Is Galileo FX safe?

Pros

Cons

Is Galileo FX A Scam?

Introduction

Galileo FX is an automated trading software that has gained attention in the forex market since its inception in 2020. Positioned as a tool designed to simplify trading for both novice and experienced traders, it claims to provide users with a range of strategies and the potential for significant returns. However, the rise of automated trading solutions has also led to increased skepticism, as traders must navigate the risks associated with unregulated platforms. Given the prevalence of scams in the financial sector, it is essential for traders to conduct thorough evaluations of any trading broker or software. This article aims to provide an objective assessment of Galileo FX by examining its regulatory status, company background, trading conditions, customer experiences, and potential risks. The investigation is based on a comprehensive review of available online resources, including user testimonials and expert analyses.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining the legitimacy of any trading platform. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial security. In the case of Galileo FX, the platform operates without any recognized regulatory oversight, which raises significant concerns regarding its trustworthiness.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Galileo FX is not subject to the stringent oversight provided by financial authorities, such as the FCA in the UK or the SEC in the US. This lack of oversight can lead to issues such as mismanagement of funds, lack of transparency, and poor customer service. Furthermore, several reviews have flagged Galileo FX as having a low trust score, indicating that it may not meet the standards expected of a reputable trading platform. The regulatory quality is particularly concerning, as traders are often advised to select platforms that are not only regulated but also have a history of compliance with financial norms.

Company Background Investigation

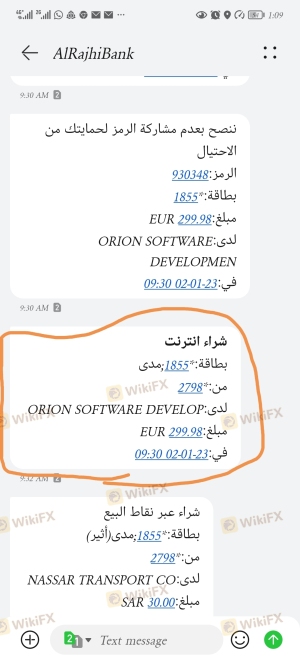

Galileo FX was founded in December 2020, with its headquarters located in Arezzo, Italy. The company is owned by Orion Software Development Srl, which has not provided detailed information about its management team or ownership structure. This lack of transparency can be a red flag for potential users, as it makes it difficult to assess the credibility of the people behind the platform.

The company's website claims that Galileo FX was developed by a team of experienced traders and software developers, but specific details about the management team are scarce. This lack of information can lead to concerns about accountability and reliability. In an industry where trust is paramount, the absence of a clear and transparent corporate structure is a significant drawback. Furthermore, the company has not been forthcoming with information regarding its operational history or any past issues it may have encountered.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Galileo FX presents a variety of trading options, but the details surrounding its fee structure and potential hidden costs warrant scrutiny. The platform operates on a one-time payment model, which may seem appealing at first glance, but traders should be cautious about the overall cost-effectiveness.

| Fee Type | Galileo FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Variable | 0.5-2% |

The spread for major currency pairs can vary significantly, which may lead to higher trading costs than anticipated. Additionally, the absence of a commission model may seem beneficial; however, it raises questions about how the platform generates revenue and whether it compensates for this through higher spreads or other fees. Traders should be aware that unexpected costs can erode profits, making it crucial to read the fine print and understand the total cost of trading on the platform.

Customer Funds Security

The safety of customer funds is a paramount concern for any trading platform. With Galileo FX being unregulated, the security of funds becomes even more questionable. The platform does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies.

Traders are often advised to choose platforms that offer secure fund management practices, including the segregation of client funds from the company's operational funds. This practice is essential for protecting traders in the event of the company's insolvency. Additionally, the lack of historical data regarding any past security issues or disputes raises concerns about the platform's reliability. Without a solid track record of handling customer funds safely, potential users may find themselves at risk.

Customer Experience and Complaints

User feedback plays a critical role in assessing the overall reliability of a trading platform. Reviews of Galileo FX present a mixed picture, with some users reporting positive experiences while others express frustration with the service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Software Performance | High | Unresolved issues |

Common complaints include difficulties with withdrawals, unresponsive customer service, and issues related to software performance. Some users have reported that they faced challenges in withdrawing their funds, a hallmark of potentially fraudulent platforms. Furthermore, the quality of customer support has been criticized, with many users stating that their inquiries went unanswered for extended periods. Such complaints can severely undermine a trader's confidence in the platform and highlight the potential for financial loss.

Platform and Execution

The performance and reliability of the trading platform itself are crucial for a positive trading experience. Users of Galileo FX have expressed mixed feelings regarding the platform's performance, with some praising its ease of use while others report issues with order execution and slippage.

In terms of execution quality, traders have noted instances of slippage during volatile market conditions, which can significantly impact trading outcomes. Additionally, there have been reports of orders being rejected, raising concerns about the platform's reliability. These issues can be detrimental, particularly for traders employing automated strategies that rely on timely order execution.

Risk Assessment

Using Galileo FX presents a variety of risks that traders should be aware of before committing their funds. The absence of regulatory oversight, combined with mixed customer feedback, creates an environment of uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | No clear policies for fund protection |

| Customer Service Risk | Medium | Complaints about responsiveness |

To mitigate these risks, traders are advised to conduct thorough research before using the platform. Choosing a regulated broker and maintaining a cautious approach to fund management can help safeguard investments. Additionally, starting with a demo account may provide insights into the platform's performance without risking real capital.

Conclusion and Recommendations

Based on the evidence gathered, it is clear that while Galileo FX offers an automated trading solution, significant concerns regarding its regulatory status, fund security, and customer service persist. The lack of oversight and transparency raises red flags that potential users should consider seriously.

For traders seeking reliable options, it may be prudent to explore regulated alternatives that offer robust customer protection and transparent fee structures. Options such as OANDA, Forex.com, or IC Markets, which are regulated and have established reputations, can provide a more secure trading environment.

In conclusion, while Galileo FX may appeal to some traders, the associated risks and concerns suggest that caution is warranted. Traders should prioritize platforms that offer regulatory oversight, clear communication, and a track record of customer satisfaction to ensure a safer trading experience.

Is Galileo FX a scam, or is it legit?

The latest exposure and evaluation content of Galileo FX brokers.

Galileo FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Galileo FX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.