Equitrade Capital Review 6

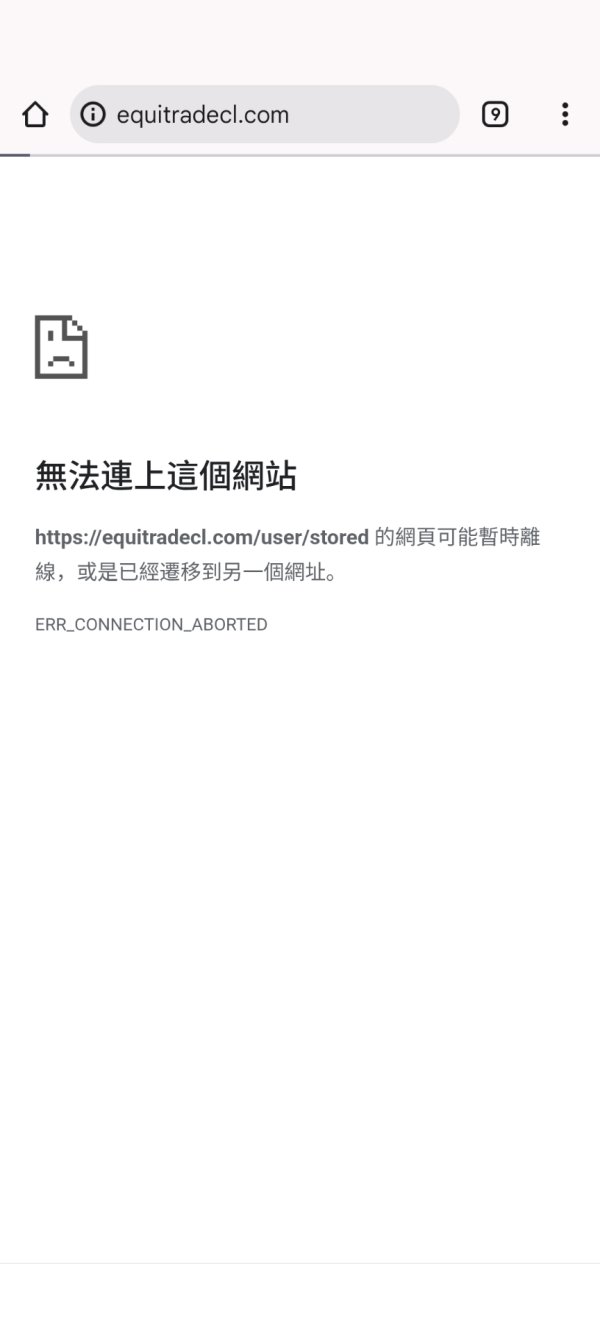

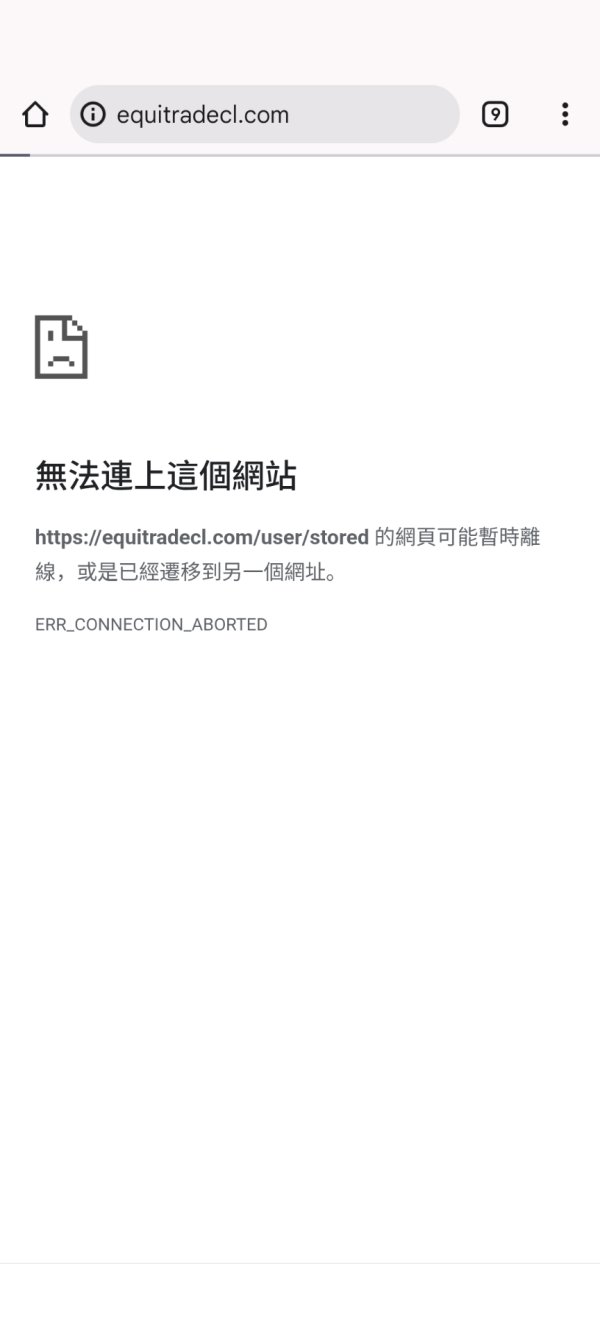

My original post exposed the official website equitradecl.com (now unreachable). I've recently found it's been changed to equitradecg.com, where they continue to scam by misusing the logo of a genuine exchange, Quantfury. Their FCA regulation number 577611 has also been modified, confirming without a doubt that this is a rebranding scam.

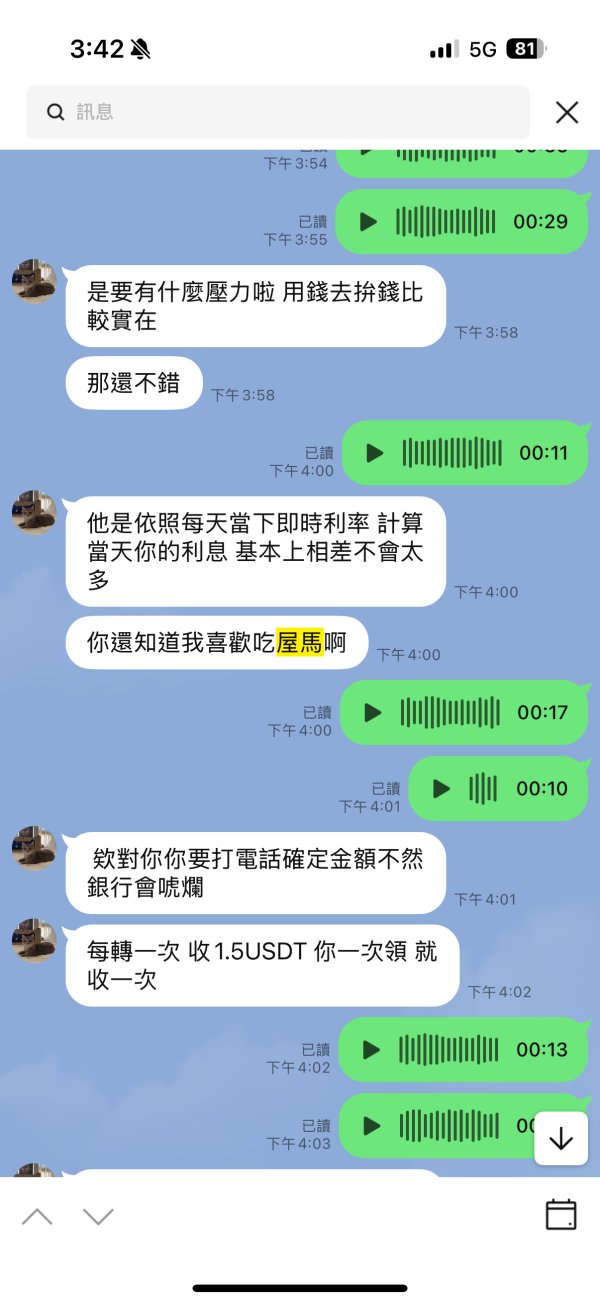

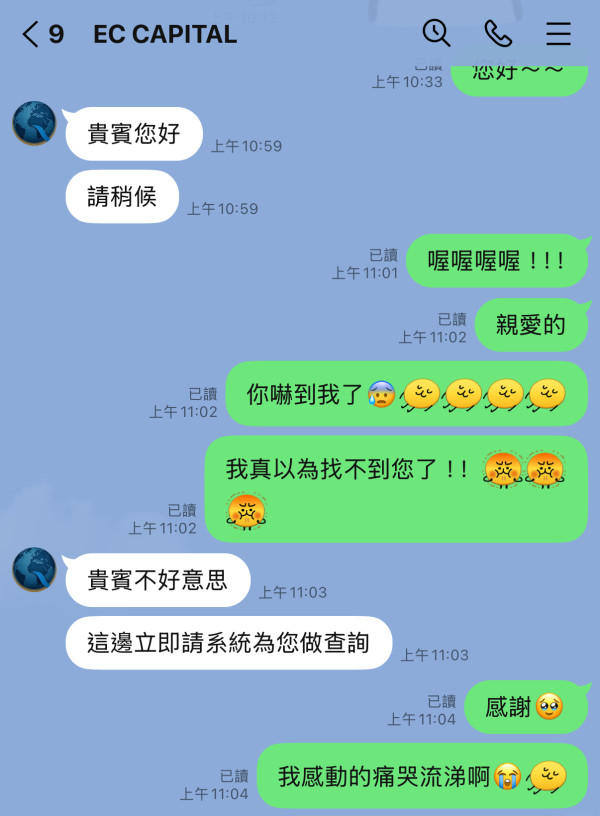

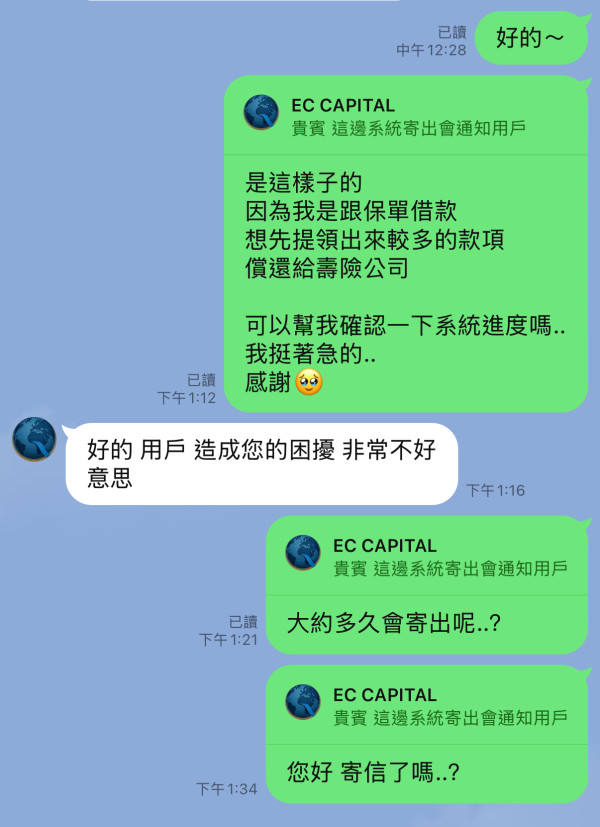

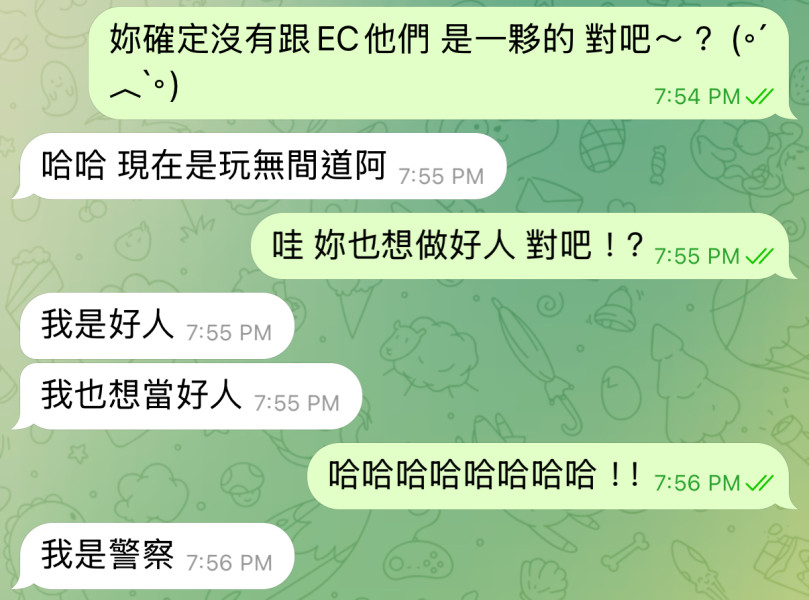

Scam Case (Part 1) In late December 2024, I met a female netizen named "Chen Chen" through MonChats. She had photos and voice clips posted there, which significantly lowered my guard against online scams. Noticing her active involvement in the crypto community, I exchanged Line contacts with her to discuss virtual currencies. Then, on January 20, 2025, when Trump was elected, Chen Chen had already predicted that Bitcoin would surge above $100,000. She advised me to buy and hold some Bitcoin. Following her suggestion, I invested $1,000 in Bitcoin—and it actually turned a profit! Grateful, I bought her a dining gift card via Line Gifts to thank her for the profitable advice. Little did I know, her real scheme was just beginning. Initially, she refused the gift, claiming we were just friends and that she hadn’t done much. She told me to save the money and treat her to yakiniku (Japanese BBQ) someday if I made more profits. Her words left a deep impression on me. As someone who hates owing favors, I kept thinking about repaying her kindness later. She then introduced me to the "Onion Ring Cryptocurrency" community, joking that its members were unserious but friendly and eager to share money-making tips. Without suspicion, I joined and interacted with them, occasionally receiving updates on Bitcoin’s rise. Chen Chen also advised me to buy EC Platform’s dual-currency wealth management products during Bitcoin’s dip. After some consideration—and coincidentally receiving a bank loan offer—I asked Chen Chen to calculate the potential returns if I invested the borrowed funds. She estimated that the principal plus interest could be recouped in three months. Convinced, I took the loan and made my first EC dual-currency investment (Bitcoin & USDT), unaware it marked the start of a nightmare. Next, she suggested I sell my U.S. stock ETFs on eToro, convert them to Bitcoin, transfer to Binance, and invest in a second round of dual-currency products. Growing suspicious, I demanded we exchange ID cards as collateral—if EC turned out to be a scam, I could at least track her down. Feigning offense at my distrust, she readily agreed, deepening my trust in her. Given our prior interactions, I dismissed my doubts and trusted this "good friend" again. For the third investment, timed during another Bitcoin low, EC Platform offered a 3% rebate for participating in their wealth management event. I consulted Chen Chen on borrowing options, comparing loan rates across banks before settling on a policy loan—withdrawing all NT$347,000 from a university-era insurance policy to reinvest. (Continued due to word limit.) The fourth investment coincided with another EC Platform promotion: a 100 USDT rebate for deposits reaching ~NT$80,000. Chen Chen guided me through buying crypto via BitoPro to qualify. The fifth and final investment topped up the fourth (which fell short of NT$80,000) with an additional NT$30,000 worth of USDT—a classic "averaging down" move. Then, things took a dark turn. In early May 2025, someone contacted me claiming they couldn’t withdraw funds from EC. Assuming it was a joke, I tried helping by reaching out to EC’s support and community managers, only to be accused of colluding with the "victim" to infiltrate and scam others. Panicked, I turned to Chen Chen, who dismissed the victim as untrustworthy and insisted I rely solely on her—she was "the police," the one in the right. My suspicions grew. On May 8, when I attempted to withdraw my EC investments, support gave me the runaround before ghosting me completely. Total losses: over NT$1 million. As an ordinary person, I lost my savings and now shoulder a massive debt. This ordeal taught me a hard lesson: even friends who joke, curse, and seem genuine can’t be fully trusted. May my story serve as a warning. Trust your own judgment when investing—not others’ platform or financial "advice." Chen Chen, if you’re reading this: I’m deeply disappointed. Your betrayal plunged me into an abyss. I still remember our yakiniku promise. I never saw it coming—never.

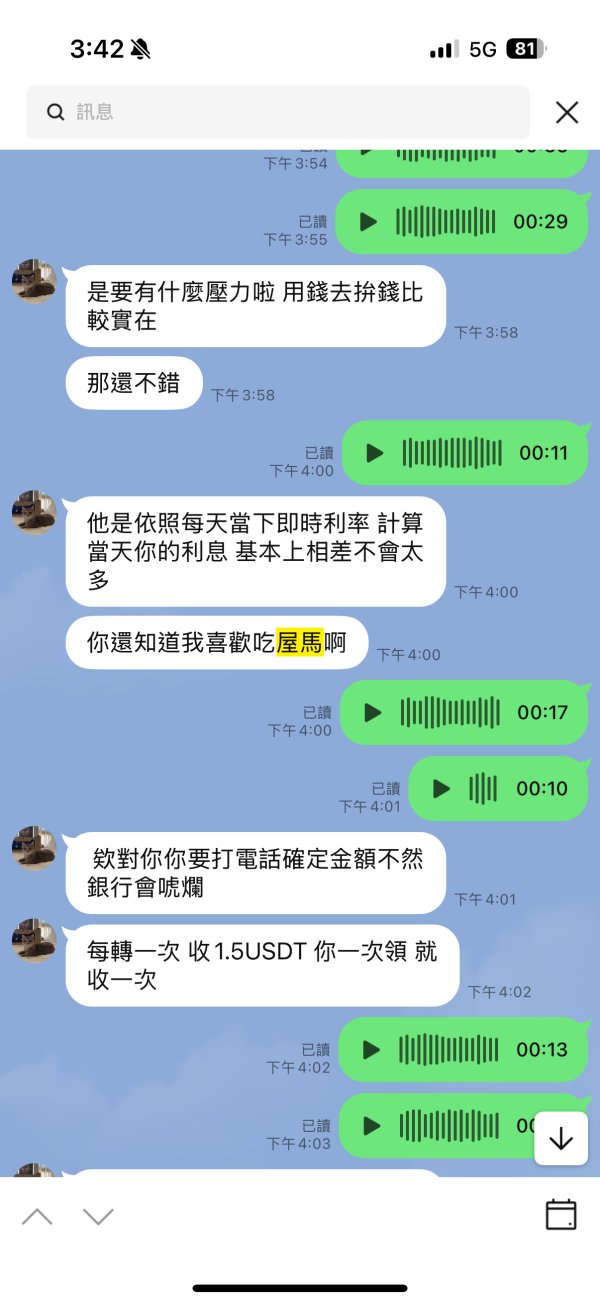

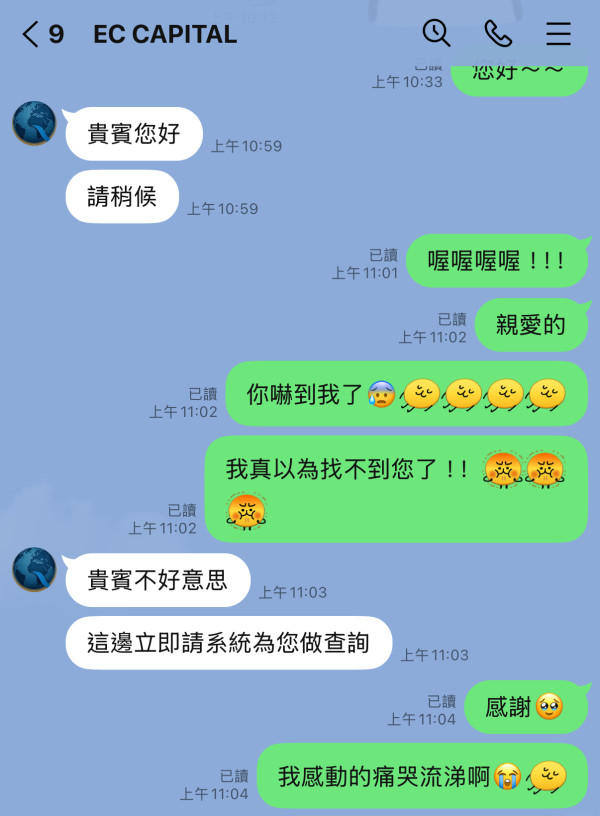

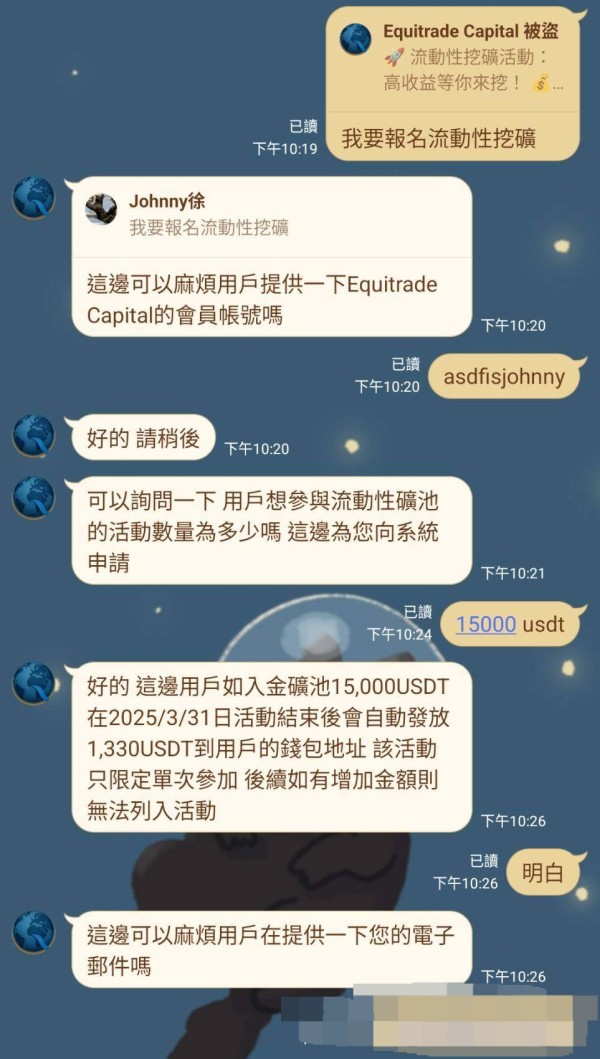

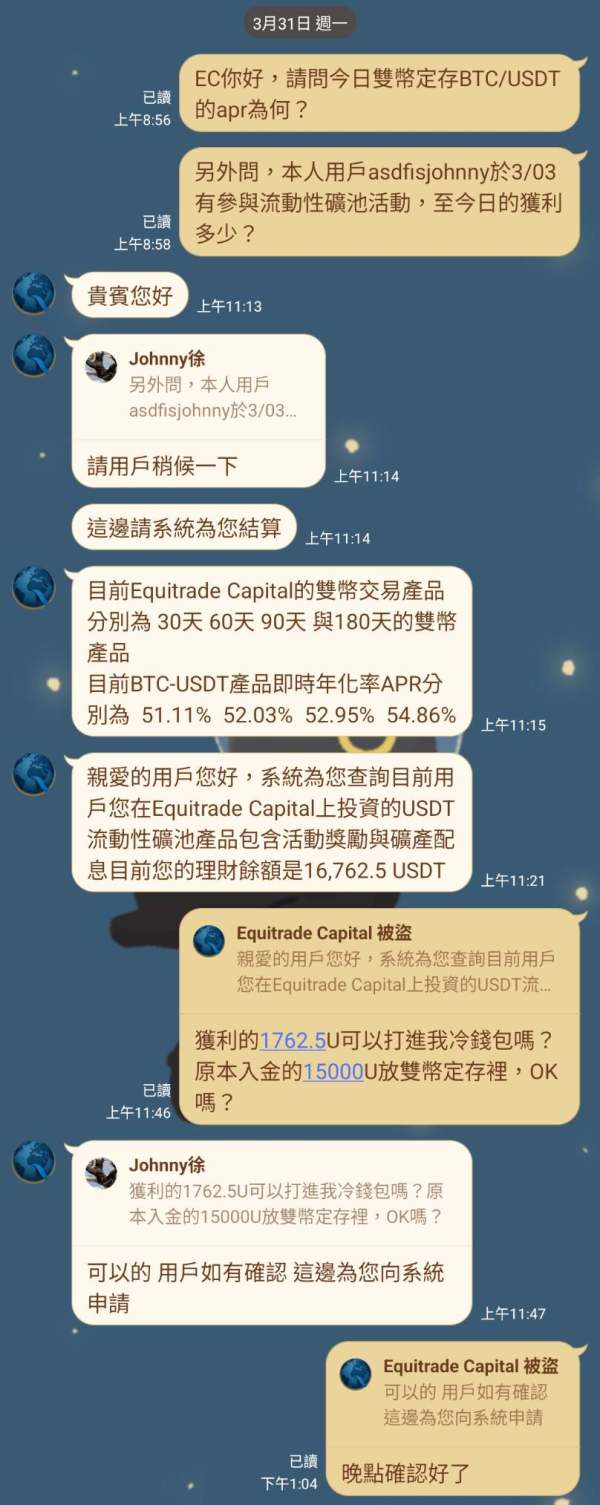

1. On 113.11.26, I met a woman through a social app, referred to as L. During our conversations, there was no mention of any investment with high returns, financial schemes, depositing into a specific account, or meeting in person to trade anything. She only recommended the LINE community "Onion Circle Cryptocurrency." This community belongs to EC Capital (Equitrade Capital, abbreviated as EC) officially, accessed through the EC website (https://equitradecl.com/). 2. Within the Onion Circle Cryptocurrency community, EC frequently introduces its platform and product categories, while advocating for anti-fraud measures. There is no inducement for investment, profit guarantees, or reports. To understand the products, one must contact EC customer service privately on LINE. For deposits, one can choose to do so within the EC official website system or directly contact EC customer service. 3. My initial deposit date was 114.03.03. Before that, I had been observing if EC had any suspicion of fraud. During this time, I also bought coins at a physical exchange and transferred them to my Binance wallet. From Binance, I deposited 15000 USDT to the address provided by EC customer service (TBA2JozKGZQBihVjX4Jq81tKiWatFRFQwb). The financial project was EC's liquidity pool activity. After the activity ended on 03.31, I decided to only withdraw the bonus interest to my Bitopro wallet. I requested the principal to be transferred directly to the dual currency BTC/USDT fixed deposit activity on EC, with a contract from 04.01 to 04.30. EC claimed to have applied to the system for the interest from the previous activity. From 04.01 onwards, I have been inquiring with EC about the withdrawal of the bonus interest. Throughout the process, they claimed system congestion and internal multi-signature wallet issues. Until 04.21, EC customer service stopped reading and replying to my messages, and there has been no response since. It seems like I have been blocked. In essence, I have not withdrawn a single cent, and my principal is stuck with EC and cannot be withdrawn. 4. As shown in the image: Conversation records (including with friends and EC officials), deposit notifications for activities, deposit transaction details.

The OTC trading process is well-established and also supports smart contracts, but the only downside is that the premium is not as high as expected. 😅

Service is attentive and diverse in terms of projects But I don't know how many users there are

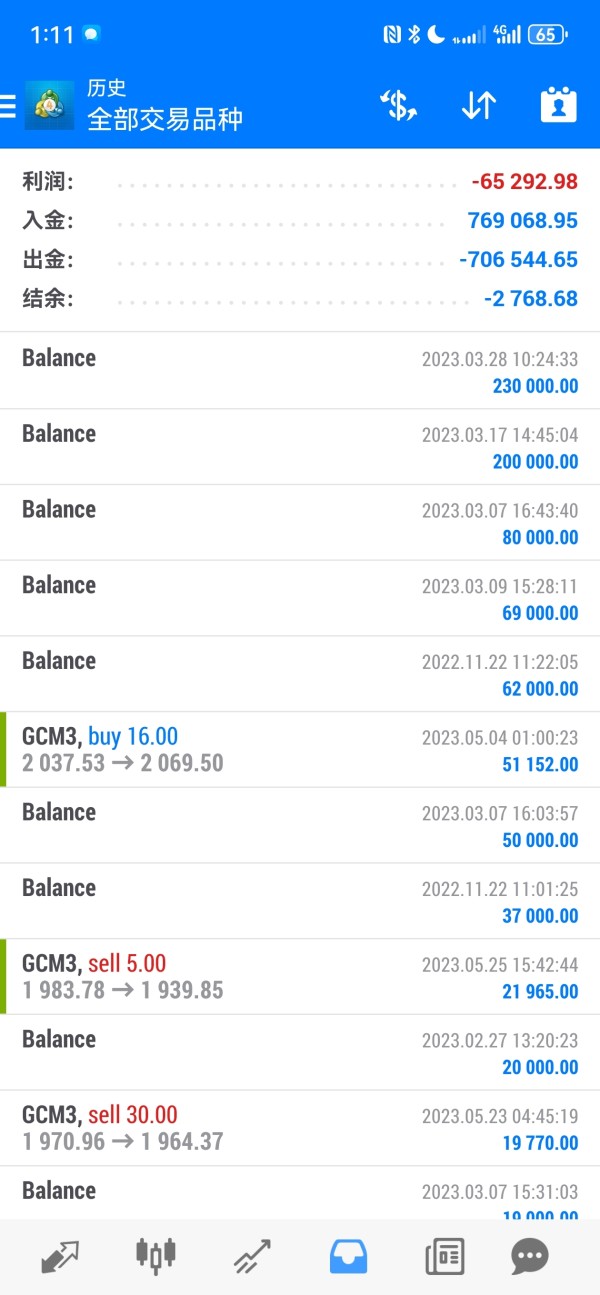

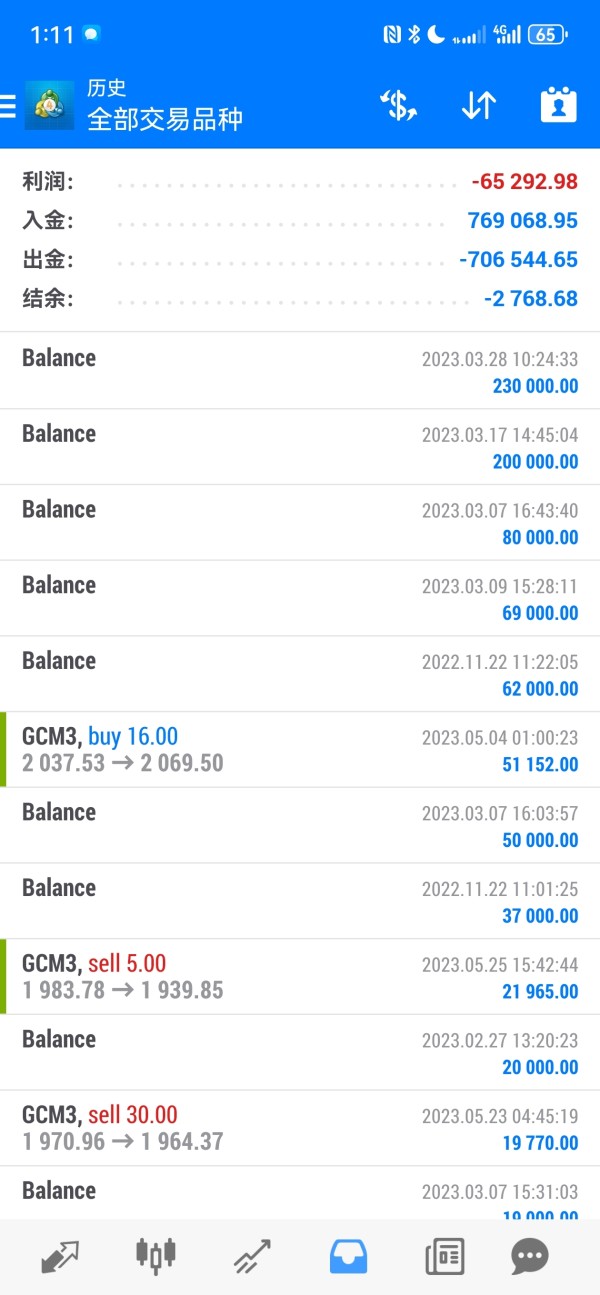

There are 3 orders for spot gold in the MT4 account of the EQUITI platform. The position was liquidated when the gold price surged after the opening on Monday, December 4, but the liquidation price was 2186+. The price of this liquidation was unacceptable. I learned that although the price of gold on almost all major global platforms and US futures prices has increased, it has not reached the 2185+ position. For these three orders, I requested that they proactively provide detailed selling information of the orders and legal certificates issued by regulatory agencies, but they did not respond! My highest peak deposit was over 5 million! I didn’t expect it to be a black platform!