Trade Nation 2025 Review: Everything You Need to Know

Executive Summary

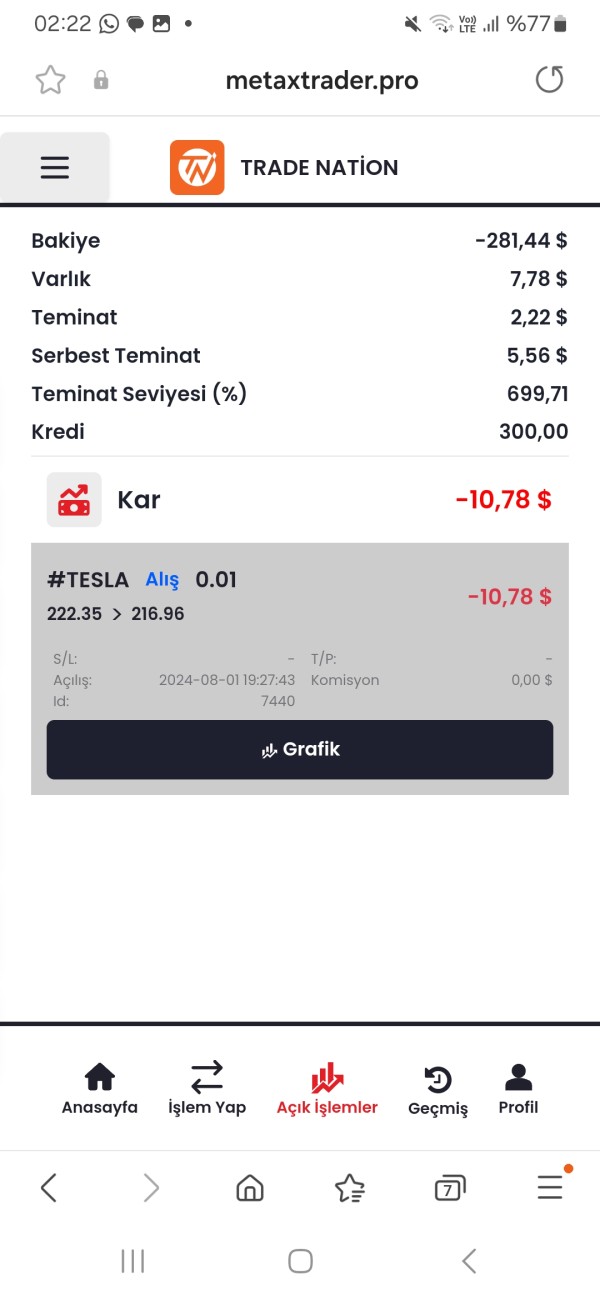

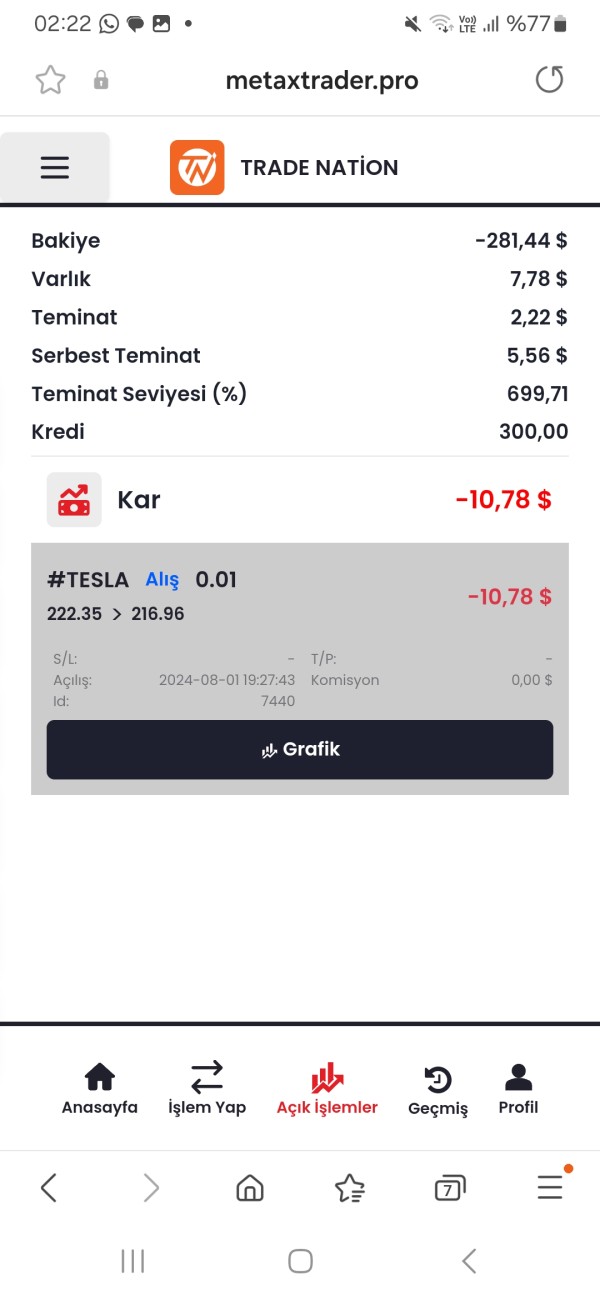

This detailed trade nation review looks at one of the forex market's well-known multi-asset brokers. Trade Nation has gained attention for its unique approach to trading costs and platform design, making it stand out in a crowded marketplace. The broker offers regulated forex trading with low-cost fixed spreads and zero commission trading conditions. These features have earned positive feedback from users who want cost-effective trading solutions.

The broker's main advantages include fixed spreads that stay stable during market ups and downs. Trade Nation also provides a well-designed trading platform that users consistently praise for its ease of use and clear interface, which makes trading more enjoyable and efficient. According to multiple industry sources, Trade Nation's TradingView-compatible platform delivers a smooth trading experience across web and mobile apps. This makes it especially attractive to traders who value platform reliability and user-friendly design.

Trade Nation mainly targets traders interested in multi-asset trading who care about costs and want clear pricing. The broker supports trading across forex, CFDs, commodities, stock market indices, and cryptocurrencies, making it a complete solution for varied trading strategies. With oversight from multiple regulatory bodies and a focus on fixed-cost trading, Trade Nation appeals to both beginner and experienced traders looking for predictable trading expenses.

Important Disclaimers

Trade Nation operates under different regulatory entities across various regions. Trading conditions may vary depending on where you live, so users should check which regulatory entity governs their account based on their country of residence. This may affect available services, leverage limits, and investor protection measures that apply to your trading account.

This review uses publicly available information, user feedback, official broker communications, and market analysis. Trading experiences may differ between users and regions, and past performance does not guarantee future results, so traders should always be cautious. All trading involves risk, and traders should carefully consider their financial situation before engaging with any forex broker.

Rating Framework

Broker Overview

Trade Nation emerged as a rebranded entity in 2019, building upon a foundation established in 2014. As a multi-asset broker, Trade Nation has positioned itself to serve traders seeking access to diverse financial markets through one unified platform, which simplifies the trading process significantly. The company's evolution reflects the changing landscape of retail trading, where brokers must offer complete solutions across multiple asset classes to remain competitive.

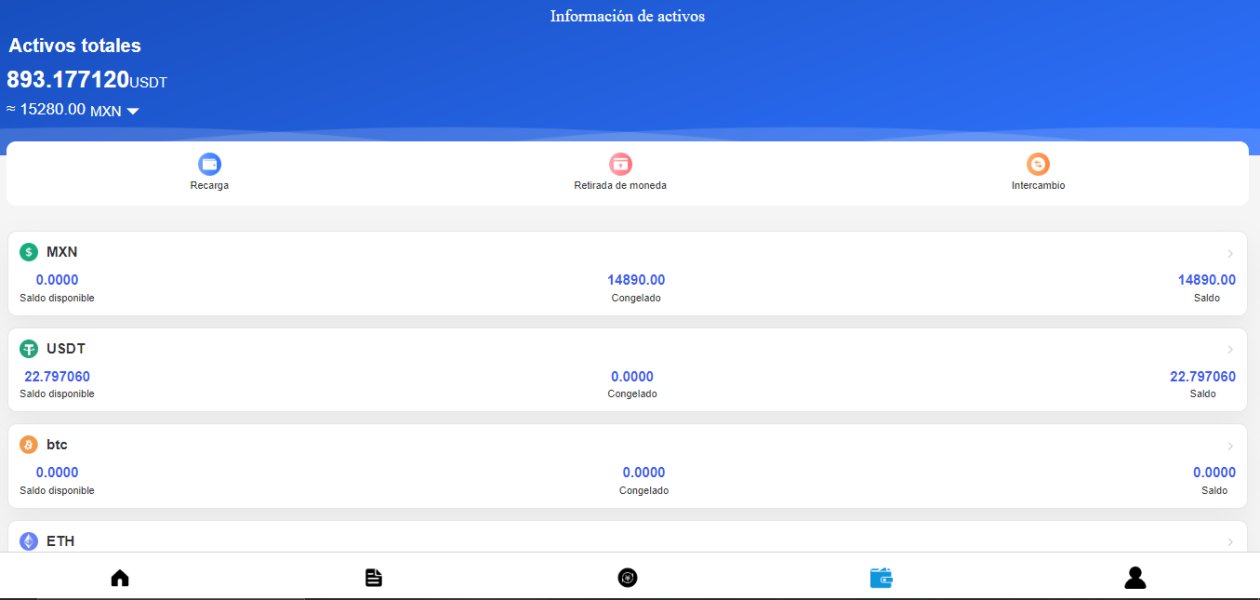

The broker operates on a business model centered around providing access to forex, CFDs, commodities, stock market indices, and cryptocurrency markets. According to ForexBrokers.com, Trade Nation's approach emphasizes fixed spreads and zero commission structures, which sets it apart from many competitors who rely on variable spread models that can change unexpectedly. This trade nation review found that the broker's commitment to cost transparency has become one of its defining characteristics in an increasingly crowded marketplace.

Trade Nation offers web-based and mobile trading apps designed with user experience as a primary consideration. The platform integrates with TradingView, providing traders with advanced charting capabilities and technical analysis tools that professional traders rely on daily. Multiple industry sources indicate that the broker supports major currency pairs, popular CFD instruments, and emerging cryptocurrency markets, making it suitable for traders with diverse portfolio interests across traditional and digital assets.

Regulatory Oversight: Trade Nation operates under multiple regulatory jurisdictions, though specific regulatory bodies and license numbers require verification through official channels. The broker maintains compliance standards across different regions to serve international clients effectively.

Deposit and Withdrawal Methods: Available payment methods are not fully detailed in current public information. Traders should verify specific options directly with the broker for their region.

Minimum Deposit Requirements: Specific minimum deposit amounts are not clearly stated in available materials. These amounts may vary by account type and region.

Promotional Offers: Current bonus and promotional structures are not detailed in accessible information. Traders should inquire directly about available incentives.

Tradeable Assets: Trade Nation supports forex pairs, CFDs on various instruments, commodities trading, stock market indices, and cryptocurrency markets. This provides complete multi-asset access for diverse trading strategies.

Cost Structure: The broker emphasizes low-cost fixed spreads with zero commission on standard accounts. This positions it as a cost-effective solution for active traders.

Leverage Ratios: Specific leverage offerings are not detailed in current information. These likely vary by asset class and regulatory jurisdiction.

Platform Options: Trade Nation provides TradingView-compatible web and mobile apps designed for ease of use across different devices and trading styles. The platform focuses on simplicity without sacrificing important features.

Geographic Restrictions: Specific country restrictions are not detailed in available information. Traders should verify availability based on their location.

Customer Support Languages: Available language support details are not fully provided in current materials. Prospective clients should confirm language options directly with the broker.

This trade nation review indicates that while the broker offers competitive core features, some specific details require direct verification with the company.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

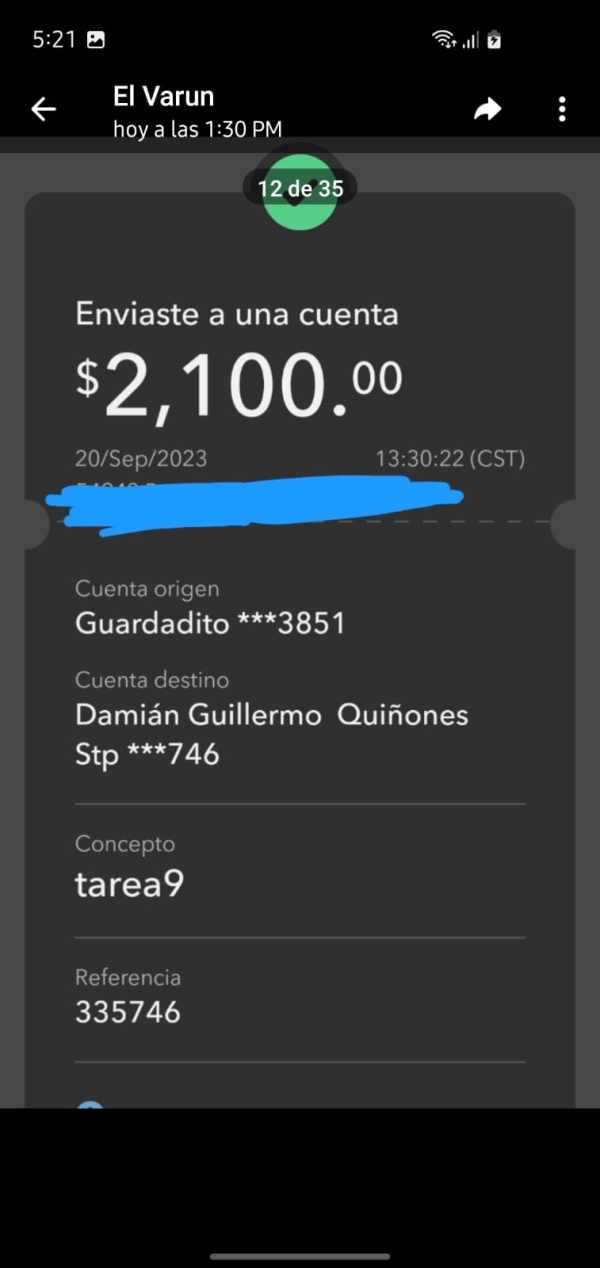

Trade Nation's account structure centers around zero commission trading with competitive fixed spreads. This represents a significant advantage in today's variable-cost trading environment where fees can quickly add up. According to industry analysis, the broker's standard account offers access to all major trading instruments without commission charges, making it particularly attractive for frequent traders who would otherwise face substantial transaction costs.

The fixed spread model provides predictability that many traders value, especially during volatile market conditions when other brokers' spreads may widen significantly. BrokerNotes research indicates that Trade Nation's approach to cost transparency helps traders calculate their trading expenses more accurately, which supports better risk management and strategy implementation across different market conditions. While specific minimum deposit requirements are not clearly detailed in available information, the broker's focus on accessibility suggests competitive entry-level requirements.

The account opening process appears streamlined, though detailed verification procedures should be confirmed directly with the broker. Account holders gain access to the full range of supported assets and platform features without tier-based restrictions commonly found with other brokers, which simplifies the trading experience. The absence of detailed information about Islamic accounts and other specialized account types represents an area where this trade nation review identifies potential improvement in public information transparency.

Trade Nation's integration with TradingView represents a significant strength in its tools and resources offering. This partnership provides traders with access to professional-grade charting capabilities, technical indicators, and analytical tools that rival those offered by much larger brokers, giving smaller traders access to institutional-quality resources. The TradingView integration supports advanced technical analysis across all supported asset classes.

The broker's web and mobile apps receive consistent praise for their user-friendly design and functionality. According to user feedback cited in industry reports, the platform's clear interface makes it accessible to beginner traders while providing the sophisticated tools that experienced traders require for complex strategies, which creates a good balance for different skill levels. However, specific details about proprietary research resources, market analysis, and educational materials are not fully available in current public information.

This represents a notable gap in the broker's public information strategy, as educational resources and market research are increasingly important differentiators in the competitive forex market. Automated trading support capabilities are not clearly detailed in available materials, which may be a consideration for traders who rely on expert advisors or algorithmic trading strategies that require specific technical compatibility. The platform's technical capabilities suggest compatibility with automated systems, but specific details require verification.

Customer Service and Support Analysis (6/10)

Customer service information represents one area where Trade Nation's public information could be more detailed and transparent. Specific details about support channels, availability hours, and response times are not readily available in current materials, making it difficult to assess the quality and accessibility of customer support services that traders rely on when issues arise. The absence of detailed multilingual support information may be a consideration for international traders, particularly given the broker's multi-jurisdictional regulatory approach.

Customer service quality often varies significantly between brokers, and the lack of specific information about Trade Nation's support structure prevents a more detailed assessment. Industry standards typically include live chat, email support, and phone assistance, but Trade Nation's specific offerings in these areas require direct verification from potential clients. Response time expectations and problem resolution processes are not detailed in available public information, representing areas where potential clients would benefit from more transparency.

The broker's approach to client communication and support documentation is not fully covered in current materials. This suggests that prospective traders should directly evaluate these aspects during their broker selection process.

Trading Experience Analysis (8/10)

User feedback consistently highlights Trade Nation's platform design and usability as significant strengths in the competitive broker landscape. According to ForexBrokers.com analysis, the broker's web and mobile apps provide a clear trading environment that accommodates both novice and experienced traders effectively, which helps reduce the learning curve for new users. The platform's design philosophy appears to prioritize user experience without sacrificing functionality.

The fixed spread advantage becomes particularly apparent during volatile market conditions, when traders can maintain predictable costs regardless of market movement. This stability in trading costs contributes to a more consistent trading experience compared to variable spread environments where costs can fluctuate significantly and unexpectedly impact trading strategies. Platform stability and execution quality are essential components of trading experience, though specific performance metrics are not detailed in available public information.

The TradingView integration suggests robust technical infrastructure, but actual execution speeds and slippage statistics would require direct testing or verification with the broker. Mobile trading functionality receives positive mentions in user feedback, indicating that Trade Nation has successfully adapted its platform for mobile-first trading approaches that many modern traders prefer for flexibility and convenience. This trade nation review notes that mobile platform quality has become increasingly important as trading habits evolve toward more flexible, location-independent approaches.

Trust and Security Analysis (7/10)

Trade Nation operates under multiple regulatory frameworks, providing a foundation for client trust and security in an industry where regulation is crucial. While specific regulatory bodies and license numbers are not fully detailed in current public information, the broker's multi-jurisdictional approach suggests compliance with established financial services regulations across different markets, which provides some reassurance to international traders. Regulatory oversight typically includes requirements for client fund segregation, capital adequacy, and operational transparency, though Trade Nation's specific implementations of these protections are not detailed in available materials.

The broker's establishment date and rebranding history indicate operational stability and commitment to the retail trading market. Industry reputation and recognition are not extensively documented in current public information, making it difficult to assess Trade Nation's standing among industry peers and regulatory bodies that evaluate broker performance. The absence of detailed information about awards, certifications, or industry recognition represents an area where more transparency could enhance client confidence.

Client fund protection measures, including deposit insurance and segregation practices, are not specifically detailed in available information. These protections are crucial considerations for traders evaluating broker security, and prospective clients should verify these details directly with the company before opening accounts.

User Experience Analysis (6/10)

Available user feedback suggests that Trade Nation achieves solid satisfaction levels, though detailed satisfaction metrics are not provided in current public information. The 27% recommendation rate mentioned in some sources provides limited insight into overall user sentiment, but suggests room for improvement in client satisfaction across various aspects of the trading experience, which is important for long-term client retention. Platform design receives consistent positive feedback, with users appreciating the clear interface and ease of navigation.

This suggests that Trade Nation has successfully prioritized user experience in its platform development, creating an environment that supports efficient trading workflows. Account registration and verification processes are not fully detailed in available information, though the broker's focus on accessibility suggests streamlined onboarding procedures that help new clients get started quickly. The efficiency of these processes significantly impacts initial user experience and should be evaluated directly by prospective clients.

Deposit and withdrawal experiences are not specifically covered in current public information, representing important aspects of user experience that require direct verification. Transaction processing times, available methods, and associated costs all contribute to overall user satisfaction with broker services and can significantly impact the overall trading experience.

Conclusion

This trade nation review reveals a broker that offers compelling advantages for cost-conscious traders seeking multi-asset market access. Trade Nation's fixed spread model and zero commission structure provide significant value propositions, particularly for active traders who benefit from predictable transaction costs that help with budget planning and strategy development. The broker's platform design and TradingView integration demonstrate a commitment to user experience and technical capability.

Trade Nation appears most suitable for traders who prioritize cost transparency and platform usability across multiple asset classes. The broker's approach to fixed spreads and user-friendly design makes it particularly attractive for both beginning traders learning market dynamics and experienced traders seeking efficient execution environments that support their trading goals. However, this analysis identifies areas where more detailed public information would benefit prospective clients, including comprehensive customer service capabilities, specific regulatory information, and complete fee structures.

While Trade Nation demonstrates solid fundamentals in core trading services, enhanced transparency in these areas would strengthen its competitive position in the evolving forex market landscape. Potential clients should conduct direct verification of important details before making their final broker selection decision.