Is FOX GLOBAL safe?

Pros

Cons

Is Fox Global A Scam?

Introduction

Fox Global is a forex brokerage that claims to offer a wide range of trading services to clients worldwide. Established with the ambition to cater to both novice and experienced traders, Fox Global positions itself as a facilitator of access to the financial markets. However, the importance of thoroughly evaluating any forex broker cannot be overstated, as the industry is rife with scams and unregulated entities. Traders need to ensure that their chosen broker adheres to regulatory standards that safeguard their investments and provide a secure trading environment. This article aims to investigate the legitimacy of Fox Global by analyzing its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The assessment is based on a review of multiple sources, including user feedback, regulatory databases, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Regulation provides oversight, enhances transparency, and offers certain protections to traders. In the case of Fox Global, it operates without valid regulation, raising significant concerns about its safety and trustworthiness. The following table summarizes the core regulatory information regarding Fox Global:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA (National Futures Association) | 0511527 | United States | Unauthorized |

As indicated in the table, Fox Global does not possess a valid license from any reputable regulatory body. The absence of regulation means that traders may not have access to the protections typically afforded by regulated brokers, such as segregated accounts for client funds, compensation schemes, and adherence to strict operational standards. Furthermore, the lack of oversight can lead to higher risks for traders, as there are no checks and balances to ensure fair trading practices.

Historically, unregulated brokers like Fox Global have been associated with various compliance issues, including delayed withdrawals and allegations of fraudulent activities. Therefore, potential clients should exercise extreme caution when considering trading with Fox Global, as the lack of regulation is a significant red flag.

Company Background Investigation

Understanding the companys history and ownership structure is essential for evaluating its reliability. Fox Global claims to have been established in the United States, with its operations reportedly based in London. However, there is a notable lack of transparency regarding its ownership and management team.

The company presents itself as having a team of professionals with extensive experience in finance and investment banking. However, specific details about these individuals, their qualifications, and their professional backgrounds are not readily available. This lack of information raises questions about the companys commitment to transparency and accountability.

Moreover, the overall corporate structure is ambiguous, which can be a cause for concern. A clear and transparent ownership structure is vital for trust, as it allows traders to know who is behind the broker and what their motivations are. In the case of Fox Global, the absence of detailed information about its management team and ownership may indicate a potential lack of accountability and reliability.

Trading Conditions Analysis

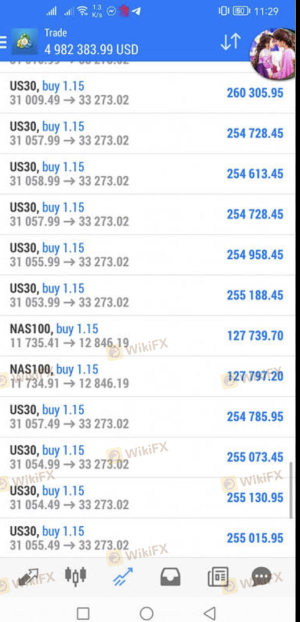

The trading conditions offered by a broker can significantly impact a traders experience and profitability. Fox Global presents a range of trading instruments, including forex, commodities, and stock CFDs. However, the overall fee structure and trading conditions warrant careful examination.

The following table outlines the core trading costs associated with Fox Global:

| Cost Type | Fox Global | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.0 pips | From 0.1 pips |

| Commission Model | Variable/None | Typically $5 per lot |

| Overnight Interest Range | High | Moderate |

As illustrated, Fox Global offers competitive spreads starting from 0.0 pips, which may initially seem attractive. However, traders should be wary of the overall commission structure, which can vary significantly based on account types and trading conditions. Additionally, while the absence of explicit commission fees might seem beneficial, it could indicate hidden costs or unfavorable trading conditions elsewhere.

Moreover, the high overnight interest rates can be a deterrent for traders who hold positions longer than a day, as these fees can accumulate quickly and erode profits. It is essential for potential clients to thoroughly understand the fee structure and any potential hidden charges before committing their funds.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. Brokers are expected to implement robust measures to protect traders' investments. In the case of Fox Global, the lack of regulation raises significant concerns about the security of client funds.

Fox Global does not provide clear information regarding its fund segregation practices, investor protection policies, or negative balance protection. Without these vital safeguards, traders risk losing their entire investment in the event of the broker's insolvency or operational failures.

Historically, unregulated brokers have faced numerous allegations of misappropriating client funds or failing to honor withdrawal requests. Traders should be particularly cautious with Fox Global, given its unauthorized status and the absence of a regulatory framework that typically ensures the safety of client funds.

Customer Experience and Complaints

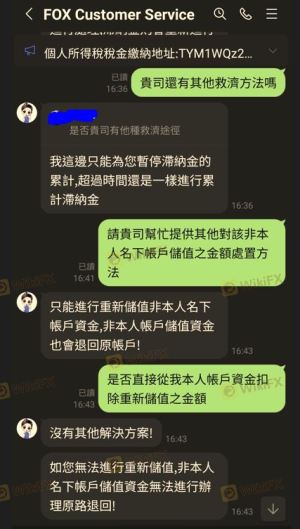

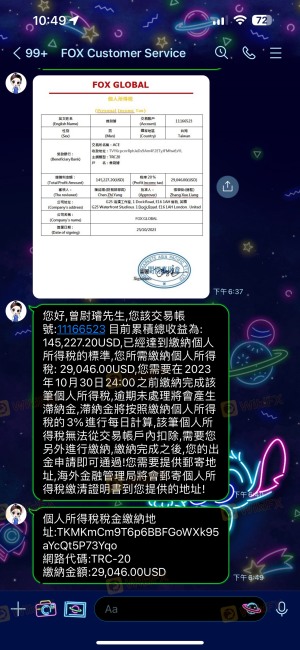

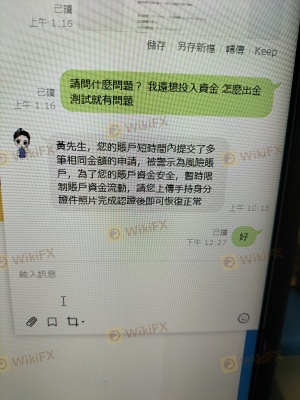

Customer feedback can provide valuable insights into a broker's reliability and overall service quality. In the case of Fox Global, reviews from users indicate a mixed experience, with several complaints highlighting issues related to withdrawal delays and poor customer support.

The following table summarizes the primary complaint types and their severity ratings:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Average |

| Poor Customer Support | High | Poor |

Common complaints include difficulties in withdrawing funds, with many users reporting extended delays and unresponsive customer service. This lack of effective communication can exacerbate frustrations and lead to further distrust among traders.

For instance, one user reported waiting weeks for a withdrawal request to be processed, only to receive vague responses from customer support. Such experiences raise significant concerns about the brokers reliability and commitment to its clients.

Platform and Trade Execution

The trading platform and execution quality are crucial factors for traders, as they directly affect the trading experience. Fox Global employs a proprietary trading platform, which may lack the robustness of industry-standard platforms like MetaTrader 4 or 5.

Users have reported mixed experiences regarding the platform's performance, with some citing issues related to stability and order execution quality. There are concerns about slippage and rejected orders, which can significantly impact trading outcomes, particularly in volatile market conditions.

Additionally, any signs of platform manipulation, such as artificially widening spreads or delaying order execution, should be taken seriously. Traders must remain vigilant and critically assess the platform's performance before fully committing their funds.

Risk Assessment

Using an unregulated broker like Fox Global carries inherent risks that traders must be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Fund Safety Risk | High | Lack of fund segregation practices. |

| Operational Risk | Medium | Potential issues with platform stability. |

| Customer Support Risk | High | Poor response to client inquiries. |

Traders should consider these risks carefully and take steps to mitigate them, such as limiting their initial investment and conducting thorough research before engaging with the broker.

Conclusion and Recommendations

In conclusion, Fox Global exhibits several red flags that warrant caution from potential traders. Its lack of regulation, combined with reports of withdrawal issues and poor customer service, raises significant concerns about its legitimacy and safety.

For traders seeking to engage in forex trading, it is advisable to consider regulated alternatives that offer robust protections and transparency. Reputable brokers such as OANDA or FXPrimus provide a safer trading environment and are more likely to adhere to industry standards.

Ultimately, while Fox Global may present attractive trading conditions, the associated risks and lack of regulatory oversight make it a potentially unsafe choice for traders. Conducting thorough research and prioritizing safety should always be the guiding principles when selecting a forex broker.

Is FOX GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of FOX GLOBAL brokers.

FOX GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOX GLOBAL latest industry rating score is 1.69, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.69 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.