Regarding the legitimacy of United Asia Futures forex brokers, it provides BAPPEBTI, JFX and WikiBit, (also has a graphic survey regarding security).

Is United Asia Futures safe?

Risk Control

Software Index

Is United Asia Futures markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. United Asia Futures

Effective Date:

--Email Address of Licensed Institution:

admin@united-asia.comSharing Status:

No SharingWebsite of Licensed Institution:

www.united-asia.comExpiration Time:

--Address of Licensed Institution:

WisMa GKBI LanTai 38-03 Jl. Jenderal SudirMan No. 28 JakarTa PusaT, Wisma GKBI Lantai 38 Suite 3803 Jl. Jend. Sudirman Street Kav. 28,Jakarta IndonesiaPhone Number of Licensed Institution:

02157906333Licensed Institution Certified Documents:

JFX Derivatives Trading License (AGN)

Jakarta Futures Exchange

Jakarta Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

United Asia Futures

Effective Date:

--Email Address of Licensed Institution:

admin@united-asia.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Wisma GKBI Lantai 38-03, Jl. Jenderal Sudirman No 28, Jakarta Pusat 10210Phone Number of Licensed Institution:

021-57906333Licensed Institution Certified Documents:

Is United Asia Futures A Scam?

Introduction

United Asia Futures is an Indonesia-based forex broker that has garnered attention in the trading community for its offerings in commodities, index futures, and foreign exchange. Established in a region where regulatory standards can vary significantly, it is crucial for traders to carefully evaluate the credibility and trustworthiness of such brokers. Given the complexities and risks associated with forex trading, potential investors must conduct thorough due diligence to avoid scams and ensure their funds are secure. This article aims to provide a comprehensive analysis of United Asia Futures, focusing on its regulatory compliance, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

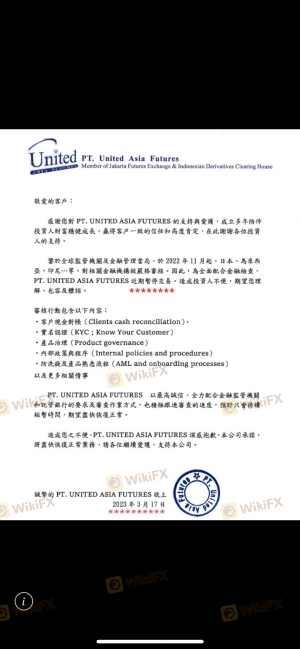

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. United Asia Futures claims to be regulated by the Indonesian Commodity Futures Trading Regulatory Agency (BAPPEBTI), which is responsible for overseeing trading activities in Indonesia. However, the effectiveness of this regulation is often questioned, as Indonesia is not considered a strict jurisdiction compared to major financial hubs like the United States or the United Kingdom.

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| BAPPEBTI | 34/BAPPEBTI/SP-PA/11/2006 | Indonesia | Verified |

While the presence of a regulatory license is a positive sign, the lack of stringent enforcement mechanisms raises concerns. Historical compliance issues and the broker's operational practices indicate that regulatory oversight may not be robust enough to protect traders from potential malpractices. As such, while United Asia Futures is technically regulated, the quality of that regulation is questionable, and traders should remain cautious.

Company Background Investigation

United Asia Futures operates under the ownership of PT United Asia Futures, a company that has been active in the Indonesian market since at least 2007. The company's history reveals a commitment to offering various financial instruments, including forex, commodities, and index futures. However, details regarding the management team and their professional backgrounds are sparse, which can be a red flag for potential investors. Transparency in the ownership structure and management expertise is essential for building trust with clients.

Furthermore, the company's website lacks comprehensive information about its operations, which diminishes its credibility. A broker that is unwilling to disclose essential details about its management and operational practices may be hiding potential risks. Therefore, while United Asia Futures has established a presence in the market, the overall transparency and information disclosure level are inadequate for fostering trader confidence.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is crucial. United Asia Futures offers a range of trading instruments, but their overall fee structure appears less competitive than industry standards. The broker's spreads for major currency pairs, such as EUR/USD and GBP/USD, are set at 2 pips, which is higher than the average spread offered by other brokers.

| Fee Type | United Asia Futures | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 2 pips | 1.5 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of clarity regarding commissions and overnight interest rates can lead to unexpected costs for traders. Such opacity in fee structures is concerning, as it complicates the assessment of the total cost of trading. Traders should be aware of these potential pitfalls and consider how they might impact their profitability.

Customer Funds Safety

The safety of client funds is paramount when choosing a forex broker. United Asia Futures claims to implement various measures to protect customer funds, but specific details regarding fund segregation, investor protection, and negative balance protection policies are not readily available. The absence of such information raises alarms about the broker's commitment to safeguarding client assets.

Moreover, there have been reports of withdrawal issues from traders, which further complicates the perception of fund security. Historical complaints about difficulties in accessing funds can indicate deeper operational problems and should be taken seriously by potential investors. The lack of a robust investor protection framework could expose traders to significant risks, especially in a jurisdiction where regulatory oversight is limited.

Customer Experience and Complaints

Customer feedback is vital for understanding a broker's operational integrity. Reviews of United Asia Futures reveal a mixed bag of experiences, with some traders reporting satisfactory service while others express frustration over withdrawal issues and lack of support. Common complaints include difficulty in processing withdrawals, slow customer service response times, and a general lack of transparency regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support Delays | Medium | Inconsistent |

| Lack of Transparency | High | Poor |

One notable case involves multiple traders from Taiwan who reported being unable to withdraw their funds for extended periods, raising concerns about the broker's reliability. Such experiences highlight the need for potential clients to approach United Asia Futures with caution, weighing the risks against their trading objectives.

Platform and Trade Execution

The trading platform offered by United Asia Futures is not based on popular systems like MetaTrader 4 or MetaTrader 5, which can deter potential clients accustomed to more established platforms. The performance and stability of the trading platform are critical for a smooth trading experience, and any issues related to order execution can significantly impact traders' profitability.

Concerns have been raised regarding order execution quality, including instances of slippage and order rejections. These issues can lead to frustration and financial losses, particularly for traders employing strategies that rely on precise execution. Without evidence of a robust and reliable trading platform, traders may find themselves at a disadvantage.

Risk Assessment

Engaging with United Asia Futures presents various risks that potential traders should consider. The overall risk profile can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight in Indonesia. |

| Financial Risk | High | Reports of withdrawal issues and lack of transparency. |

| Operational Risk | Medium | Unfamiliar trading platform and execution concerns. |

| Client Support Risk | Medium | Inconsistent customer service experiences. |

To mitigate these risks, traders should exercise caution, conduct thorough research, and consider using risk management strategies such as setting stop-loss orders and limiting exposure to any single broker.

Conclusion and Recommendations

In conclusion, while United Asia Futures is technically regulated by BAPPEBTI, the quality of that regulation and the overall transparency of the broker raise significant concerns. The combination of high spreads, reports of withdrawal issues, and a lack of clarity regarding trading conditions suggests that potential clients should approach this broker with caution.

Traders seeking to engage with United Asia Futures should carefully weigh the risks involved and consider alternative brokers with stronger regulatory oversight and better customer feedback. Recommended alternatives include brokers regulated by tier-one authorities such as the FCA, ASIC, or NFA, which offer greater security and transparency for traders. Ultimately, ensuring the safety of your funds and the reliability of your trading experience should be the top priority when selecting a forex broker.

Is United Asia Futures a scam, or is it legit?

The latest exposure and evaluation content of United Asia Futures brokers.

United Asia Futures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

United Asia Futures latest industry rating score is 6.75, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.75 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.