Is RALLYTRADE safe?

Pros

Cons

Is Rallytrade Safe or Scam?

Introduction

Rallytrade is a forex broker that has positioned itself within the growing market of online trading, particularly targeting traders in emerging economies. Founded in 2016 and based in Nigeria, Rallytrade offers a range of trading services, including forex, commodities, and indices. However, the rapid expansion of online trading has led to an influx of brokers, making it essential for traders to conduct thorough evaluations before investing their funds. This article aims to assess whether Rallytrade is a safe option for traders or if it raises red flags that indicate potential scams. Our investigation combines data gathered from various sources, including user reviews, regulatory information, and industry analyses, to provide a comprehensive overview of the broker's credibility.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its safety. A regulated broker is subject to oversight by financial authorities, which helps protect traders' interests. In the case of Rallytrade, the broker claims to be a member of a financial commission; however, it lacks regulation from major recognized authorities.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a legitimate regulatory framework raises concerns about the broker's reliability. Without a governing body to enforce compliance, traders may be at risk of potential fraud, mismanagement, or other unethical practices. Moreover, the lack of transparency regarding the broker's operational practices further exacerbates these concerns. As such, it is crucial for potential clients to exercise extreme caution when considering whether Rallytrade is safe for their trading activities.

Company Background Investigation

Rallytrade was established in 2016 and is owned by FRNG Nigeria, with offices located in Lagos. Despite being operational for several years, the company has not made significant strides in establishing itself as a reputable broker in the highly competitive forex market. The management team consists of individuals with varying degrees of experience in finance and trading, but specific details about their backgrounds remain scarce.

The company's transparency regarding its ownership structure and operational practices is limited. While they provide some information on their website, crucial details about their management team, financial health, and business practices are notably absent. This lack of transparency can be a red flag for potential investors, as it raises questions about the broker's commitment to ethical trading practices. In light of these factors, traders should carefully consider whether Rallytrade is safe for their investment needs.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for assessing its overall value. Rallytrade provides several account types, each with different minimum deposit requirements and trading conditions. The broker claims to offer competitive spreads and leverage options, but the specifics can be concerning.

| Fee Type | Rallytrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips (Standard) | 0.6 - 1.0 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Rallytrade are higher than the industry average, which may indicate that traders could incur higher trading costs. Additionally, the broker has been noted for its inactivity fees, which can be a burden for traders who do not actively engage in trading. These fees combined with the unclear commission structure raise concerns about the overall cost of trading with Rallytrade. Therefore, potential clients should carefully evaluate whether the trading conditions justify the risks associated with using this broker and consider if Rallytrade is safe for their trading activities.

Client Funds Security

The safety of client funds is paramount when assessing a broker's reliability. Rallytrade claims to implement certain security measures, including segregated accounts for client funds. However, the broker's lack of regulation means that there is no independent verification of these claims.

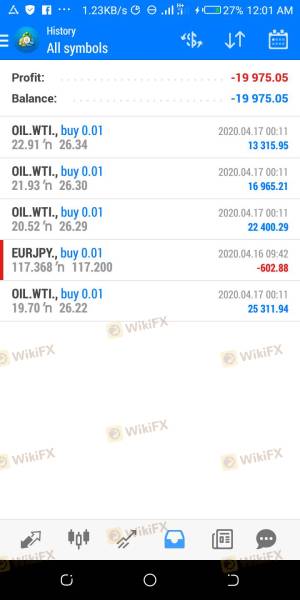

Furthermore, the absence of investor protection measures, such as negative balance protection, poses significant risks for traders. In the event of market volatility, traders may find themselves liable for losses that exceed their account balance, leading to substantial financial burdens. Historical complaints regarding delayed withdrawals and unresponsive customer support further exacerbate concerns about the safety of funds with Rallytrade. Traders must weigh these risks carefully when determining if Rallytrade is safe for their investments.

Customer Experience and Complaints

Customer feedback is a critical component of assessing a broker's trustworthiness. Many users have reported difficulties with withdrawals, slow customer service responses, and a lack of transparency regarding fees. Common complaint patterns include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Unresponsive |

| Hidden Fees | High | Limited clarity |

For instance, several users have shared experiences of being unable to withdraw their funds after making requests, with delays extending for weeks or even months. Such issues raise significant concerns about whether the broker is genuinely committed to customer service or if it is employing tactics that could be classified as deceptive. Given these factors, potential clients should consider if Rallytrade is safe based on the collective experiences of its users.

Platform and Trade Execution

The performance of a trading platform is vital for a positive trading experience. Rallytrade offers popular platforms such as MetaTrader 4 and 5, which are generally well-regarded in the industry. However, user experiences with the platform's stability and execution quality have been mixed.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. Additionally, concerns regarding potential platform manipulation have been raised, with users questioning the broker's integrity in trade execution. These issues contribute to the overall risk profile of trading with Rallytrade, leading many to wonder if Rallytrade is safe for their trading endeavors.

Risk Assessment

When evaluating the overall risks associated with Rallytrade, several factors must be considered. The lack of regulation, high trading costs, and numerous customer complaints indicate a heightened risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | Medium | High fees and commissions |

| Operational Risk | High | Poor customer service |

To mitigate these risks, potential clients should conduct thorough due diligence, consider using a demo account to test the platform, and explore alternative brokers with stronger regulatory oversight. This approach will help ensure that traders are making informed decisions about whether Rallytrade is safe for their trading activities.

Conclusion and Recommendations

In conclusion, the analysis of Rallytrade raises several red flags that suggest potential risks for traders. The broker's lack of regulation, high trading costs, and numerous customer complaints indicate that it may not be a safe option for those looking to invest their hard-earned money. While some traders may find the offered services appealing, the overall risk profile suggests a need for caution.

For those considering trading with Rallytrade, it is advisable to explore other reputable brokers that offer better regulatory protection and customer service. Brokers such as IG, OANDA, and Forex.com provide robust regulatory oversight, transparent fee structures, and positive user experiences, making them safer alternatives for traders. Ultimately, it is crucial for traders to prioritize their safety and financial security when choosing a broker, leading to the question—Is Rallytrade safe? The evidence suggests that potential clients should proceed with caution.

Is RALLYTRADE a scam, or is it legit?

The latest exposure and evaluation content of RALLYTRADE brokers.

RALLYTRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RALLYTRADE latest industry rating score is 2.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.