Is UPFX safe?

Business

License

Is Upfx Safe or Scam?

Introduction

Upfx is a relatively new player in the foreign exchange (forex) market, providing trading services primarily focused on Contracts for Difference (CFDs) across various financial instruments. Established in 2017, Upfx aims to attract both novice and experienced traders with its competitive trading conditions and user-friendly platforms. However, with the increasing number of fraudulent brokers in the forex industry, it is crucial for traders to conduct thorough evaluations of any broker before committing their funds.

This article aims to assess the safety and legitimacy of Upfx by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. By utilizing a combination of qualitative analysis and structured data presentation, we aim to provide a comprehensive overview of whether Upfx is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment is a critical aspect of assessing any forex broker's legitimacy. Regulation serves as a safety net for traders, ensuring that brokers adhere to specific operational standards and provide a level of investor protection. In the case of Upfx, it claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, the quality of this regulation is often questioned due to Vanuatu's reputation as a haven for many unregulated brokers.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 40202 | Vanuatu | Verified |

The VFSC's oversight is considered less stringent compared to other prominent regulatory bodies like the UK‘s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC). Many traders have raised concerns regarding Upfx's compliance with regulatory standards, with some reviews suggesting that the broker operates beyond the scope of its license. Furthermore, there are reports that Upfx has made misleading claims about its regulatory status, suggesting it is licensed under multiple jurisdictions, including ASIC and NFA, which cannot be verified.

Company Background Investigation

Upfx is operated by Ultimate Pinnacle Limited, a company registered in Vanuatu. The broker's establishment in 2017 marks it as a relatively new entrant in the competitive forex market. The ownership structure and management team of Upfx remain somewhat opaque, with limited information available regarding their professional backgrounds. This lack of transparency raises questions about the broker's accountability and operational integrity.

The company's historical development has faced scrutiny, particularly concerning its marketing practices and claims of regulatory compliance. While Upfx promotes itself as a legitimate broker, the absence of a robust regulatory framework and the unclear ownership structure can lead to skepticism about its operational practices. Traders should be cautious and consider these factors when evaluating whether Upfx is safe for their trading activities.

Trading Conditions Analysis

Upfx offers a variety of trading conditions that are generally competitive, including high leverage options and a diverse range of financial instruments. However, the broker's fee structure has raised concerns among users, particularly regarding hidden costs and withdrawal fees.

| Fee Type | Upfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | 0.5% | 0.2% |

While Upfx advertises low spreads, many users have reported that these spreads can widen significantly during volatile market conditions. Additionally, the absence of a clear commission structure can lead to confusion for traders, particularly those accustomed to more transparent fee models. The potential for hidden fees, especially during the withdrawal process, raises further concerns about whether Upfx is safe for traders looking to manage their costs effectively.

Customer Fund Security

Customer fund security is paramount in the forex trading environment, and Upfx claims to implement several measures to protect client funds. However, the effectiveness of these measures is often called into question.

Upfx reportedly utilizes segregated accounts to hold client funds, which is a standard practice among regulated brokers. This means that client funds are kept separate from the broker's operating funds, providing a layer of protection in the event of insolvency. However, the lack of additional investor protection schemes, such as those provided by the Financial Services Compensation Scheme (FSCS) in the UK, diminishes the overall security profile of Upfx.

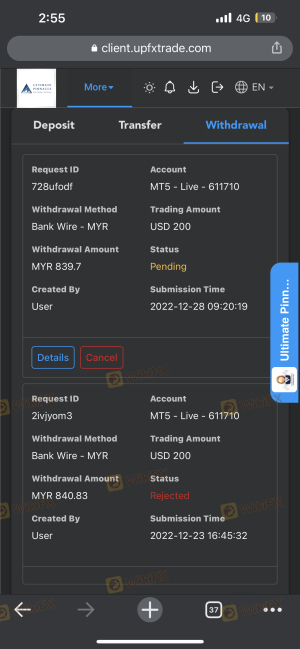

Historical complaints regarding fund withdrawal issues have also raised red flags. Some users have reported significant delays in accessing their funds, which can be indicative of underlying operational problems. These factors contribute to the ongoing debate about whether Upfx is safe for traders concerned about the security of their investments.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Upfx has received mixed reviews from its users, with a notable number of complaints regarding customer service and withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Service | Medium | Average |

| Misleading Information | High | Poor |

Common complaints include difficulties in withdrawing funds and a lack of timely responses from customer support. Users have reported waiting weeks for their withdrawal requests to be processed, which can be particularly frustrating for traders looking to access their profits. Moreover, the quality of customer support has been criticized, with many users describing it as unresponsive or lacking in helpfulness.

Two typical cases highlight these issues: one user reported a three-week delay in receiving their funds, while another faced multiple unsuccessful attempts to contact support regarding an account issue. Such experiences lead to significant concerns about whether Upfx is safe for traders who may require reliable support and prompt access to their funds.

Platform and Trade Execution

The trading platform is a crucial aspect of the trading experience, and Upfx offers the widely used MetaTrader 4 (MT4) platform. While MT4 is known for its robust features and user-friendly interface, some users have reported issues with order execution quality.

Concerns have been raised regarding slippage and order rejections, particularly during high volatility periods. Traders expect their orders to be executed promptly and at the requested prices; however, reports of slippage exceeding normal levels have emerged. Such issues can significantly impact trading performance and profitability, leading traders to question whether Upfx is safe for executing their strategies effectively.

Risk Assessment

Engaging with Upfx carries several risks, primarily due to its regulatory status and customer feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Customer Service Risk | Medium | Poor response times and support issues. |

| Withdrawal Risk | High | Reports of delayed withdrawals are common. |

Given these factors, potential traders should approach Upfx with caution. It is advisable to conduct thorough research and consider alternative, more reputable brokers with established regulatory oversight and positive customer feedback.

Conclusion and Recommendations

In conclusion, while Upfx presents itself as a competitive forex broker with attractive trading conditions, significant concerns regarding its regulatory status, customer service, and withdrawal processes suggest that traders should exercise caution. The mixed reviews and reports of operational issues raise valid questions about whether Upfx is safe for trading.

For traders seeking reliable and secure options, it is recommended to consider brokers that are well-regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers typically offer better investor protection and a more transparent trading environment.

Ultimately, while Upfx may offer certain appealing features, the risks associated with its operation and the negative feedback from users warrant a careful approach before committing funds.

Is UPFX a scam, or is it legit?

The latest exposure and evaluation content of UPFX brokers.

UPFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UPFX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.