ZFX 2025 Review: Everything You Need to Know

Executive Summary

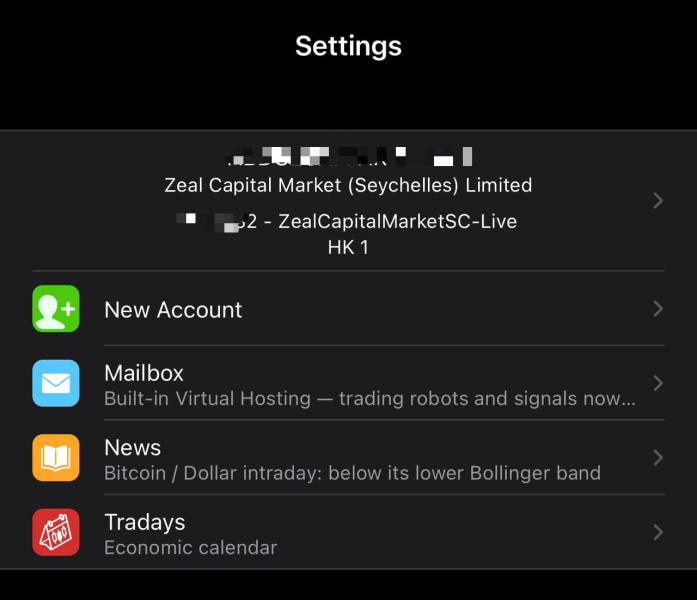

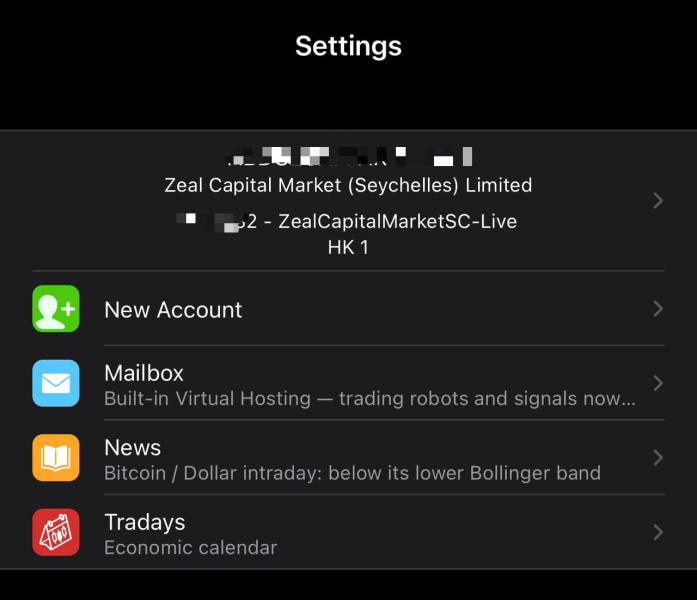

This zfx review looks at a regulated online trading platform that serves both retail and institutional investors. ZFX operates under the regulatory oversight of the UK's Financial Conduct Authority (FCA) and the Financial Services Authority (FSA) in Seychelles, providing traders with access to multiple asset classes including forex, indices, commodities, stocks, and cryptocurrencies through the popular MetaTrader 4 platform.

The broker stands out through its focus on educational resources and trading strategy tools. This makes it particularly appealing to traders seeking comprehensive learning materials alongside their trading activities. ZFX offers copy trading functionality and economic calendars to enhance trading strategies, while maintaining cross-device compatibility through dedicated mobile applications.

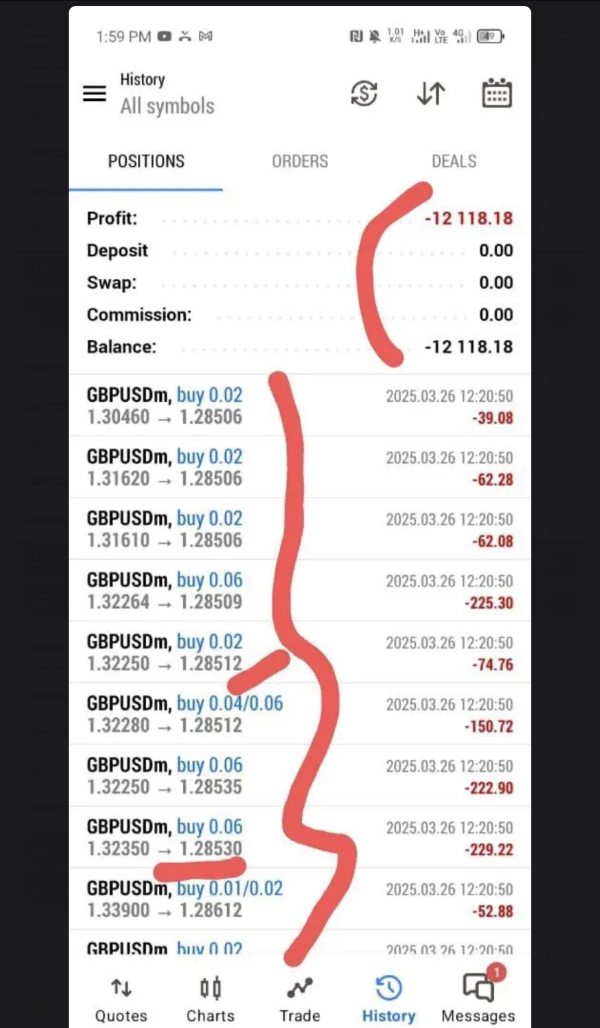

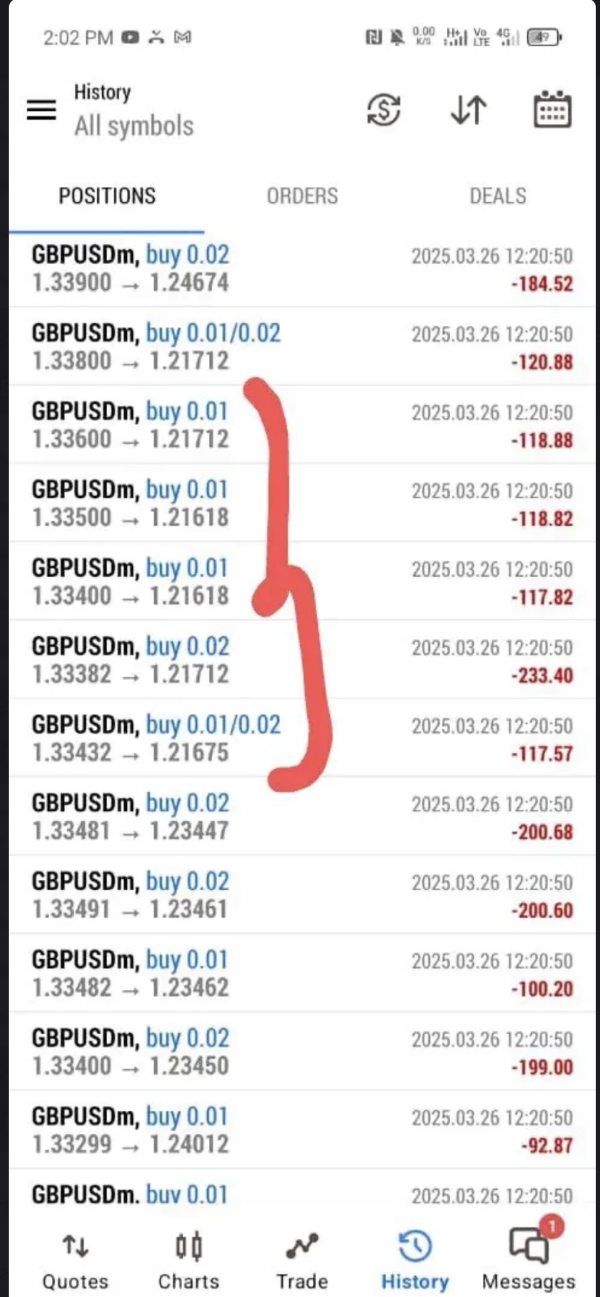

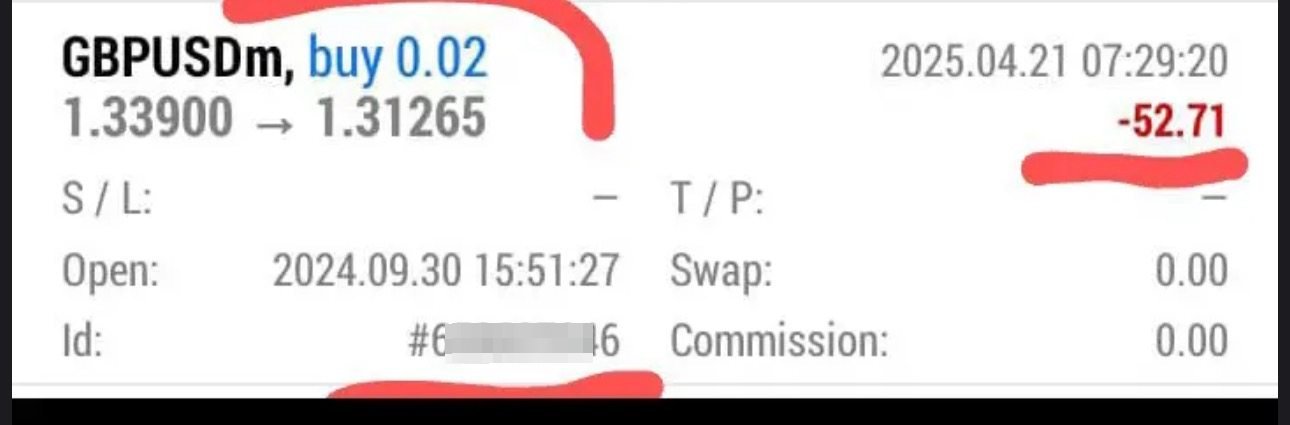

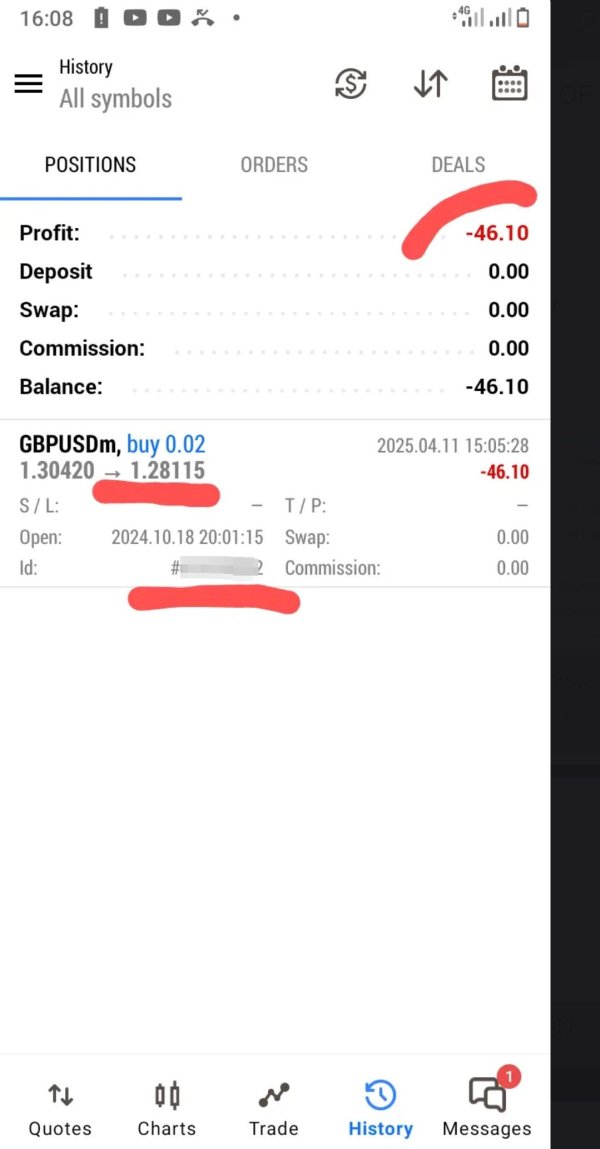

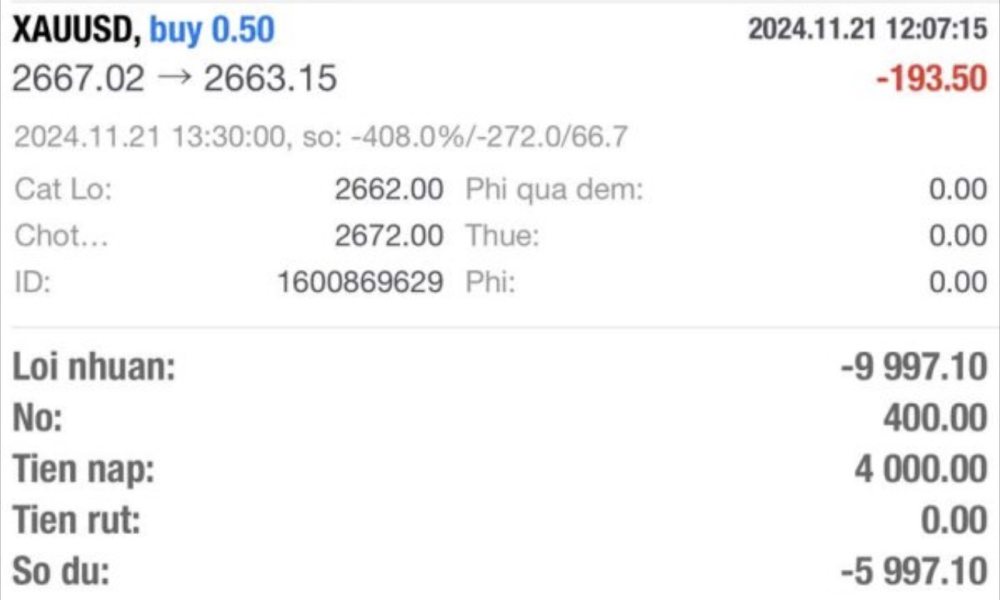

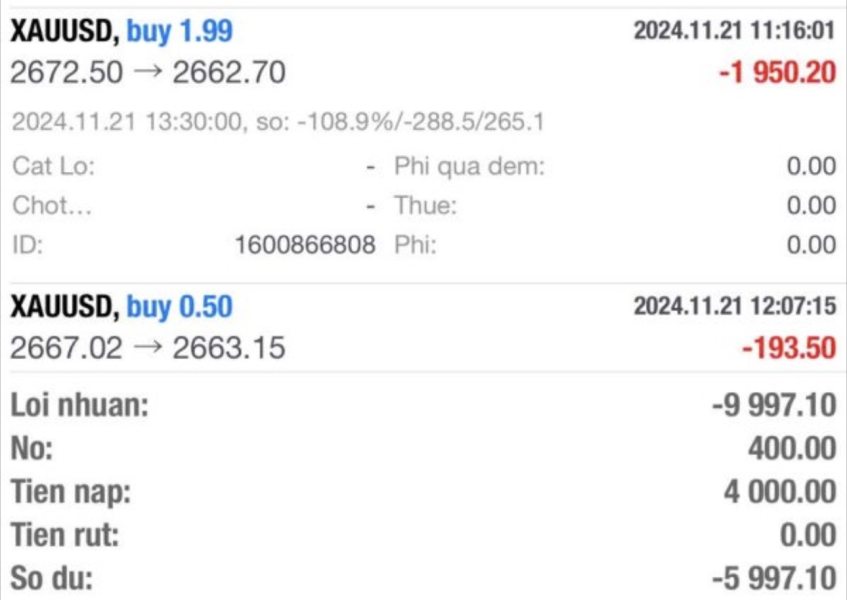

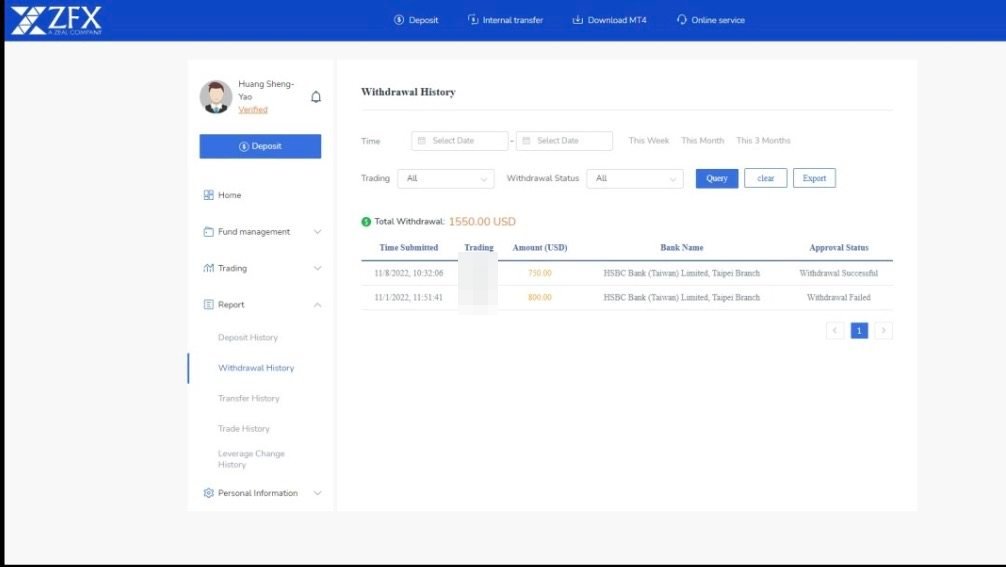

However, user feedback regarding ZFX shows mixed results. While the platform's regulatory standing and diverse trading instruments receive positive recognition, concerns have been raised about withdrawal processing times and customer service quality. Some users have expressed expectations for faster withdrawal processing, with one review specifically mentioning hopes for "one minute" withdrawal capabilities, suggesting current processing times may not meet all user expectations.

The broker's target audience includes both retail traders seeking accessible investment opportunities and institutional investors requiring more sophisticated trading solutions. This reflects ZFX's goal to serve a broad spectrum of market participants.

Important Disclaimer

Regional Entity Differences: ZFX operates under different regulatory frameworks across various jurisdictions. The platform is regulated by the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority (FSA) in Seychelles. Traders should verify which regulatory entity governs their specific region and understand the different protections and regulations that may apply to their accounts.

Review Methodology: This evaluation is based on publicly available information, user feedback, and regulatory data current as of the review date. Information regarding broker services, fees, and policies may change over time. Readers should verify current terms and conditions directly with ZFX before making trading decisions. The assessment reflects available data and user experiences but may not capture all aspects of the trading experience for every user demographic.

Rating Framework

Broker Overview

ZFX represents a modern approach to online trading. The company established itself as a platform designed to make investing more accessible to a diverse range of market participants. The company's founding vision centered on creating a revolutionary trading platform that would bridge the gap between retail traders seeking accessible investment opportunities and institutional investors requiring sophisticated trading infrastructure.

This dual focus reflects the founders' recognition of the evolving needs within the financial trading landscape. The broker's business model revolves around providing comprehensive trading services across multiple asset classes, supported by educational resources and strategic trading tools. ZFX has positioned itself as more than just a trading platform, emphasizing the importance of trader education and providing resources that enable users to develop and refine their trading strategies.

This approach suggests a long-term view of client relationships, focusing on trader development rather than purely transactional interactions. ZFX operates primarily through the MetaTrader 4 platform, a widely recognized and trusted trading interface that provides robust functionality for both novice and experienced traders. The platform supports trading across currencies, cryptocurrencies, indices, metals, energies, and stocks, offering significant diversification opportunities within a single trading environment.

The broker's emphasis on cross-device compatibility ensures that traders can access their accounts and execute trades seamlessly across desktop and mobile platforms. The regulatory framework supporting ZFX operations includes oversight from two significant financial authorities: the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority (FSA) in Seychelles. This dual regulatory structure provides different levels of protection and oversight depending on the trader's jurisdiction, contributing to the platform's credibility while accommodating various international trading requirements.

Key Trading Details

Regulatory Oversight: ZFX operates under dual regulatory supervision. The Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority (FSA) in Seychelles provide oversight. This regulatory structure ensures compliance with international trading standards and provides trader protections consistent with established financial regulations.

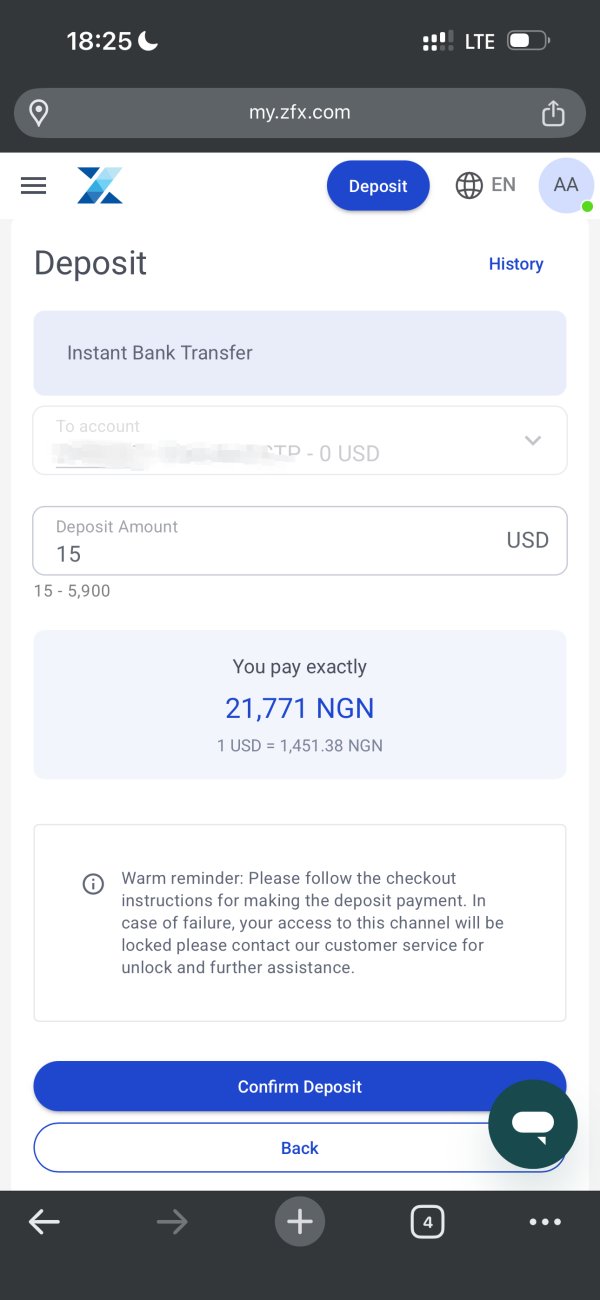

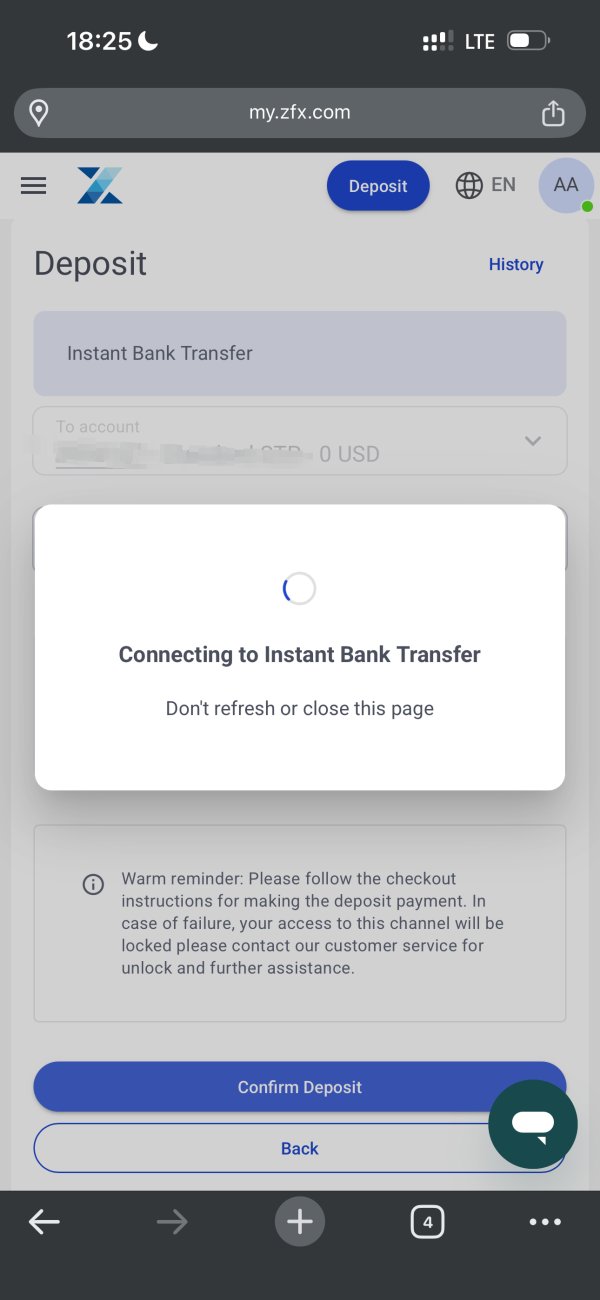

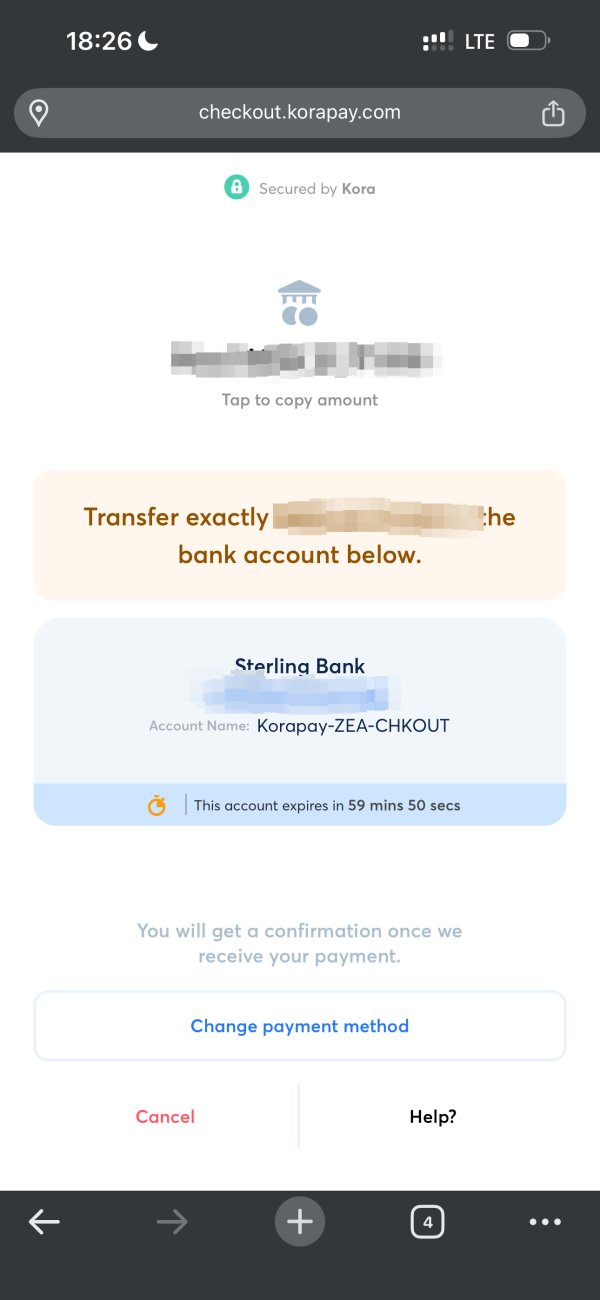

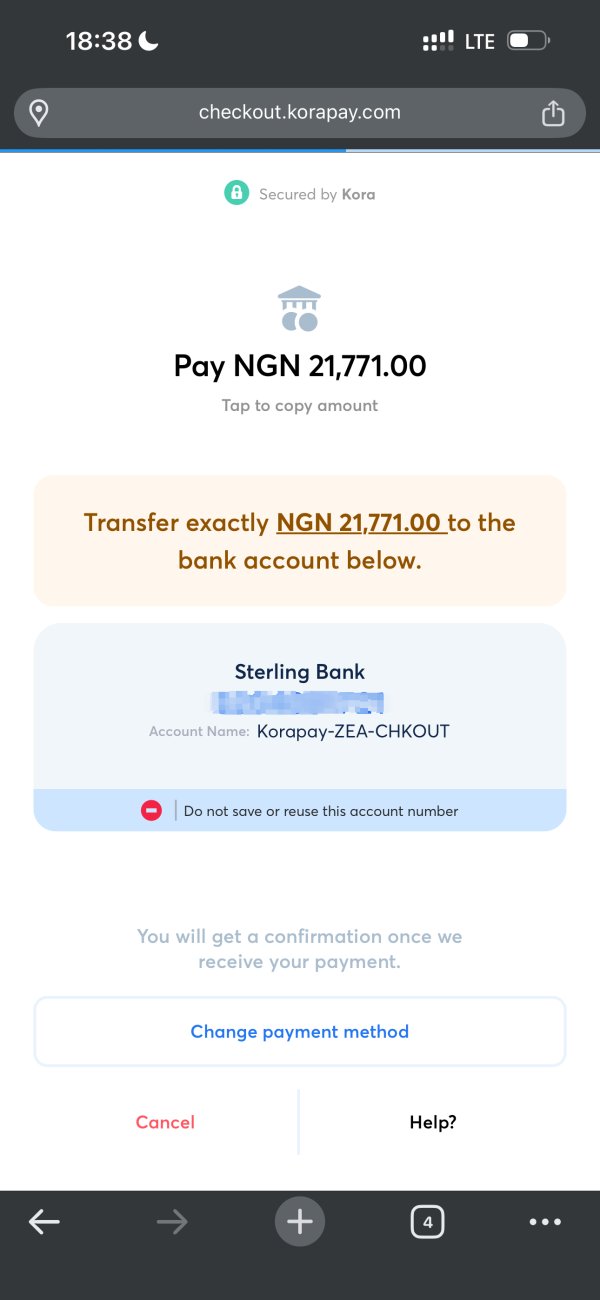

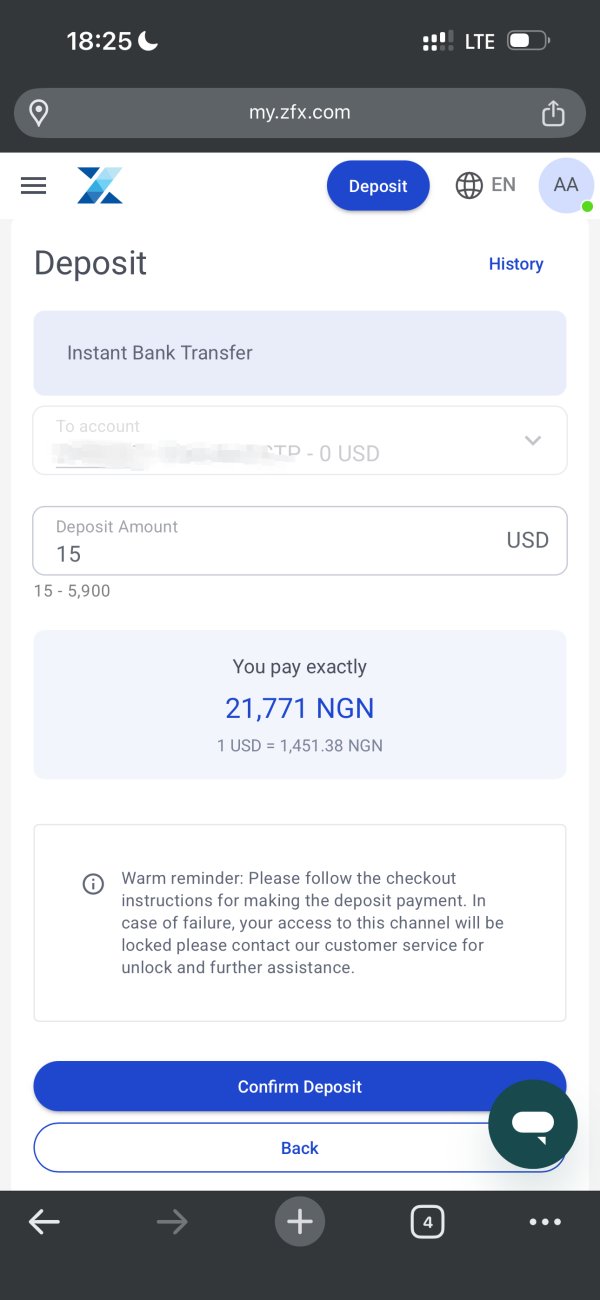

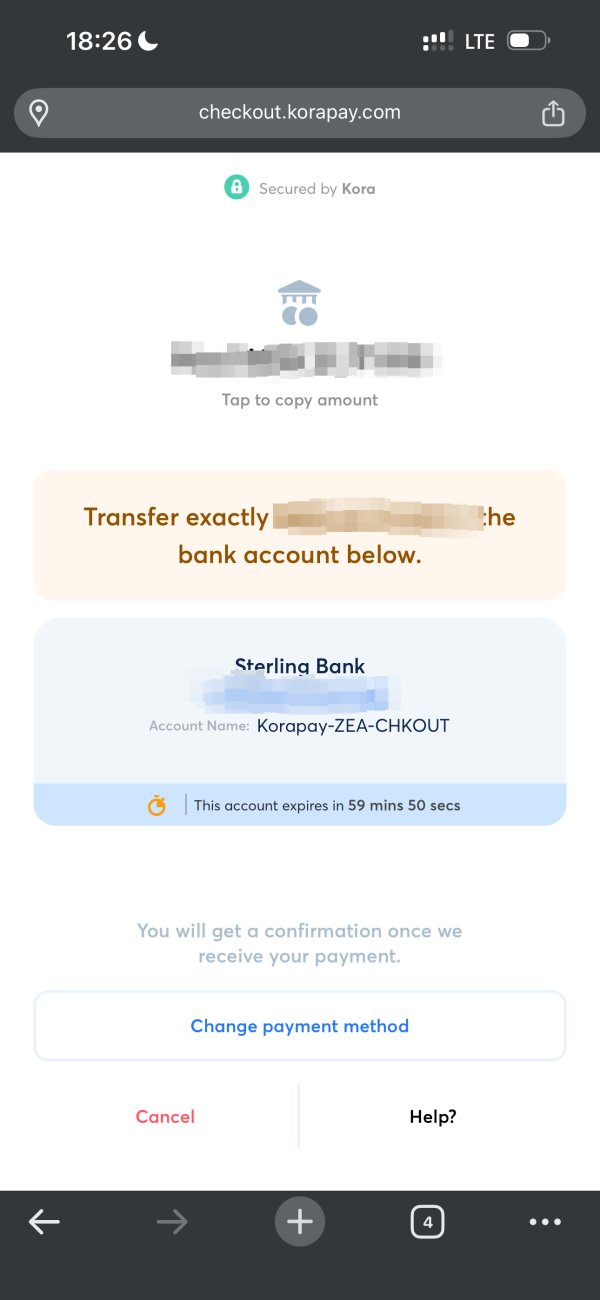

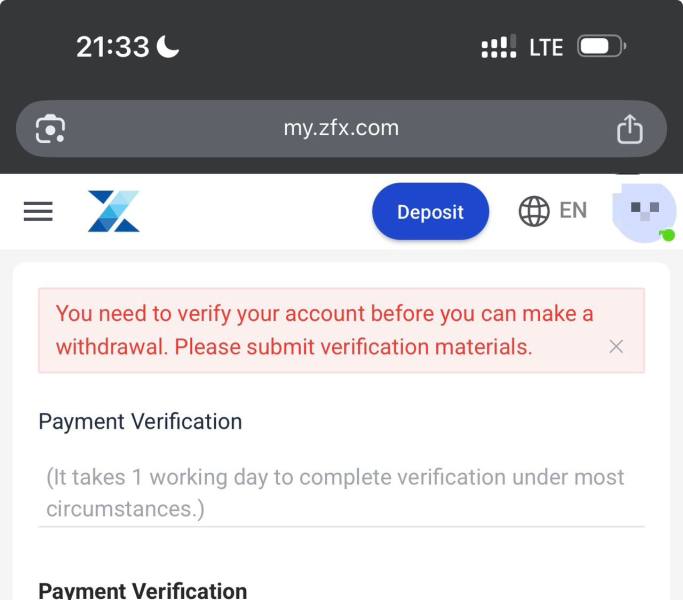

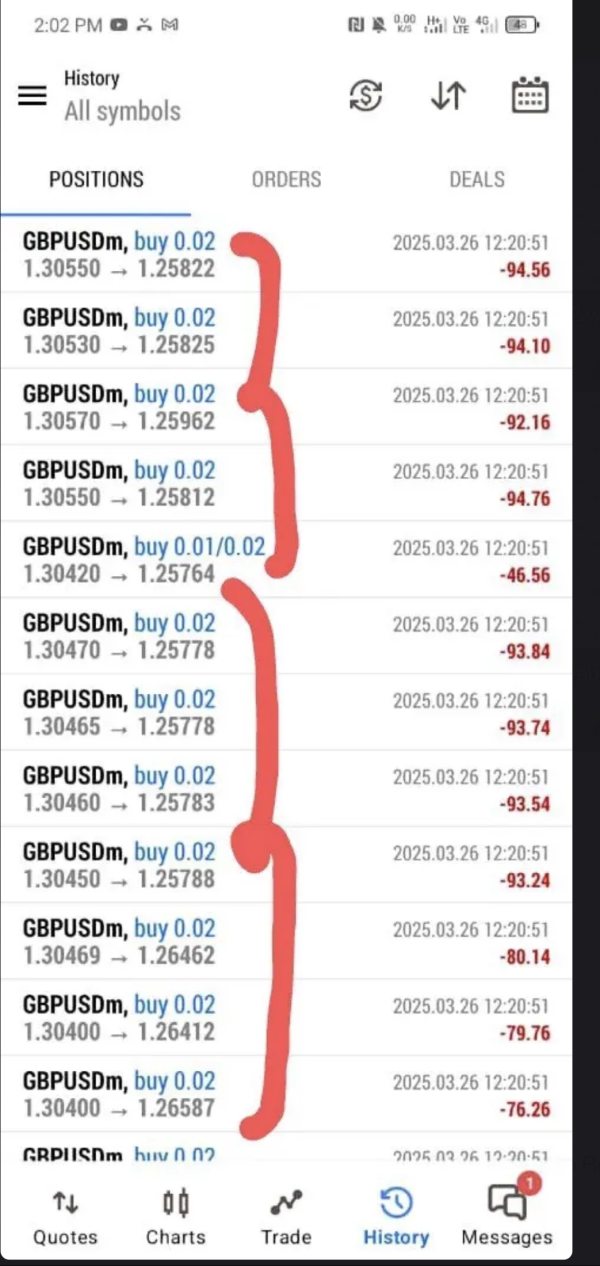

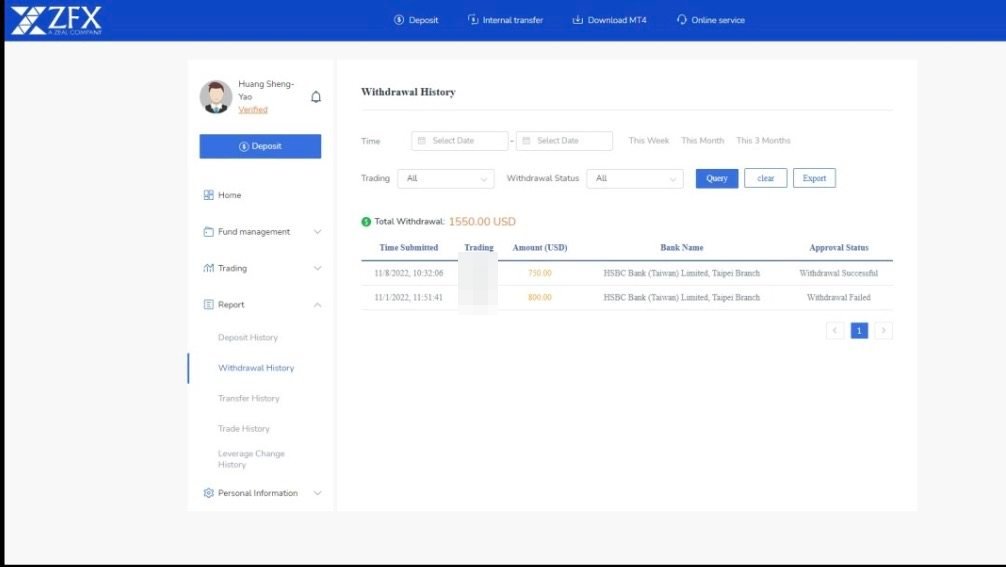

Deposit and Withdrawal Methods: Specific funding methods and withdrawal procedures are not detailed in available source materials. However, user feedback indicates ongoing discussions about withdrawal processing speeds and efficiency.

Minimum Deposit Requirements: Current minimum deposit thresholds are not specified in the available information. This requires direct verification with the broker for accurate account opening requirements.

Promotional Offerings: Details regarding bonus structures, promotional campaigns, or incentive programs are not mentioned in the source materials reviewed.

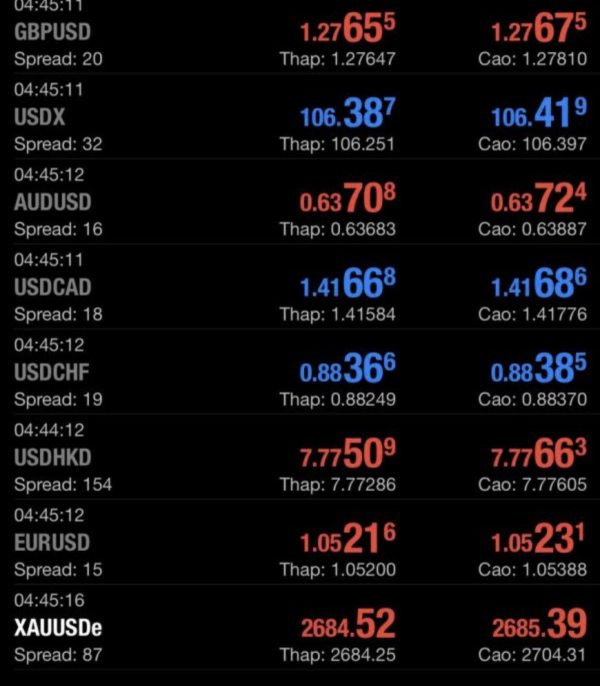

Tradeable Assets: ZFX provides access to a comprehensive range of financial instruments. These include major and minor currency pairs, cryptocurrency assets, global indices, precious metals, energy commodities, and individual stock positions, offering significant portfolio diversification opportunities.

Cost Structure: Specific information regarding spreads, commission rates, overnight fees, and other trading costs is not detailed in the available sources. However, the platform is noted to offer "low" spreads according to some rating systems.

Leverage Ratios: Maximum leverage availability and margin requirements are not specified in the current information set.

Platform Technology: The broker exclusively utilizes MetaTrader 4. This provides traders with a proven, feature-rich trading environment that supports automated trading, technical analysis, and custom indicators.

Geographic Restrictions: Specific country restrictions or regulatory limitations are not outlined in the available source materials.

Customer Support Languages: The range of supported languages for customer service is not specified in current documentation. This requires direct inquiry for multilingual support availability.

This zfx review continues with detailed analysis of each evaluation criterion based on available information and user feedback.

Detailed Analysis

Account Conditions Analysis

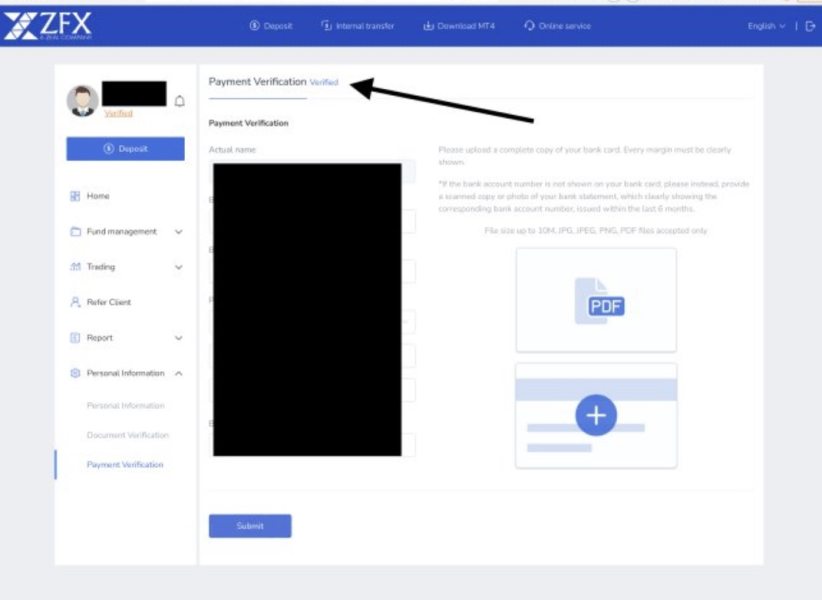

The account structure and conditions offered by ZFX remain largely unspecified in available public information. This creates a significant information gap for potential traders evaluating the platform. This lack of transparency regarding fundamental account details such as minimum deposit requirements, available account types, and specific terms of service represents a notable limitation in assessing the broker's competitiveness within the market.

Without detailed information about account tiers, traders cannot effectively compare ZFX's offerings against industry standards. They also cannot determine which account type might best suit their trading capital and strategy requirements. The absence of clearly published minimum deposit thresholds makes it difficult for potential clients to understand the financial commitment required to begin trading with the platform.

The account opening process, verification requirements, and any special account features such as Islamic accounts or professional trader classifications are not addressed in current public materials. This information gap extends to understanding what additional services or benefits might be available to different account holders, potentially including reduced spreads, dedicated support, or enhanced trading tools.

For traders considering ZFX, the recommendation would be to directly contact the broker to obtain comprehensive account condition details before making any commitment. This zfx review highlights the importance of transparency in account terms, which appears to be an area where ZFX could improve its public communication and marketing materials to better serve potential clients seeking detailed preliminary information.

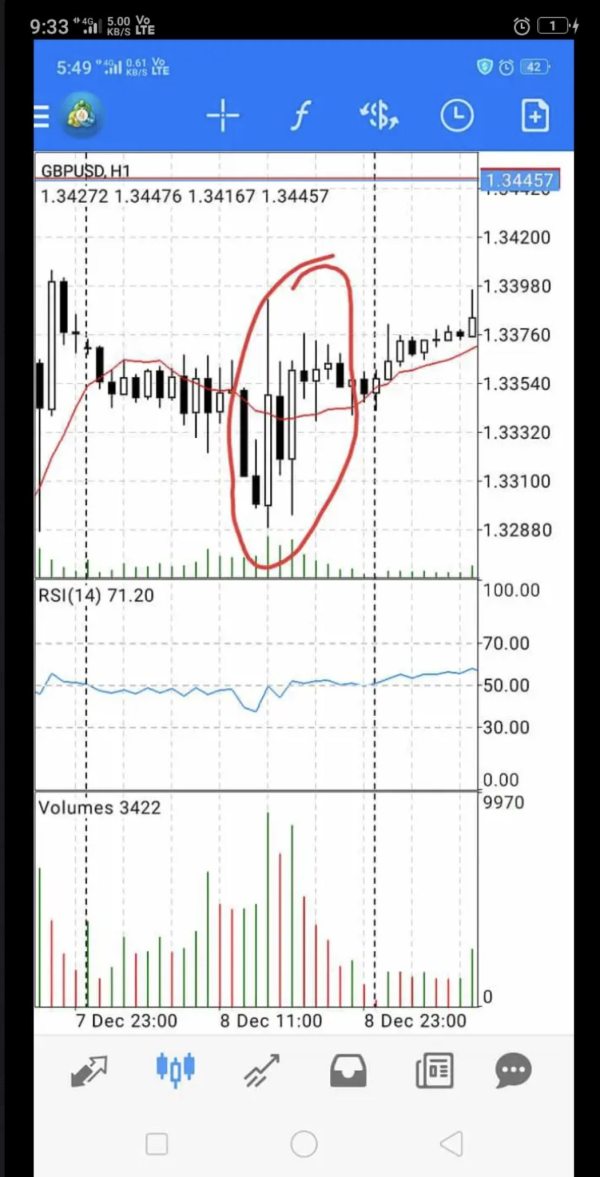

ZFX demonstrates strong performance in the tools and resources category. This is primarily through its comprehensive MetaTrader 4 implementation and diverse asset coverage. The platform's commitment to providing educational resources and strategic trading tools positions it favorably for traders seeking more than basic execution capabilities.

The MetaTrader 4 integration provides traders with access to advanced charting capabilities, technical analysis tools, automated trading through Expert Advisors, and custom indicator development. This platform choice reflects an understanding of trader needs for sophisticated analysis tools while maintaining user-friendly operation for less experienced market participants.

The broker's emphasis on educational resources represents a significant value proposition, particularly for developing traders who benefit from structured learning materials and strategy development guidance. The inclusion of copy trading functionality allows less experienced traders to learn from successful strategies while potentially generating returns, creating a bridge between education and practical application.

Economic calendar integration provides essential fundamental analysis support. This enables traders to stay informed about market-moving events and plan their trading activities around significant economic releases. This tool integration suggests a comprehensive approach to trader support that extends beyond basic platform functionality.

The multi-asset trading environment covering forex, cryptocurrencies, indices, metals, energies, and stocks provides significant diversification opportunities within a single platform. This reduces the need for traders to maintain multiple broker relationships to access different markets. However, specific details about research resources, market analysis, and advanced trading tools beyond the standard MetaTrader 4 offering are not detailed in available sources.

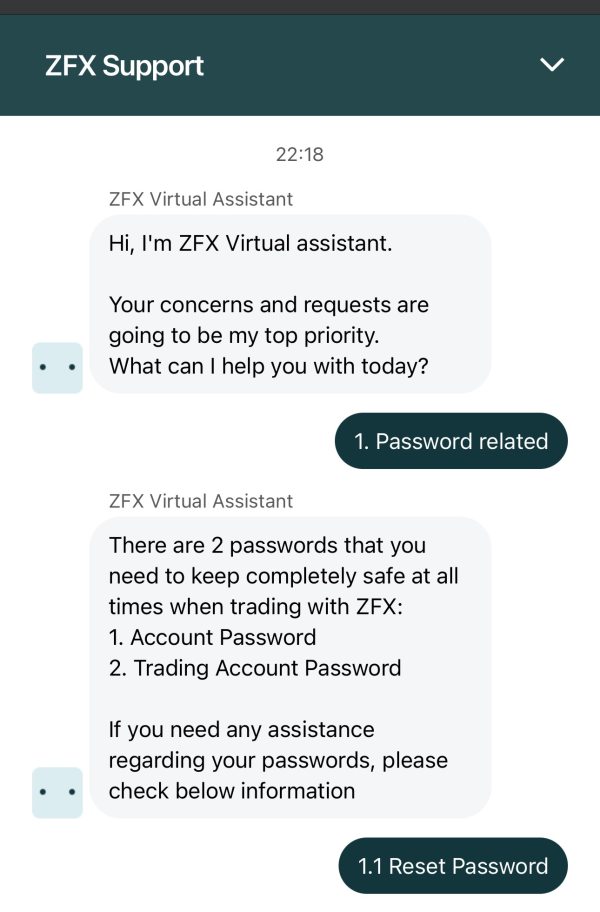

Customer Service and Support Analysis

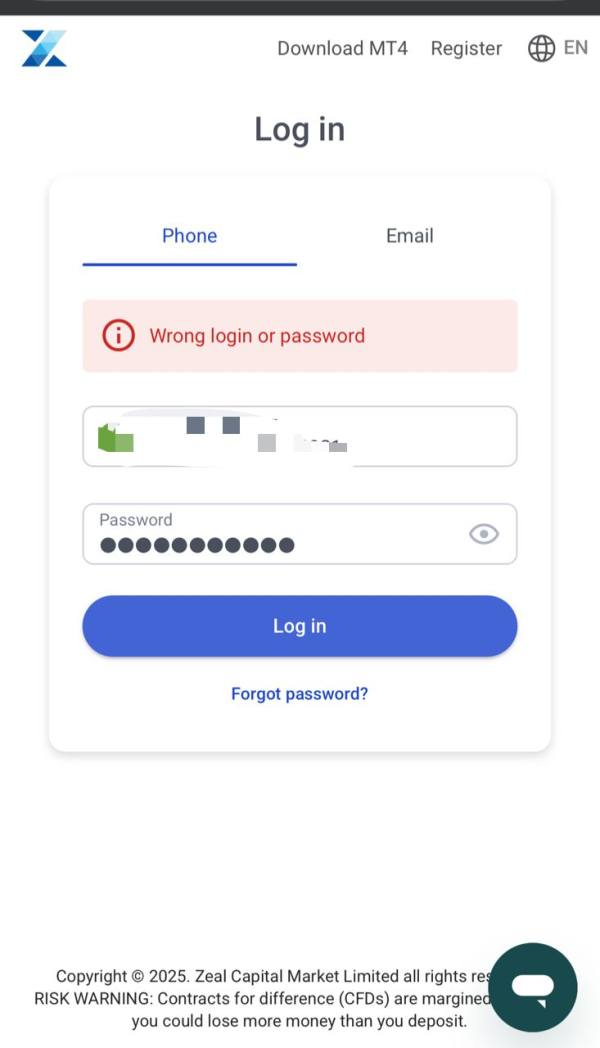

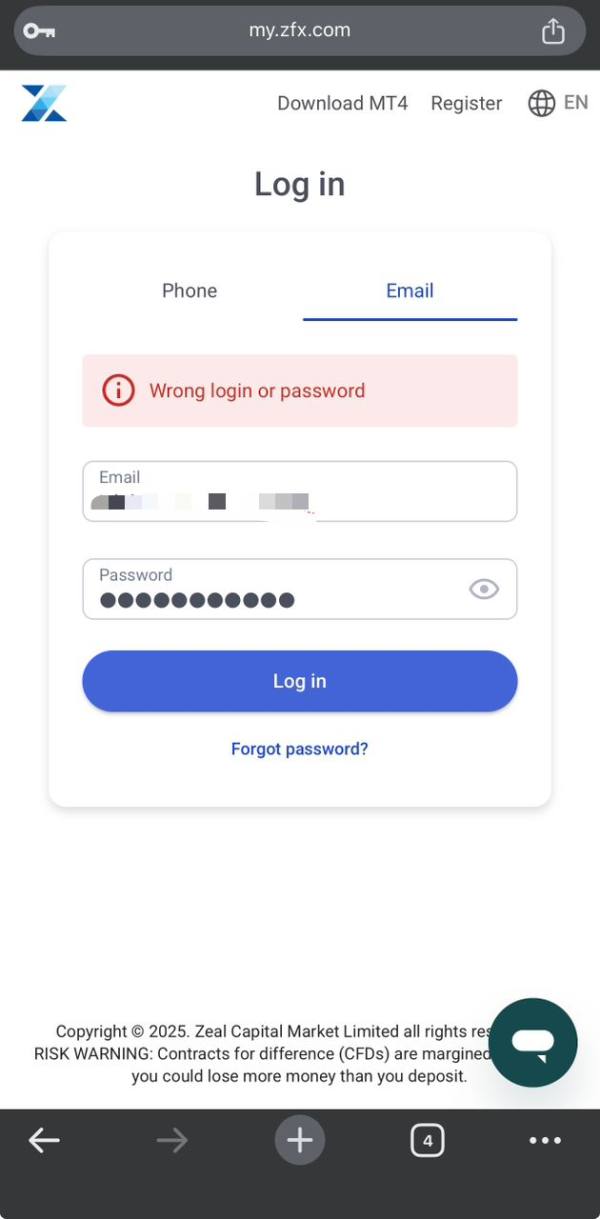

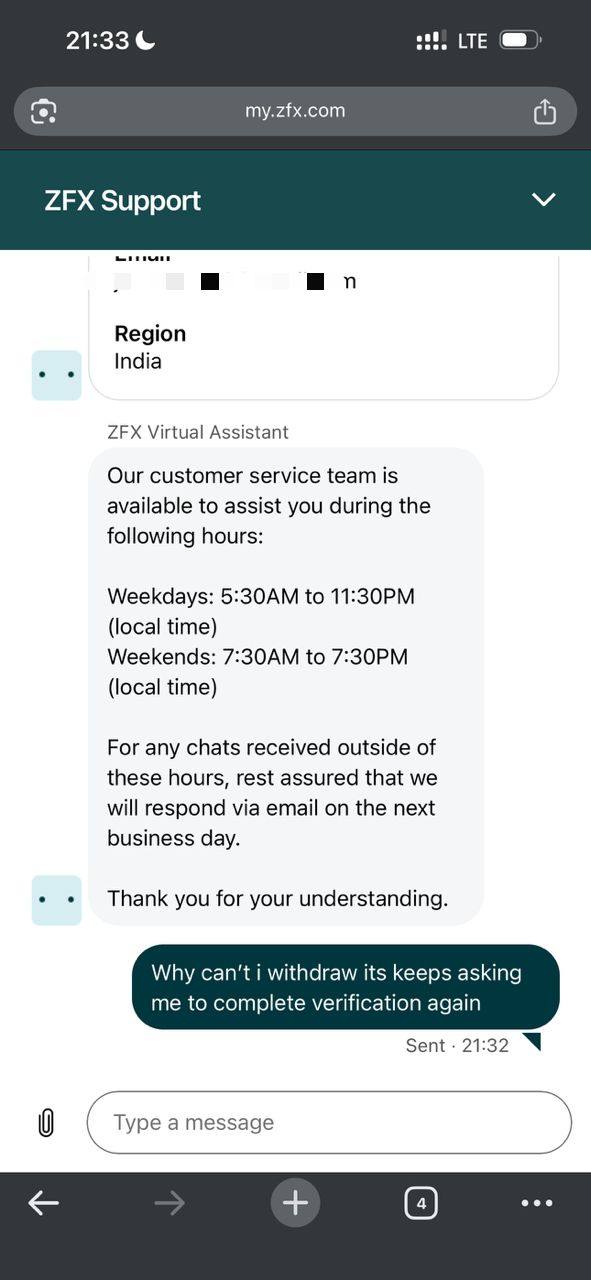

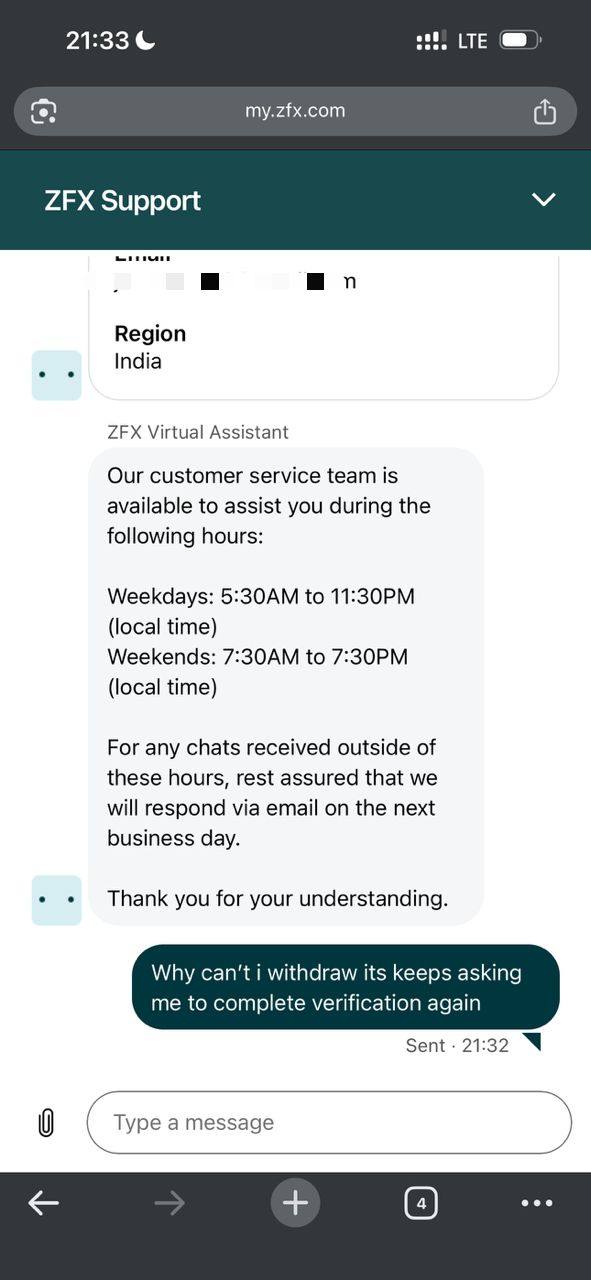

Customer service represents a challenging area for ZFX based on available user feedback and limited information about support infrastructure. User reviews indicate mixed experiences with service quality and response times, suggesting inconsistency in support delivery that may impact overall trader satisfaction.

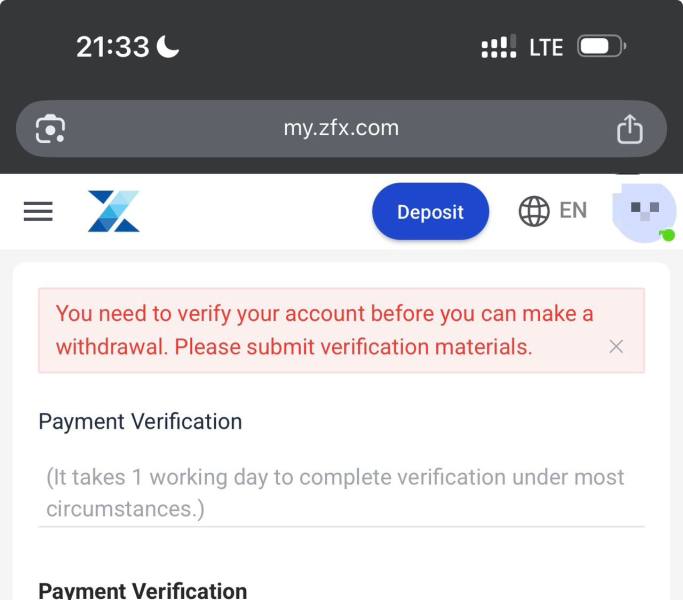

One notable user comment specifically mentions expectations for withdrawal processing within "one minute." This indicates that current processing times may not meet user expectations for speed and efficiency. This feedback suggests that while users appreciate the platform's trading capabilities, administrative processes may require improvement to match user expectations for modern financial services.

The variability in user feedback regarding service quality indicates potential inconsistencies in support delivery. This could stem from factors such as inquiry complexity, communication channels used, or regional differences in support team capabilities. Without specific information about available support channels, operating hours, or response time guarantees, it's difficult to assess the structural adequacy of ZFX's customer service framework.

The absence of detailed information about multilingual support capabilities, specialized support for different account types, or escalation procedures for complex issues represents another area where improved transparency could benefit potential clients. Professional traders and institutional clients typically require more sophisticated support capabilities than retail traders, and the lack of clear information about differentiated service levels makes it challenging to assess ZFX's suitability for different user segments.

For traders considering ZFX, the recommendation would be to test the customer service responsiveness during the account evaluation process. They should also establish clear expectations about support availability and response times before committing significant trading capital to the platform.

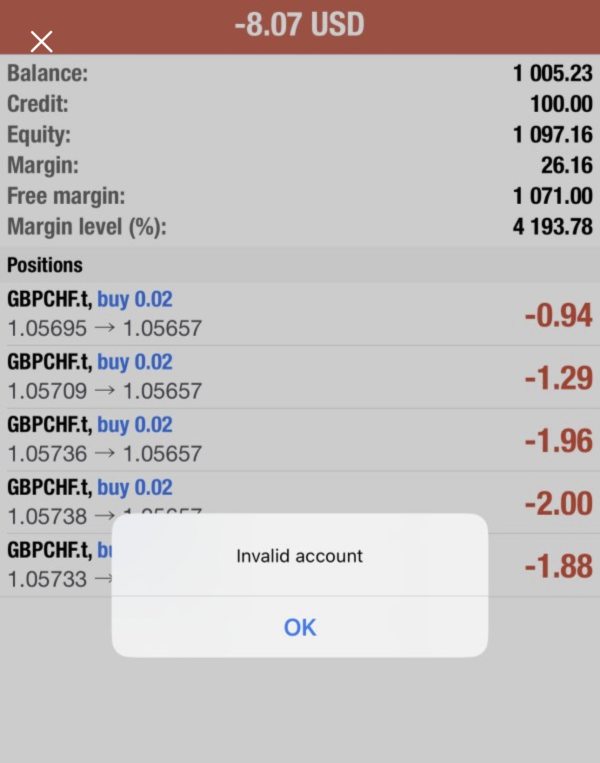

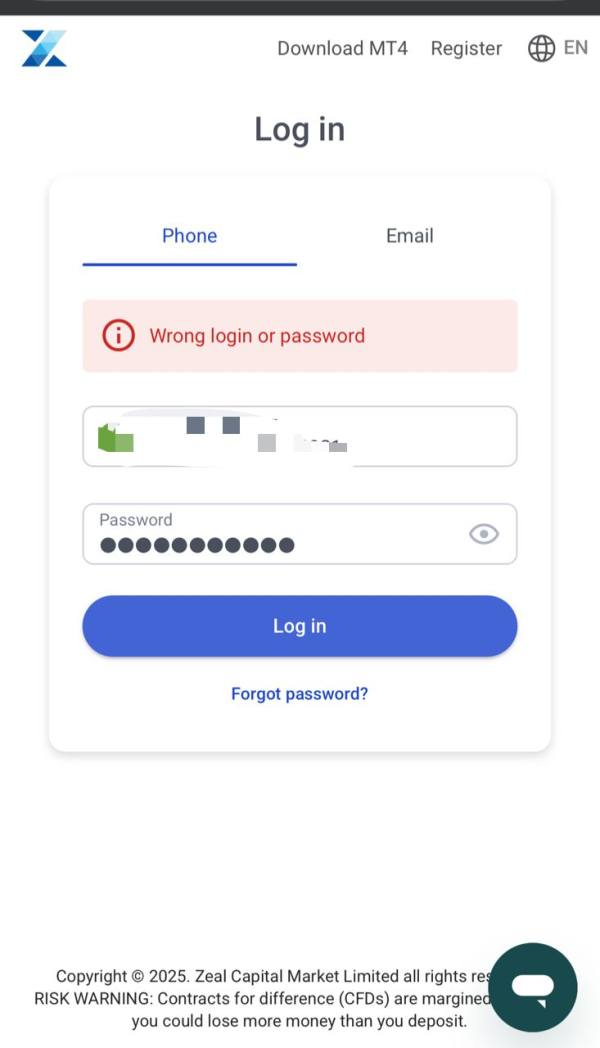

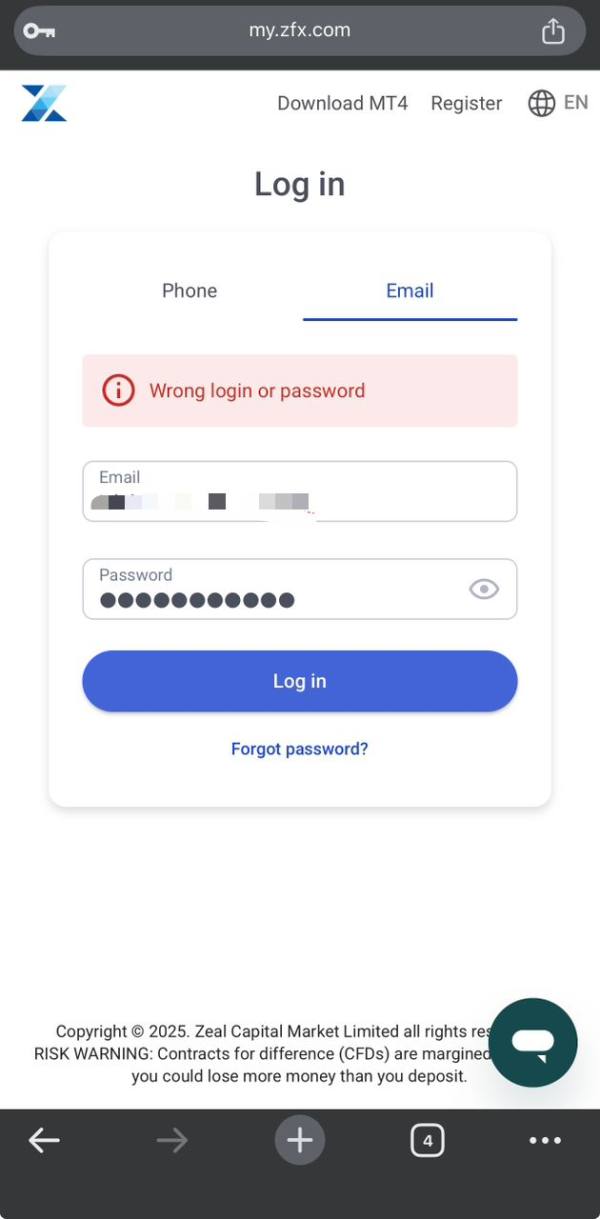

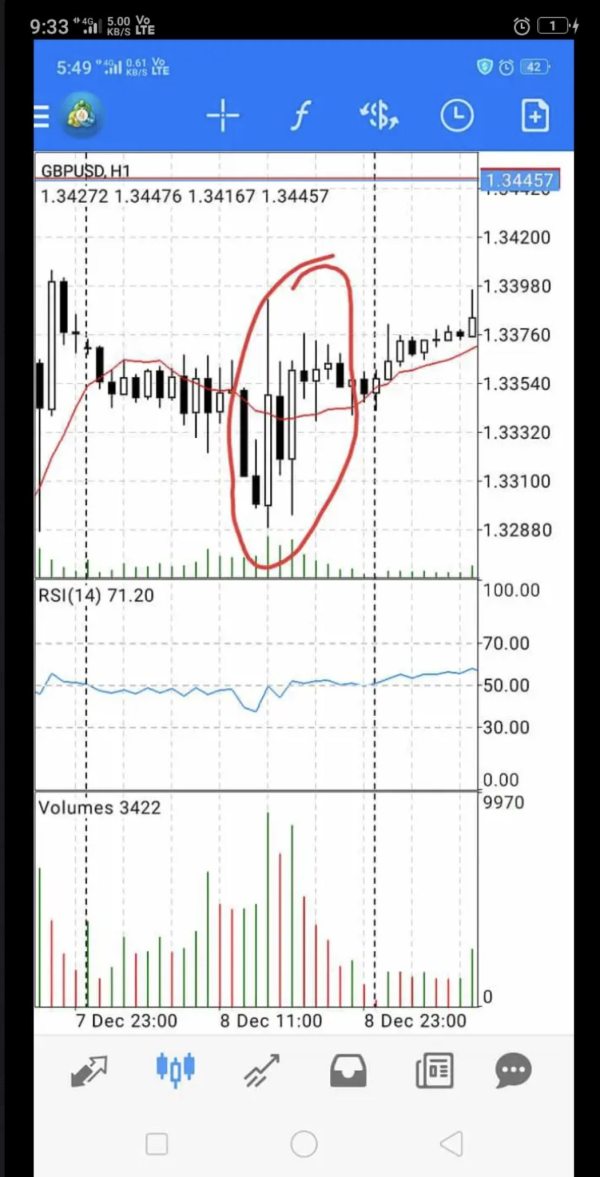

Trading Experience Analysis

The trading experience evaluation for ZFX faces limitations due to insufficient specific data about platform performance, execution quality, and user interface design in available sources. However, the MetaTrader 4 foundation provides a baseline expectation for functionality and reliability given the platform's established market position.

MetaTrader 4's proven architecture typically delivers stable performance with reliable order execution, comprehensive charting capabilities, and robust technical analysis tools. The platform's widespread adoption across the industry suggests that ZFX traders should experience familiar functionality and interface design, reducing the learning curve for traders transitioning from other brokers using the same platform.

The multi-device compatibility mentioned in source materials indicates that ZFX has invested in ensuring consistent trading experiences across desktop and mobile platforms. This cross-platform functionality is essential for modern traders who require the flexibility to monitor and adjust positions regardless of their location or preferred device.

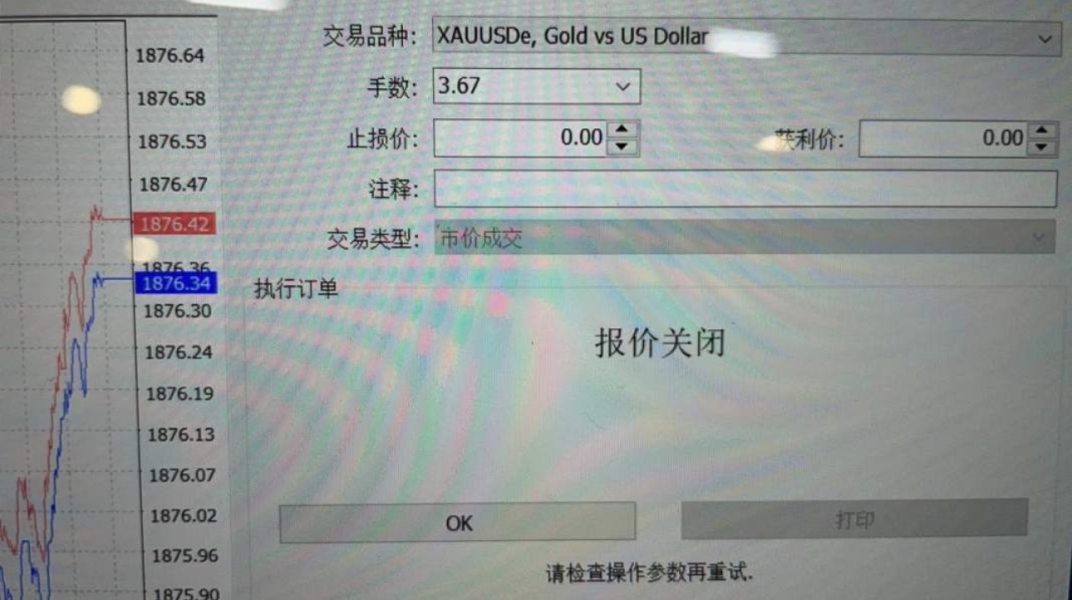

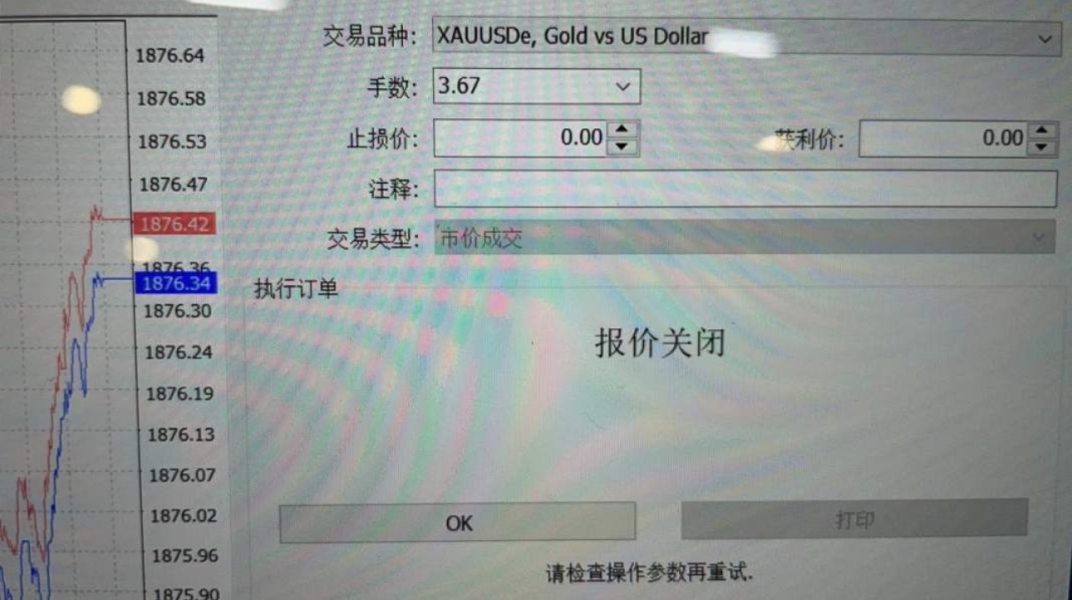

However, critical trading experience factors such as execution speed, slippage rates, requote frequency, and platform downtime statistics are not available in current source materials. These performance metrics significantly impact trading profitability and user satisfaction, particularly for active traders employing scalping or high-frequency strategies.

The absence of specific information about order types supported, partial fill handling, and advanced execution features makes it difficult to assess ZFX's suitability for sophisticated trading strategies. Similarly, details about platform customization options, plugin support, and integration with third-party tools are not addressed in available materials.

This zfx review recommends that potential traders utilize demo accounts or small live positions to evaluate execution quality and platform stability before committing significant trading capital. This is especially important given the limited publicly available performance data.

Trust and Reliability Analysis

ZFX's regulatory standing provides a solid foundation for trust assessment. It operates with oversight from both the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority (FSA) in Seychelles. The FCA regulation, in particular, represents a high-standard regulatory framework that includes strict capital requirements, client fund segregation, and dispute resolution mechanisms.

The dual regulatory structure allows ZFX to serve international clients while maintaining compliance with different jurisdictional requirements. However, traders should understand that the level of protection and regulatory oversight may vary depending on which entity holds their account, as FCA and FSA regulations differ in scope and enforcement mechanisms.

The absence of detailed information about specific fund security measures, insurance coverage, or client fund segregation practices represents a transparency gap that could be improved. While regulatory oversight implies certain baseline protections, explicit communication about additional security measures would enhance client confidence and demonstrate commitment to fund safety.

ZFX's establishment as a platform serving both retail and institutional investors suggests a business model focused on sustainable growth rather than short-term profit maximization. However, without specific information about company ownership, financial backing, or operational history, it's challenging to assess the long-term stability and commitment of the organization.

The lack of available information about any regulatory actions, disputes, or negative events in ZFX's operational history makes it difficult to assess the company's track record for handling challenges or maintaining compliance standards. Transparency in these areas would strengthen trust assessment and provide potential clients with a more complete picture of the broker's reliability profile.

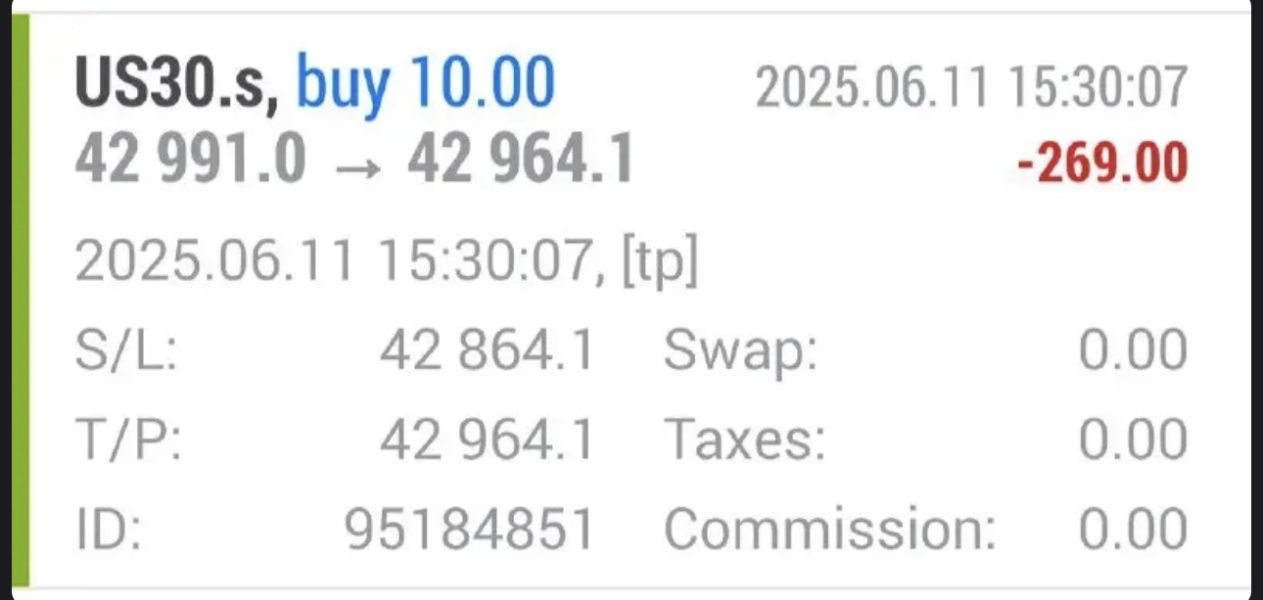

User Experience Analysis

User experience evaluation for ZFX reveals a mixed landscape of satisfaction levels. Particular attention is needed in areas of administrative efficiency and service delivery. The platform appears to serve its intended dual purpose of accommodating both retail and institutional traders, though user feedback suggests room for improvement in operational aspects.

The MetaTrader 4 foundation provides a familiar and functional trading interface that most users can navigate effectively. This reduces barriers to entry for traders experienced with this platform. The cross-device compatibility ensures that users can maintain consistent access to their trading accounts, which is essential for modern trading requirements.

However, user concerns about withdrawal processing times highlight a significant operational challenge that impacts overall satisfaction. The specific user comment about hoping for "one minute" withdrawal processing suggests that current timeframes may not meet contemporary expectations for financial service speed and efficiency.

The mixed feedback regarding service quality indicates inconsistent user experiences that could stem from various factors including communication preferences, inquiry complexity, or regional service differences. This inconsistency suggests that while some users receive satisfactory support, others encounter challenges that impact their overall platform satisfaction.

The absence of detailed information about user interface design, account management features, and self-service capabilities makes it difficult to assess the completeness of the user experience beyond basic trading functionality. Modern traders typically expect comprehensive account management tools, detailed reporting, and intuitive navigation that minimizes time spent on administrative tasks.

For potential ZFX users, the recommendation would be to thoroughly test all aspects of the platform during an evaluation period. They should pay particular attention to withdrawal procedures and customer service responsiveness to ensure alignment with individual expectations and requirements.

Conclusion

This comprehensive zfx review reveals a broker with solid regulatory foundations and competitive trading tools, but with areas requiring attention to meet evolving trader expectations. ZFX's dual regulatory oversight from the FCA and FSA provides credible institutional backing, while the MetaTrader 4 platform and diverse asset offerings create a functional trading environment suitable for various trading strategies.

The broker's emphasis on educational resources and copy trading functionality makes it particularly suitable for developing traders who value learning opportunities alongside their trading activities. However, user feedback regarding withdrawal processing speeds and customer service consistency indicates operational areas where improvements could significantly enhance overall user satisfaction.

ZFX appears most appropriate for traders who prioritize regulatory security and educational resources over ultra-fast administrative processing. It also suits those who are comfortable with MetaTrader 4's interface and functionality. The platform's strength in providing diverse asset access within a single trading environment offers value for traders seeking portfolio diversification without multiple broker relationships.