Regarding the legitimacy of ZFX forex brokers, it provides FCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is ZFX safe?

Pros

Cons

Is ZFX markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

Zeal Capital Market (UK) Limited

Effective Date:

2017-09-04Email Address of Licensed Institution:

support@zfx.co.uk, complaints@zfx.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.zfx.co.ukExpiration Time:

--Address of Licensed Institution:

Landmark Space Ltd 1 Royal Exchange London City Of London EC3V 3DG UNITED KINGDOMPhone Number of Licensed Institution:

+442071579968Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Zeal Capital Market (Seychelles) Limited

Effective Date:

--Email Address of Licensed Institution:

cs@zfx.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.zfx.comExpiration Time:

--Address of Licensed Institution:

Room 2, Green Corner Building, Providence Industrial Estate, Mahe, Seychelles.Phone Number of Licensed Institution:

4344034Licensed Institution Certified Documents:

Is ZFX A Scam?

Introduction

ZFX, short for Zeal Capital Market, is a forex and CFD broker that has been gaining attention in the trading community since its establishment in 2016. Headquartered in London, United Kingdom, ZFX positions itself as a global player in the forex market, offering a variety of financial instruments, including currency pairs, commodities, indices, and stocks. As the popularity of online trading continues to rise, traders must exercise caution when selecting a broker, as the industry is rife with both reputable firms and potential scams. This article aims to provide a comprehensive analysis of ZFX, evaluating its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The assessment is based on a review of multiple credible sources, including regulatory disclosures, user reviews, and expert analyses.

Regulation and Legitimacy

The regulation of a forex broker is crucial for ensuring the safety and security of traders' funds. ZFX is regulated by two primary authorities: the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. The FCA is widely regarded as one of the most stringent regulatory bodies in the world, enforcing strict compliance standards that protect traders. On the other hand, the FSA is considered a tier-3 regulator, which may not provide the same level of oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 768451 | United Kingdom | Verified |

| FSA | SD 027 | Seychelles | Verified |

The FCA's oversight ensures that ZFX adheres to high standards of transparency and fairness, including the segregation of client funds. This means that clients' money is kept separate from the broker's operational funds, enhancing security. Additionally, the FCA provides compensation coverage of up to £85,000 for clients in the event of broker insolvency. However, the FSA does not offer such protections, which raises concerns for traders operating under ZFX's Seychelles entity. Overall, while ZFX's FCA regulation offers a strong layer of security, the presence of offshore regulation can be a red flag for some traders.

Company Background Investigation

ZFX is part of the Zeal Group, a conglomerate that includes various regulated financial institutions and fintech companies. The broker was founded by a team of experienced traders with decades of industry knowledge, aiming to provide next-level trading services to both retail and institutional investors. The company's commitment to transparency is evident in its operational practices and the accessibility of information on its website.

The management team at ZFX comprises seasoned professionals with extensive backgrounds in finance and trading, which adds credibility to the broker's operations. However, the companys relatively short history in the industry, having been established only in 2016, may raise questions for potential clients about its long-term viability. Transparency regarding company ownership and affiliations is crucial, and ZFX appears to maintain a reasonable level of disclosure regarding its operations.

Trading Conditions Analysis

ZFX offers various trading accounts, including mini, standard, and ECN accounts, catering to different types of traders. The broker's fee structure is competitive, with no commissions on most accounts, although ECN accounts may incur additional fees.

| Fee Type | ZFX | Industry Average |

|---|---|---|

| Spread for Major Pairs | From 1.3 pips | From 1.0 pips |

| Commission Model | None (most) | Varies widely |

| Overnight Interest Range | Varies | Varies widely |

The minimum deposit to open a mini account is $50, which is relatively low compared to many brokers. However, the ECN account requires a minimum deposit of $1,000, which may not be suitable for beginner traders. Overall, ZFX's trading conditions appear favorable, but potential clients should be aware of the varying costs associated with different account types.

Customer Fund Security

The safety of customer funds is paramount for any trading broker. ZFX implements several measures to ensure fund security, including the segregation of client funds from company funds. This practice is essential in mitigating risks associated with broker insolvency. Additionally, ZFX offers negative balance protection, which prevents traders from losing more than their deposited amount.

Despite these safety measures, traders should remain vigilant. While ZFX has not reported any significant fund security issues, the lack of compensation schemes for clients trading under the Seychelles entity raises concerns. Traders should conduct thorough research and consider their risk tolerance before engaging with ZFX.

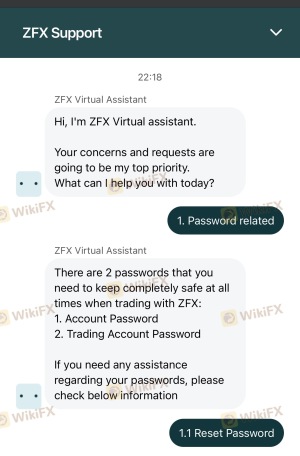

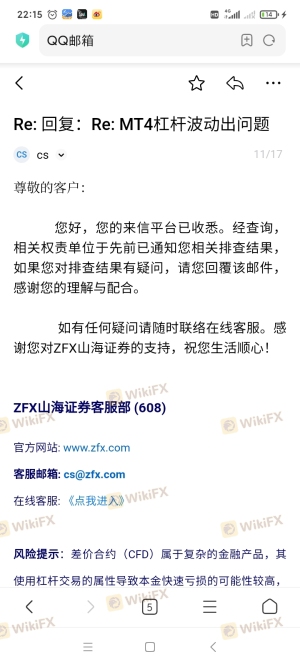

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of ZFX are mixed, with some users praising the broker's competitive spreads and efficient withdrawal processes, while others report issues related to customer support and fund withdrawals.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Some delays reported |

| Customer Support Availability | High | Limited hours |

| Slippage and Execution Issues | Medium | Addressed but inconsistent |

Typical complaints include delays in processing withdrawals and difficulties in reaching customer support. For instance, one user reported successful withdrawals but faced challenges when attempting to contact support for assistance with account issues. Such feedback highlights the importance of prompt and effective customer service in the trading environment.

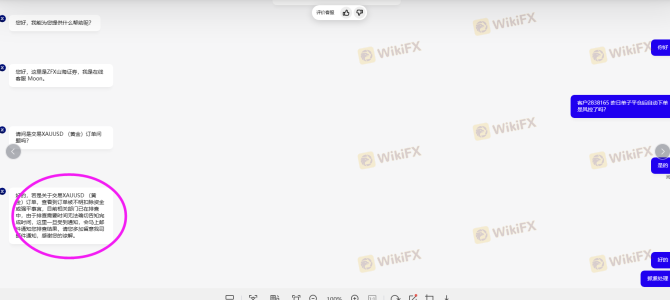

Platform and Trade Execution

ZFX utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. The platform supports various order types, technical analysis tools, and automated trading options. However, some users have reported issues with order execution, including slippage and rejected orders during volatile market conditions.

The overall performance of ZFX's trading platform appears satisfactory, but traders should remain cautious of potential execution problems, particularly during high volatility periods.

Risk Assessment

Engaging with ZFX carries specific risks that traders should consider. While the broker is regulated by reputable authorities, the presence of offshore regulation raises concerns regarding the level of investor protection.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may offer less protection. |

| Execution Risk | Medium | Potential for slippage and rejected orders. |

| Customer Support Risk | High | Limited availability and mixed feedback. |

To mitigate these risks, traders are advised to maintain a diversified portfolio, utilize risk management strategies, and thoroughly review ZFX's terms and conditions before trading.

Conclusion and Recommendations

In conclusion, ZFX appears to be a legitimate broker with strong regulatory backing from the FCA. However, the presence of offshore regulation and mixed customer feedback necessitates caution. While ZFX offers competitive trading conditions and a user-friendly platform, potential traders should be aware of the risks and consider their individual trading needs.

For traders seeking alternatives, brokers with robust regulatory frameworks and positive user experiences, such as IG Group or OANDA, may provide safer options. Ultimately, conducting thorough research and due diligence is essential for any trader looking to engage with ZFX or any other forex broker.

Is ZFX a scam, or is it legit?

The latest exposure and evaluation content of ZFX brokers.

ZFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZFX latest industry rating score is 2.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.