aeforex 2025 Review: Everything You Need to Know

Abstract

The aeforex review shows a negative picture of this broker. User concerns focus on transparency issues and reports of irregular practices, which are serious problems for any trading platform. Despite offering access to the popular MetaTrader 4 platform and being regulated by ASIC , aeforex has drawn significant criticism from traders. The broker was established in 2023 and provides a limited range of trading tools while supporting a narrow asset selection, including forex, indices, commodities, and stocks. Its basic trading functionality might appeal to beginners seeking a straightforward forex trading experience. However, the broker's lack of clarity regarding operational details and opaque account conditions raises serious red flags that cannot be ignored. It is important to note that even though aeforex touts its regulatory oversight, users have repeatedly expressed doubts about its transparency and ethical conduct in multiple reviews. The platform may attract novices in search of basic functionality. Overall, it requires caution due to the prevailing negative sentiment.

Cautionary Notes

aeforex is an Australian-registered broker. It operates under cross-regional conditions that subject it to varying legal and regulatory standards depending on the jurisdiction, which creates complexity for users. This review is based on a synthesis of user feedback and publicly available information and may not reflect every individual experience. Differences in the operational strategies and legal environments across regions could lead to inconsistent trading conditions that affect user experience. Therefore, potential clients should carefully consider these variations before engaging with the platform. While the broker is regulated by ASIC, some critical details remain inadequately documented, including comprehensive deposit and withdrawal processes or customer support responsiveness. As such, this review encourages prospective traders to conduct thorough due diligence in light of the available but sometimes conflicting data.

Rating Framework

Broker Overview

aeforex was established in 2023. The broker is headquartered in Melbourne, Australia, at Unit 701, 167 Queen Street, Melbourne VIC 3000, which provides a physical address for the company. The broker operates under the regulatory oversight of the Australian Securities and Investments Commission , with license number 246250. Despite its relatively recent start in the competitive landscape of forex trading, aeforex seems to have taken a basic approach regarding the range of services offered to its clients, which may limit its appeal to more experienced traders. The company's strategy appears to focus on delivering basic trading functionalities, primarily through the well-known MetaTrader 4 platform. This platform is widely recognized for its stability and user familiarity among traders worldwide. However, reports from various sources suggest that the broker has struggled with maintaining the level of transparency and operational clarity that modern traders expect. This factor necessitates a cautious approach from potential clients who value clear information about their trading conditions.

aeforex provides access to several asset classes, including forex, indices, commodities, and stocks. These options may appeal to traders seeking diversification in their investment portfolios, though the selection remains relatively basic compared to larger brokers. The platform is built around the robust MetaTrader 4 system, offering a reliable and familiar interface that many market participants rely upon. The broker's regulatory framework under ASIC offers some security for traders. However, this advantage is somewhat undermined by the ongoing concerns regarding transparency and the absence of detailed disclosures on trading conditions such as spreads and commissions, which are crucial for making informed trading decisions. Overall, while the aeforex review acknowledges some strengths in platform selection and regulatory affiliation, it emphasizes that the broker's limited operational scope and the opacity surrounding its practices pose significant challenges for traders.

aeforex operates under the regulatory umbrella of the Australian Securities and Investments Commission with license number 246250. This provides a basic level of oversight that is expected from Australian brokers, though regulatory oversight alone does not guarantee quality service. However, despite this regulatory association, several key aspects remain unclear to potential users. The deposit and withdrawal methods, for instance, have not been explicitly detailed in the available information, which creates uncertainty for traders planning their financial transactions.

The minimum deposit requirement is set at $100. This amount might be appealing to beginners who want to start trading with a smaller investment, though the lack of descriptive information regarding account types and associated features leaves much to be desired. No bonus promotions or deposit incentives are advertised by the broker. This further suggests that aeforex focuses solely on the fundamental aspects of trading without offering additional incentives that might attract new clients.

Traders can access a core set of instruments covering forex, indices, commodities, and stocks. However, the absence of a broader range of trading tools or educational resources could be a limiting factor for more seasoned investors who require advanced analysis capabilities. The cost structure is particularly opaque, with no clear details on spreads, commissions, or other trading fees available to potential clients. Users have voiced concerns about the overall transparency of these critical details, which are essential for calculating trading costs accurately.

Leverage information is also missing from the available documentation. The maximum leverage offered is not specified, leaving potential concerns about risk management unanswered for traders who rely on leverage for their strategies. In terms of platform options, the broker has chosen to exclusively support the MetaTrader 4 platform. This decision may be reassuring for some traders familiar with MT4 while limiting flexibility for others who prefer different trading interfaces. Furthermore, there are no detailed disclosures regarding regional restrictions or the languages supported by customer service. This might complicate access for international traders who need support in their native languages. Overall, the aeforex review highlights that while some foundational elements are in place, the significant gaps in detailed operational information require traders to proceed with caution.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for aeforex exhibit several shortcomings that cannot be overlooked by potential traders. The broker imposes a minimum deposit requirement of $100, which is accessible for beginners who want to start with a smaller amount. However, the absence of detailed information about various account types or conditions creates uncertainty that may frustrate users seeking specific features. There is no insight provided into the different account functionalities that could accommodate diverse trading needs or preferences. The process for account setup remains vaguely described, leaving many potential questions regarding verification requirements and the speed of the onboarding process unanswered for new users.

Users have frequently raised concerns regarding transparency. They particularly worry about hidden fees or additional terms that might not be immediately apparent upon account opening, which could lead to unexpected costs later. Compared to other brokers, aeforex lacks clarity on special account features, such as Islamic accounts. This might further alienate segments of the trading population looking for ethical and Sharia-compliant options that meet their religious requirements. This lack of detailed disclosure undermines confidence and makes it challenging for traders to fully understand what they are signing up for when they open an account. In summation, the ambiguous nature of account conditions remains a significant barrier. This impacts overall user trust and satisfaction with the broker's services.

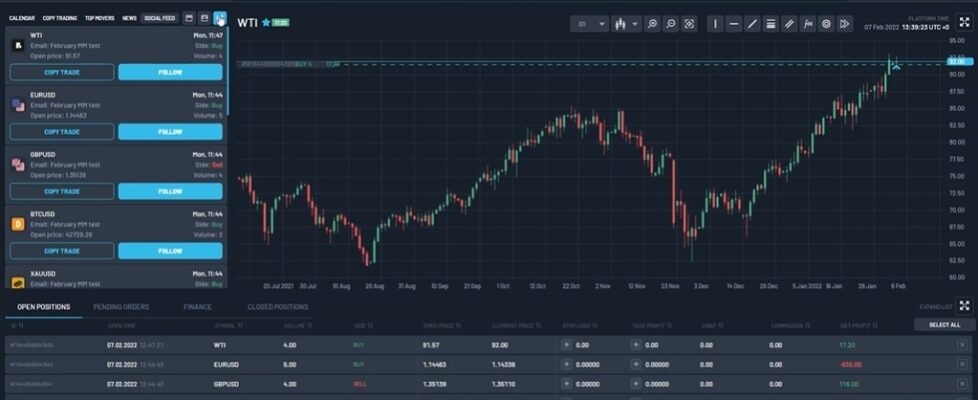

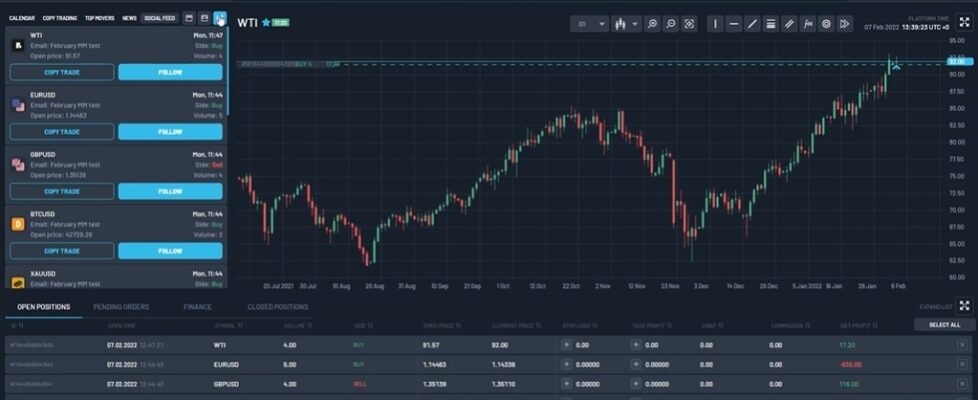

aeforex offers the tried-and-tested MetaTrader 4 platform in terms of tools and resources. This platform is well-regarded in the industry for its reliability, functionality, and extensive support for automated trading strategies that many traders rely on. Despite this advantage, the broker falls short on several fronts that modern traders expect from their brokers. There is a notable absence of advanced research tools, analytical resources, and educational materials that many contemporary brokers provide to assist traders in making informed decisions. No information is available regarding the provision of market analysis, daily trading signals, or news feeds. These resources are essential for a dynamic trading environment where information can significantly impact trading outcomes.

The limited platform selection restricts users to a single trading interface. This leaves little room for customization or the integrated use of innovative trading technologies that some traders prefer for their strategies. Users have reported that while the platform itself is robust, the lack of supplementary resources and integrated third-party solutions hampers their ability to execute more informed or strategic trades effectively. The overall offering in terms of tools and resources seems minimal and basic. This may suffice for entry-level traders but could be a significant limitation for more experienced market participants who require advanced analytical capabilities.

Customer Service and Support Analysis

Customer service is a critical component in any trading environment. However, aeforex seems to have significant deficiencies in this area that affect user satisfaction and confidence. The available data does not provide detailed insights into the range of customer support channels available, nor is there clarity on the response time or operating hours for support services. Reports from certain users indicate that issues related to irregular practices and a lack of prompt resolution have been frequent problems. There are limited indications of a multilingual support system, suggesting that traders from various language backgrounds might face hurdles in accessing quality customer assistance when they need help.

Users have reported unsatisfactory interactions with support representatives in some instances. This further highlights the need for improved service quality that meets modern customer expectations in the financial services industry. The absence of documented case studies or testimonials regarding effective problem resolution further compounds these concerns about the broker's commitment to customer service. Without explicit assurances regarding the accessibility and responsiveness of customer support, traders are left questioning whether their issues will be handled with the urgency and precision required in financial markets. Customer support deficiencies for aeforex fall short of expectations. This is a significant drawback given the sensitivity and immediacy of trading-related issues that require prompt resolution.

Trading Experience Analysis

The trading experience at aeforex unfolds against the backdrop of using the MetaTrader 4 platform. While MT4 is an industry-standard tool recognized for its stability and reliability, the overall experience is limited by a lack of transparency around essential trading parameters that traders need to know. Specific details regarding order execution quality, such as spread variability, slippage, and commission structures, are notably absent from available information. This information gap creates uncertainties, particularly during periods of high volatility when precise execution becomes crucial for trading success.

Traders rely on consistent, predictable trading conditions to make informed decisions. Any ambiguity in this regard can lead to hesitations in executing trades confidently, which can impact trading performance significantly. Moreover, while the platform supports a set of core asset classes, there is limited insight into the overall liquidity and depth of market data provided to users. User feedback has underscored concerns about the platform's consistency in maintaining optimal performance during peak trading hours when market activity is highest. While the MT4 interface may offer a familiar and functional environment for executing trades, the broader trading experience suffers due to insufficient details on cost structures and execution quality. This, in turn, may result in a suboptimal trading environment that could deter more discerning traders who require detailed information about their trading conditions.

Trustworthiness Analysis

Trust is paramount in the domain of online trading. The aeforex review clearly casts a shadow over the broker's credibility that potential clients should carefully consider before investing. Although aeforex is regulated by ASIC, which should theoretically offer a degree of reassurance, numerous warnings and negative user feedback raise serious concerns regarding the broker's operational integrity. Specific issues highlighted include potential irregular practices and a lack of comprehensive transparency in disclosing trading conditions and fee structures that traders need to understand. The presence of conflicting information from various reports further erodes confidence in the reliability of the provided regulatory details.

There is a notable absence of clearly defined measures for funds security and segregation. These measures are critical in ensuring client assets remain safe from potential misuse or company financial difficulties. Additionally, third-party evaluations have not consistently endorsed the broker, and there is a general consensus among users that the level of trustworthiness is considerably lower than industry standards. This mismatch between regulatory claims and practical transparency issues makes it challenging for traders to determine whether their investments are being safeguarded adequately. The overall sentiment suggests that those who value high levels of accountability and trust may find aeforex unsatisfactory for their trading needs.

User Experience Analysis

The overall user experience with aeforex is affected by unresolved issues that primarily revolve around a lack of transparency and ambiguous operational details. While the interface provided by the MetaTrader 4 platform is familiar and functional for most traders, the broader user journey—from account registration to executing trades—exhibits significant friction that can frustrate users. Users have repeatedly expressed dissatisfaction with the opacity surrounding key elements such as fee structures, spreads, and withdrawal procedures. The registration process itself has been critiqued for not providing a clear, streamlined approach, thereby potentially leaving new users confused about compliance and verification requirements that they must meet.

The absence of comprehensive support information and multichannel communication options further diminishes the overall user experience. Frequent complaints about unclear conditions and inconsistent service quality create an environment where users feel insecure about their trading endeavors and the safety of their investments. In light of these challenges, the feedback from various users suggests that while aeforex might suffice for those seeking a basic forex trading setup, the deficiencies in transparent operations and customer support significantly compromise overall satisfaction. This makes it difficult for the broker to build a loyal customer base that trusts the platform for long-term trading activities.

Conclusion

The aeforex review reveals a broker that falls short in terms of transparency and trustworthiness. While the provision of the MetaTrader 4 platform and access to basic asset classes might appeal to beginners, the significant concerns around unclear operating conditions and reported irregular practices should not be overlooked by potential clients. aeforex is best suited for those seeking entrance-level forex trading functionality. However, users must exercise caution given the potential drawbacks in customer support, detailed fee structures, and overall execution quality that could impact their trading success. Prospective traders are advised to conduct further due diligence before engaging with this broker to ensure it meets their specific needs and risk tolerance.