LHCM 2025 Review: Everything You Need to Know

Executive Summary

LHCM is a regulated investment company based in the UK. It provides global market access through the EXANTE trading platform. This lhcm review reveals that the broker offers access to over 50 markets and more than one million financial instruments through a single account, making it particularly attractive for investors seeking diversified trading opportunities. The company operates under the regulation of the Financial Conduct Authority. This ensures maximum security and minimal latencies for its clients.

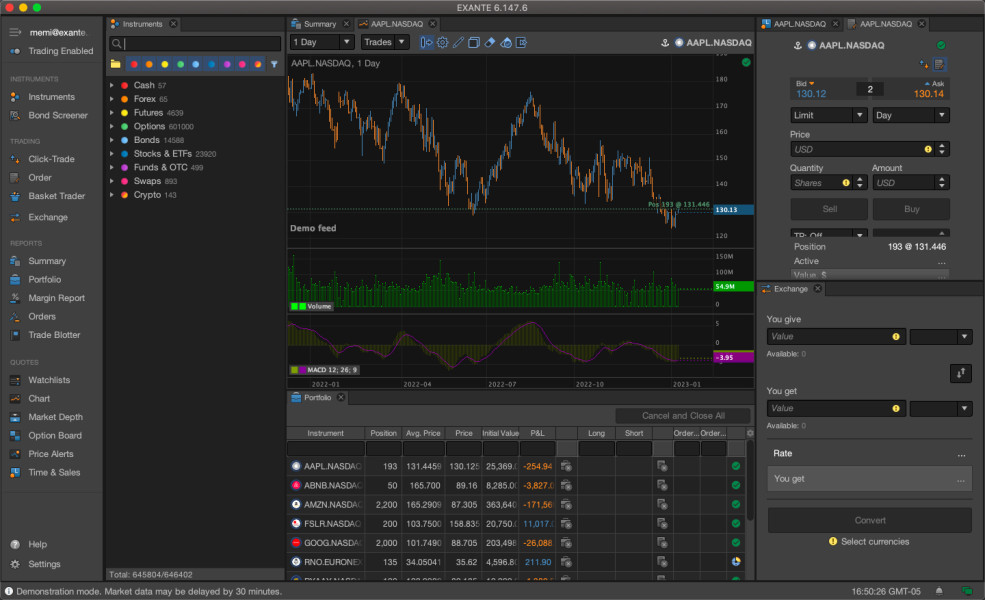

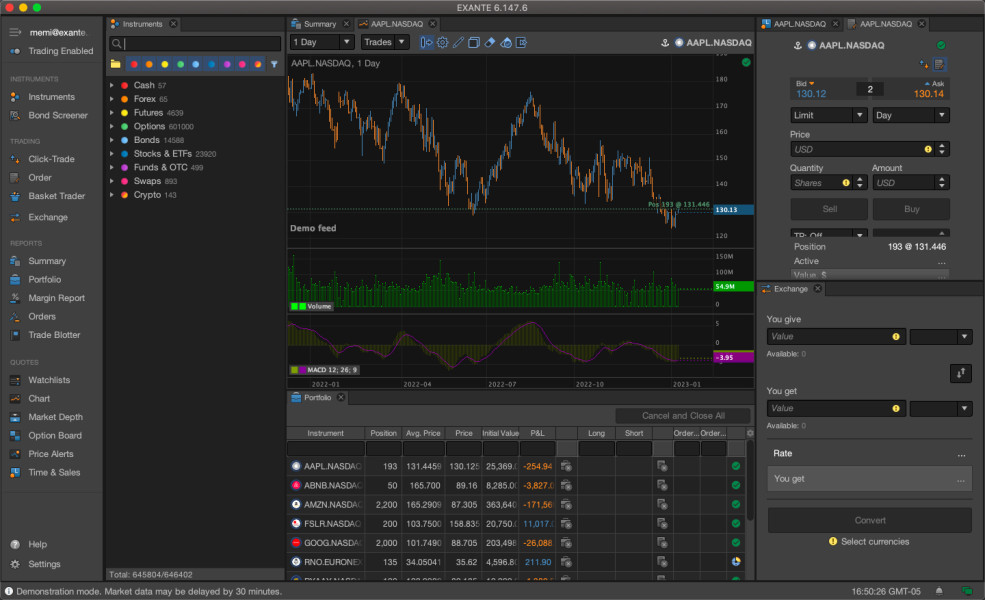

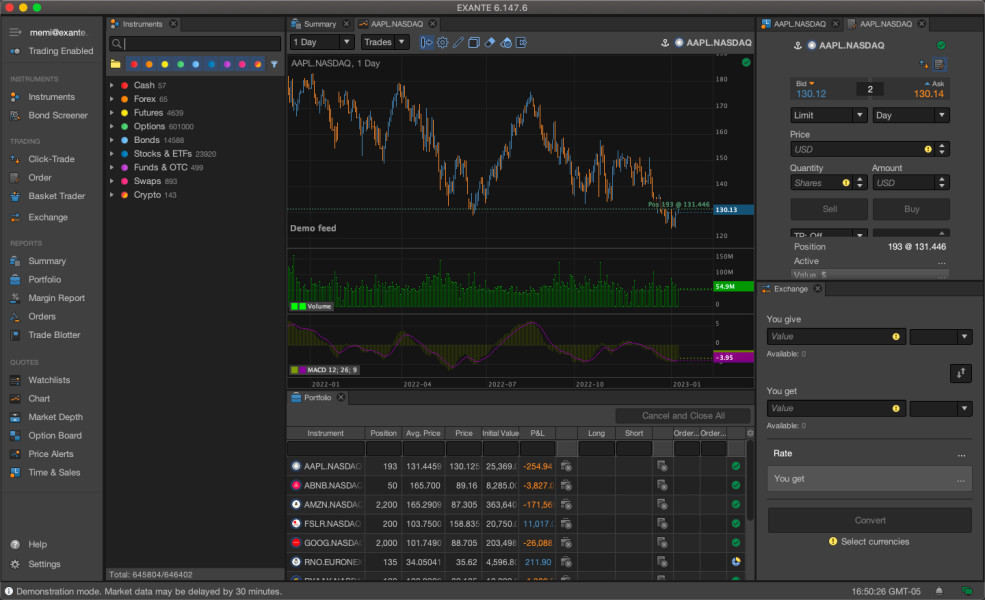

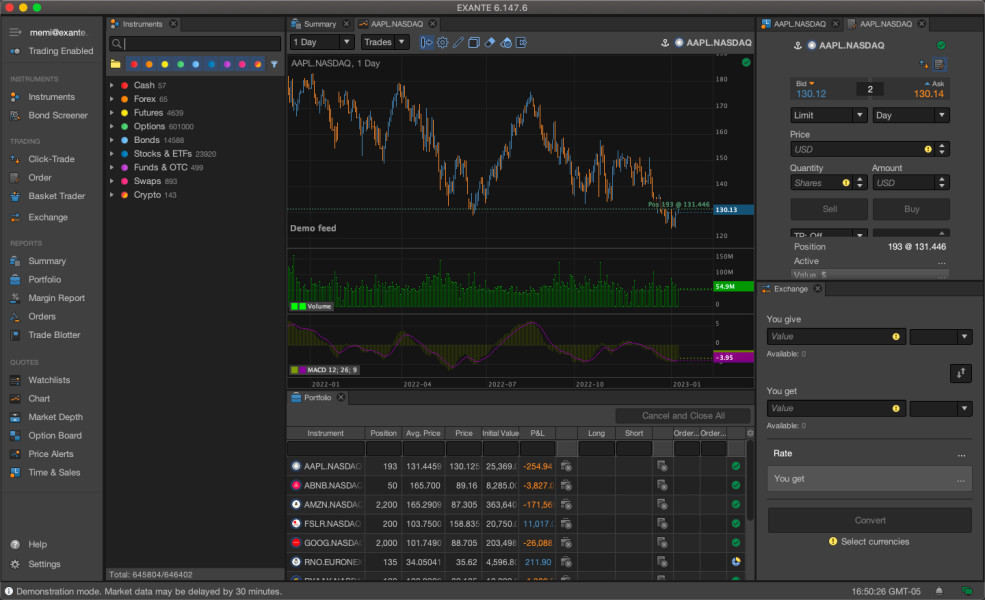

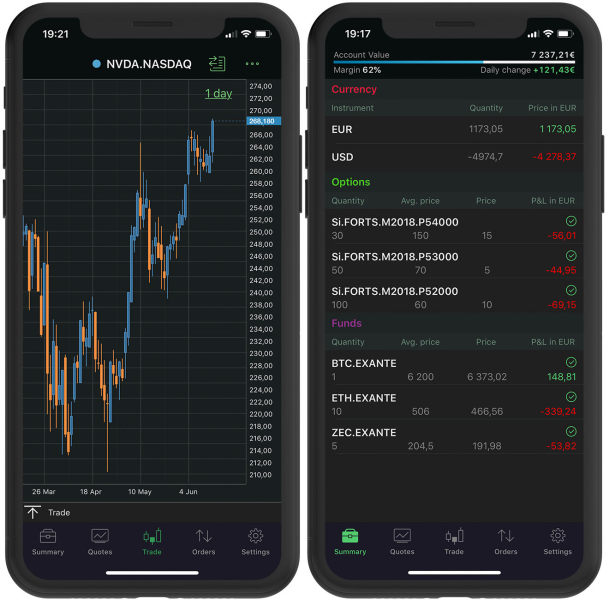

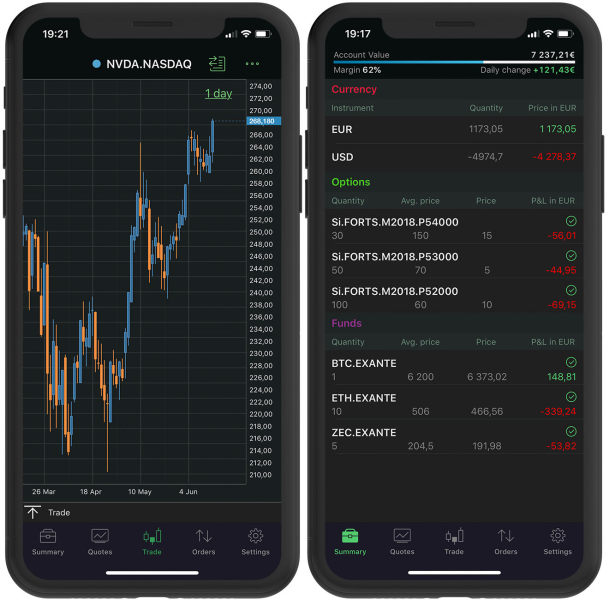

LHCM's standout feature is its comprehensive EXANTE trading platform. The platform provides direct market access across multiple asset classes including stocks, ETFs, options, futures, bonds, and funds. The platform is available on web, desktop, and mobile devices, catering to different trading preferences. The broker positions itself as suitable for investors who want to trade various asset categories through a unified platform while maintaining regulatory compliance and security standards.

Important Notice

This review is based on publicly available information. It should be considered for informational purposes only. LHCM operates under UK regulation, but potential clients should verify local regulatory requirements in their jurisdiction before opening an account. The regulatory landscape may vary across different regions, and traders should ensure compliance with their local financial laws.

The information presented in this evaluation reflects the current available data about LHCM's services. It should not be considered as investment advice. Prospective clients are encouraged to conduct their own due diligence and consider their individual financial circumstances before making any trading decisions.

Rating Framework

Broker Overview

LHCM Ltd operates as a fully regulated and licensed investment company in the United Kingdom. It positions itself as a gateway to global financial markets. The company focuses on providing comprehensive market access through its partnership with the EXANTE trading platform. The broker emphasizes security, regulatory compliance, and technological efficiency as its core value propositions.

The company's business model centers around offering institutional-grade trading infrastructure to retail and professional clients. Through its EXANTE platform integration, LHCM provides direct market access to over 50 global exchanges, enabling clients to trade more than one million financial instruments from a single account. This approach distinguishes LHCM from traditional brokers by offering a more comprehensive and unified trading experience.

LHCM's regulatory status under the Financial Conduct Authority provides clients with confidence in the broker's operational standards and client fund protection measures. The broker's focus on minimal latencies and maximum security suggests a technology-driven approach to trading services, which is particularly relevant in today's fast-paced financial markets. This lhcm review indicates that the broker targets sophisticated investors who value regulatory oversight and comprehensive market access.

Regulatory Jurisdiction: LHCM operates under the regulation of the UK's Financial Conduct Authority. This provides clients with regulatory protection and oversight. This regulatory framework ensures compliance with strict financial standards and client protection measures.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. Prospective clients should contact LHCM directly for comprehensive information about funding options and processing procedures.

Minimum Deposit Requirements: The minimum deposit requirements are not specified in available documentation. This information would typically be provided during the account opening process or through direct communication with the broker.

Bonus and Promotions: Available sources do not mention specific bonus programs or promotional offers. The broker appears to focus on service quality and platform capabilities rather than promotional incentives.

Tradable Assets: LHCM offers access to a diverse range of financial instruments including stocks, ETFs, options, futures, bonds, and funds across more than 50 global markets. This extensive selection enables portfolio diversification and various trading strategies.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in current sources. The fee structure would typically be disclosed in the broker's terms and conditions or account opening documentation.

Leverage Ratios: Specific leverage information is not mentioned in available materials. Leverage terms would likely vary based on asset class and client categorization under FCA regulations.

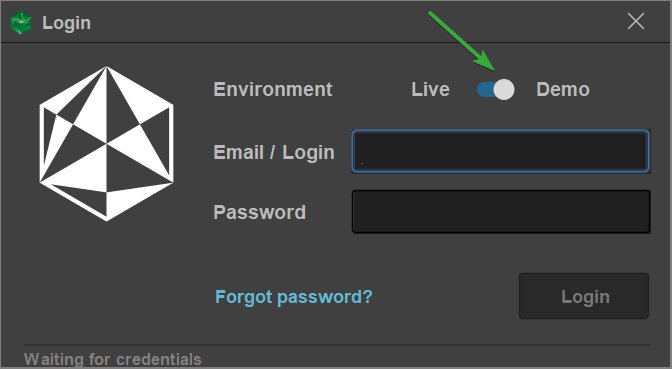

Platform Options: Clients have access to the EXANTE trading platform. It is available across web, desktop, and mobile devices. This lhcm review confirms the platform's multi-device compatibility and comprehensive market access capabilities.

Geographic Restrictions: Specific geographic limitations are not detailed in available sources. The broker's UK base and FCA regulation suggest primary focus on UK and European markets.

Customer Service Languages: Language support information is not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for LHCM are not comprehensively detailed in available public information. This makes it challenging to provide a thorough evaluation of this aspect. LHCM offers access to global markets through the EXANTE platform with a single account structure, which simplifies the trading experience for clients interested in multiple asset classes.

The single account approach represents a significant advantage for traders who want to diversify across different markets and instruments without managing multiple accounts. However, the lack of specific information about account types, minimum deposit requirements, and account tiers makes it difficult to assess how well LHCM's offerings compare to industry standards.

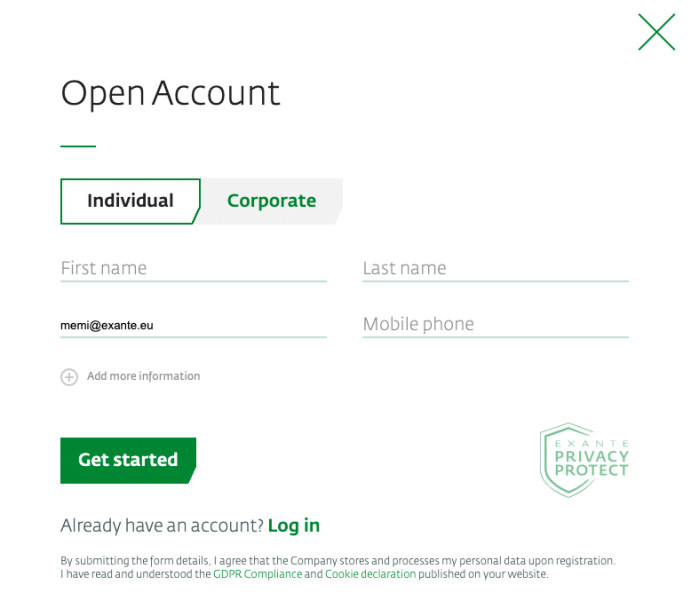

Without detailed information about the account opening process, verification requirements, or special account features, potential clients would need to contact LHCM directly for comprehensive account condition details. This lhcm review notes that transparency in account conditions would enhance the broker's appeal to prospective clients who prefer to evaluate all terms before committing to a broker.

The regulatory oversight by the FCA suggests that account conditions would meet UK financial standards. However, specific terms and conditions require direct verification with the broker.

LHCM demonstrates strong performance in the tools and resources category through its provision of the EXANTE trading platform and access to over one million financial instruments across 50+ global markets. The platform's availability across web, desktop, and mobile devices ensures that traders can access markets and manage positions from virtually anywhere.

The breadth of available instruments, including stocks, ETFs, options, futures, bonds, and funds, provides traders with extensive opportunities for portfolio diversification and various trading strategies. This comprehensive asset selection positions LHCM favorably for investors seeking a one-stop solution for global market access.

However, available information does not detail specific research and analysis resources, educational materials, or automated trading support that might be available through the platform. These additional resources are increasingly important for traders who rely on broker-provided analysis and educational content to inform their trading decisions.

The technological infrastructure emphasizing minimal latencies suggests that LHCM prioritizes execution quality and platform performance. These are crucial factors for active traders. The multi-platform availability ensures accessibility across different devices and trading environments.

Customer Service and Support Analysis

Customer service and support information for LHCM is not detailed in available sources. This creates a significant gap in evaluating this crucial aspect of broker services. Effective customer support is essential for resolving trading issues, account inquiries, and technical problems that may arise during trading activities.

Without specific information about support channels, availability hours, response times, or language support, it's impossible to assess how well LHCM serves its clients' support needs. Modern brokers typically offer multiple contact methods including phone, email, live chat, and sometimes social media support.

The quality and responsiveness of customer service often distinguish superior brokers from average ones, particularly during market volatility when traders may need immediate assistance. Professional traders and institutional clients typically expect high-quality support services that can address complex trading and technical issues promptly.

Given LHCM's regulatory status and focus on providing institutional-grade services, one would expect professional-level customer support. However, verification of support quality and availability would require direct contact with the broker or user testimonials that are not currently available in public sources.

Trading Experience Analysis

The trading experience evaluation for LHCM is limited by the lack of detailed user feedback and platform performance data in available sources. However, the broker's emphasis on providing minimal latencies and maximum security suggests a focus on delivering quality trading conditions.

The EXANTE platform's availability across multiple devices indicates flexibility in trading access, which is important for traders who need to monitor and manage positions across different environments. The direct market access to over 50 exchanges suggests that traders can benefit from competitive pricing and execution quality.

Platform stability, order execution speed, and functionality completeness are critical factors that determine trading experience quality. However, specific performance metrics or user testimonials are not available in current sources. The breadth of available instruments and markets provides opportunities for diverse trading strategies, which could enhance the overall trading experience.

Without detailed information about platform features, order types, charting capabilities, or mobile app functionality, this lhcm review cannot provide a comprehensive assessment of the actual trading experience that clients can expect.

Trust and Reliability Analysis

LHCM demonstrates strong credentials in trust and reliability through its regulation by the UK's Financial Conduct Authority. FCA regulation is among the most respected in the global financial services industry, providing clients with confidence in the broker's operational standards and client protection measures.

The regulatory framework ensures that LHCM must adhere to strict capital requirements, client fund segregation, and operational standards designed to protect client interests. This regulatory oversight significantly enhances the broker's trustworthiness compared to unregulated alternatives.

The company's focus on providing secure access to global markets with minimal latencies suggests investment in robust technological infrastructure. This supports reliability in trading operations. However, specific information about additional security measures, fund protection schemes, or the company's financial strength is not detailed in available sources.

The absence of reported negative incidents or regulatory actions in available information is positive. However, a comprehensive trust assessment would benefit from more detailed information about the company's operational history, client fund protection measures, and industry reputation.

User Experience Analysis

User experience evaluation for LHCM is constrained by the limited availability of user feedback and detailed platform information in current sources. The single account structure for accessing multiple markets and instruments suggests a streamlined approach that could enhance user experience by reducing complexity.

The multi-platform availability of the EXANTE trading platform indicates consideration for different user preferences and trading environments. This flexibility is important for modern traders who expect seamless access across various devices.

However, without specific information about interface design, ease of use, registration processes, or user satisfaction feedback, it's challenging to assess the actual user experience quality. Important factors such as platform learning curve, navigation efficiency, and overall user satisfaction remain unclear from available sources.

The comprehensive range of available instruments and markets could appeal to sophisticated investors. However, the user experience would ultimately depend on how well the platform presents and organizes this complexity in an accessible manner.

Conclusion

LHCM presents itself as a regulated investment company offering comprehensive global market access through the EXANTE trading platform. The broker's FCA regulation and extensive instrument selection represent significant strengths for investors seeking diversified trading opportunities with regulatory oversight.

This lhcm review identifies LHCM as potentially suitable for investors who prioritize regulatory compliance, global market access, and asset diversity. The single account structure for accessing over one million instruments across 50+ markets offers convenience and comprehensive trading opportunities.

However, the evaluation is limited by insufficient publicly available information about account conditions, costs, customer service, and user experience. Prospective clients would benefit from direct communication with LHCM to obtain detailed information about these crucial aspects before making account opening decisions. The broker's regulatory status provides confidence, but comprehensive service evaluation requires additional information beyond what is currently available in public sources.