Quotex 2025 Review: Everything You Need to Know

Executive Summary

Quotex is a new online trading platform. The company has quickly gained attention in financial markets since starting in 2020, making this quotex review important for traders who want to understand what the broker offers, including its strengths and potential problems.

The platform stands out with several key features that attract everyday investors. Quotex offers one of the lowest minimum deposits in the industry at just $10, which makes trading accessible to people with limited money to invest.

The platform gives users access to over 400 trading assets across multiple categories. These include forex, commodities, cryptocurrencies, indices, and binary options, providing traders with many different investment choices.

Most users are everyday investors who want a simple trading process and different investment opportunities. Quotex markets itself as a user-friendly platform that makes trading "more accessible and efficient" for both new and experienced traders, though the company's claims should be carefully evaluated.

The broker has built its reputation on digital options trading through modern technology. However, potential users should know about important risks before they start trading on this platform.

According to available information, 74-89% of retail investors lose money when trading CFDs. This statistic raises serious questions about risk management and whether traders get enough education about the dangers involved.

The platform started recently, which means it doesn't have the long-term track record that many experienced traders look for when choosing a broker. Despite these concerns, some users say they like the platform's simple approach to trading, with reports suggesting that the interface makes trading "more accessible" compared to more complex platforms, though individual results may vary significantly.

Important Notice

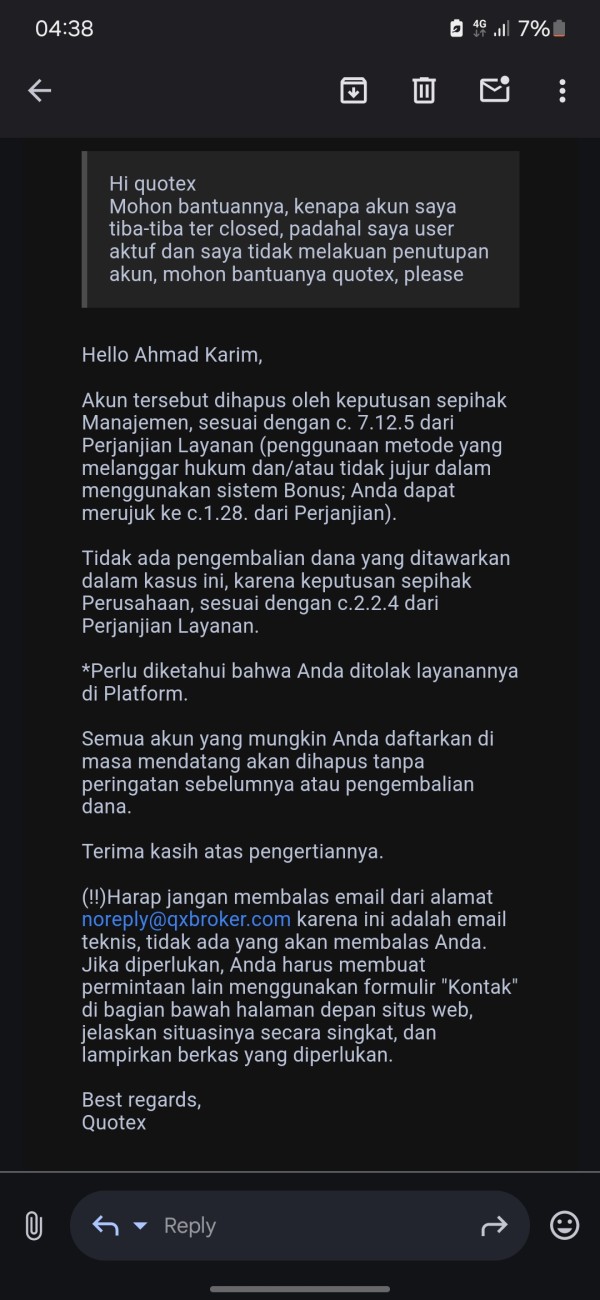

Regulatory Disclaimer: Quotex has not provided clear regulatory details based on available information. Traders should be very careful when deciding if the platform is legitimate and reliable, since the lack of transparent regulatory information is a major concern for potential users.

Review Limitations: This evaluation uses publicly available market feedback and accessible information. Individual trading experiences can be very different, and this review might not show all user experiences or everything the platform offers, so prospective traders should do their own research before making any trading decisions.

Rating Framework

Broker Overview

Quotex started in the online trading world in 2020. The company positions itself as a modern trading platform focused on binary options and contracts for difference (CFDs), building its business around providing a user-friendly trading environment for newcomers and experienced investors.

The platform's fast growth since starting reflects the growing demand for accessible trading solutions. Quotex has found success by focusing on digital options trading, offering what it calls "exceptional speed" powered by modern technology, though these claims should be independently verified.

This technological focus aims to ensure fast and efficient performance for smooth trading experiences, according to the platform's marketing materials. QX Broker, as Quotex is also known, operates as a complete trading platform that covers multiple asset classes, allowing users to trade across forex markets, commodity futures, cryptocurrency pairs, major global indices, and various binary options contracts.

This variety strategy lets users build different portfolios within a single trading environment. The company's approach to market positioning emphasizes accessibility and simplicity rather than targeting institutional investors or wealthy individuals.

This quotex review finds that the platform mainly serves everyday traders who value simple interfaces and low requirements to start trading. The $10 minimum deposit requirement shows this approach, making trading accessible to people who might be excluded from platforms with higher money requirements, though traders should still be aware of the significant risks involved.

Regulatory Jurisdiction: Available documents do not specify clear regulatory oversight or licensing information. This represents a major gap in transparency that potential users should carefully consider before using the platform, as regulatory protection is crucial for trader safety.

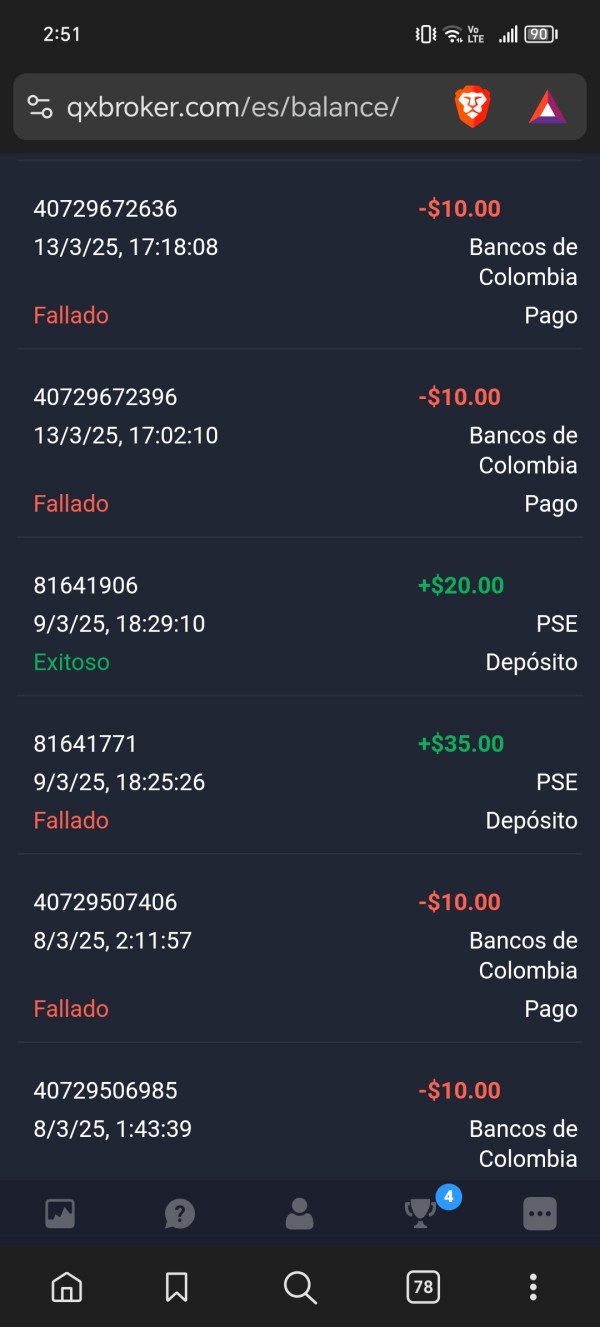

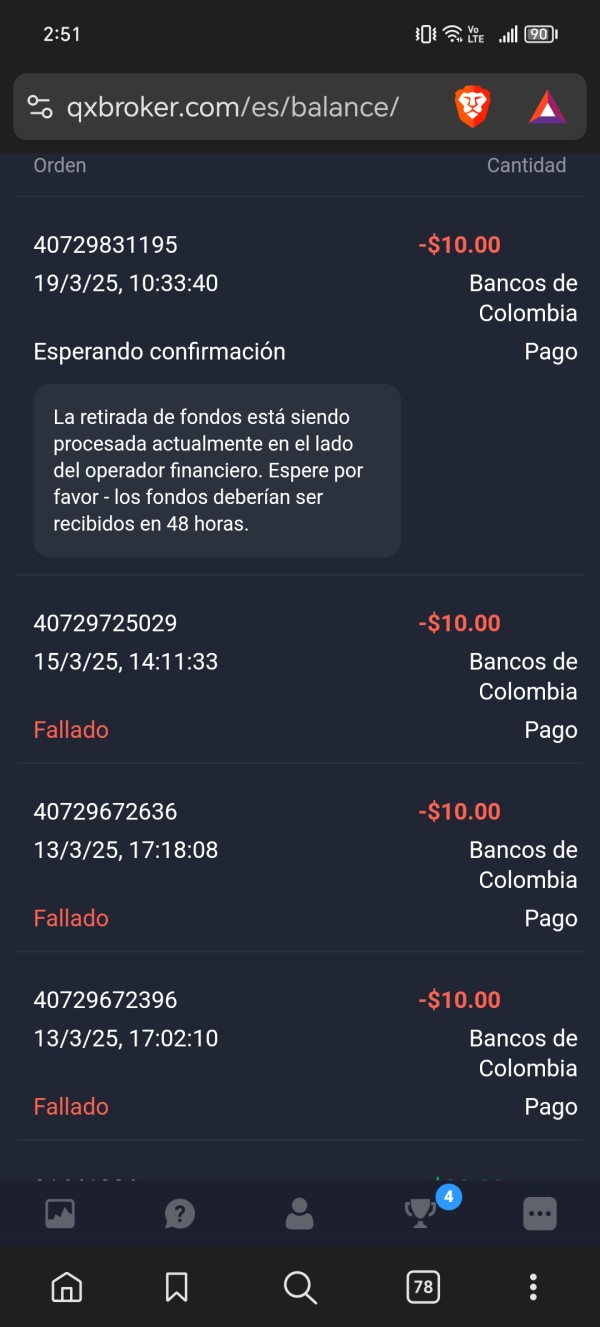

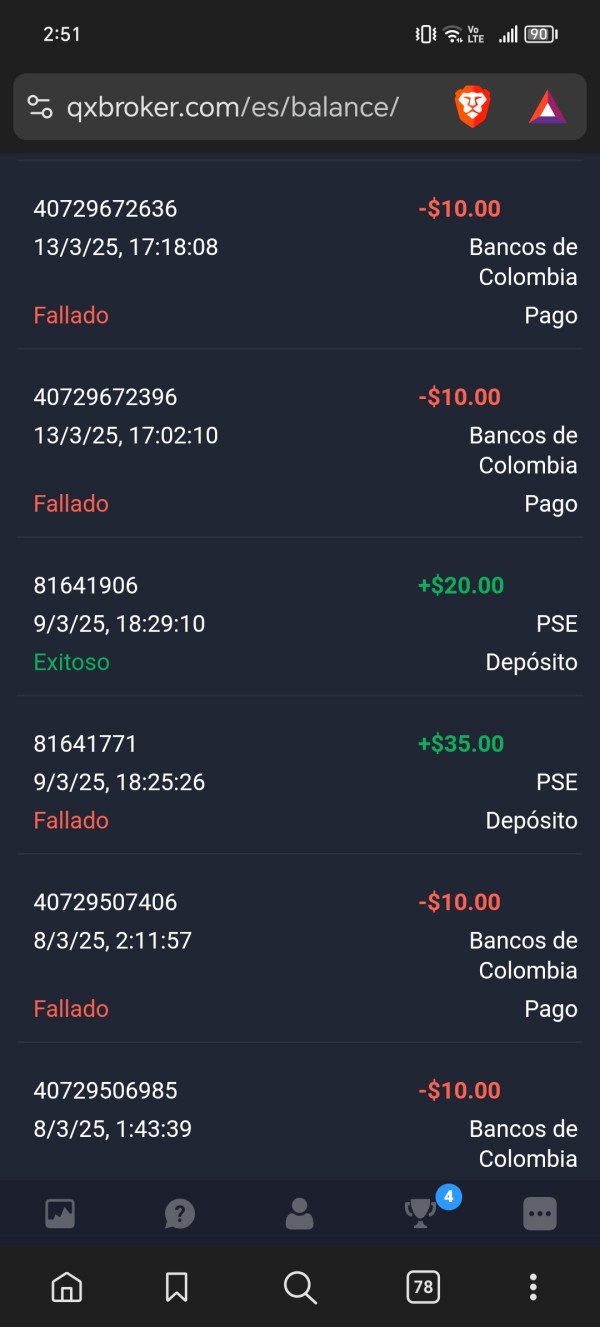

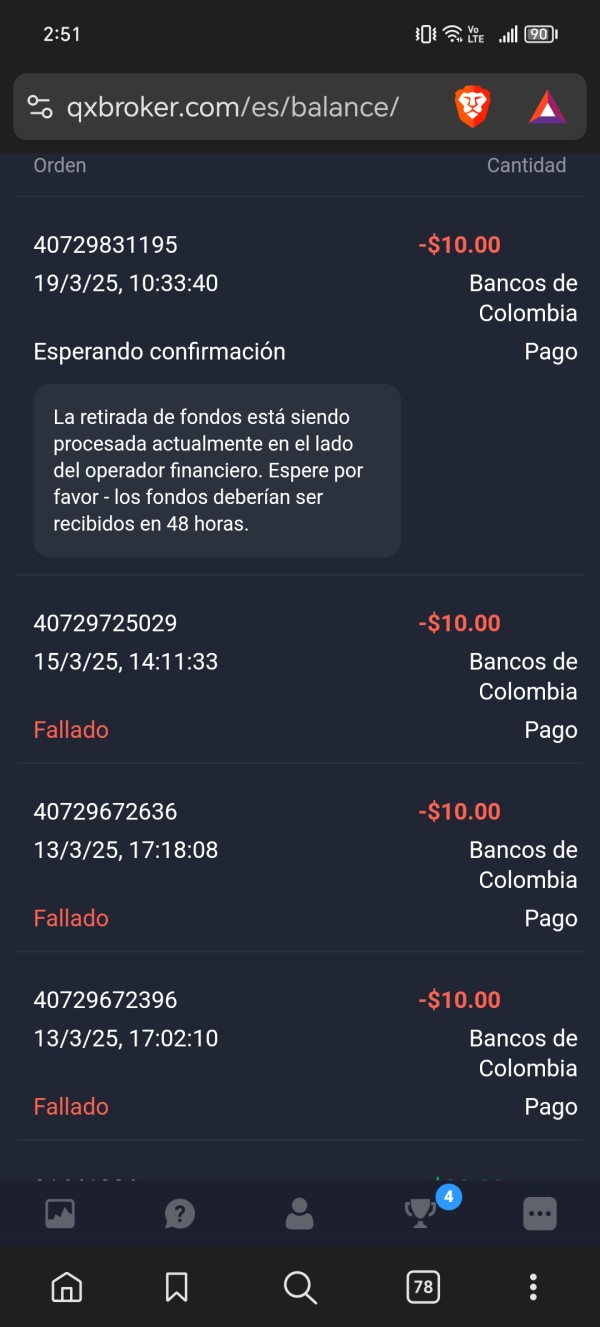

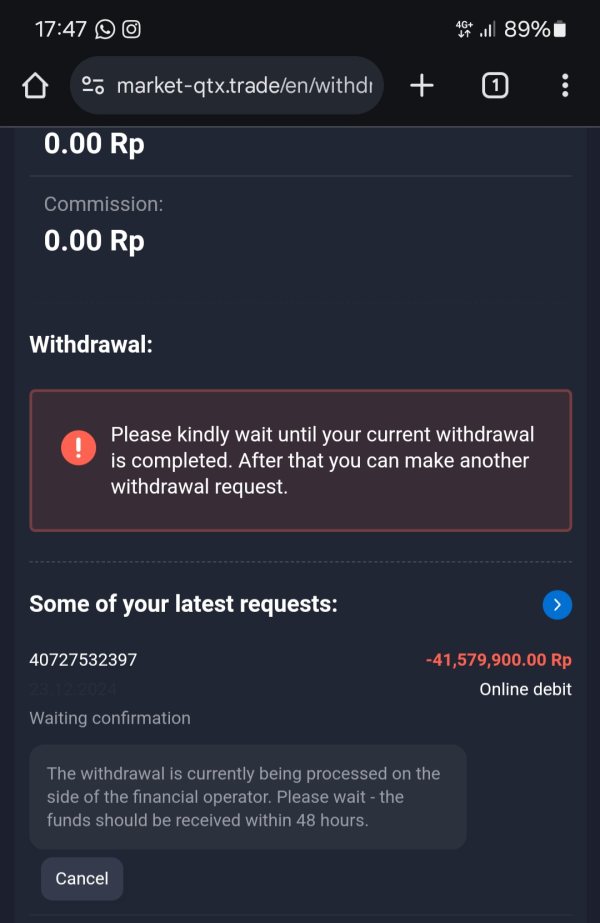

Deposit and Withdrawal Methods: Specific information about available payment methods has not been detailed in accessible sources. The platform appears to support standard payment options including major credit cards based on visual references to payment processors, but traders should verify these options directly with the platform.

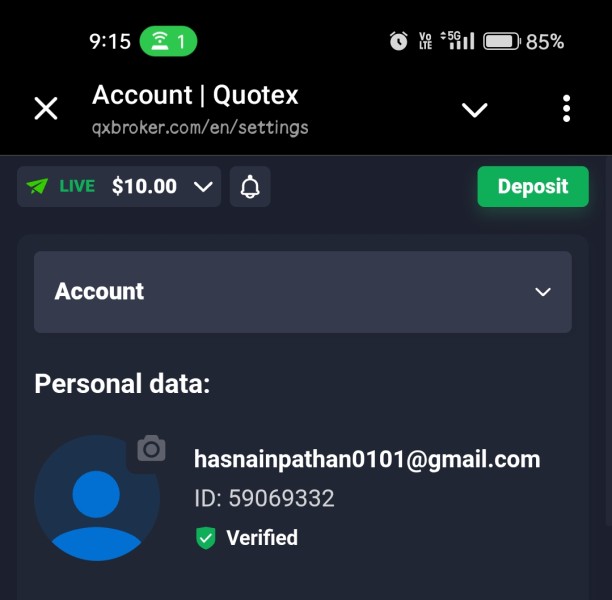

Minimum Deposit Requirements: The platform maintains a $10 minimum deposit requirement. This positions it among the most accessible brokers in terms of initial money requirements, making it particularly attractive for new traders or those testing the platform's capabilities, though low deposits don't eliminate trading risks.

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not detailed in available information. This suggests either limited promotional activities or lack of transparency in marketing these benefits, which potential users should investigate further.

Available Trading Assets: Quotex provides access to over 400 different trading instruments spanning multiple asset classes. This includes major and minor forex pairs, commodity contracts, cryptocurrency trading pairs, global stock indices, and various binary options contracts, giving traders many options for portfolio diversification within a single platform.

Fee Structure and Costs: Detailed commission and spread information is not readily available in public documentation. This raises concerns about cost transparency, and this quotex review notes that the absence of clear fee disclosure makes it difficult for traders to accurately assess the total cost of trading.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available sources. This represents another area where the platform lacks transparency in its public information, which is concerning for traders who need to understand their risk exposure.

Platform Technology: Quotex operates on its own trading platform rather than using established third-party solutions like MetaTrader. The platform emphasizes mobile accessibility and cross-device functionality, though the reliability of proprietary platforms can vary.

Geographic Restrictions: Specific information about regional availability and restrictions has not been disclosed in accessible documentation. Traders should verify whether they can legally access the platform in their location.

Customer Support Languages: The range of supported languages for customer service has not been specified in available materials. This could be important for international users who need support in their native language.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

The account conditions at Quotex present a mixed picture that earns a solid but not exceptional rating. The platform's strongest feature in this category is its $10 minimum deposit requirement, which stands among the lowest in the industry and significantly benefits new traders and those with limited capital who want to explore online trading without substantial financial commitment.

However, the evaluation is limited by the lack of detailed information about different account types and their respective features. Most established brokers offer tiered account structures with varying benefits, but available documentation does not clearly outline whether Quotex provides multiple account levels or what additional features might be available to higher-tier users, which limits transparency.

The account opening process appears streamlined based on user feedback suggesting that getting started is relatively straightforward. However, specific details about verification requirements, documentation needed, and processing times are not readily available in public sources, and this quotex review finds that while the low entry barrier is good, the lack of transparency about account features and processes prevents a higher rating.

Account funding flexibility appears limited based on available information, with unclear details about supported payment methods and processing times. For a platform targeting retail investors, more comprehensive information about account management would be expected to help users make informed decisions.

Quotex's tools and resources receive an average rating due to limited transparency about the quality and depth of available trading tools. While the platform provides access to over 400 trading assets, which demonstrates breadth, the specific analytical tools, charting capabilities, and research resources are not well-documented in available sources, making it difficult to assess their quality.

The platform's emphasis on "cutting-edge technology" suggests modern trading tools. However, without detailed specifications about chart types, technical indicators, drawing tools, or analytical capabilities, it's difficult to assess whether the platform meets the needs of serious traders who require comprehensive charting packages, multiple timeframes, and extensive technical analysis tools.

Educational resources, which are crucial for the retail investor demographic that Quotex targets, are not clearly outlined in available documentation. Given that many users are likely new to trading, the absence of visible educational content represents a significant gap, since established brokers typically provide extensive educational materials, webinars, tutorials, and market analysis to support trader development.

Automated trading support and API access are not mentioned in available sources. This may limit the platform's appeal to more advanced users who rely on algorithmic trading strategies or third-party tools for their trading activities.

Customer Service and Support Analysis (Score: 5/10)

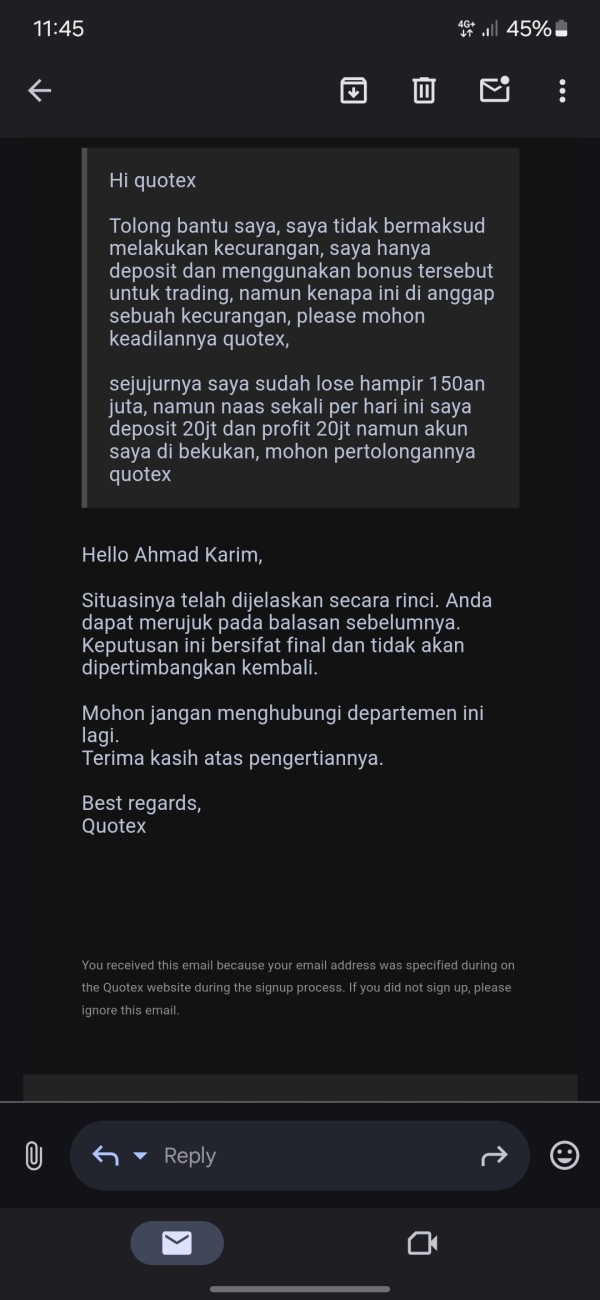

Customer service receives a below-average rating due to limited information about support channels, availability, and service quality. For a platform targeting retail investors, particularly those new to trading, robust customer support is essential, yet available documentation does not provide clear details about how users can access help when needed, which is concerning.

The absence of clearly stated support channels, response time commitments, or service level agreements raises concerns about the platform's commitment to customer service. Most reputable brokers prominently display their support options, including live chat, phone support, email tickets, and comprehensive FAQ sections to help users resolve issues quickly.

Multi-language support information is not available, which could be problematic for international users. Given the global nature of online trading, language support is often a key differentiator for platforms serving diverse user bases who need assistance in their native languages.

Operating hours for customer support are not specified, leaving users uncertain about when they can expect assistance. This is particularly important for traders in different time zones or those trading during off-hours when immediate support might be needed to resolve urgent issues.

Trading Experience Analysis (Score: 7/10)

The trading experience at Quotex receives a good rating based on available user feedback suggesting that the platform makes trading "more accessible" and user-friendly. The emphasis on technological performance and speed indicates that the platform prioritizes execution quality and system reliability, which are important factors for successful trading.

User reports suggest that the platform successfully simplifies the trading process, which aligns with its target demographic of retail investors seeking straightforward trading solutions. The proprietary platform design appears to focus on ease of use rather than overwhelming users with complex features that might confuse beginners.

However, this quotex review notes that specific performance metrics such as execution speeds, slippage rates, or uptime statistics are not publicly available. These technical specifications are important for traders who need reliable performance, particularly in volatile market conditions when quick execution can impact profitability.

Mobile trading capabilities appear to be a platform strength based on references to mobile accessibility, which is crucial for modern traders who need flexibility to manage positions on the go. The cross-device functionality suggests a well-designed user interface that adapts to different screen sizes and input methods for consistent user experience.

The variety of available assets (400+) provides traders with substantial opportunities for diversification and strategy implementation across multiple markets and timeframes. This breadth allows users to explore different trading approaches and spread risk across various asset classes.

Trust and Reliability Analysis (Score: 4/10)

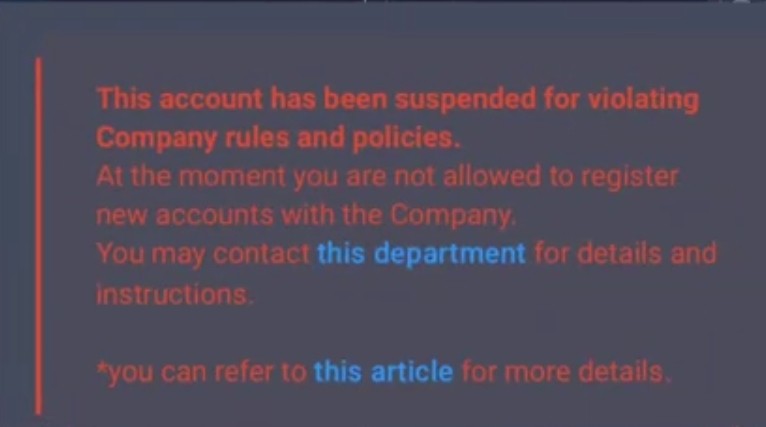

Trust and reliability receive the lowest rating in this evaluation due to several significant concerns. The most critical issue is the absence of clear regulatory information, which represents a fundamental transparency problem for any financial services provider and raises serious questions about user protection.

The lack of disclosed regulatory oversight means users cannot verify the platform's compliance with financial services regulations or confirm what protections might be available for client funds. Established brokers typically hold licenses from recognized regulatory bodies and prominently display their regulatory status to build trust with potential users.

The concerning statistic that 74-89% of retail investors lose money when trading CFDs raises questions about risk management education and whether the platform adequately prepares users for the risks involved in leveraged trading. While this statistic is not unique to Quotex, the combination with unclear regulatory status amplifies concerns about user protection and platform accountability.

Fund security measures, segregation of client funds, and insurance protections are not detailed in available documentation. These are standard features that reputable brokers use to protect client assets and build trust with users, and their absence is concerning.

The platform's relatively recent establishment (2020) means it lacks the long-term track record that provides confidence to experienced traders. While being new doesn't necessarily indicate problems, it does mean less historical data is available to assess reliability over time and through different market conditions.

User Experience Analysis (Score: 6/10)

User experience receives an average rating based on mixed feedback and limited detailed information about interface design and usability. The available user rating of 4 out of 5 suggests generally positive experiences, but this quotex review notes that more comprehensive feedback data would provide better insights into actual user satisfaction.

The platform's focus on simplicity appears to resonate with users who appreciate streamlined interfaces over complex trading environments. For retail investors, particularly those new to trading, an intuitive interface can significantly impact success and satisfaction by reducing the learning curve and minimizing user errors.

Registration and verification processes are not detailed in available sources, but user feedback suggesting easy access implies that onboarding is relatively straightforward. However, the lack of specific information about verification requirements and processing times represents a transparency gap that could affect user planning and expectations.

The concerning statistic about retail investor losses (74-89%) may impact overall user satisfaction, as financial losses typically correlate with negative platform experiences regardless of interface quality. This factor likely contributes to mixed user feedback and prevents a higher rating in this category since user experience includes financial outcomes.

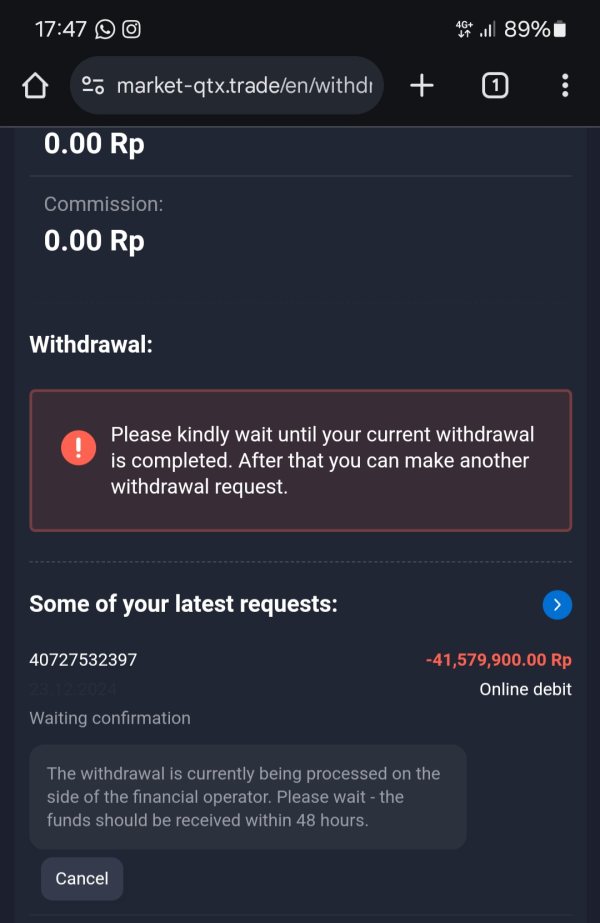

Account management and fund operation experiences are not well-documented, making it difficult to assess how users interact with the platform for routine account maintenance, deposits, and withdrawals. These everyday interactions significantly impact overall user satisfaction and platform usability.

Conclusion

Quotex presents itself as an accessible entry point into online trading with its $10 minimum deposit and over 400 available assets. While the platform offers certain advantages for retail investors seeking simplified trading experiences, significant concerns about transparency and regulatory oversight limit its overall appeal and raise important questions about user protection.

The platform's strengths lie in its low barrier to entry and user-friendly approach, making it potentially suitable for new traders exploring financial markets. However, the absence of clear regulatory information, limited transparency about fees and features, and concerning statistics about retail investor losses suggest that potential users should exercise considerable caution before committing funds.

This quotex review concludes that while Quotex may serve certain user needs, the lack of regulatory clarity and comprehensive information makes it difficult to recommend without reservations. Prospective traders should carefully consider these limitations and explore alternative platforms with stronger regulatory credentials and greater transparency to better protect their investments and trading interests.