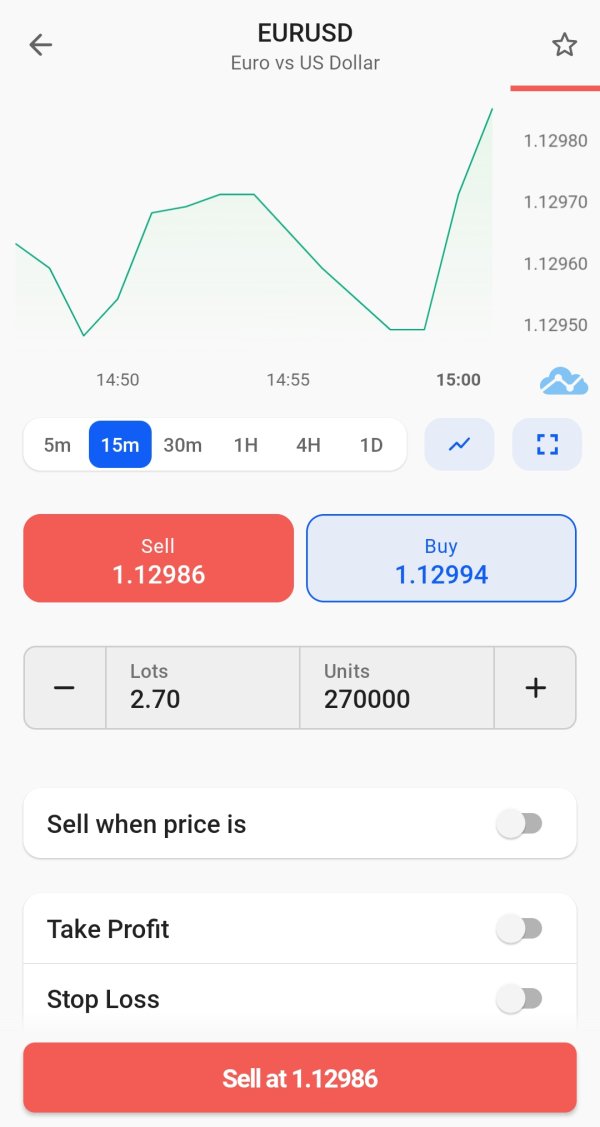

Tradeable Assets: The broker provides access to comprehensive asset coverage. This includes major, minor, and exotic forex pairs, CFDs on global stock indices, individual equity shares from major exchanges, precious metals and energy commodities, popular cryptocurrencies, exchange-traded funds (ETFs), and government and corporate bonds.

Cost Structure: Forex spreads begin from 0 pips on major currency pairs. Commission structures and typical spreads during different market conditions require verification directly with the broker. The overall fee transparency could be enhanced with more detailed cost breakdowns.

Leverage Ratios: Maximum leverage reaches 1:1000 on select instruments. Actual leverage availability depends on client classification, instrument type, and regulatory jurisdiction. European clients face ESMA restrictions limiting leverage to lower ratios.

Platform Options: Trading occurs through MetaTrader 4 and MetaTrader 5 platforms. Both platforms come enhanced with Admiral Markets' Supreme plugin suite providing additional analytical tools and advanced order types.

Geographic Restrictions: Specific geographic limitations were not detailed in available materials. Regulatory compliance requirements typically restrict service availability in certain jurisdictions.

Customer Support Languages: The range of supported languages for customer service was not specified in available documentation. This Admiral Markets review continues with detailed analysis of each evaluation criterion to provide comprehensive insights for potential clients.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

Admiral Markets' account structure reflects industry standards while maintaining competitive elements. The broker offers multiple account types designed to accommodate varying experience levels and capital requirements. Specific details regarding minimum deposits and account tier benefits require direct verification with the broker.

The account opening process appears streamlined. It follows standard KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures required by FCA, ASIC, and CySEC regulations. However, the lack of transparent information regarding minimum deposit requirements and specific account features in publicly available materials suggests potential clients need to engage directly with Admiral Markets representatives.

Leverage availability up to 1:1000 provides flexibility for experienced traders. European clients face ESMA-imposed restrictions limiting leverage to significantly lower ratios. This regulatory variance means account conditions differ substantially based on client location and regulatory jurisdiction.

The broker's multi-entity structure ensures compliance but creates complexity in understanding applicable terms for specific client situations. While spreads starting from 0 pips appear competitive, the absence of detailed commission structures and typical spread ranges during different market conditions prevents comprehensive cost evaluation. This Admiral Markets review notes that account condition transparency could be enhanced through more detailed public disclosure of fees, minimum deposits, and account-specific benefits.

Admiral Markets demonstrates strong commitment to providing comprehensive trading tools. The company achieves this through its enhanced MetaTrader platform offerings. The MT4 and MT5 platforms come equipped with the special Supreme plugin suite, adding significant functionality beyond standard MetaTrader capabilities.

These enhancements include advanced charting tools, additional technical indicators, mini terminal for quick order placement, and session map showing global trading hours. The broker's educational resources cater to traders across experience levels, from beginners requiring fundamental market education to advanced practitioners seeking sophisticated analytical tools. According to available information, Admiral Markets provides quality investment education, though specific details regarding webinar schedules, educational content volume, and expert analysis frequency were not detailed in accessible materials.

Automated trading support through Expert Advisors (EAs) and signal services enables algorithmic trading strategies. The MetaTrader ecosystem's strong backtesting capabilities allow strategy development and optimization. However, the extent of special research and analysis resources, market commentary frequency, and economic calendar features require further investigation.

The Supreme plugin suite represents a significant value addition. It provides tools typically found in more expensive professional trading platforms. These include correlation matrix, symbol info tools, and enhanced risk management features that improve the overall trading environment beyond standard retail broker offerings.

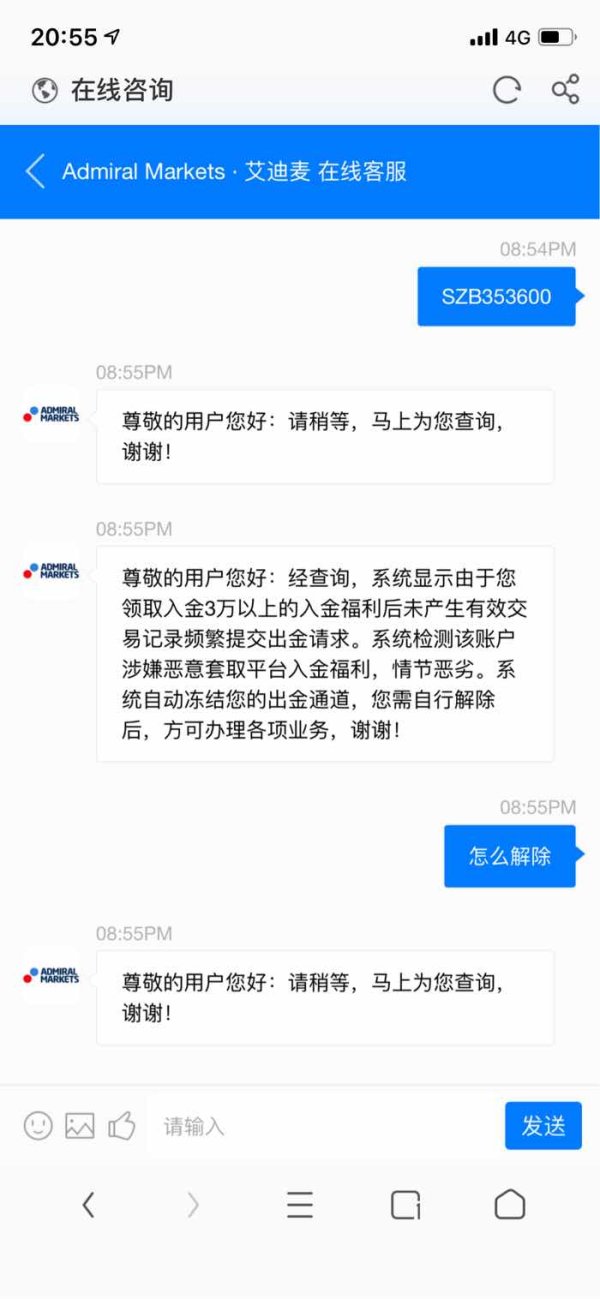

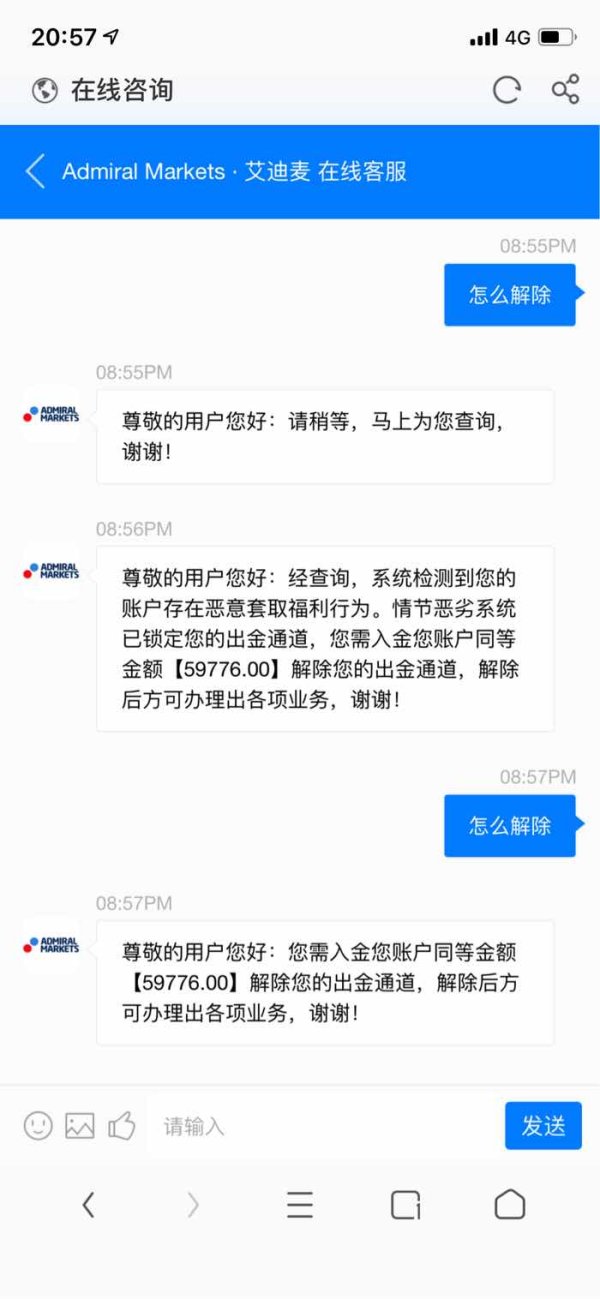

Customer Service and Support Analysis (6/10)

Customer service evaluation for Admiral Markets faces limitations. This is due to insufficient publicly available information regarding support channels, response times, and service quality metrics. Industry standards typically include live chat, telephone support, and email ticketing systems, though specific availability and operating hours for Admiral Markets require direct verification.

The broker's multi-jurisdictional operations suggest customer support availability across different time zones to serve global clientele effectively. However, without specific information regarding supported languages, response time commitments, or service level agreements, comprehensive evaluation of customer support quality remains challenging. User feedback available in public forums and review platforms provides mixed signals regarding customer service effectiveness.

Some traders report satisfactory support experiences, while others indicate areas for improvement in response times and issue resolution efficiency. The 3/5 star overall rating suggests customer service performance may be contributing to lower satisfaction levels. Professional traders often require specialized support for complex trading issues, platform technical problems, and account-specific inquiries.

The availability of dedicated account managers, technical support specialists, and trading desk assistance was not detailed in available materials. This indicates potential gaps in service provision for high-value clients.

Trading Experience Analysis (7/10)

The trading experience with Admiral Markets centers on the enhanced MetaTrader platform ecosystem. This provides familiar interfaces for traders experienced with industry-standard platforms. Platform stability and execution quality appear satisfactory based on available user feedback, though specific performance metrics regarding slippage, requotes, and order execution speeds were not detailed in accessible materials.

MT4 and MT5 platforms offer comprehensive trading functionality including multiple order types, pending orders, partial position closing, and advanced charting capabilities. The Supreme plugin enhancements add professional-grade tools typically unavailable on standard retail platforms. This improves the overall trading environment for serious traders.

Mobile trading capabilities through MetaTrader mobile applications enable position management and market monitoring from anywhere. However, specific information regarding mobile platform performance, feature completeness compared to desktop versions, and user interface quality requires direct evaluation by potential clients. Market access to over 4,000 instruments provides extensive trading opportunities across multiple asset classes.

The diversity of available markets enables portfolio diversification and various trading strategies. However, specific information regarding market depth, liquidity provision, and trading conditions during volatile market periods was not available in reviewed materials. This Admiral Markets review notes that while the basic trading infrastructure appears solid, enhanced transparency regarding execution statistics and platform performance metrics would strengthen trader confidence.

Trust and Reliability Analysis (8/10)

Admiral Markets demonstrates strong regulatory credentials through authorizations from three tier-one financial regulators. FCA regulation provides strong consumer protection for UK clients, including Financial Services Compensation Scheme coverage. ASIC oversight ensures Australian client protection with appropriate dispute resolution mechanisms.

CySEC authorization enables EU operations under MiFID II frameworks with investor compensation scheme participation. The broker implements negative balance protection, preventing client accounts from falling below zero during extreme market volatility. This risk management feature provides important downside protection, particularly for leveraged trading activities.

Investment protection schemes vary by regulatory jurisdiction but generally provide coverage for eligible client funds in case of broker insolvency. Company transparency regarding financial health, management structure, and operational performance could be enhanced. While regulatory compliance ensures minimum standards, additional disclosure regarding company financials, audit results, and risk management practices would strengthen stakeholder confidence.

The 2017 bond issuance of only 鈧' 20+ year operational history provides evidence of business model sustainability and market adaptation capabilities. However, specific information regarding awards, industry recognition, or third-party assessments of operational quality was not available in reviewed materials.

The absence of significant negative publicity or regulatory sanctions suggests stable operational management.

User Experience Analysis (6/10)

Overall user satisfaction with Admiral Markets reflects mixed experiences. This is indicated by the 3/5 star rating from available user feedback. This moderate rating suggests adequate service provision while highlighting opportunities for improvement across various service dimensions.

Platform usability benefits from the familiar MetaTrader interface, reducing learning curves for traders experienced with industry-standard platforms. However, newcomers to trading may find the platform complex without adequate educational support and onboarding assistance. The Supreme plugin enhancements add functionality but may increase interface complexity for basic trading needs.

Account management processes, including registration, verification, and ongoing maintenance, were not detailed in available materials. Streamlined onboarding and transparent account management procedures significantly impact user experience, particularly for new clients navigating regulatory requirements and platform setup. Fund management convenience, including deposit and withdrawal processes, affects daily trading operations.

Without specific information regarding processing times, available payment methods, and associated fees, comprehensive user experience evaluation remains incomplete. The moderate user rating suggests Admiral Markets provides essential trading services while potentially falling short of excellence in customer-facing operations. Areas for improvement likely include customer service responsiveness, platform user-friendliness for beginners, and overall service delivery consistency.

Conclusion

This comprehensive Admiral Markets review reveals a well-established broker with solid regulatory foundations and competitive trading infrastructure. The company's 20+ year operational history, multi-jurisdictional regulatory compliance, and access to over 4,000 financial instruments position it as a viable option for diverse trading requirements.

Admiral Markets particularly suits traders seeking regulated environment protection, MetaTrader platform familiarity, and educational resource access. The enhanced Supreme plugin suite adds professional-grade functionality typically unavailable from standard retail brokers. However, the moderate 3/5 user rating indicates areas requiring improvement, particularly in customer service delivery and overall user experience optimization.

The broker's main strengths include strong regulatory oversight from tier-one authorities, comprehensive asset class coverage, competitive leverage offerings up to 1:1000, and enhanced MetaTrader platforms with special tools. Primary weaknesses involve limited transparency regarding fees and account conditions, moderate customer satisfaction ratings, and insufficient public information regarding support quality and service levels. Potential clients should conduct direct due diligence to verify current terms, conditions, and service quality before committing to Admiral Markets as their trading partner.