Is 4XC safe?

Pros

Cons

Is 4XC A Scam?

Introduction

4XC, a forex and CFD broker established in 2018, operates out of the Cook Islands. It positions itself as an accessible trading platform for both novice and experienced traders, offering a wide range of financial instruments, including forex, commodities, and cryptocurrencies. Given the proliferation of online brokers, it is essential for traders to conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive analysis of 4XC, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The insights presented are based on a review of multiple credible sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a critical factor in assessing its legitimacy. 4XC is regulated by the Financial Supervisory Commission (FSC) of the Cook Islands. While this regulatory body provides a level of oversight, it is essential to note that it is classified as a tier-3 regulator, which generally indicates a lower level of scrutiny compared to tier-1 regulators such as the FCA or ASIC.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC | MC 03/2018 | Cook Islands | Verified |

The FSC's oversight primarily involves monitoring compliance with anti-money laundering (AML) and know your customer (KYC) regulations. However, the lack of stringent capital requirements and investor compensation schemes raises concerns about the level of protection available to traders. Furthermore, the Cook Islands has gained notoriety for being a haven for offshore brokers, which can lead to potential exploitation of regulatory loopholes.

4XC has not faced any significant regulatory sanctions to date, but the relatively short operational history and the nature of its regulatory environment warrant caution. Traders should be aware that while 4XC is legally operating, the protective measures offered may not be as robust as those provided by brokers regulated in more stringent jurisdictions.

Company Background Investigation

4XC is operated by 4XCube Ltd, a company registered in the Cook Islands. Since its inception, the broker has aimed to cater to a global audience, particularly targeting markets in Latin America and other regions. The management team comprises professionals with varying degrees of experience in finance and trading, but specific details about their backgrounds are limited. This lack of transparency can be a red flag for potential clients.

The company has made efforts to enhance its public image through marketing and promotional activities, including offering various account types and trading bonuses. However, the absence of detailed information regarding its ownership structure and the qualifications of its management team may raise concerns about its operational integrity.

4XC's website provides essential information about its services and trading conditions, but it lacks comprehensive disclosures that would typically be expected from more established brokers. This opacity can lead to uncertainty for prospective clients regarding the broker's commitment to transparency and accountability.

Trading Conditions Analysis

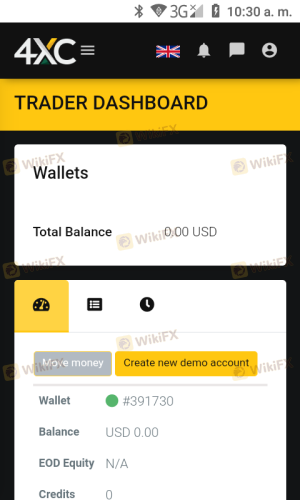

When evaluating a broker, the trading conditions it offers can significantly impact a trader's profitability. 4XC offers various account types, including standard, pro, and VIP accounts, each with differing minimum deposits and fee structures.

4XC's fee structure is competitive, with spreads starting as low as 0.0 pips for pro and VIP accounts, but it is essential to scrutinize the overall cost of trading, including commissions and overnight financing fees.

| Fee Type | 4XC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | From 0.1 pips |

| Commission Model | $4-$5 per lot | $3 per lot |

| Overnight Interest Range | High for some pairs | Moderate |

While the spreads appear attractive, the commission structure can vary significantly between account types, with pro accounts incurring additional fees. Moreover, the overnight interest rates are reported to be higher than industry standards, which could detract from long-term trading strategies.

Traders should also be aware of the inactivity fee charged by 4XC, which is relatively high compared to industry norms. This fee can accumulate quickly for those who are not actively trading, further impacting profitability.

Client Fund Security

The safety of client funds is paramount when choosing a broker. 4XC claims to implement several security measures, including segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This practice is essential for protecting traders in the event of the broker facing financial difficulties.

4XC also offers negative balance protection, which means that clients cannot lose more than their deposited funds when trading forex pairs and metals. However, it is important to note that this protection may not extend to all instruments offered by the broker.

Despite these measures, the lack of an investor compensation scheme raises concerns. If 4XC were to become insolvent, clients may not have access to any form of compensation, which is a significant risk factor to consider.

Historically, there have been no major incidents reported regarding fund security at 4XC, but the offshore nature of its regulation and the absence of stringent oversight can lead to potential vulnerabilities.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's performance. Reviews of 4XC indicate a mixed bag of experiences. Some users praise the broker for its user-friendly platform and efficient withdrawal processes, while others express dissatisfaction with customer service and high fees.

Common complaints include issues with account verification, withdrawal delays, and a lack of educational resources for novice traders.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Verification | Medium | Moderate response |

| High Fees | Low | Acknowledged |

Two notable cases highlight these issues. One user reported a lengthy verification process that delayed their ability to trade, while another experienced delays in fund withdrawals that took longer than promised. In both instances, the company's response was deemed inadequate, leading to frustration among affected clients.

Platform and Trade Execution

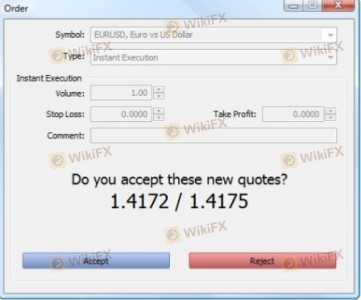

4XC provides access to popular trading platforms, including MetaTrader 4 and MetaTrader 5. These platforms are known for their stability and advanced trading features, which can enhance the trading experience. However, user reviews suggest variability in order execution quality, with some traders reporting instances of slippage and order rejections.

The overall performance of the platforms is generally rated positively, but traders should remain vigilant for any signs of manipulation or execution issues, particularly during high volatility periods.

Risk Assessment

Trading with 4XC presents several risks that traders should consider. The offshore regulatory environment, while providing some level of oversight, does not offer the same protections as more stringent jurisdictions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Fund Safety Risk | Medium | Segregated funds but no investor compensation scheme. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders are advised to perform thorough due diligence, utilize risk management strategies, and consider starting with a demo account to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, while 4XC operates legally under the FSC of the Cook Islands, several factors raise concerns about its overall safety and reliability. The tier-3 regulatory status, potential fund security vulnerabilities, and mixed customer feedback suggest that traders should approach this broker with caution.

For those considering trading with 4XC, it is recommended to start with a small investment and thoroughly assess the trading conditions and platform performance. If you seek a more regulated environment, consider brokers with tier-1 regulatory oversight, such as those regulated by the FCA or ASIC, which provide more robust protections and a higher level of accountability.

Ultimately, the decision to trade with 4XC should be made with careful consideration of the associated risks and the broker's overall reputation in the industry.

Is 4XC a scam, or is it legit?

The latest exposure and evaluation content of 4XC brokers.

4XC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

4XC latest industry rating score is 2.15, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.15 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.