RallyTrade 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive rallytrade review examines a broker that has created major controversy in the trading community. Based on detailed user feedback and market analysis, RallyTrade shows a mixed picture with serious concerns that overshadow its promotional offerings. The broker calls itself an international financial services provider that targets emerging financial economies, particularly operating in Nigeria's major cities including Lagos, Port Harcourt, and Ibadan.

RallyTrade's key features include over 500 trading instruments spanning commodities, indices, agricultural products, and currencies, alongside leverage ratios reaching up to 1:1000. The platform focuses on educational activities and training programs through its Rally Academy division. However, many user reports show major issues with fund withdrawals, customer service quality, and overall platform reliability. Multiple sources have raised fraud claims against the platform, with users reporting large financial losses and difficulties accessing their invested capital. These worrying patterns suggest potential risks for future traders considering this broker.

Important Disclaimer

This evaluation focuses mainly on RallyTrade's operations in Nigeria and emerging markets, where regulatory frameworks may differ greatly from established financial centers. The broker's legal status and compliance requirements vary across jurisdictions, and potential users should verify local regulations before engaging with the platform. This assessment is based on available user reviews, market feedback, and publicly accessible company information. Given the limited transparency regarding regulatory oversight and the prevalence of negative user experiences, traders should exercise extreme caution and conduct thorough due diligence before considering any financial commitment to this platform.

Rating Framework

Broker Overview

RallyTrade operates as an international online broker with a primary focus on emerging financial economies, particularly maintaining a strong presence across Nigeria's commercial centers. The company calls itself a comprehensive financial services provider, emphasizing competitive brokerage services tailored to developing markets. According to available information, RallyTrade has established operations in Lagos, Port Harcourt, and Ibadan, suggesting a focused effort to capture the Nigerian trading market. The broker's business model appears centered on attracting new traders through educational initiatives and training programs, marketed under the Rally Academy brand.

The platform's service portfolio covers multiple asset classes, with the company claiming to offer over 500 trading instruments covering commodities, indices, agricultural products, and currency pairs. RallyTrade promotes high leverage ratios up to 1:1000, which may appeal to traders seeking amplified market exposure but also greatly increases risk levels. The broker emphasizes its educational component, organizing seminars and training events, including specialized conferences for professional and aspiring traders. However, this rallytrade review must note that specific details regarding trading platforms, regulatory compliance, and operational transparency remain notably absent from publicly available information, raising questions about the company's overall credibility and regulatory standing.

Regulatory Status: Available information does not specify any recognized financial regulatory oversight, which represents a major red flag for potential users seeking regulatory protection and recourse mechanisms.

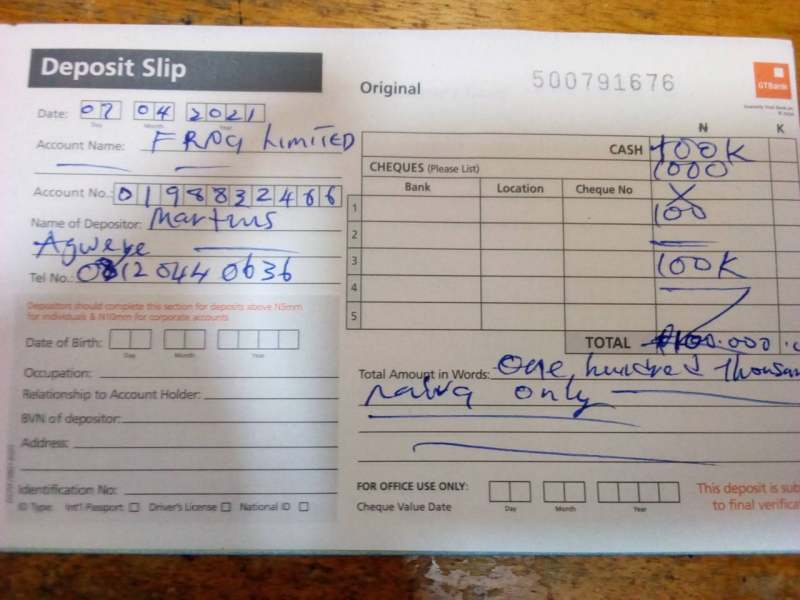

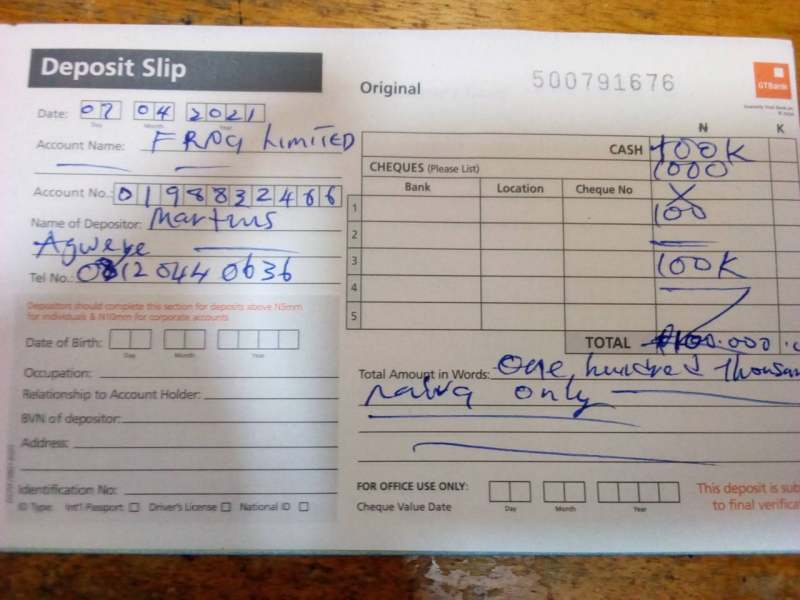

Deposit and Withdrawal Methods: Specific payment processing options and supported financial instruments are not detailed in available sources, though user feedback suggests major difficulties with withdrawal processes.

Minimum Deposit Requirements: The broker has not disclosed minimum account funding requirements in publicly available materials, indicating a lack of transparency in basic account specifications.

Bonus and Promotions: No specific promotional offers or bonus structures are mentioned in current information sources, suggesting either absence of such programs or poor marketing transparency.

Available Trading Assets: RallyTrade claims to provide access to over 500 trading instruments across multiple categories including commodities, indices, agricultural products, and currency pairs, though specific asset lists and market coverage details remain unspecified.

Cost Structure: Commission rates, spread structures, and additional fees are not disclosed in available information. However, user feedback shows concerning patterns regarding hidden costs and unexpected charges that may impact trading profitability.

Leverage Options: The broker advertises maximum leverage ratios of 1:1000, which represents extremely high risk levels that could lead to rapid account depletion for inexperienced traders.

Trading Platform Options: While the company mentions providing multiple trading platforms, specific platform names, features, or compatibility information are not detailed in this rallytrade review's source materials.

Geographic Restrictions: Services appear primarily targeted toward emerging financial economies, with concentrated operations in Nigeria, though global availability and restrictions remain unclear.

Customer Support Languages: Available support languages and communication options are not specified in current information sources.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

RallyTrade's account conditions present major transparency issues that contribute to its poor rating in this category. The broker fails to provide clear information about account types, minimum deposit requirements, or specific trading conditions in publicly available materials. This lack of transparency represents a fundamental problem for potential traders who require detailed account specifications to make informed decisions. User feedback shows that the account opening process may involve complications and unexpected requirements not clearly communicated during initial marketing presentations.

The absence of detailed fee structures, commission rates, and spread information further adds to concerns about account conditions. Professional traders typically require comprehensive cost breakdowns to evaluate platform competitiveness, yet RallyTrade appears to withhold this crucial information. Additionally, user reports suggest that actual trading conditions may differ greatly from initial representations, with some traders experiencing unexpected costs and restrictions after funding their accounts. The lack of clear account tier structures or premium account benefits also shows limited sophistication in account management offerings compared to established brokers in the industry.

RallyTrade's tools and resources offering represents one of its relatively stronger areas, though major limitations persist. The broker's claim of providing over 500 trading instruments suggests a comprehensive asset selection that could appeal to diversified trading strategies. This extensive instrument range potentially covers multiple market sectors and geographic regions, offering traders various opportunities for portfolio diversification. The educational component through Rally Academy demonstrates some commitment to trader development, with organized seminars and training events that may benefit newcomers to financial markets.

However, the quality and accessibility of these tools remain questionable based on user feedback. While the quantity of available instruments appears substantial, users report concerns about execution quality and platform reliability that may undermine the practical value of extensive asset selection. The educational resources, though promoted actively, lack detailed curriculum information or accreditation details that would validate their professional value. Additionally, the absence of specific information about research tools, market analysis resources, or automated trading support suggests potential gaps in comprehensive trading support that experienced traders typically require for effective market participation.

Customer Service and Support Analysis (2/10)

Customer service represents RallyTrade's most critically deficient area, with overwhelming negative feedback from users across multiple touchpoints. User reports consistently highlight prolonged response times, inadequate problem resolution, and particularly severe difficulties when attempting to withdraw funds or resolve account-related issues. The lack of specified customer support channels, operating hours, or multilingual support options in available information suggests minimal investment in professional customer service infrastructure.

The most concerning aspect of customer service feedback relates to withdrawal processing difficulties, with multiple users reporting extended delays, additional verification requirements imposed after initial account approval, and in some cases, complete inability to access deposited funds. These patterns show systemic issues rather than isolated incidents, suggesting fundamental problems with the broker's operational commitment to customer service excellence. The absence of clear escalation procedures or regulatory complaint mechanisms further adds to these issues, leaving users with limited recourse when experiencing service problems. Professional traders require reliable, responsive support systems, particularly when dealing with time-sensitive market opportunities or urgent account issues.

Trading Experience Analysis (4/10)

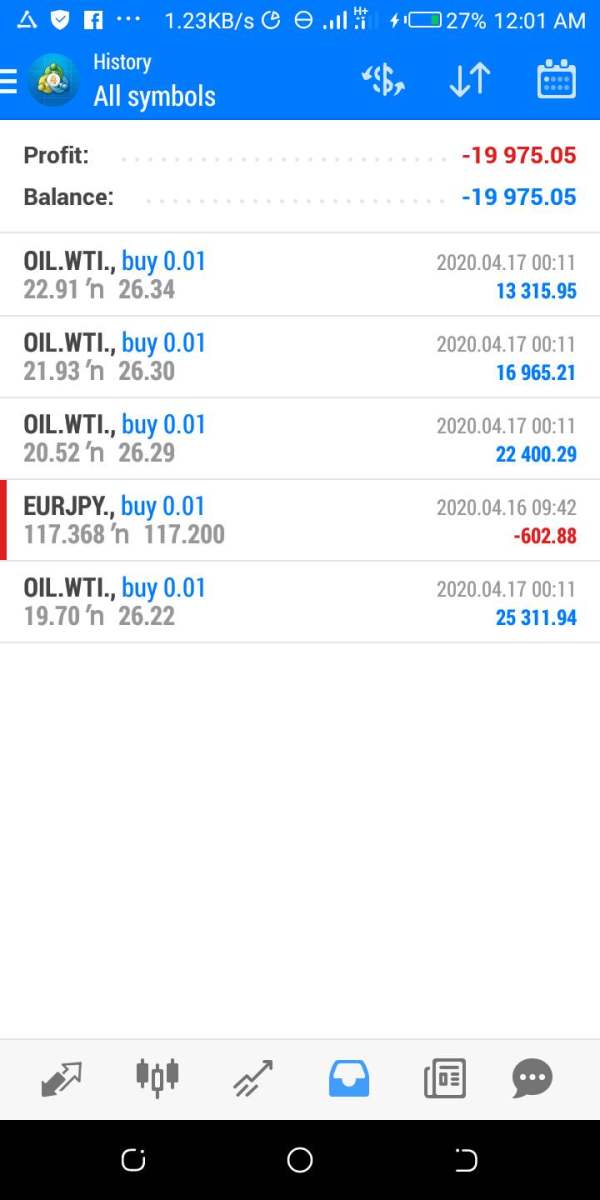

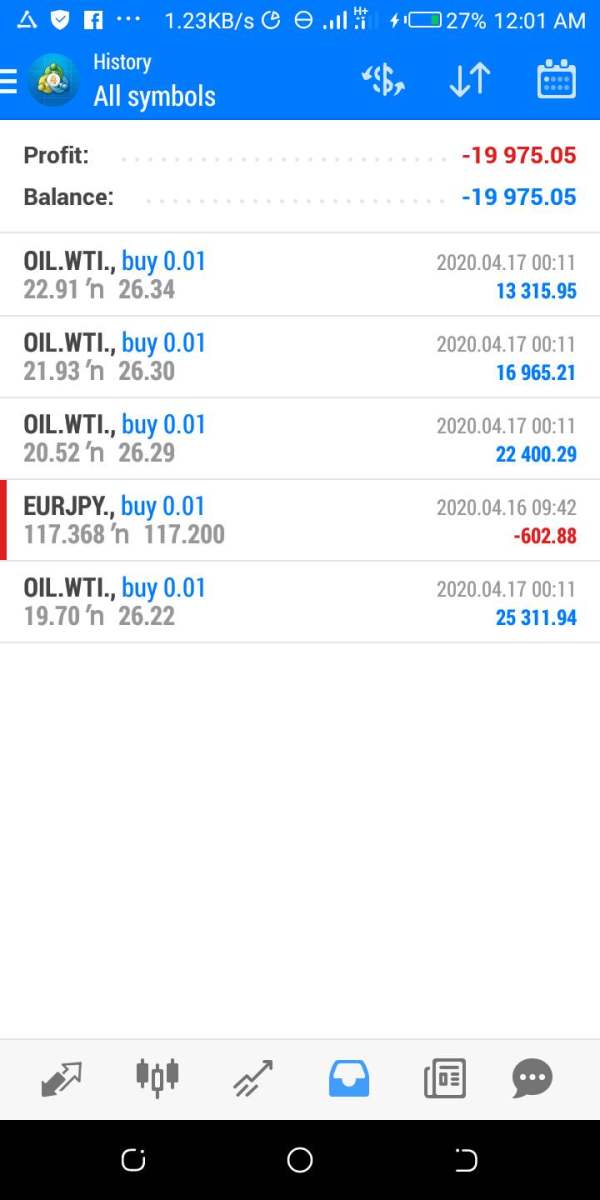

The trading experience with RallyTrade presents mixed results with major areas of concern that impact overall platform usability. User feedback shows inconsistent platform stability and execution quality that can negatively impact trading outcomes, particularly during volatile market conditions when reliable execution becomes crucial. The high leverage ratios up to 1:1000, while potentially attractive to some traders, may create unrealistic expectations and contribute to rapid account depletion for inexperienced users who underestimate associated risks.

Platform functionality and feature sophistication appear limited compared to industry-standard offerings from established brokers. Users report concerns about order execution speed, price accuracy, and platform responsiveness during peak trading hours. The absence of detailed information about mobile trading capabilities, advanced order types, or algorithmic trading support suggests potential limitations for traders requiring sophisticated execution tools. Additionally, the lack of transparent pricing information makes it difficult for traders to assess the true cost of trading operations, which can greatly impact long-term profitability. This rallytrade review notes that while the broker claims to offer multiple trading platforms, the quality and reliability of these platforms remain questionable based on available user feedback.

Trust and Reliability Analysis (1/10)

Trust and reliability represent RallyTrade's most severe deficiencies, with multiple fraud allegations and user warnings creating substantial credibility concerns. The absence of verified regulatory oversight from recognized financial authorities eliminates crucial investor protections that legitimate brokers typically provide. This regulatory gap means users have limited legal recourse if disputes arise or if the broker fails to meet its obligations, creating unacceptable risk levels for serious traders.

User reports of major financial losses, withdrawal difficulties, and potential fraudulent practices create a pattern of concerning behavior that suggests systemic operational problems. Multiple sources have specifically warned against engaging with this platform, citing experiences of fund confiscation, account manipulation, and communication breakdown after initial deposits. The lack of transparent company information, including verified business registration details, management team credentials, and audited financial statements, further undermines confidence in the broker's legitimacy. Without proper regulatory oversight and transparent operations, users face substantial risks of financial loss with minimal prospects for recovery or legal protection.

User Experience Analysis (3/10)

Overall user satisfaction with RallyTrade remains consistently poor across multiple evaluation criteria, with negative feedback greatly outweighing positive experiences. Users report frustrations with the registration and verification process, citing unclear requirements, prolonged approval times, and additional documentation requests that may not be clearly communicated initially. The fund management experience appears particularly problematic, with withdrawal difficulties creating major stress and financial uncertainty for users attempting to access their invested capital.

Interface design and platform usability information remains limited in available sources, though user feedback suggests areas for improvement in navigation, functionality, and overall user-friendliness. The educational components, while promoted as a key feature, receive mixed feedback regarding practical value and professional quality. Common user complaints center on communication difficulties, lack of transparency in fee structures, and inadequate support for problem resolution. The broker appears most suitable for high-risk tolerance traders who prioritize extensive leverage options over regulatory protection and operational reliability, though even this limited demographic should exercise extreme caution given the prevalence of negative user experiences and fraud allegations.

Conclusion

This comprehensive rallytrade review reveals a broker with major operational deficiencies and credibility concerns that outweigh any potential benefits. While RallyTrade offers extensive trading instruments and high leverage ratios that may initially attract traders, the overwhelming pattern of negative user feedback, fraud allegations, and absence of regulatory oversight creates unacceptable risk levels for serious market participants. The broker's poor performance across critical evaluation criteria, particularly in trust, customer service, and user experience, shows fundamental operational problems that are unlikely to support successful long-term trading relationships. We strongly advise traders to consider well-regulated, established brokers with transparent operations and verified track records rather than risking capital with platforms that lack proper oversight and demonstrate concerning user experience patterns.