4xc 2025年评测:您需要了解的一切

Executive Summary

This comprehensive 4xc review looks at a forex broker that offers low-spread trading conditions with competitive leverage options. 4XC works as an STP (Straight Through Processing) broker, giving traders direct market access without dealer interference. The platform supports both MetaTrader 4 and MetaTrader 5, helping traders who want familiar and strong trading environments.

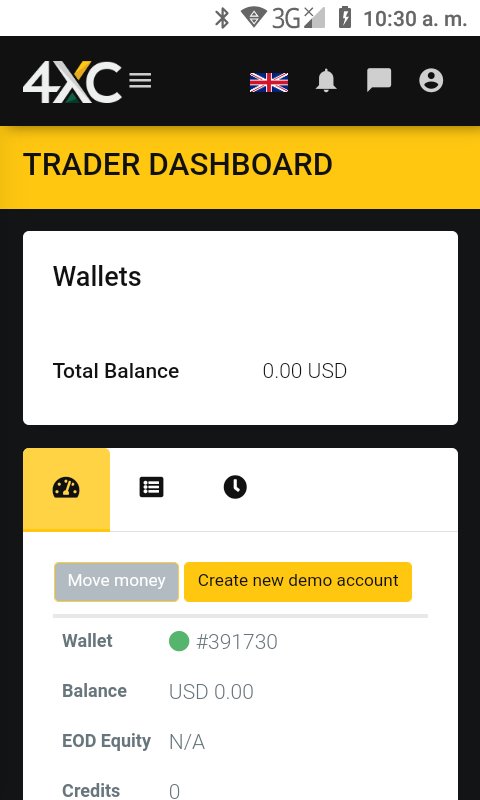

Based on user feedback from ForexRating.com, 4XC has a user rating of 4.2 out of 5. Traders especially like the low spreads and helpful customer service. The broker offers leverage up to 1:500 and gives access to multiple asset classes including forex and cryptocurrencies. 4XC also attracts new clients with a 50% first deposit bonus to encourage trading activity.

However, this 4xc review must point out that while user satisfaction seems generally positive, there are worrying gaps in regulatory transparency and some negative user experiences that need careful thought. The broker's target audience mainly includes traders seeking cost-effective trading conditions and high leverage opportunities. Though the lack of clear regulatory information may worry risk-conscious traders.

Important Notice

Regional Entity Differences: The regulatory status of 4XC entities may vary across different jurisdictions. Traders should check the regulatory compliance and licensing status for their region before working with the broker. This evaluation cannot confirm specific regulatory oversight for all operational territories.

Review Methodology: This assessment uses available user feedback, market data, and public information about 4XC's services. Trading involves significant risk, and past performance does not guarantee future results.

Rating Framework

Broker Overview

4XC works as a Straight Through Processing (STP) forex broker, using a business model that sends client orders directly to liquidity providers without dealer interference. This approach should ensure that the broker's interests match those of its clients, as 4XC profits from trading volumes rather than client losses. The broker has positioned itself in the competitive retail forex market by focusing on low-cost trading conditions and accessible leverage options.

The company's service portfolio covers multiple asset classes, with particular strength in forex trading and expanding offerings in cryptocurrency markets. According to available information, 4XC has built its reputation on providing competitive spreads and maintaining reliable order execution. Though specific performance metrics and historical data remain limited in public sources.

4XC's technology infrastructure centers on the widely-used MetaTrader ecosystem, supporting both MT4 and MT5 platforms. This choice shows the broker's focus on providing familiar trading environments that work for both new and experienced traders. The platform selection also enables access to extensive third-party tools, expert advisors, and automated trading solutions that are important to modern forex trading strategies.

However, this 4xc review must acknowledge significant information gaps about the company's corporate structure, founding details, and comprehensive regulatory framework. These omissions represent important considerations for traders evaluating the broker's long-term stability and regulatory compliance.

Regulatory Jurisdiction: Specific regulatory information for 4XC is not detailed in available sources, representing a significant transparency gap that potential clients should investigate independently before account opening.

Deposit and Withdrawal Methods: Complete information about payment processing options, including supported payment methods, processing times, and associated fees, is not specified in available documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not disclosed in accessible sources, requiring direct inquiry with the broker.

Bonus and Promotions: 4XC offers a 50% first deposit bonus designed to enhance initial trading capital for new clients. Though complete terms and conditions require verification directly with the broker.

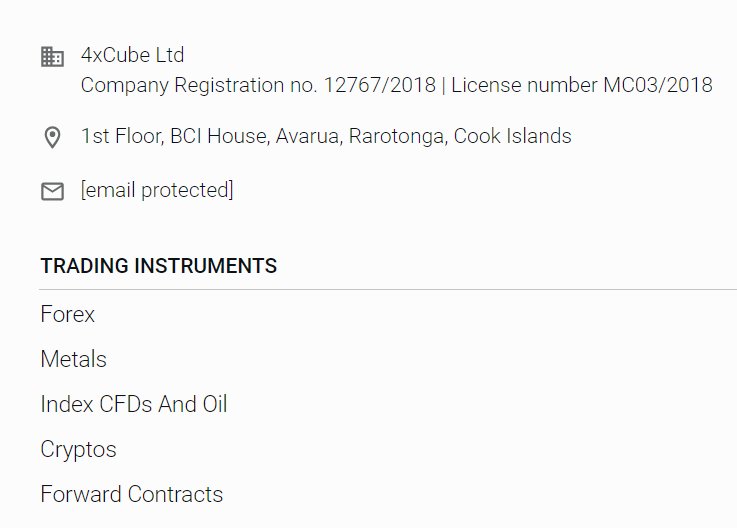

Tradeable Assets: The broker provides access to forex currency pairs and cryptocurrency instruments, though the complete range of available markets and specific contract specifications are not comprehensively detailed.

Cost Structure: 4XC emphasizes low-spread trading conditions as a primary competitive advantage. Though specific commission structures, overnight financing rates, and additional fees are not clearly outlined in available materials.

Leverage Ratios: Maximum leverage reaches 1:500, positioning 4XC competitively within the high-leverage segment of the retail forex market.

Platform Options: Trading is facilitated through MetaTrader 4 and MetaTrader 5 platforms, providing comprehensive charting, analysis, and automated trading capabilities.

Geographic Restrictions: Information regarding restricted jurisdictions and regional service limitations is not specified in available sources.

Customer Support Languages: Specific language support options are not detailed in accessible documentation, requiring direct verification with the broker's support team.

This 4xc review emphasizes that many crucial operational details require direct verification with 4XC representatives due to limited publicly available information.

Account Conditions Analysis

The account structure at 4XC appears designed to accommodate traders seeking competitive trading costs. Though comprehensive details about account tiers and their specific features are not fully disclosed in available sources. The broker's emphasis on low spreads suggests a focus on cost-conscious traders who prioritize tight bid-ask spreads over other potential benefits such as educational resources or premium research tools.

Regarding minimum deposit requirements, specific amounts are not clearly stated in accessible documentation, which represents a significant information gap for potential clients planning their initial investment. This lack of transparency may complicate the decision-making process for traders comparing brokers based on capital requirements and account accessibility.

The account opening process details are not comprehensively outlined in available sources, including verification requirements, documentation needs, and typical approval timeframes. Modern traders increasingly expect streamlined onboarding experiences, and the absence of clear process information may impact user experience expectations.

Special account features, such as Islamic swap-free accounts for Muslim traders or institutional-grade services for high-volume clients, are not specifically mentioned in available materials. These specialized offerings have become increasingly important differentiators in the competitive forex brokerage landscape.

User feedback regarding account conditions appears generally positive based on the 4.2/5 rating from ForexRating.com, suggesting that despite information gaps, actual account holders find the trading conditions satisfactory. However, this 4xc review cannot provide detailed comparisons with industry standards due to limited specific data about 4XC's complete account structure and features.

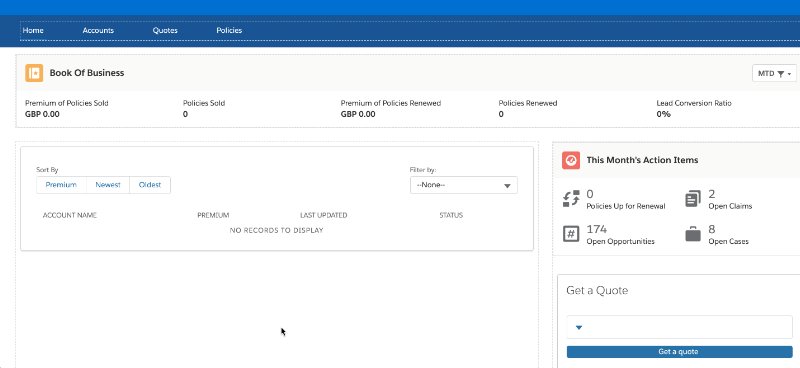

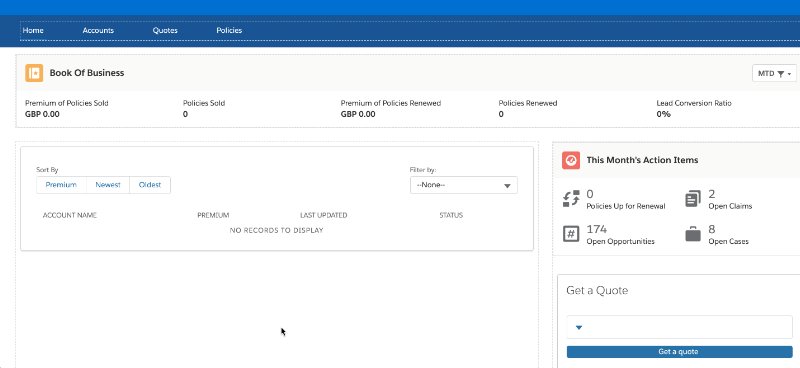

4XC's technology offering centers on the MetaTrader ecosystem, supporting both MT4 and MT5 platforms that represent industry-standard trading environments. This dual-platform approach provides traders with flexibility to choose between the familiar MT4 interface or the more advanced features of MT5, including additional timeframes, more technical indicators, and enhanced order management capabilities.

The MetaTrader platforms enable access to comprehensive charting tools, technical analysis indicators, and automated trading capabilities through Expert Advisors (EAs). These platforms also support custom indicators and trading robots, allowing experienced traders to implement sophisticated trading strategies and algorithmic approaches.

However, detailed information about proprietary research and analysis resources is not specified in available sources. Modern forex traders increasingly expect comprehensive market analysis, economic calendars, trading signals, and educational materials as standard broker offerings. The absence of detailed information about these resources represents a notable gap in this evaluation.

Educational resources, including webinars, tutorials, trading guides, and market analysis, are not comprehensively detailed in accessible documentation. Educational support has become a crucial differentiator for brokers targeting developing traders and those seeking to improve their trading skills.

Automated trading support through the MetaTrader platforms provides robust capabilities for algorithmic trading. Though specific information about VPS services, latency optimization, or advanced execution features is not detailed in available sources. The platform choice does ensure compatibility with the extensive MT4/MT5 ecosystem of third-party tools and services.

User feedback suggests satisfaction with the available tools, though specific testimonials about platform performance, tool effectiveness, or resource quality are limited in accessible reviews.

Customer Service and Support Analysis

User feedback indicates generally positive experiences with 4XC's customer service, contributing to the broker's 4.2/5 rating on ForexRating.com. Traders appear to appreciate the responsiveness and quality of support interactions, though specific metrics about response times, resolution rates, or service availability are not detailed in available sources.

The range of customer service channels, including phone support, email, live chat, or social media engagement, is not comprehensively outlined in accessible documentation. Modern traders expect multiple communication options and 24/5 availability during market hours, making this information gap significant for service evaluation.

Response time expectations and typical resolution timeframes for various inquiry types are not specified, though user satisfaction suggests acceptable performance levels. However, without specific benchmarks or service level commitments, traders cannot set appropriate expectations for support interactions.

Multilingual support capabilities are not detailed in available sources, which may be crucial for international clients seeking assistance in their native languages. The global nature of forex trading makes language support an important service differentiator.

Operating hours for customer support services are not clearly specified, though forex market hours typically require extended support availability. Traders often need assistance outside traditional business hours, making service availability a critical consideration.

While user feedback suggests positive service experiences, specific case studies, problem resolution examples, or detailed testimonials are not available in accessible sources. The general satisfaction indicated by ratings suggests competent support delivery, though this 4xc review cannot provide detailed service quality analysis due to limited specific information.

Trading Experience Analysis

User feedback indicates generally positive trading experiences with 4XC, with the 4.2/5 rating suggesting satisfactory platform performance and execution quality. Traders appear to appreciate the overall trading environment, though specific performance metrics and detailed execution statistics are not available in accessible sources.

Platform stability and execution speed are crucial factors for successful forex trading, and user satisfaction suggests adequate performance in these areas. However, without specific uptime statistics, latency measurements, or execution quality benchmarks, this evaluation cannot provide detailed technical performance analysis.

The MetaTrader 4 and MT5 platforms offer comprehensive functionality including advanced charting, technical analysis tools, and automated trading capabilities. These platforms are industry standards known for reliability and feature richness, providing traders with professional-grade trading environments.

Mobile trading experience details are not specifically outlined in available sources, though both MT4 and MT5 offer mobile applications that typically provide core trading functionality. Modern traders increasingly rely on mobile access for position monitoring and trade management.

Trading environment quality, including spread consistency, slippage rates, and order execution reliability, appears satisfactory based on user feedback emphasizing low spreads and positive trading experiences. However, specific performance data and execution statistics are not available for detailed analysis.

Liquidity and market depth information is not detailed in available sources, though the STP business model suggests direct market access that should provide competitive execution conditions. This 4xc review notes that while user feedback is positive, comprehensive trading performance data would enhance evaluation accuracy.

Trust and Reliability Analysis

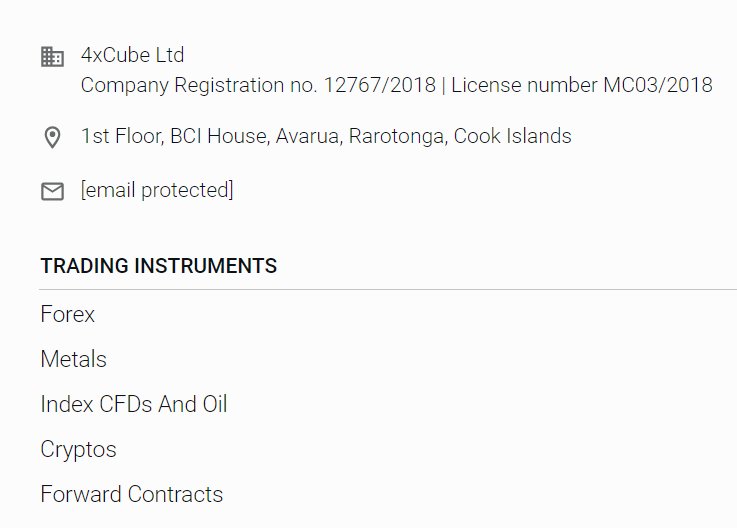

The trust and reliability assessment for 4XC reveals significant concerns due to limited regulatory transparency in available sources. Comprehensive regulatory information, including specific licensing jurisdictions, regulatory numbers, and oversight authorities, is not detailed in accessible documentation, representing a major evaluation gap.

Regulatory compliance is fundamental to broker trustworthiness, as proper oversight provides client protection, dispute resolution mechanisms, and operational standards. The absence of clear regulatory information makes it difficult for traders to assess the level of protection and recourse available.

Client fund security measures, including segregated account policies, deposit insurance, and fund protection mechanisms, are not specified in available sources. These protections are crucial for client confidence and represent standard expectations in regulated forex brokerage.

Company transparency regarding corporate structure, ownership, financial reporting, and business operations is limited in accessible information. Transparent disclosure helps clients understand the organization they're entrusting with their trading capital.

Industry reputation and third-party assessments beyond user ratings are not comprehensively available, limiting the ability to gauge broader market perception and professional recognition. While user feedback suggests operational competence, broader industry validation would strengthen credibility assessment.

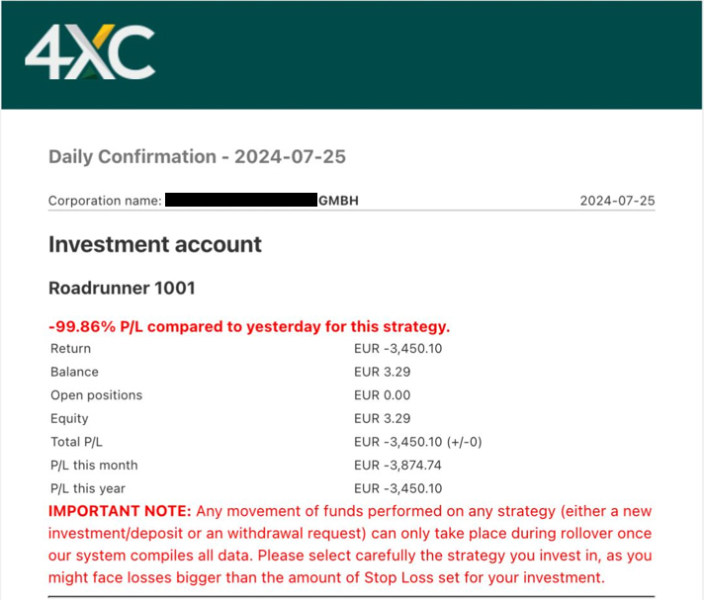

The presence of user warnings and negative feedback mentioned in sources raises additional concerns about potential issues that traders should investigate thoroughly. These red flags, combined with limited regulatory transparency, suggest elevated due diligence requirements for potential clients considering 4XC services.

User Experience Analysis

The overall user satisfaction rating of 4.2/5 from ForexRating.com indicates above-average user experiences, though this represents a mixed picture with both positive feedback and concerning negative experiences. This rating suggests that while many traders find 4XC's services satisfactory, there are notable areas for improvement.

User interface design and platform usability benefit from the MetaTrader ecosystem, which provides familiar and intuitive trading environments for most forex traders. The MT4 and MT5 platforms offer comprehensive functionality while maintaining user-friendly interfaces that accommodate both novice and experienced traders.

Account registration and verification processes are not detailed in available sources, though user feedback suggests manageable onboarding experiences. Streamlined account opening procedures are increasingly important for user satisfaction and competitive positioning.

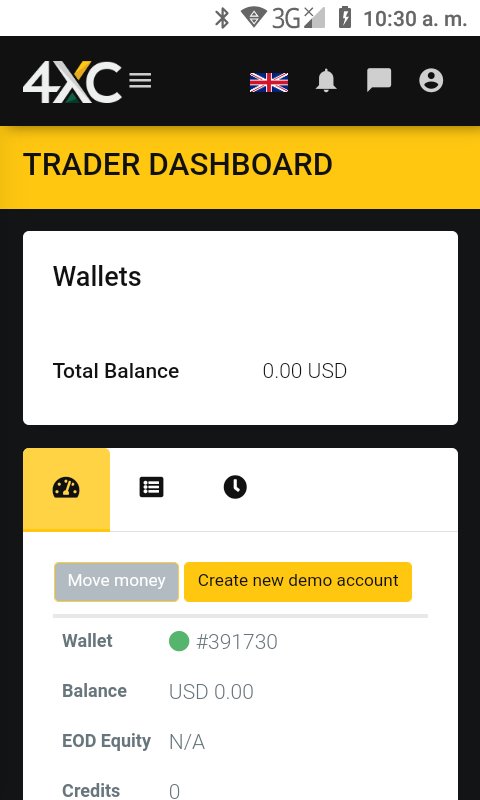

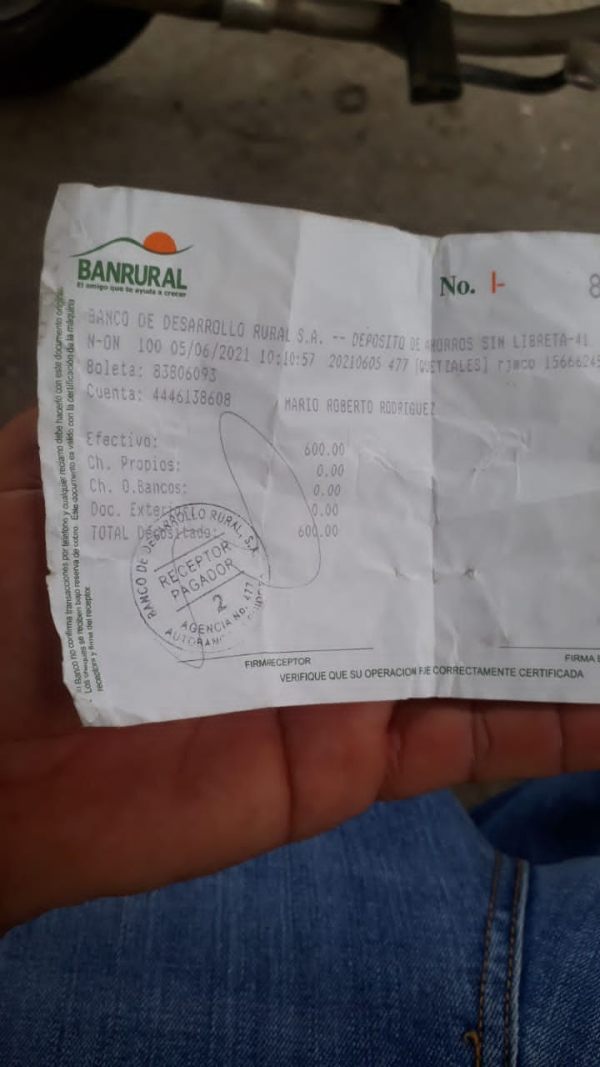

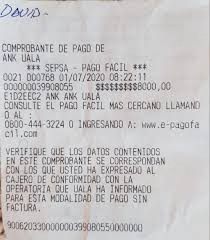

Funding operations experience, including deposit and withdrawal efficiency, processing times, and fee transparency, lacks specific detail in accessible documentation. These operational aspects significantly impact overall user satisfaction and require direct verification with the broker.

Common user complaints mentioned in sources include negative experiences and warning flags that suggest some clients have encountered significant issues. These concerns, while not detailed specifically, indicate that user experiences are not uniformly positive across all client interactions.

The target user profile appears to be cost-conscious traders seeking low spreads and high leverage options, suggesting 4XC may be most suitable for active traders prioritizing trading costs over comprehensive service features. However, the mixed feedback indicates that user satisfaction may depend significantly on individual trading needs and expectations.

Improvement opportunities identified through this analysis include enhanced regulatory transparency, clearer operational information disclosure, and addressing the negative experiences that contribute to mixed user feedback.

Conclusion

This comprehensive 4xc review reveals a forex broker offering competitive trading conditions with low spreads and high leverage up to 1:500, supported by industry-standard MetaTrader platforms. User feedback indicates generally satisfactory experiences with customer service and trading execution, reflected in the 4.2/5 rating from ForexRating.com.

4XC appears most suitable for cost-conscious traders seeking competitive spreads and high leverage options, particularly those comfortable with the MetaTrader trading environment. The broker's STP business model theoretically aligns interests with clients, while the 50% deposit bonus may attract new traders seeking enhanced initial capital.

However, significant concerns emerge regarding regulatory transparency and trustworthiness. The lack of clear regulatory information, combined with user warnings and negative feedback, suggests elevated risk considerations. Primary advantages include competitive trading costs and reliable platform access, while key disadvantages encompass limited transparency, regulatory uncertainty, and mixed user experiences that potential clients should carefully evaluate before engagement.