1. Executive Summary: The Ultimate All-Rounder Broker

Blueberry Markets, an Australian broker founded in 2016, has rapidly built an exceptional reputation as a trader-centric, high-service brokerage. This 2025 review confirms its standing as a premier choice, particularly for new and intermediate traders seeking professional-grade trading conditions without the high barriers to entry. The brokers philosophy is built on three core pillars: accessible ECN-style pricing, an outstanding suite of trading platforms, and what is widely regarded as industry-leading customer support.

The brokers most compelling feature is its account structure. Both its Standard (commission-free) and Direct (raw spread + commission) accounts are accessible with a remarkably low minimum deposit of just $100. This democratization of ECN-style trading—offering spreads from 0.0 pips plus a competitive $7 commission for a small initial deposit—is a significant competitive advantage. This is powerfully combined with a top-tier platform offering, including MT4, MT5, and the coveted direct TradingView integration, catering to all technical trading styles.

Regulated by both the stringent Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC) for its international arm, Blueberry Markets provides a secure and transparent trading environment. While its instrument range of 500+ assets is comprehensive rather than exhaustive, it covers all major markets sufficiently for the vast majority of traders.

Ultimately, Blueberry Markets excels by getting the essentials right. It provides the tools and pricing of a professional broker while delivering the supportive, responsive service of a boutique firm. For traders who value a seamless user experience, low-cost execution, and the peace of mind that comes with award-winning support, Blueberry Markets is one of the most highly recommended all-around brokers for 2025.

Overall Rating Framework: 2025

2. Trust and Regulation: A Secure Dual-Jurisdiction Framework

Blueberry Markets operates under a well-structured dual-regulation model that provides both stringent oversight for Australian residents and flexible conditions for its global clientele.

1. Australian Regulation (ASIC)

For clients residing in Australia, Blueberry Markets operates under its entity Eightcap Pty Ltd, which is regulated by the Australian Securities and Investments Commission (ASIC) under AFSL number 391441. ASIC is a world-renowned Tier-1 regulator, enforcing some of the strictest financial standards globally. Trading with the ASIC-regulated entity provides:

- High Level of Investor Protection: Strict rules on how client funds are handled, including mandatory segregation in Australian Authorised Deposit-taking Institutions (ADIs).

- Negative Balance Protection: Retail clients are protected from losing more than their account balance.

- Leverage Restrictions: Leverage is capped at 1:30 for major forex pairs and lower for other assets, in line with ASICs retail client protection measures.

- Access to AFCA: Clients have recourse to the Australian Financial Complaints Authority (AFCA), an independent dispute resolution body.

2. International Regulation (VFSC)

For its international clients outside of Australia, Blueberry Markets is operated by Blueberry Markets (Vanuatu) Ltd, which is regulated by the Vanuatu Financial Services Commission (VFSC). This is a common structure used by Australian brokers to compete on a global scale. The VFSC entity offers:

- Higher Leverage: Access to significantly higher leverage, up to 1:500, which is a major draw for experienced traders seeking to maximize their capital efficiency.

- Global Account Opening: A streamlined process for traders from a wide range of countries.

While the VFSC is an offshore regulator and does not offer the same level of protection as ASIC, Blueberry Markets Australian roots and its consistent positive reputation since its founding in 2016 provide a strong layer of operational trust. They maintain segregated client fund accounts for the international entity as well, showcasing a commitment to safety beyond the minimum regulatory requirements.

3. Account Types and Trading Costs: Professional Pricing for All

This is Blueberry Markets most significant advantage. They have simplified their offering into two main account types, both of which are accessible for a low minimum deposit.

Cost Analysis: Why the Direct Account is the Clear Winner

The accessibility of the Direct account for just $100 is a game-changer. Lets compare the real cost of trading one standard lot of EUR/USD:

- Standard Account:

- Average Spread: ~1.2 pips

- Commission: $0

- Total Cost per Trade: 1.2 pips * $10/pip = ~$12.00

- Verdict: This cost is average and perfectly fine for beginners learning the ropes or swing traders who arent sensitive to every fraction of a pip.

- Direct Account:

- Average Spread: ~0.2 pips

- Commission: $7.00

- Total Cost per Trade: (0.2 pips * $10/pip) + $7.00 = $2.00 + $7.00 = ~$9.00

- Verdict: A total cost of ~$9.00 is highly competitive and puts Blueberry Markets in the same league as top-tier professional ECN brokers. The fact that this is available for a mere $100 deposit is outstanding value.

For any trader planning to trade with any regularity, the Direct account is the logical and far more cost-effective choice.

Other Fees

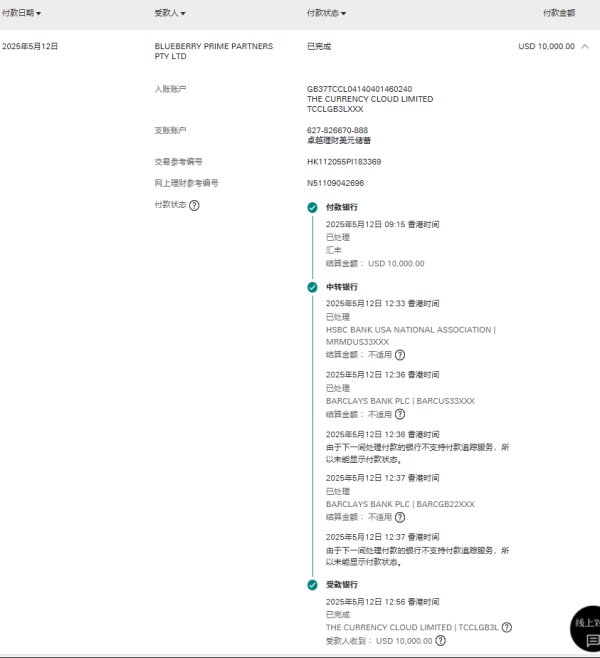

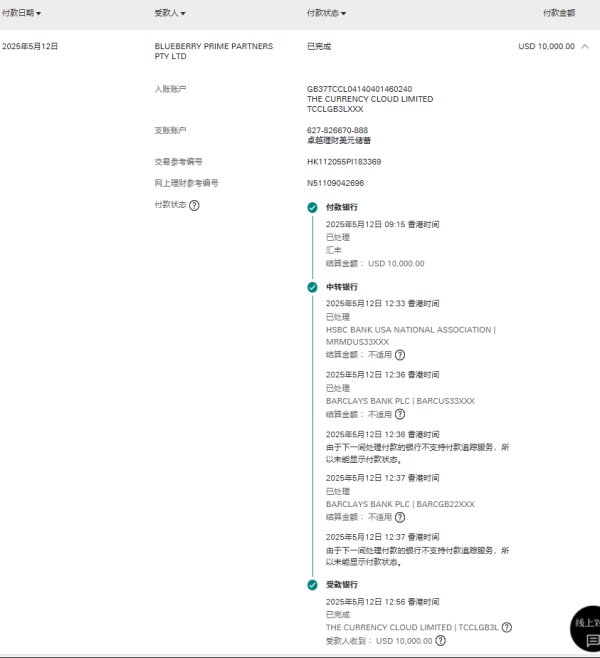

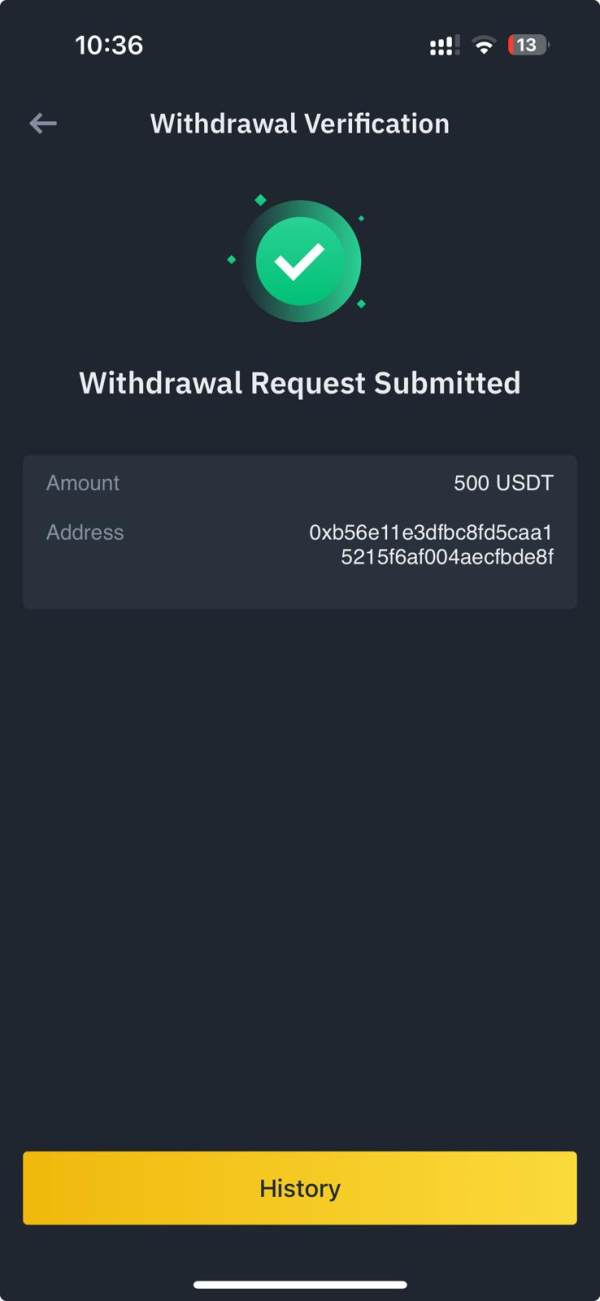

- Deposit/Withdrawal Fees: Blueberry Markets charges zero internal fees for both deposits and withdrawals. Note that your bank or payment provider may still charge their own fees.

- Inactivity Fee: There is no inactivity fee, which is excellent for traders who may take breaks from the market.

4. Trading Platforms: A Powerful and Modern Suite

Blueberry Markets provides a curated selection of elite platforms to ensure traders have the best tools for the job.

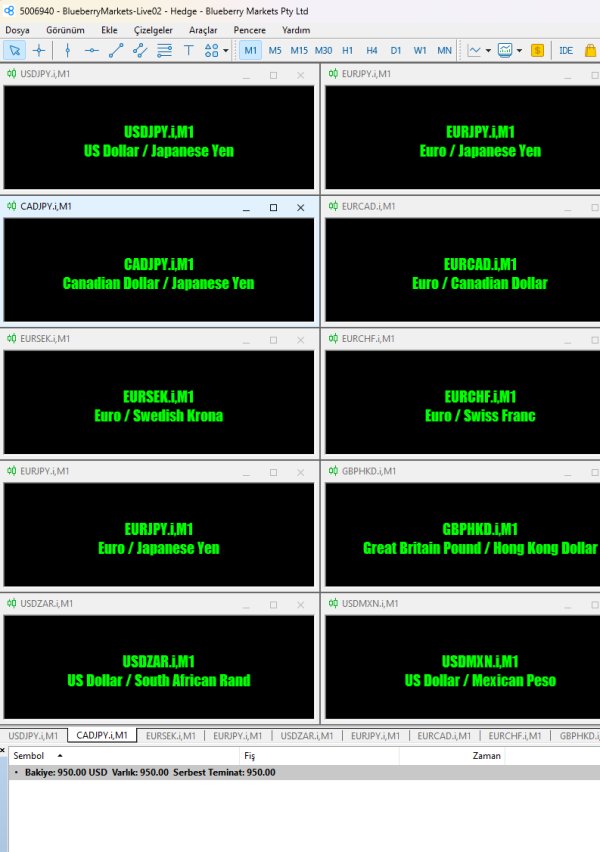

1. MetaTrader 4 (MT4)

The reliable workhorse of the forex world.

- Best For: Traders who rely on a vast library of existing Expert Advisors (EAs) and custom indicators. Its simplicity and stability are legendary.

- Features: The classic interface loved by millions, with all the essential charting and analysis tools.

2. MetaTrader 5 (MT5)

The upgraded, multi-asset successor.

- Best For: Traders who want more technical indicators, more timeframes, and a platform better equipped to handle a wider range of assets like share CFDs.

- Features: Depth of Market (DOM) functionality, an integrated economic calendar, and the more powerful MQL5 programming language.

3. TradingView Integration

This is the crown jewel of their platform offering.

- Best For: Technical analysts and chartists who demand the most powerful, intuitive, and feature-rich charting package on the planet.

- Features: Blueberry Markets offers full broker integration, meaning you can connect your account and trade directly from TradingViews superior charts. You get access to its massive community, 100s of built-in and community-created indicators, and unparalleled drawing tools.

5. Tradable Instruments: Solid and Comprehensive Coverage

While not the largest offering on the market, Blueberry Markets provides a well-rounded selection of over 500 instruments, covering all the key markets that most traders focus on.

- Forex: A strong selection of major, minor, and exotic currency pairs.

- Indices: CFDs on the worlds most popular stock indices, such as the SPX500, NAS100, GER30, and AUS200.

- Commodities: Trade CFDs on precious metals (Gold, Silver, Platinum) and energies (WTI and Brent Crude Oil, Natural Gas).

- Share CFDs: A good selection of CFDs on major stocks from the US (NYSE & NASDAQ), Australia (ASX), and Hong Kong (HKEX).

- Cryptocurrency CFDs: Access to popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and more, allowing for speculation without needing a digital wallet.

The range is more than sufficient for traders looking to build a diversified portfolio and engage with major market movements.

6. Customer Support: The Brokers Signature Strength

If there is one area where Blueberry Markets consistently receives universal praise, it is customer support. This is a core part of their brand identity.

- Availability: They offer true 24/7 customer support, which is rare and incredibly valuable, especially for crypto traders active over the weekend or those needing help during the Sunday market open.

- Quality: The support team is widely cited as being fast, knowledgeable, and genuinely friendly. The Live Chat feature is particularly effective, with users often reporting near-instant connections to a real human agent who can solve problems efficiently.

- Channels: Support is readily available via Live Chat, Email, and a direct Phone line.

This commitment to high-quality, accessible support provides an invaluable safety net for traders, especially those new to the markets. It fosters a sense of partnership rather than a purely transactional relationship.

Education and Research

- Market Analysis: Blueberry Markets Chief Market Analyst, Jonathan Kibble, provides regular, high-quality market commentary, analysis, and trading ideas through their blog and YouTube channel. This provides actionable insights that are a step above the generic content offered by many brokers.

- Educational Resources: The broker offers a range of webinars, platform tutorials, and articles designed to help traders improve their skills.

7. Final Conclusion: Who is Blueberry Markets Best For?

Blueberry Markets has carved out a perfect niche for itself by blending professional-grade trading conditions with an accessible, supportive environment. It has successfully eliminated the common trade-off between low cost and good service.

Blueberry Markets is the ideal choice for:

- Ambitious Beginners: The low $100 minimum deposit, combined with outstanding 24/7 support and educational resources, makes it the perfect place to start a serious trading journey.

- Intermediate Traders: The ability to access a low-cost Direct (ECN) account for just $100 allows developing traders to significantly reduce their trading costs and improve profitability.

- Technical Analysts and Chart Traders: The full integration with TradingView is a massive draw for anyone who prioritizes charting excellence.

- Traders Who Value Service: If you want to feel like a valued client with a dedicated support team behind you, Blueberry Markets is unmatched.

Blueberry Markets may be less suitable for:

- Institutional Traders or Hedge Funds: While they can cater to them, these clients might seek brokers with even deeper liquidity pools and more bespoke institutional services.

- Traders Needing Obscure Instruments: If your strategy relies on trading thousands of exotic share CFDs or niche markets, a larger, more specialized broker might be a better fit.

In conclusion, Blueberry Markets is a standout broker that delivers exceptional value. It has intelligently packaged its offering to appeal to the 95% of retail traders who need competitive pricing, great platforms, and reliable support. It is, without reservation, one of the top recommendations for a trusted, all-around brokerage in 2025.