Regarding the legitimacy of TRADE NATION forex brokers, it provides ASIC, FCA, FSCA, SCB, FSA and WikiBit, (also has a graphic survey regarding security).

Is TRADE NATION safe?

Pros

Cons

Is TRADE NATION markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Trade Nation Australia Pty Ltd

Effective Date: Change Record

2012-10-11Email Address of Licensed Institution:

andrew.merry@finsa.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 17 123 PITT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

00447437416329Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Trade Nation Financial UK Ltd

Effective Date:

2011-05-09Email Address of Licensed Institution:

fcamatters@tradenation.comSharing Status:

No SharingWebsite of Licensed Institution:

https://tradenation.com/Expiration Time:

--Address of Licensed Institution:

14 Bonhill Street 6th Floor London EC2A 4BX UNITED KINGDOMPhone Number of Licensed Institution:

+4402031805952Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TRADE NATION FINANCIAL (PTY) LTD

Effective Date: Change Record

2019-02-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1ST FLOOR 19 9TH STREET HOUGHTON ESTATE JOHANNESBURG 2196Phone Number of Licensed Institution:

27086 0111 563Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Trade Nation Ltd.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Office 2B, One Sandyport Plaza, West Bay Street, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TRADE NATION FINANCIAL MARKETS LIMITED

Effective Date: Change Record

--Email Address of Licensed Institution:

andrew.merry@tradenation.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.tradenation.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 6B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373551Licensed Institution Certified Documents:

Is Trade Nation A Scam?

Introduction

Trade Nation is an online broker that has carved a niche for itself in the forex and CFD trading markets since its inception in 2014. Originally known as Core Spreads, it rebranded to Trade Nation in 2020, reflecting its growth and expanding global presence. As a broker, Trade Nation positions itself as a low-cost provider with fixed spreads, appealing to both novice and experienced traders. However, the forex market is rife with potential pitfalls, and traders must exercise due diligence when choosing a broker to ensure their investments are secure. This article aims to provide a comprehensive analysis of Trade Nation, evaluating its regulatory standing, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. The findings are derived from a thorough examination of various credible sources, including regulatory disclosures, user reviews, and expert evaluations.

Regulation and Legitimacy

Regulation is a critical factor in determining the trustworthiness of a trading broker. It ensures that the broker adheres to strict guidelines designed to protect traders' interests. Trade Nation is regulated by multiple reputable authorities, which adds a layer of credibility to its operations. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 525164 | United Kingdom | Verified |

| Australian Securities and Investments Commission (ASIC) | 422661 | Australia | Verified |

| Financial Sector Conduct Authority (FSCA) | 49846 | South Africa | Verified |

| Securities Commission of the Bahamas (SCB) | SIA-F 216 | Bahamas | Verified |

| Financial Services Authority (FSA) | SD150 | Seychelles | Verified |

The presence of top-tier regulators like the FCA and ASIC is significant, as these bodies enforce stringent compliance standards. The FCA, for example, provides a compensation scheme that protects clients up to £85,000 in the event of broker insolvency. However, it is important to note that while Trade Nation is regulated in several jurisdictions, the level of protection varies. For instance, accounts regulated under the FSCA and FSA do not offer the same investor protection schemes as those under the FCA. Overall, Trade Nation's regulatory framework appears robust, contributing to its legitimacy as a trading platform.

Company Background Investigation

Trade Nation, established in 2014, has a relatively short but notable history in the financial services industry. Initially operating under the name Core Spreads, the company focused on providing competitive spread betting services. The rebranding to Trade Nation in 2020 marked a strategic shift aimed at expanding its global footprint and enhancing its service offerings. The company is headquartered in London, UK, and operates multiple entities across various jurisdictions, including Australia, South Africa, the Bahamas, and Seychelles.

The management team at Trade Nation comprises seasoned professionals with extensive experience in the financial sector, which adds to the company's credibility. The leadership is committed to transparency and customer service, as evidenced by their engagement with clients and efforts to provide educational resources. However, while the company publicly shares its regulatory affiliations and operational strategies, there is limited information regarding its ownership structure and financial health. This lack of transparency could raise concerns among potential clients regarding the companys stability and reliability.

Trading Conditions Analysis

An essential aspect of evaluating any broker is understanding its trading conditions, including fees, spreads, and commissions. Trade Nation offers a competitive fee structure with fixed spreads, which can be advantageous for traders looking to minimize costs. Below is a comparison of Trade Nation's core trading costs against industry averages:

| Fee Type | Trade Nation | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips (EUR/USD) | 1.0 pips |

| Commission Structure | No commissions | Varies |

| Overnight Interest Range | Standard | Standard |

The fixed spread of 0.6 pips on the EUR/USD pair is notably lower than the industry average, making Trade Nation an attractive option for forex traders. However, it is important to be aware that while fixed spreads provide predictability, they can also widen during periods of high volatility. Additionally, Trade Nation does not charge deposit or withdrawal fees, which is a significant advantage. Nevertheless, the brokers fee structure may not be entirely transparent, as some users have reported encountering unexpected charges, particularly concerning overnight financing fees.

Customer Funds Safety

The safety of customer funds is paramount in the trading industry. Trade Nation employs several measures to ensure the security of its clients' investments. The broker maintains segregated accounts, meaning that client funds are kept separate from the company's operational funds. This practice is essential in safeguarding customer deposits in case of financial difficulties faced by the broker. Additionally, Trade Nation provides negative balance protection, which ensures that clients cannot lose more than their account balance, thus mitigating the risk of excessive losses.

Despite these measures, there have been historical concerns regarding the safety of funds at various brokers, including Trade Nation. However, as of now, there have been no significant incidents reported that would undermine the broker's credibility in this area. Clients should remain vigilant and ensure they understand the terms and conditions surrounding their accounts, particularly regarding how their funds are managed and the protections in place.

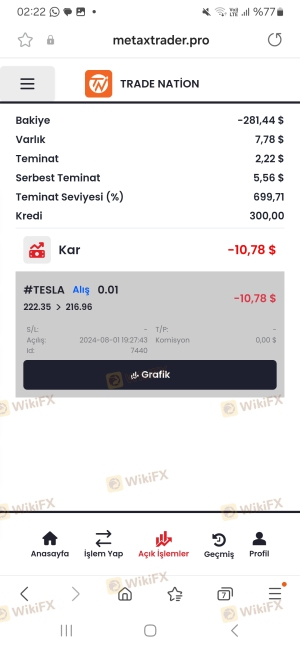

Customer Experience and Complaints

User feedback is a crucial indicator of a broker's reliability and service quality. Trade Nation has received a mix of reviews from its clients, with many praising its user-friendly platform and responsive customer service. However, common complaints include issues with withdrawal processing times and the lack of a live chat support option. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Generally responsive but can take 1-5 business days |

| Limited Educational Resources | Low | Ongoing improvements noted |

| Lack of Live Support | Medium | Chatbot available, but no live agents |

For instance, some users have reported delays in receiving their funds, particularly those withdrawing from accounts regulated in regions with less stringent oversight. In contrast, clients in the UK and Australia often experience quicker processing times. Overall, while Trade Nation appears to address most complaints adequately, the absence of a live chat feature may hinder prompt resolution of urgent issues.

Platform and Execution Quality

The quality of a trading platform is vital for a smooth trading experience. Trade Nation offers both its proprietary platform and the widely-used MetaTrader 4 (MT4). The proprietary platform is designed to be user-friendly, featuring advanced charting tools and real-time news feeds. However, some users have noted that it lacks certain advanced features available on other platforms, such as custom indicators and automated trading capabilities.

Regarding order execution, Trade Nation generally provides a reliable experience, with minimal slippage and a low rejection rate. The fixed spreads help ensure that traders know their costs upfront, although some users have reported occasional delays during volatile market conditions. Overall, the platform performs well, but traders seeking advanced functionalities may find it lacking compared to other brokers.

Risk Assessment

Evaluating the risks associated with trading through Trade Nation is essential for prospective clients. Below is a summary of the key risk areas identified during the review:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Varies by jurisdiction; stronger protections in the UK and Australia |

| Market Risk | High | Trading forex and CFDs involves significant market volatility |

| Operational Risk | Medium | Dependence on technology and potential delays in withdrawals |

While Trade Nation is regulated by reputable authorities, the risk levels can vary significantly depending on the client's location and the regulatory entity governing their account. Additionally, the inherent volatility of the forex and CFD markets poses a risk to traders, especially those using leverage. It is advisable for traders to implement risk management strategies, such as setting stop-loss orders and only trading with capital they can afford to lose.

Conclusion and Recommendations

In conclusion, Trade Nation is a legitimate broker that operates under multiple regulatory authorities, including the FCA and ASIC, providing a solid foundation of trust. While the broker offers competitive trading conditions, including fixed spreads and no commission fees, potential clients should be aware of the varying levels of protection based on their jurisdiction.

Although there are no significant signs of fraudulent activity associated with Trade Nation, traders should remain cautious, especially regarding withdrawal times and the transparency of fees. For beginners, Trade Nation can serve as a good entry point into the forex and CFD markets, thanks to its user-friendly platform and educational resources.

However, traders looking for a more comprehensive range of services or advanced trading features may want to consider alternative brokers. Some reliable alternatives include IG Group and CMC Markets, both of which offer robust platforms and extensive educational resources.

Overall, Trade Nation is a credible option for forex trading, but it is essential for traders to conduct thorough research and consider their individual trading needs before committing to any broker.

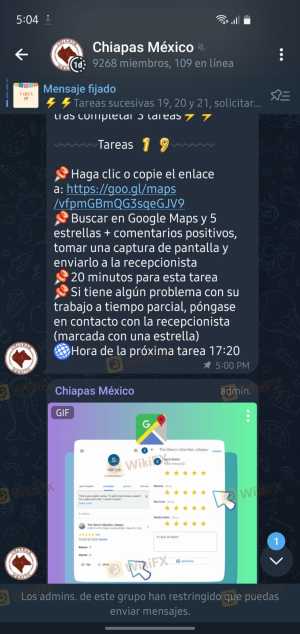

Is TRADE NATION a scam, or is it legit?

The latest exposure and evaluation content of TRADE NATION brokers.

TRADE NATION Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADE NATION latest industry rating score is 9.09, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 9.09 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.