Capitalix 2025 Review: Everything You Need to Know

Summary

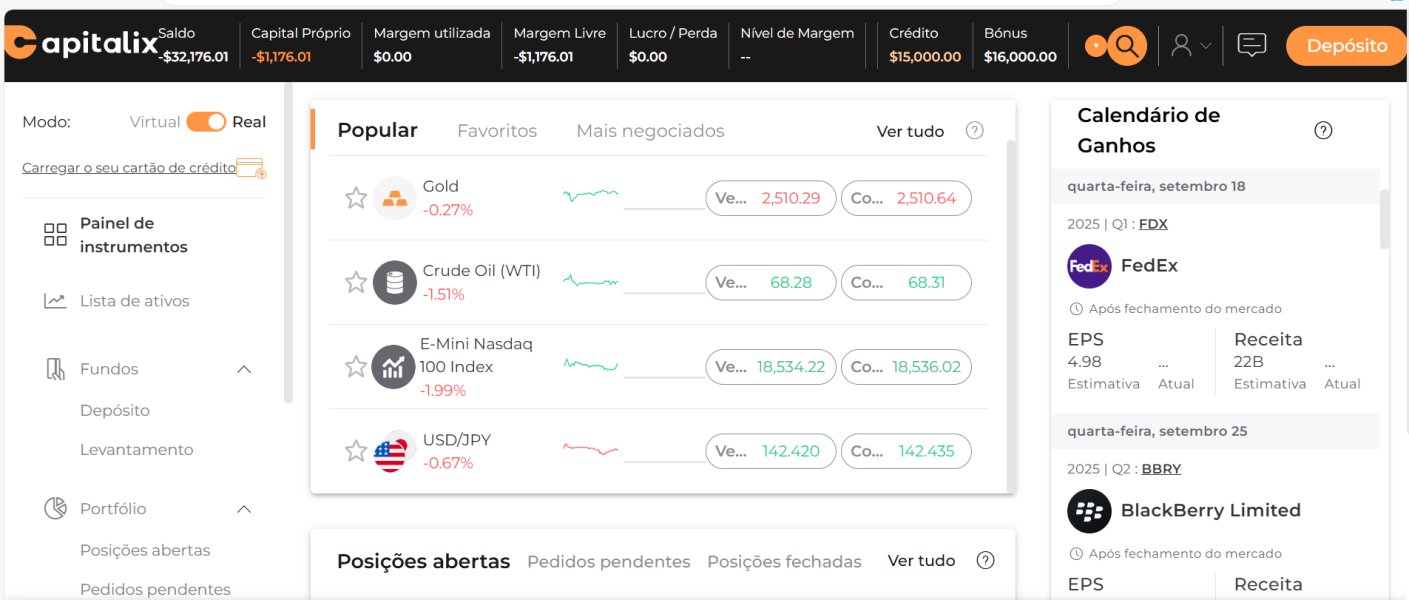

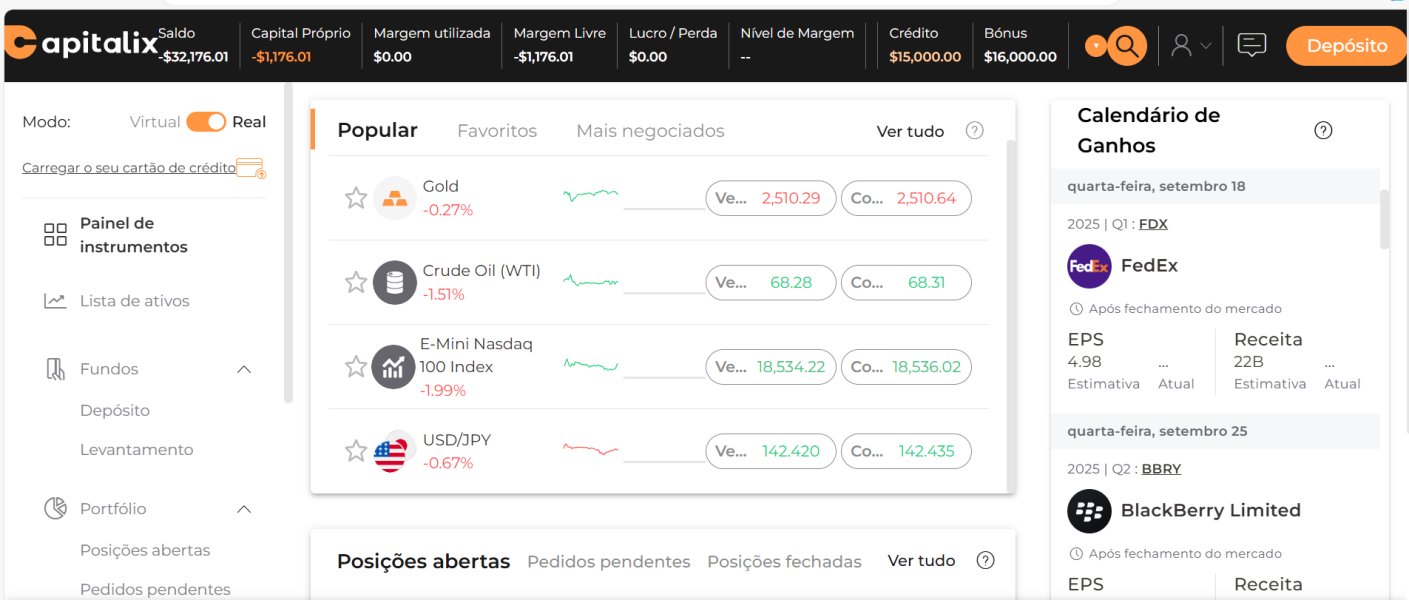

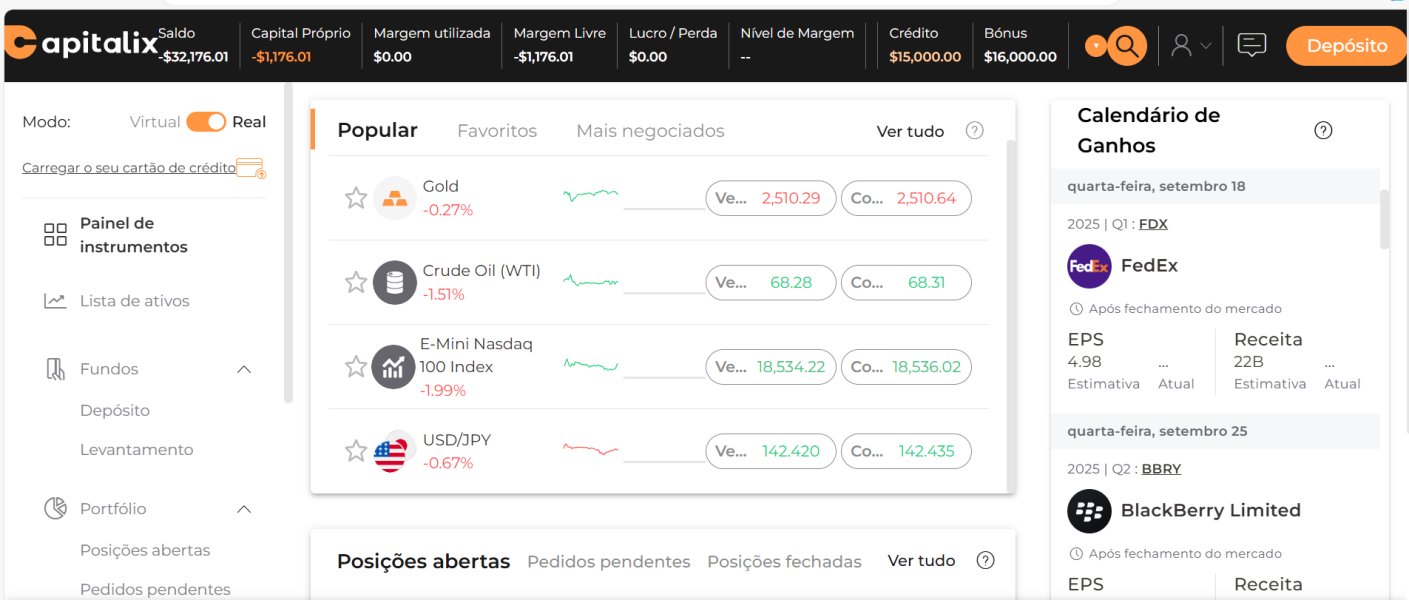

This comprehensive Capitalix review examines one of the emerging players in the forex and CFD trading space. Capitalix positions itself as a multi-asset broker offering competitive trading conditions with zero commission structures and tight spreads starting from 0.3 pips. The platform provides access to over 350 tradeable instruments across forex, cryptocurrencies, stocks, and CFDs. This makes it attractive for traders seeking portfolio diversification.

However, our analysis reveals several areas of concern that potential clients should carefully consider. The broker operates under Seychelles Financial Services Authority (FSA) regulation. This offers less strict oversight compared to tier-1 regulatory jurisdictions. Additionally, according to review aggregation sites, Capitalix has been flagged for suspicious review activity, raising questions about the authenticity of some online testimonials. The platform primarily targets retail traders and small to medium-sized investors who prioritize low trading costs and diverse asset selection. However, regulatory concerns may limit its appeal to more risk-averse traders seeking maximum protection.

Important Notice

Regulatory Considerations: Capitalix operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA). Traders should be aware that Seychelles-based regulation typically provides different levels of investor protection compared to more established regulatory frameworks such as the FCA, CySEC, or ASIC. The regulatory environment in Seychelles generally offers more flexible operational conditions for brokers. However, it may provide limited recourse for client disputes.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, and user feedback compiled from multiple sources. Our assessment aims to provide an objective analysis of Capitalix's strengths and limitations. However, traders should conduct their own due diligence before making any investment decisions.

Rating Framework

Broker Overview

Company Background and Establishment

Capitalix entered the online trading market in 2010. The company positions itself as a multi-asset broker focused on providing accessible trading conditions for retail investors. The company operates as an online trading platform specializing in forex, CFDs, cryptocurrencies, and equity instruments. According to available information, Capitalix aims to bridge the gap between institutional-grade trading tools and retail accessibility. However, detailed information about the company's founding team and corporate structure remains limited in public sources.

The broker's business model centers on providing commission-free trading with revenue generated through spread markups. This approach aligns with industry trends toward zero-commission retail trading. However, traders should understand that costs are typically embedded in wider spreads rather than eliminated entirely.

Platform Technology and Asset Coverage

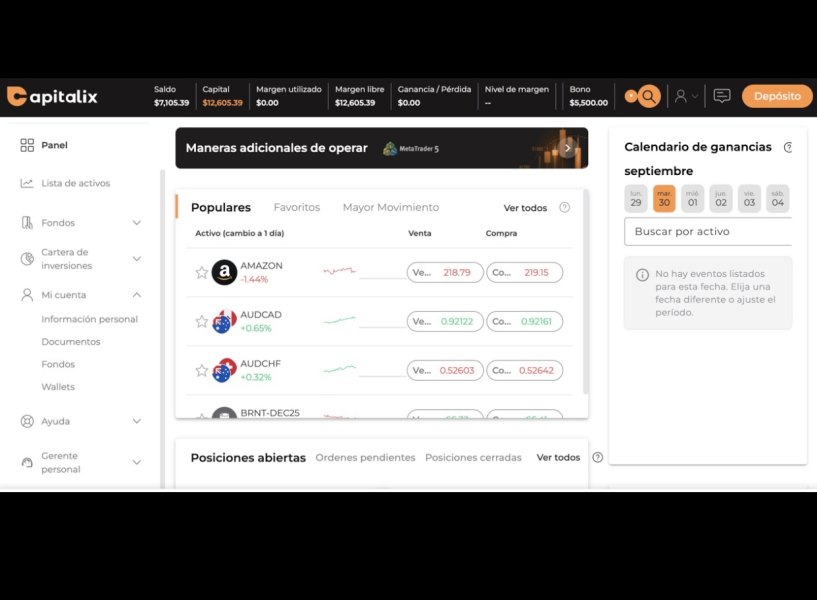

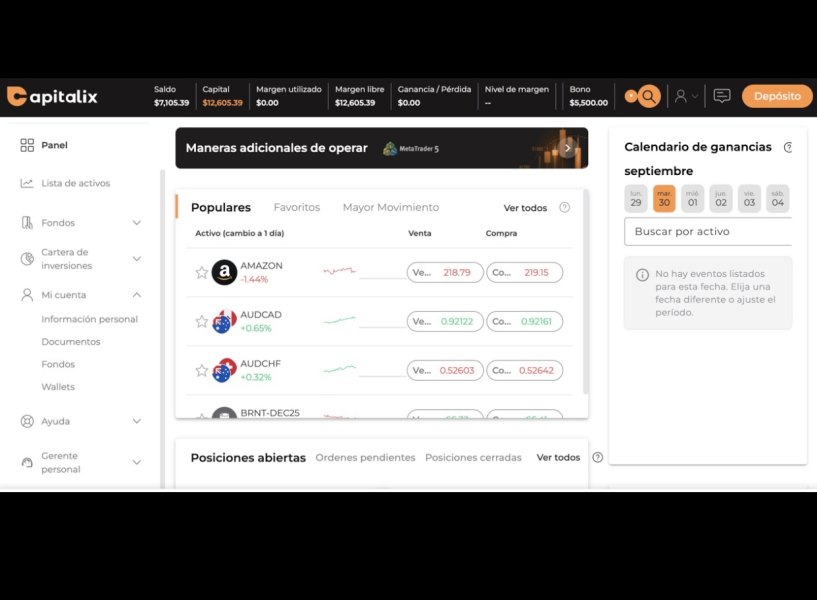

Capitalix supports multiple trading platforms including the industry-standard MetaTrader 4 (MT4), a proprietary WebTrader platform, and mobile applications for iOS and Android devices. The Capitalix review data indicates that the platform provides access to over 350 tradeable instruments spanning major asset classes. The forex selection includes major, minor, and exotic currency pairs, while the CFD offering covers global stock indices, individual equities, commodities, and energy products. Cryptocurrency trading encompasses popular digital assets including Bitcoin, Ethereum, and various altcoins.

The broker operates under the regulatory authority of the Seychelles Financial Services Authority (FSA). This provides the legal framework for its operations. However, traders should note that Seychelles regulation generally offers different investor protection standards compared to more established regulatory jurisdictions.

Regulatory Jurisdiction

Capitalix holds its primary regulatory license through the Seychelles Financial Services Authority (FSA). This offshore regulatory environment provides operational flexibility but may offer limited investor protection compared to tier-1 regulatory frameworks. Traders should carefully consider the implications of this regulatory structure.

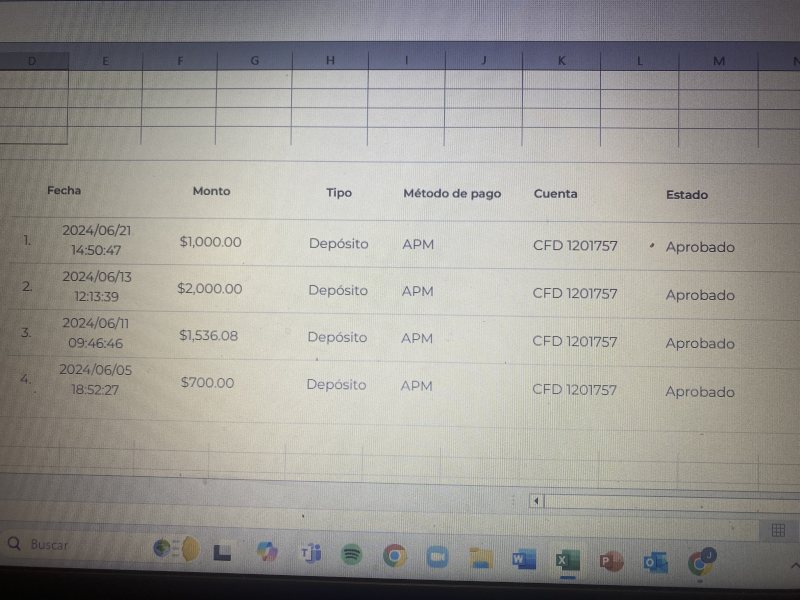

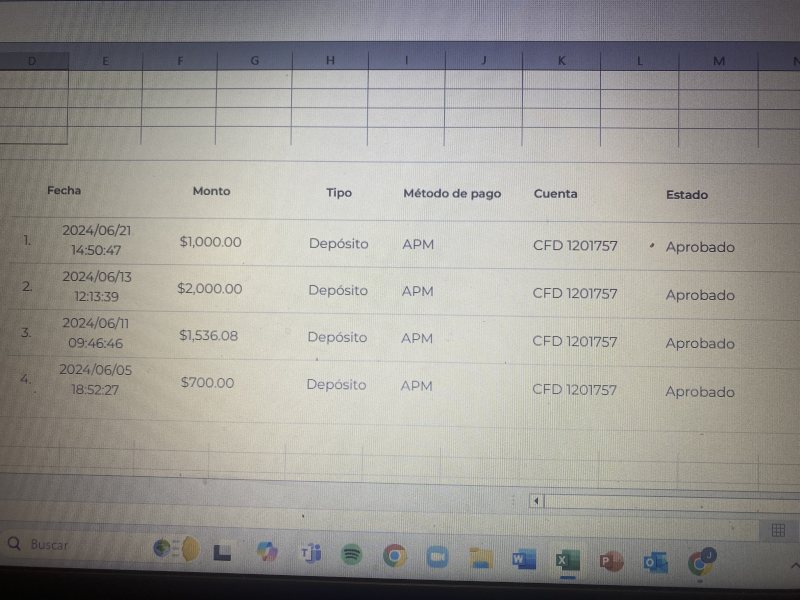

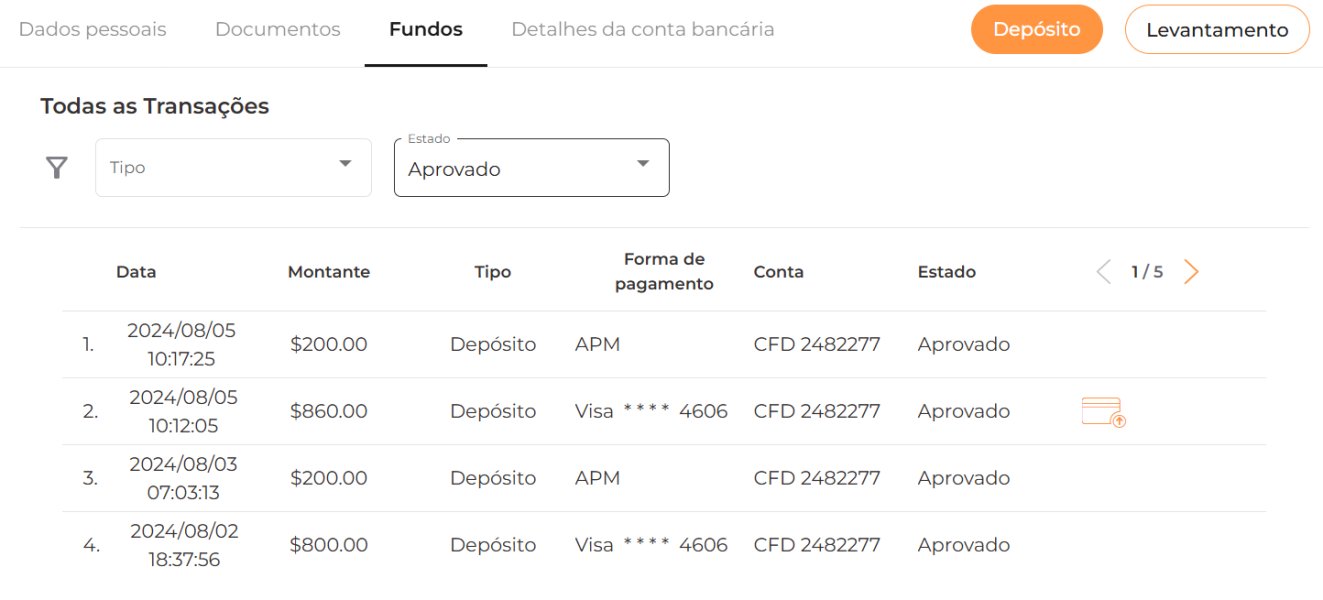

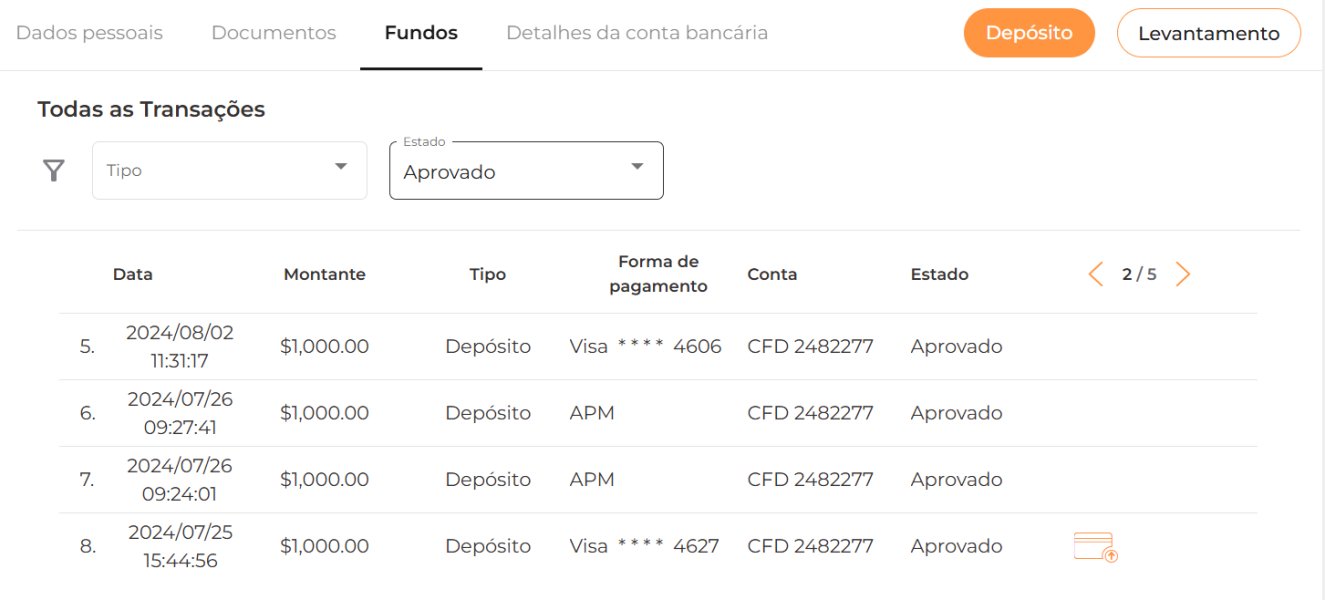

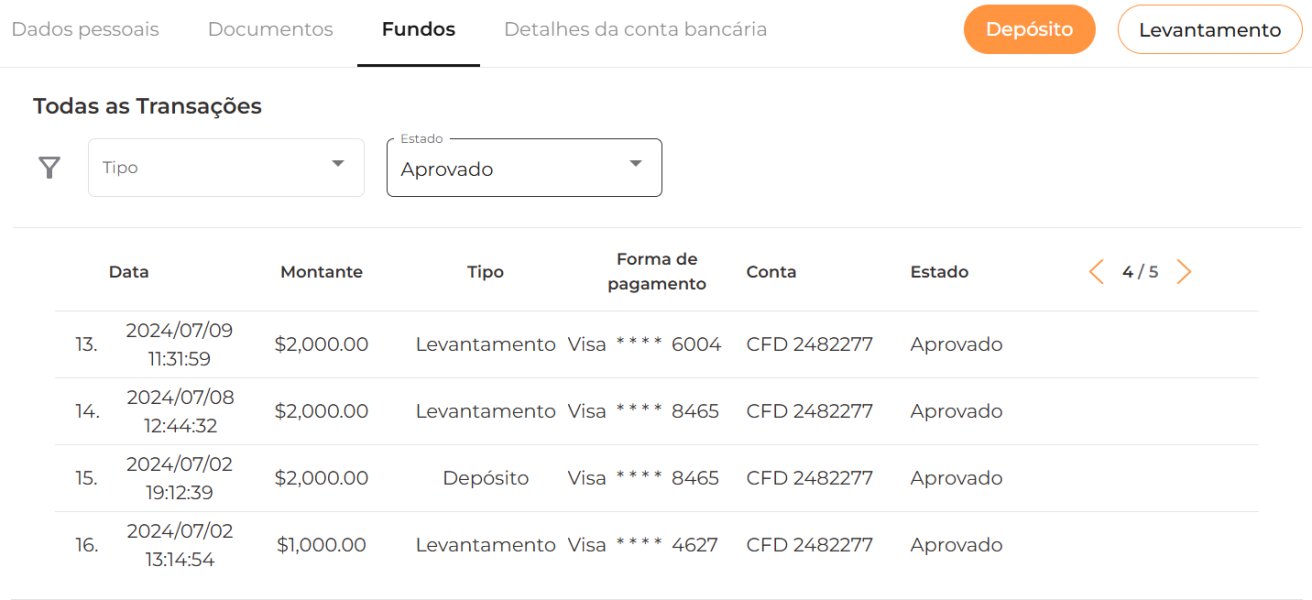

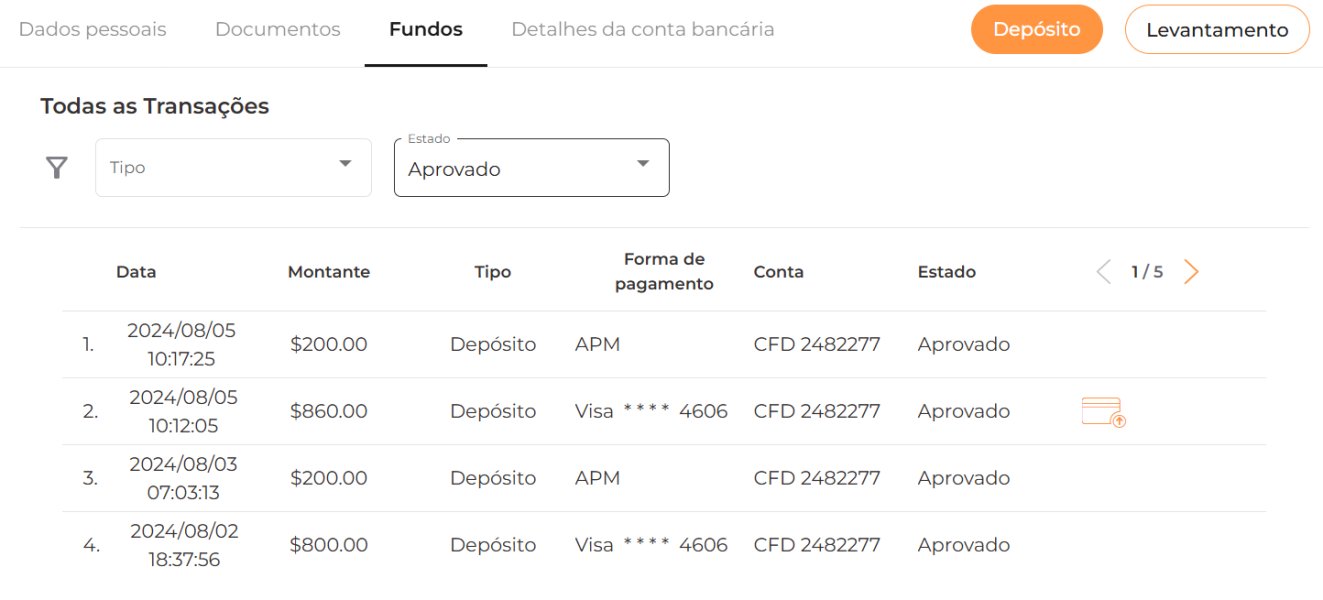

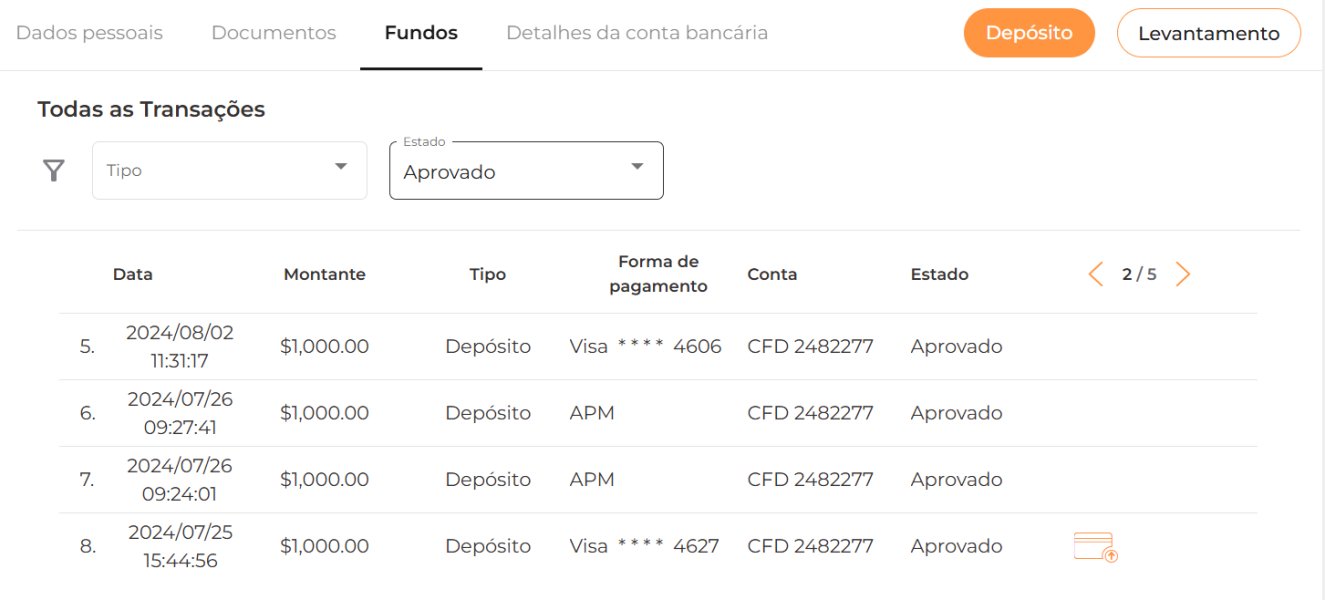

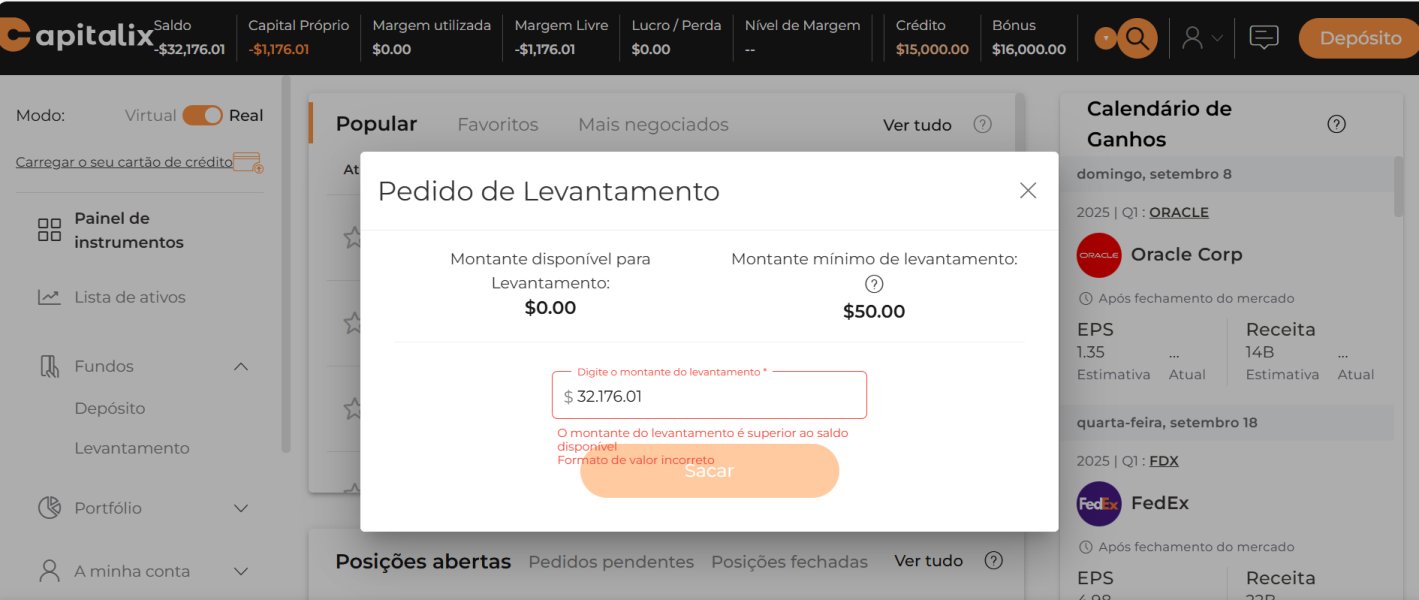

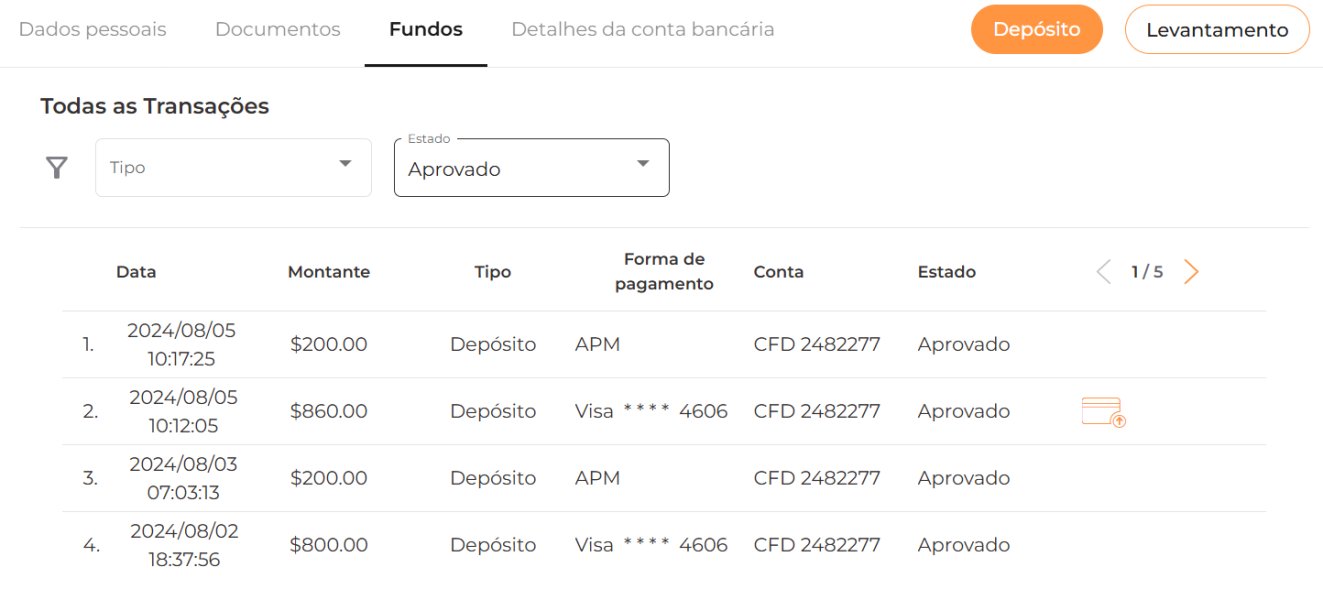

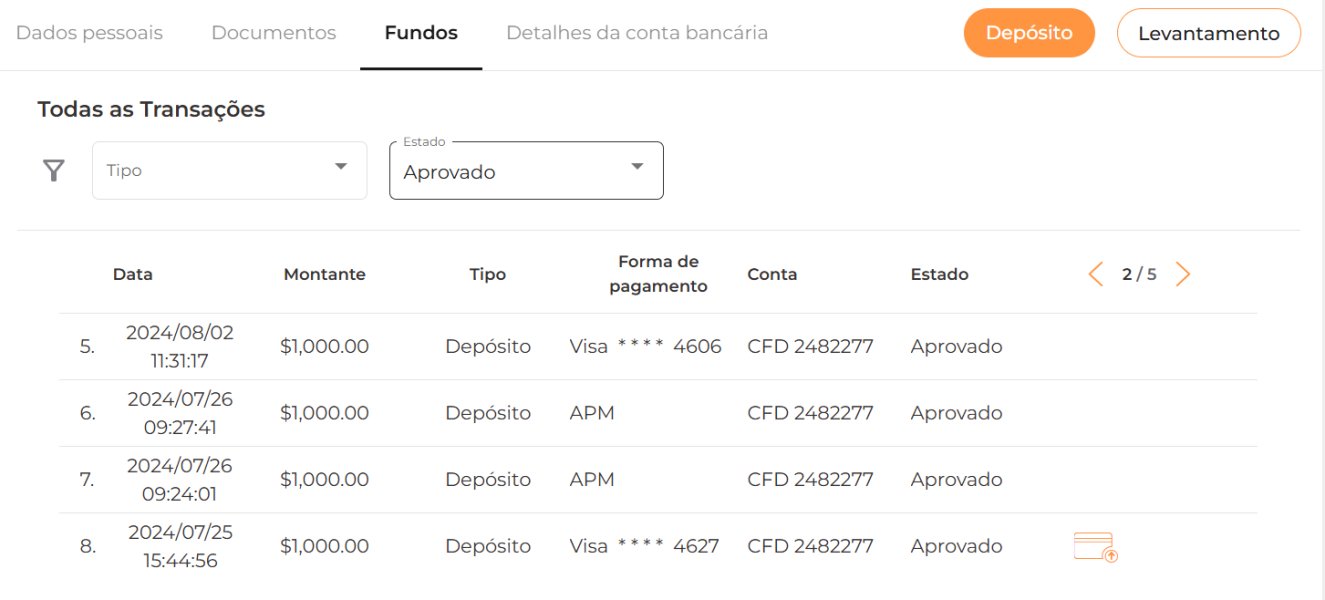

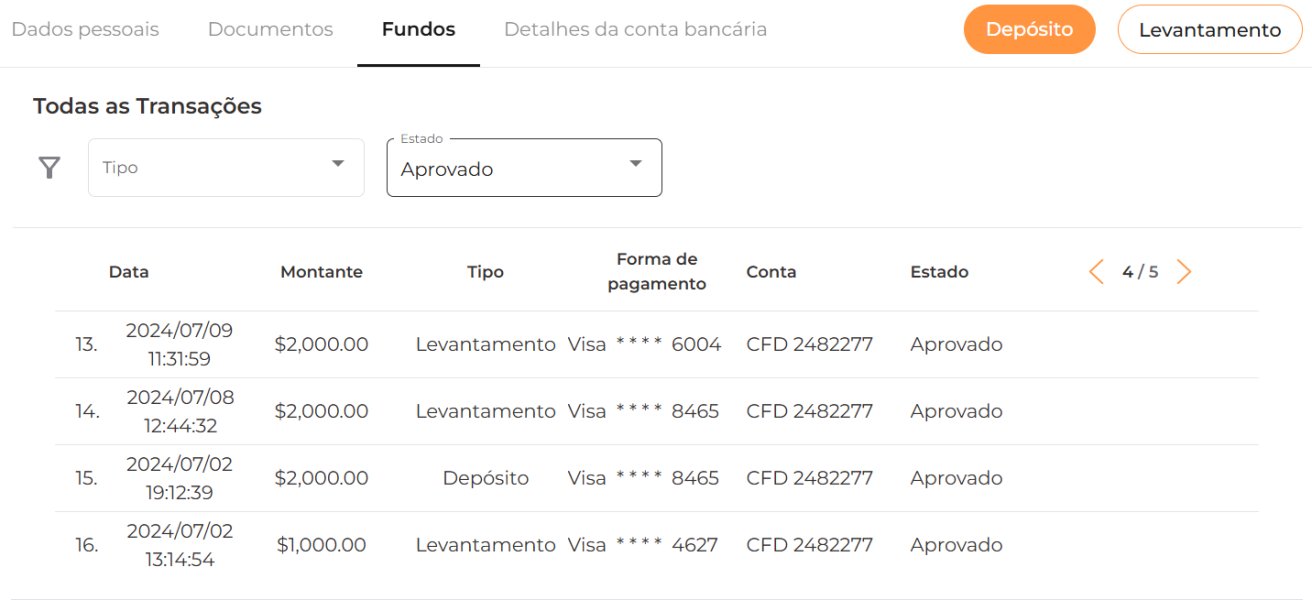

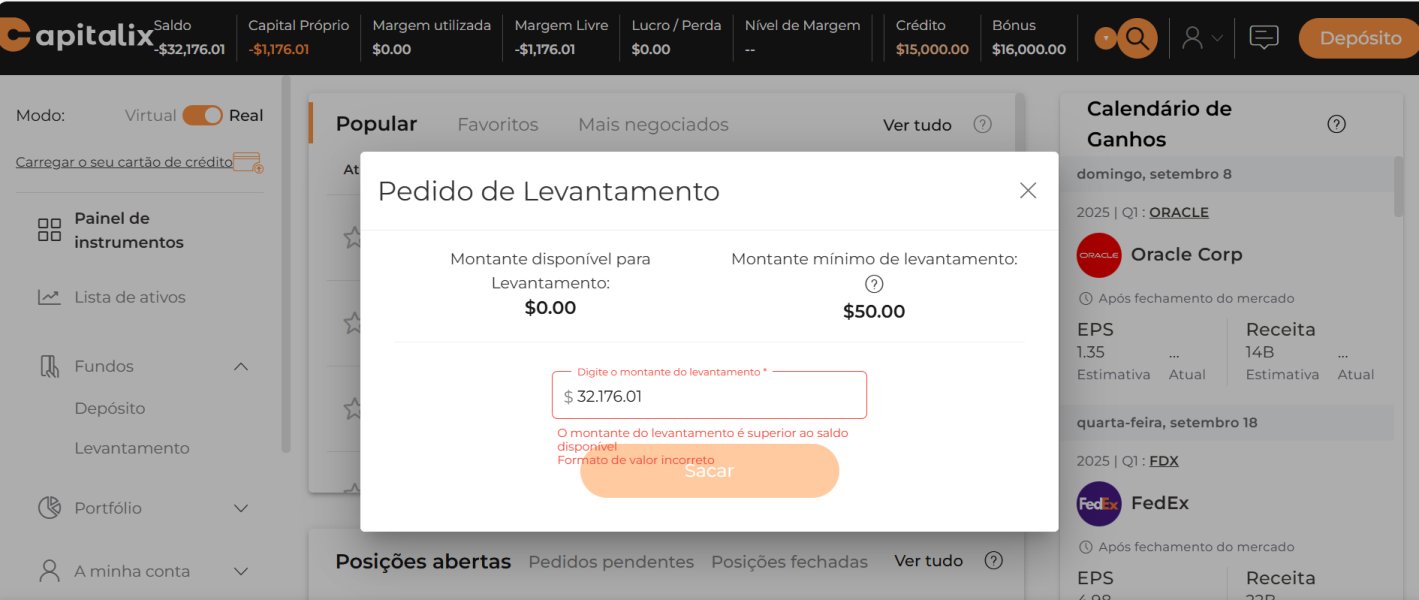

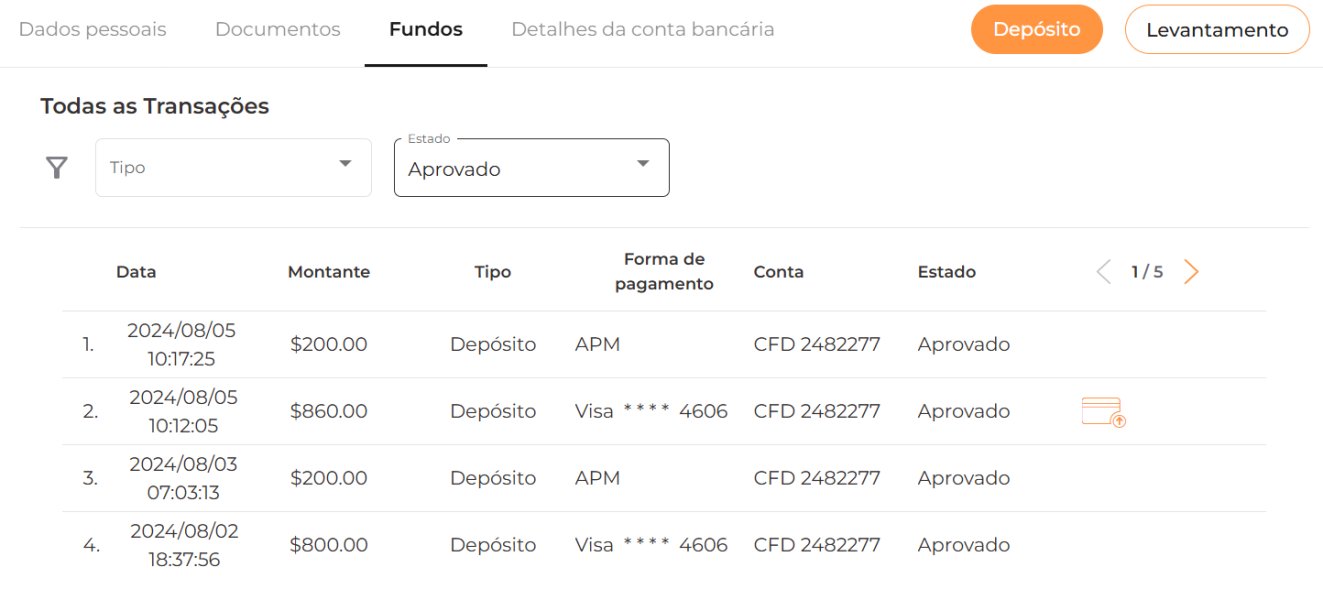

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods was not detailed in available sources. Traders should contact the broker directly to confirm available payment processors, processing times, and any associated fees for funding account transactions.

Minimum Deposit Requirements

The platform maintains a $250 minimum deposit requirement. This positions itself as accessible to small and medium-sized retail traders. This threshold aligns with industry standards for entry-level trading accounts and supports the broker's focus on retail market participation.

Promotional Offerings

Available sources did not provide specific information regarding bonus programs or promotional campaigns. Potential clients should inquire directly about current promotional offerings and carefully review terms and conditions.

Tradeable Instruments

Capitalix provides access to over 350 tradeable instruments across multiple asset classes. The offering includes major and minor forex pairs, global stock indices, individual equity CFDs, commodity contracts, energy products, and cryptocurrency instruments. This supports diversified trading strategies.

Cost Structure Analysis

The broker advertises spreads starting from 0.3 pips with zero commission charges on most instruments. This pricing structure can provide competitive trading costs. However, traders should verify current spreads during active trading sessions and consider the impact of spread widening during volatile market conditions.

Leverage Provisions

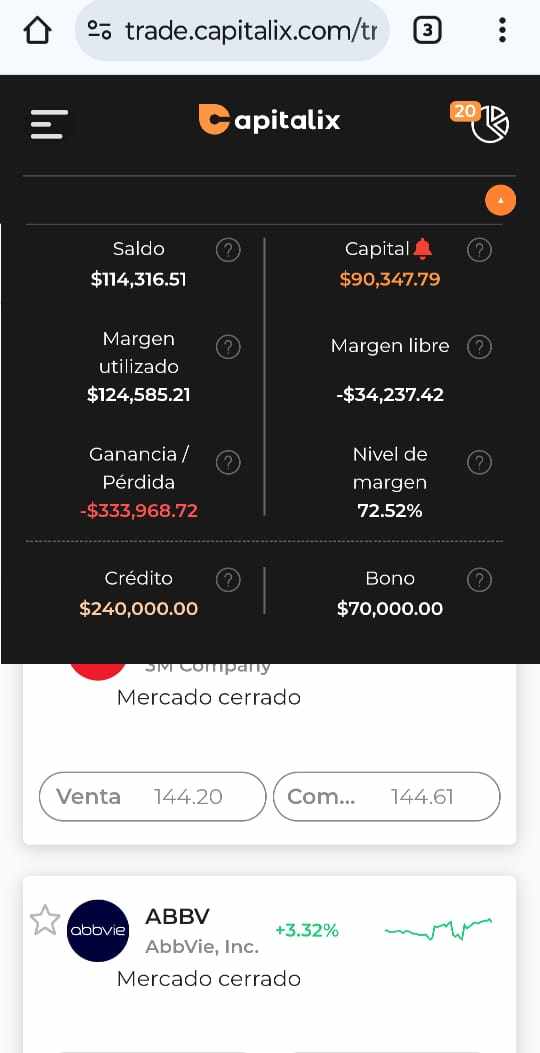

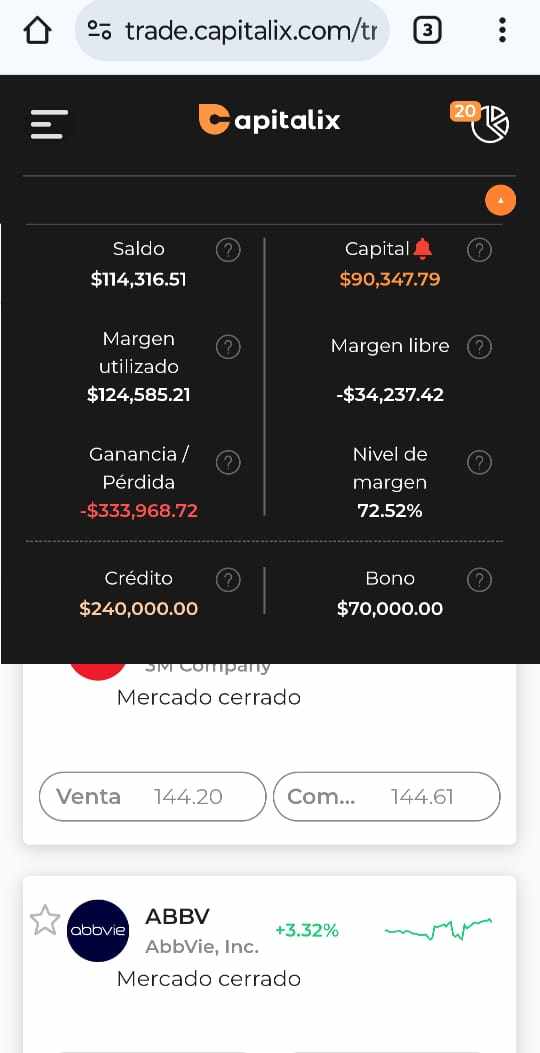

Maximum leverage reaches 1:200. This accommodates various trading strategies while maintaining relatively conservative risk parameters compared to some offshore brokers offering higher leverage ratios.

Platform Selection

Trading platform options include MetaTrader 4, the broker's proprietary WebTrader, and mobile applications. This selection provides flexibility for different trading preferences and technical requirements.

Geographic Restrictions

Specific information regarding geographic trading restrictions was not available in the reviewed sources. Potential clients should verify availability in their jurisdiction before account opening.

Customer Support Languages

Available sources did not specify the range of customer support languages offered by the platform.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

The Capitalix review of account conditions reveals a competitive structure designed to attract retail traders. The $250 minimum deposit requirement positions the broker accessibly within the retail market segment. This allows smaller investors to participate without significant capital barriers. This threshold compares favorably with industry standards, where many brokers require similar or higher initial deposits.

The zero commission structure represents a significant advantage for active traders, particularly those employing scalping or high-frequency strategies where commission costs can accumulate rapidly. However, traders should understand that zero commissions typically mean wider spreads compared to commission-based pricing models. The advertised spreads starting from 0.3 pips appear competitive. However, actual trading spreads may vary based on market conditions and account activity levels.

The 1:200 maximum leverage ratio provides substantial trading power while maintaining relatively conservative risk parameters compared to some offshore brokers offering 1:500 or higher leverage. This leverage level supports various trading strategies without encouraging excessive risk-taking that could lead to rapid account depletion.

Available information did not specify multiple account types or specialized account features such as Islamic accounts for traders requiring swap-free trading conditions. The account opening process details and verification requirements were also not detailed in accessible sources.

Capitalix provides access to the widely-used MetaTrader 4 platform. This offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors (EAs). The MT4 platform includes standard features such as multiple timeframe analysis, custom indicators, and algorithmic trading capabilities that appeal to both manual and automated trading strategies.

The proprietary WebTrader platform provides browser-based trading access without requiring software downloads. This supports traders who prefer web-based solutions or need to access their accounts from multiple devices. Mobile applications for iOS and Android devices extend trading accessibility. However, specific features and functionality of these mobile platforms were not detailed in available sources.

However, the analysis reveals limited information regarding additional research and analytical resources. Many competitive brokers provide daily market analysis, economic calendars, trading signals, and educational webinars to support trader decision-making. The absence of detailed information about these resources in available sources suggests that Capitalix may have limited offerings in this area. This potentially disadvantages traders who rely on broker-provided market intelligence.

Educational resources, which are crucial for developing trader skills and market understanding, were not specifically mentioned in the reviewed materials. This represents a potential gap for novice traders who benefit from structured learning programs and ongoing educational support.

Customer Service and Support Analysis (5/10)

Customer service evaluation for Capitalix faces limitations due to sparse publicly available information regarding support channels, response times, and service quality metrics. According to review aggregation sites, the broker has received some customer complaints. However, specific details about complaint resolution and service quality were not comprehensively documented.

The lack of detailed information about customer support channels—such as live chat availability, phone support hours, email response times, and multilingual support—creates uncertainty for potential clients who prioritize responsive customer service. Effective customer support becomes particularly important when dealing with account issues, technical problems, or withdrawal requests.

User feedback from various sources indicates mixed experiences with customer service, with some traders expressing concerns about response times and issue resolution effectiveness. However, the limited sample size of available reviews makes it difficult to draw definitive conclusions about overall service quality.

The absence of comprehensive FAQ sections, detailed help documentation, or self-service resources in reviewed materials suggests that traders may need to rely primarily on direct contact with support representatives for assistance. This potentially creates bottlenecks during peak inquiry periods.

Trading Experience Analysis (7/10)

The trading experience evaluation for Capitalix review shows several positive aspects, particularly in cost structure and asset diversity. The advertised spreads starting from 0.3 pips provide competitive trading conditions, especially for major currency pairs where tight spreads significantly impact trading profitability. The zero commission structure eliminates per-transaction costs that can accumulate for active traders.

Platform stability and execution quality are crucial factors for trading experience. However, specific performance metrics such as average execution speeds, slippage statistics, or uptime percentages were not available in reviewed sources. The MetaTrader 4 platform generally provides reliable performance. However, individual broker implementation can vary significantly.

The diverse asset selection of over 350 instruments supports various trading strategies and portfolio diversification approaches. This range includes major forex pairs, stock indices, individual equities, commodities, and cryptocurrencies. This allows traders to capitalize on opportunities across multiple markets from a single platform.

Mobile trading capabilities extend accessibility, enabling traders to monitor positions and execute trades away from desktop computers. However, specific mobile platform features and functionality were not detailed in available sources. This makes it difficult to assess the quality of mobile trading experience.

Order execution quality, including fill rates, slippage characteristics, and requote frequency, represents critical aspects of trading experience that were not specifically addressed in available information.

Trust and Reliability Analysis (4/10)

The trust and reliability assessment for Capitalix review reveals several concerning factors that potential clients should carefully consider. The broker operates under Seychelles Financial Services Authority (FSA) regulation. This provides a legal operational framework but generally offers less stringent oversight and investor protection compared to tier-1 regulatory jurisdictions such as the UK's FCA, Cyprus's CySEC, or Australia's ASIC.

According to review aggregation websites, Capitalix has been flagged for suspicious review activity, suggesting potential manipulation of online testimonials and ratings. This raises questions about the authenticity of positive reviews and the overall transparency of the broker's marketing practices. Such activities can indicate broader concerns about business ethics and transparency.

The limited availability of detailed information about the company's management team, corporate structure, and operational transparency creates additional uncertainty. Reputable brokers typically provide comprehensive information about their leadership, regulatory status, and business operations to build client confidence.

Client fund protection measures, such as segregated account arrangements, deposit insurance, or compensation schemes, were not specifically detailed in available sources. These protections are crucial for trader security and represent standard practices among well-regulated brokers.

The absence of detailed information about the company's financial stability, audited financial statements, or third-party security assessments further limits the ability to assess overall reliability and long-term viability.

User Experience Analysis (6/10)

User experience evaluation for Capitalix presents a mixed picture based on available feedback and platform features. The relatively low minimum deposit requirement and zero commission structure create positive initial impressions for cost-conscious traders seeking accessible entry points into financial markets.

Platform accessibility through multiple channels—including MT4, WebTrader, and mobile applications—supports diverse user preferences and technical requirements. However, specific user interface design quality, navigation efficiency, and overall usability were not detailed in available sources.

The account opening and verification process efficiency represents crucial aspects of user experience that were not comprehensively documented. Streamlined onboarding processes with clear documentation requirements and reasonable verification timeframes contribute significantly to positive user experiences.

Available user feedback indicates mixed experiences, with some traders appreciating the competitive trading conditions while others express concerns about customer service responsiveness and transparency issues. The flagged suspicious review activity complicates the assessment of genuine user satisfaction levels.

Common user complaints appear to center around customer service quality and transparency concerns rather than core trading functionality. However, the limited sample size of verified user feedback makes it difficult to identify systematic issues or overall satisfaction trends.

The absence of detailed information about user education resources, account management tools, and self-service capabilities suggests potential limitations in supporting trader development and account management efficiency.

Conclusion

This comprehensive Capitalix review reveals a broker with competitive trading conditions but significant concerns regarding transparency and regulatory oversight. The platform's strengths include zero commission trading, tight spreads from 0.3 pips, and access to over 350 tradeable instruments across multiple asset classes. The $250 minimum deposit makes the platform accessible to retail traders and small investors seeking diverse market exposure.

However, several factors warrant careful consideration. The Seychelles regulatory framework provides limited investor protection compared to tier-1 jurisdictions. Meanwhile, flagged suspicious review activity raises questions about transparency and business practices. Customer service quality appears inconsistent based on available feedback, and limited information about educational resources may disadvantage novice traders.

Capitalix may suit experienced traders who prioritize low trading costs and diverse asset selection while accepting higher regulatory risk. However, traders seeking maximum investor protection and comprehensive support services might consider alternatives with stronger regulatory oversight and more transparent business practices.