Regarding the legitimacy of Equitrade Capital forex brokers, it provides FCA and WikiBit, .

Is Equitrade Capital safe?

Business

License

Is Equitrade Capital markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Quantfury Trading UK Limited

Effective Date:

2012-04-23Email Address of Licensed Institution:

support@quantfury.comSharing Status:

No SharingWebsite of Licensed Institution:

https://quantfury.co.uk/Expiration Time:

--Address of Licensed Institution:

4th Floor 1 Bolton Street London London W1J 8HY UNITED KINGDOMPhone Number of Licensed Institution:

+4401214540770Licensed Institution Certified Documents:

Is Equitrade Capital Safe or a Scam?

Introduction

Equitrade Capital is a UK-based forex broker that has positioned itself as a reputable player in the foreign exchange market since its establishment in 2003. As traders navigate the complexities of the forex landscape, it is crucial to evaluate brokers thoroughly to ensure their safety and legitimacy. The potential for scams in the trading industry makes it imperative for traders to conduct due diligence before committing their funds. This article aims to provide a comprehensive analysis of Equitrade Capital, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on a thorough review of various online resources and user feedback, ensuring a balanced perspective on whether Equitrade Capital is indeed safe for trading.

Regulation and Legitimacy

When it comes to trading, regulatory oversight is a fundamental aspect that determines a broker's legitimacy. Equitrade Capital is regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent regulatory framework. This regulation is crucial as it ensures that brokers adhere to strict standards, providing a level of assurance for traders regarding the safety of their funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 577611 | United Kingdom | Verified |

The FCA is recognized as a top-tier regulator, which means that Equitrade Capital must comply with rigorous requirements, including maintaining sufficient capital reserves, implementing effective risk management practices, and ensuring the segregation of client funds. Furthermore, there have been no significant negative disclosures or compliance issues reported against Equitrade Capital, reinforcing its credibility within the industry. However, it is essential to note that while regulation by the FCA is a strong indicator of safety, it does not completely eliminate the risks associated with trading. Traders should remain vigilant and informed about the potential pitfalls of trading with any broker, including Equitrade Capital.

Company Background Investigation

Equitrade Capital has been operating since 2003, providing a variety of trading services, including forex, CFDs, and commodities. The company is headquartered in Birmingham, UK, with a commitment to offering a transparent and client-focused trading environment. The ownership structure of Equitrade Capital is publicly available, contributing to its transparency and trustworthiness.

The management team at Equitrade Capital boasts extensive experience in the financial services sector, with backgrounds in trading, risk management, and compliance. This expertise is crucial for fostering a secure trading environment and ensuring that the broker adheres to best practices in the industry. The company has made efforts to maintain transparency by providing detailed information about its services, fees, and trading conditions on its official website. However, the level of information disclosure could still be improved, particularly regarding specific trading conditions and potential risks.

Trading Conditions Analysis

Equitrade Capital offers a range of trading instruments, including forex pairs, commodities, and CFDs. However, the broker's fee structure has raised some concerns among traders. The spreads offered by Equitrade Capital are reported to be higher than the industry average, which could impact the overall trading costs for clients.

| Fee Type | Equitrade Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 4 pips | 1-2 pips |

| Commission Structure | Variable | Variable |

| Overnight Interest Range | Not disclosed | Varies |

The higher spreads may deter some traders, especially those who engage in high-frequency trading strategies. Additionally, the lack of transparency regarding overnight interest rates could lead to unexpected costs for traders holding positions overnight. It is essential for potential clients to carefully assess these trading conditions and consider how they align with their trading strategies and goals.

Customer Funds Security

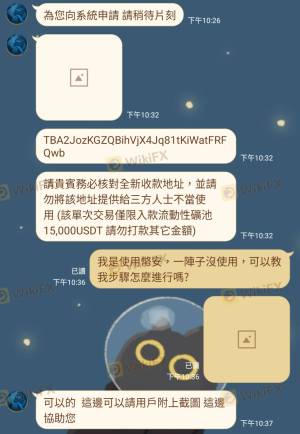

The safety of customer funds is a critical consideration when evaluating any broker. Equitrade Capital implements several measures to protect client funds, including the segregation of client accounts from the company's operational funds. This practice ensures that in the event of financial difficulties, client funds remain protected.

Moreover, as a regulated entity under the FCA, Equitrade Capital is required to participate in the Financial Services Compensation Scheme (FSCS), which provides additional protection for clients in case the broker becomes insolvent. However, it is important to note that the FSCS compensation limit is subject to certain conditions and may not cover all losses incurred by traders.

Despite these protective measures, there have been historical complaints regarding fund security and withdrawal issues from users. These concerns highlight the importance of understanding the broker's policies and the potential risks involved in trading with Equitrade Capital.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. Equitrade Capital has received mixed reviews from users, with some praising its customer service and trading platform, while others have reported issues related to withdrawals and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Account Management | Medium | Inconsistent support |

| Slippage Complaints | Medium | Addressed but not resolved |

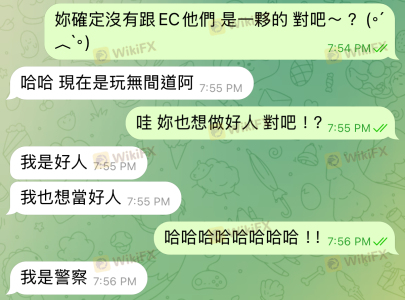

A notable case involves a trader who reported difficulties withdrawing funds after a successful trading period, leading to frustration and dissatisfaction with the broker's customer service. Such experiences can significantly impact a trader's perception of whether Equitrade Capital is safe for trading. While the broker has made efforts to address these complaints, the consistency and effectiveness of its customer support remain areas for improvement.

Platform and Execution

Equitrade Capital provides a trading platform that is designed to facilitate a smooth trading experience. However, the performance and stability of the platform have been scrutinized by users. Reports of slippage and execution delays have raised concerns about the overall reliability of the trading environment.

Traders have noted instances where unexpected slippage occurred during volatile market conditions, leading to losses that could have been mitigated with better execution practices. Furthermore, the refusal of some trades during high-impact news events has led to suspicions of potential platform manipulation. These factors contribute to the overall risk assessment of using Equitrade Capital as a trading partner.

Risk Assessment

When evaluating the risks associated with Equitrade Capital, it is essential to consider various factors, including regulatory compliance, trading conditions, and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | FCA regulated |

| Trading Costs | Medium | Higher spreads than average |

| Customer Service | Medium | Mixed feedback on support |

| Platform Reliability | High | Reports of slippage and execution issues |

To mitigate these risks, traders are advised to maintain a diversified portfolio, utilize risk management strategies, and remain informed about market conditions. Additionally, conducting thorough research before committing funds can help traders make informed decisions about whether Equitrade Capital is safe for their trading needs.

Conclusion and Recommendations

In conclusion, while Equitrade Capital is regulated by the FCA, which provides a level of safety for traders, there are several areas of concern that potential clients should consider. The broker's higher trading costs, mixed customer feedback, and reports of execution issues raise questions about its overall reliability.

For traders seeking a trustworthy broker, it is essential to weigh these factors carefully. If you are risk-averse or new to trading, it may be prudent to explore alternative options with a stronger track record for customer service and execution reliability. Some recommended alternatives include brokers with a history of positive user experiences and lower trading costs. Ultimately, whether Equitrade Capital is safe or a potential scam depends on an individual trader's risk tolerance and trading strategy.

Is Equitrade Capital a scam, or is it legit?

The latest exposure and evaluation content of Equitrade Capital brokers.

Equitrade Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Equitrade Capital latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.