Regarding the legitimacy of Capitalix forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Capitalix safe?

Pros

Cons

Is Capitalix markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

4 Square SY Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@4squaresy.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fxroad.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 4B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Capitalix A Scam?

Introduction

Capitalix is a forex and CFD broker that has been operational since 2019, positioning itself as a platform for traders looking to access a variety of financial instruments, including forex pairs, cryptocurrencies, commodities, and indices. With its headquarters in Seychelles and claims of regulatory compliance, Capitalix aims to attract traders from various regions. However, as with any financial service provider, potential clients must exercise caution and conduct due diligence before committing their funds. The forex market is rife with both legitimate brokers and scams, making it crucial for traders to thoroughly assess the credibility of their chosen broker.

This article will evaluate Capitalix's legitimacy through a comprehensive investigation that includes its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks. By employing a structured framework, we aim to provide a balanced view of whether Capitalix is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory environment surrounding a broker is one of the most critical factors that determine its legitimacy. Capitalix claims to be regulated by the Financial Services Authority (FSA) of Seychelles. While this regulatory status provides some level of oversight, it is important to note that the FSA is considered a less stringent regulatory body compared to top-tier regulators like the FCA (UK) or ASIC (Australia).

Here is a summary of Capitalix's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | SD 052 | Seychelles | Valid |

Despite holding a license from the FSA, the quality of regulation is often questioned. Offshore regulators like the FSA do not impose the same stringent requirements as their onshore counterparts, which can lead to potential risks for traders. For instance, there are no guarantees of client fund protection or compensation schemes in place, which are commonly offered by more reputable regulatory authorities. Moreover, the absence of a robust regulatory framework raises concerns regarding Capitalix's operational practices and adherence to compliance standards.

Company Background Investigation

Capitalix is operated by 4 Square SY Ltd, a company registered in Seychelles. The broker claims to provide a transparent trading environment, but details about its ownership structure and management team remain sparse. The lack of transparency can be a red flag for potential investors, as it raises questions about accountability and the broker's operational integrity.

The management team's background and professional experience are crucial in assessing the broker's reliability. However, the information available on Capitalix's website does not provide sufficient details about the individuals leading the company or their qualifications. This lack of information can lead to skepticism among potential clients, as it is difficult to ascertain the broker's credibility without knowing who is behind the operations.

Furthermore, the broker's transparency regarding its operations and financial practices is questionable. Many reviews indicate that Capitalix has not been forthcoming with essential information about its services, fees, and trading conditions. This opacity can lead to misunderstandings and ultimately impact traders' experiences negatively.

Trading Conditions Analysis

Capitalix offers a range of trading conditions that include various account types, leverage options, and fee structures. The broker claims to provide competitive pricing, with spreads starting as low as 0.5 pips and leverage up to 1:200. However, it is essential to scrutinize these claims further.

Heres a summary of the core trading costs associated with Capitalix:

| Fee Type | Capitalix | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 - 3 pips | 1.5 - 2 pips |

| Commission Model | No commissions | Varies |

| Overnight Interest Range | Varies | Varies |

Despite the attractive spread offerings, the absence of transparency regarding fees can be concerning. For instance, while Capitalix claims to have a commission-free trading model, it does not provide clear information on any potential hidden fees or charges that may arise during the trading process. This lack of clarity can lead to unexpected costs that traders may encounter, particularly when withdrawing funds or maintaining their accounts.

Moreover, the broker's fee structure includes potential inactivity fees, which can deter traders who do not trade frequently. Such fees can be a significant disadvantage, especially for those who may want to take a break from trading or are unable to engage regularly due to personal circumstances.

Customer Fund Security

The security of customer funds is paramount when evaluating a broker's credibility. Capitalix states that it segregates client funds from its operational funds, which is a standard practice among reputable brokers. This means that clients' money should not be used for the broker's operational expenses, providing an additional layer of protection.

However, the effectiveness of these measures can vary significantly based on the regulatory framework governing the broker. As mentioned earlier, the FSA's oversight may not offer the same level of protection as that provided by top-tier regulators. Additionally, the absence of a compensation scheme, which would safeguard traders in the event of the broker's insolvency, raises further concerns.

Capitalix also claims to implement negative balance protection, ensuring that clients cannot lose more than their initial deposit. While this feature can mitigate risks associated with trading, it is essential for traders to remain aware of the inherent risks of leveraged trading, which can lead to significant losses even with protective measures in place.

Customer Experience and Complaints

Customer feedback is invaluable in assessing the reliability of a broker. Unfortunately, reviews for Capitalix are predominantly negative, with many users reporting issues related to withdrawals, account management, and customer service responsiveness. Common complaints include difficulty in accessing funds, aggressive sales tactics, and inadequate support when issues arise.

Heres a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Management | Medium | Inconsistent |

| Customer Support Availability | High | Poor communication |

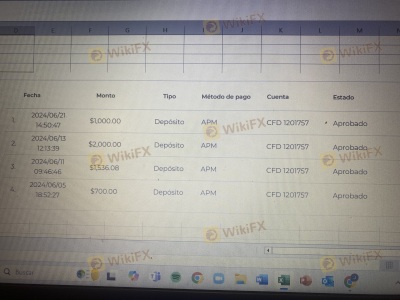

Numerous users have reported that after making initial deposits, they faced significant challenges when attempting to withdraw their funds. Many claimed that their withdrawal requests were either delayed or denied, often accompanied by requests for additional deposits to "secure" their funds. This pattern is indicative of potential scam behavior, as it mirrors tactics commonly employed by fraudulent brokers to retain clients' money.

For instance, one user reported losing a substantial amount of money due to pressure from their account manager to invest more, only to find themselves unable to withdraw their funds later. Such experiences raise serious concerns about the broker's practices and the overall safety of clients' investments.

Platform and Trade Execution

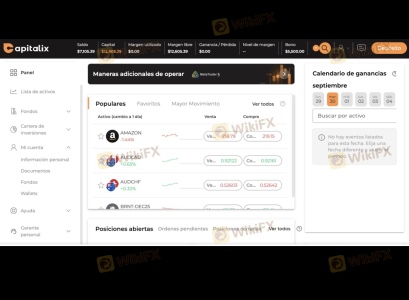

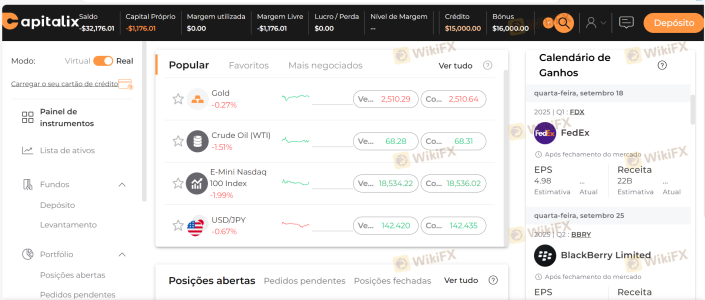

The trading platform offered by Capitalix is a proprietary web-based solution that lacks the advanced features and reliability associated with industry-standard platforms like MetaTrader 4 or 5. While the platform is designed to be user-friendly, the absence of robust analytical tools and real-time data may hinder traders' ability to make informed decisions.

Additionally, the quality of order execution is critical for traders. Reports of slippage, delays, and rejected orders have surfaced, leading to further dissatisfaction among users. The lack of transparency regarding order execution policies and performance metrics can exacerbate these issues, making it challenging for traders to trust the platform's reliability.

Risk Assessment

Trading with Capitalix presents several risks that potential clients should consider. The combination of offshore regulation, questionable customer service practices, and negative user experiences raises significant concerns about the broker's overall trustworthiness.

Heres a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal issues. |

| Transparency Risk | Medium | Lack of clear information on fees and trading conditions. |

| Platform Reliability Risk | Medium | Reports of slippage and execution issues. |

To mitigate these risks, traders are advised to conduct thorough research, consider the use of demo accounts before committing real funds, and remain cautious about the amount they invest initially. Diversifying investments and avoiding overly leveraged positions can also help manage potential losses.

Conclusion and Recommendations

In conclusion, while Capitalix presents itself as a legitimate broker with regulatory backing from the Seychelles FSA, the overall assessment indicates that caution is warranted. The combination of negative customer feedback, potential withdrawal issues, and a lack of transparency suggests that traders should be wary of engaging with this broker.

For those considering Capitalix, it is crucial to weigh the risks carefully and be prepared for possible challenges related to fund withdrawals and customer support. If you are a novice trader or someone looking for a reliable trading environment, it may be advisable to explore alternative brokers with stronger regulatory frameworks and positive reputations, such as those regulated by the FCA or ASIC.

In summary, while Capitalix may offer some attractive trading conditions, the potential risks and negative customer experiences highlight the importance of thorough research and caution when selecting a forex broker.

Is Capitalix a scam, or is it legit?

The latest exposure and evaluation content of Capitalix brokers.

Capitalix Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Capitalix latest industry rating score is 2.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.