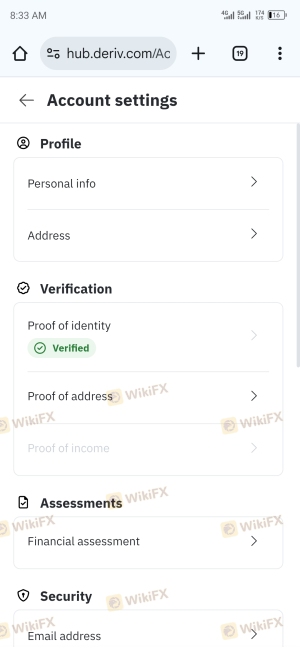

Regarding the legitimacy of deriv forex brokers, it provides MFSA, CMA, FSC, VFSC, CIMA and WikiBit, (also has a graphic survey regarding security).

Is deriv safe?

Pros

Cons

Is deriv markets regulated?

The regulatory license is the strongest proof.

MFSA Market Making License (MM) 20

Malta Financial Services Authority

Malta Financial Services Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

DERIV INVESTMENTS (EUROPE) LIMITED

Effective Date: Change Record

2015-05-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://deriv.com/euExpiration Time:

--Address of Licensed Institution:

LEVEL 3, W BUSINESS CENTRE, TRIQ DUN KARM, BIRKIRKARA MALTA BKR 9033Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CMA Forex Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Deriv Capital Contracts & Currencies L.L.C

Effective Date:

2024-04-03Email Address of Licensed Institution:

x-compreg@deriv.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

2402, One by Omniyat, Plot No. 17, Business Bay, Dubai, United Arab Emirates. P.O Box 0000 City DubaiPhone Number of Licensed Institution:

971-509116301Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Deriv (BVI) Ltd.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Deriv (V) Ltd

Effective Date:

2022-12-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Deriv Investments (Cayman) Limited

Effective Date:

2025-04-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

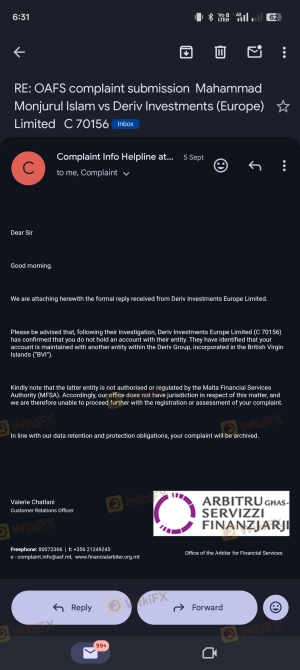

Is Deriv A Scam?

Introduction

Deriv, established in 1999, is a prominent player in the online trading landscape, particularly known for its innovative trading platforms and a diverse range of financial instruments. It offers trading in forex, commodities, indices, cryptocurrencies, and its proprietary synthetic indices. With over 2.5 million clients worldwide, Deriv positions itself as a user-friendly broker catering to both novice and experienced traders. However, the rise of online trading has also brought about a plethora of scams and unreliable brokers, making it crucial for traders to carefully evaluate the legitimacy of any trading platform before committing their funds.

In this article, we will employ a comprehensive approach to assess whether Deriv is a trustworthy broker or a potential scam. Our investigation will include an analysis of its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. By synthesizing information from reputable sources and user reviews, we aim to provide a balanced view that helps traders make informed decisions.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a fundamental aspect of its legitimacy. Deriv operates under several regulatory authorities, which enhances its credibility and ensures compliance with financial standards. The following table summarizes the key regulatory information for Deriv:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Malta Financial Services Authority (MFSA) | IS/70156 | Malta | Verified |

| Labuan Financial Services Authority (LFSA) | MB/18/0024 | Labuan | Verified |

| British Virgin Islands Financial Services Commission (BVI FSC) | SIBA/L/18/1114 | British Virgin Islands | Verified |

| Vanuatu Financial Services Commission (VFSC) | 14556 | Vanuatu | Verified |

Deriv's regulation by multiple authorities, including the MFSA, which is considered a tier-1 regulator, signifies a commitment to maintaining high standards of operational integrity. The presence of segregated accounts, negative balance protection, and participation in compensation schemes further bolster clients' confidence in the safety of their funds.

Historically, Deriv has maintained compliance with regulatory requirements, and its long-standing presence in the industry underscores its reliability. The broker is also a member of the Financial Commission, which provides an additional layer of protection for traders through dispute resolution mechanisms. Overall, the regulatory landscape surrounding Deriv suggests that it is a legitimate broker, though potential users should remain vigilant and conduct their own research.

Company Background Investigation

Deriv's journey began in 1999 as Binary.com, making it one of the pioneers in the online trading space. Over the years, the company has evolved significantly, rebranding itself as Deriv in 2020 to reflect its broader range of services and commitment to innovation. The broker is owned by the Regent Markets Group, which has consistently focused on making trading accessible to a global audience.

The management team at Deriv comprises experienced professionals with extensive backgrounds in finance and technology. This expertise is crucial for navigating the complexities of the trading industry and ensuring that the platform remains competitive and user-friendly. Deriv's commitment to transparency is evident in its detailed disclosures regarding its operations, regulatory compliance, and the security measures it has implemented.

In terms of information disclosure, Deriv maintains a user-friendly website that provides comprehensive details about its services, trading conditions, and educational resources. This level of transparency is vital for building trust with clients, as it allows traders to understand the risks and benefits associated with trading on the platform. Overall, Deriv's solid foundation, experienced management team, and commitment to transparency contribute to its reputation as a reliable broker in the online trading market.

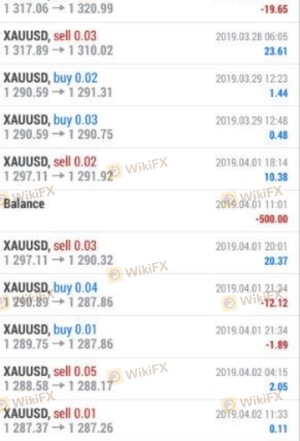

Trading Conditions Analysis

When evaluating a broker, the trading conditions it offers are a critical factor. Deriv provides a competitive trading environment characterized by low minimum deposits, tight spreads, and a variety of account types. The following table outlines the key components of Deriv's fee structure:

| Fee Type | Deriv | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | Variable | Average |

Deriv's spreads start as low as 0.5 pips for major currency pairs, which is significantly lower than the industry average. This competitive pricing structure makes it an attractive option for traders looking to minimize costs. Moreover, the absence of commissions on trades further enhances the broker's appeal, allowing traders to retain more of their profits.

However, it is essential to note that Deriv does charge overnight swap fees, which are based on the interest rate differentials of the currencies involved. While these fees are standard in the industry, traders should be aware of them, especially if they plan to hold positions overnight. Overall, Deriv's trading conditions are favorable, with low costs that can benefit a wide range of trading strategies.

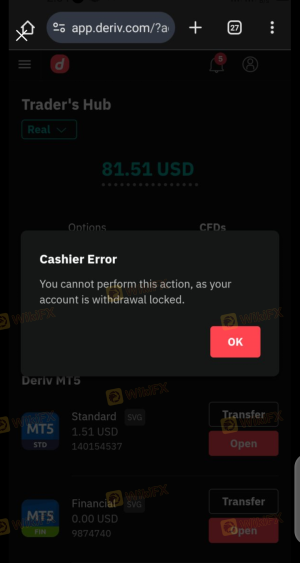

Client Fund Security

Client fund security is paramount when choosing a broker, and Deriv has implemented several measures to protect its clients' assets. The broker employs segregated accounts, ensuring that client funds are kept separate from the company's operational funds. This segregation reduces the risk of loss in the event of insolvency and guarantees that clients can access their funds.

Additionally, Deriv offers negative balance protection, meaning that clients cannot lose more than their account balance. This feature is particularly important in volatile markets, where rapid price movements can lead to significant losses. The broker has also established robust security protocols, including SSL encryption, to safeguard personal and financial information.

Despite these measures, it is crucial for potential clients to remain cautious and conduct thorough research. While Deriv has not faced significant security issues in the past, traders should always be aware of the inherent risks associated with online trading platforms.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. Overall, Deriv has received a mix of reviews from users. Many traders appreciate the user-friendly interface, competitive trading conditions, and responsive customer support. However, some common complaints have emerged, primarily concerning the quality of educational resources and the lack of phone support.

The following table summarizes the most prevalent complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Limited Educational Content | Moderate | Responded with links to resources |

| Slow Customer Support Response | High | Acknowledged and improved response times |

| Platform Usability Issues | Moderate | Ongoing updates and enhancements |

One notable case involved a trader who experienced delays in accessing their account due to verification issues. While the trader reported a lack of timely communication, Deriv's support team eventually resolved the matter. This incident highlights the importance of responsive customer service and effective communication in maintaining client trust.

Platform and Trade Execution

The quality of a broker's trading platform is crucial for a seamless trading experience. Deriv offers several platforms, including the widely used MetaTrader 5, as well as proprietary options like Deriv X and Deriv Trader. Users have generally reported satisfaction with the performance and stability of these platforms, noting their intuitive interfaces and advanced charting tools.

In terms of order execution, Deriv boasts quick processing times and minimal slippage. Traders have reported that orders are executed at the requested prices, which is essential for effective trading strategies. However, there have been occasional concerns regarding platform stability during high volatility periods, leading to brief downtimes.

Overall, Deriv's platforms provide a reliable trading environment, allowing users to execute trades efficiently and effectively.

Risk Assessment

Trading with any broker carries inherent risks, and Deriv is no exception. While the broker has implemented several safety measures, potential clients should be aware of the following risk categories:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Operates under multiple regulators, but not all are tier-1. |

| Market Risk | High | Exposure to volatile markets can lead to significant losses. |

| Operational Risk | Medium | Potential for platform outages during peak trading times. |

To mitigate these risks, traders should employ sound risk management strategies, such as setting stop-loss orders and avoiding over-leveraging their accounts. Additionally, conducting thorough research and staying informed about market conditions can help traders navigate potential pitfalls.

Conclusion and Recommendations

In conclusion, Deriv appears to be a legitimate broker with a solid regulatory framework, competitive trading conditions, and a commitment to client fund security. While there are some areas for improvement, particularly in customer support and educational resources, the overall evidence suggests that Deriv is not a scam.

For traders considering Deriv, it is advisable to start with a demo account to familiarize themselves with the platform and its features. Additionally, traders should remain vigilant about market risks and employ effective risk management strategies.

If you are looking for alternatives, consider brokers like IG or OANDA, which offer robust regulatory oversight and extensive educational resources. Ultimately, the choice of broker should align with individual trading goals and risk tolerance.

Is deriv a scam, or is it legit?

The latest exposure and evaluation content of deriv brokers.

deriv Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

deriv latest industry rating score is 6.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.