united asia futures 2025 Review: Everything You Need to Know

Abstract

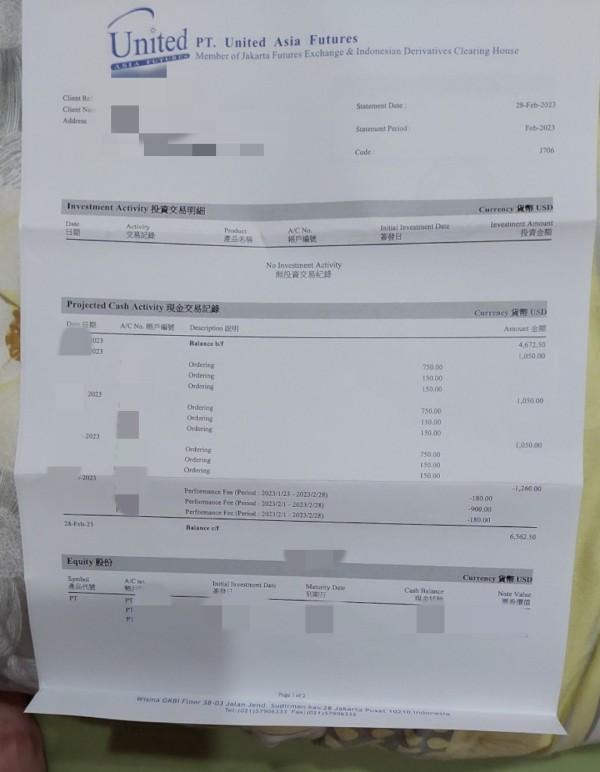

This united asia futures review gives United Asia Futures a very negative rating. The platform has low user trust and has been connected to possible scam risks, which should warn investors right away. One major problem is that the company does not share clear information about trading details, with important facts about costs, minimum deposits, and special offers missing completely. United Asia Futures also uses its own trading platform instead of the popular MT4/MT5 systems that most traders prefer, which hurts its reputation even more. The company mainly targets investors who want to trade financial products like forex, stocks, and ETFs. However, the high risks and unclear business structure make it unappealing even to experienced traders. We strongly recommend being careful because future clients may face unexpected problems due to weak oversight and a bad reputation overall. Users must do their own research before thinking about investing with this broker.

Precautions

You need to understand regional and regulatory differences before considering United Asia Futures. The platform is based in Indonesia, so its rules are different from major financial centers around the world. This review uses available user feedback and public information, which show a worrying lack of clear details. The oversight by groups like Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan and Jakarta Futures Exchange may not protect investors as well as Western regulatory institutions do. Investors should be careful and well-informed as a result.

Score Framework

Broker Overview

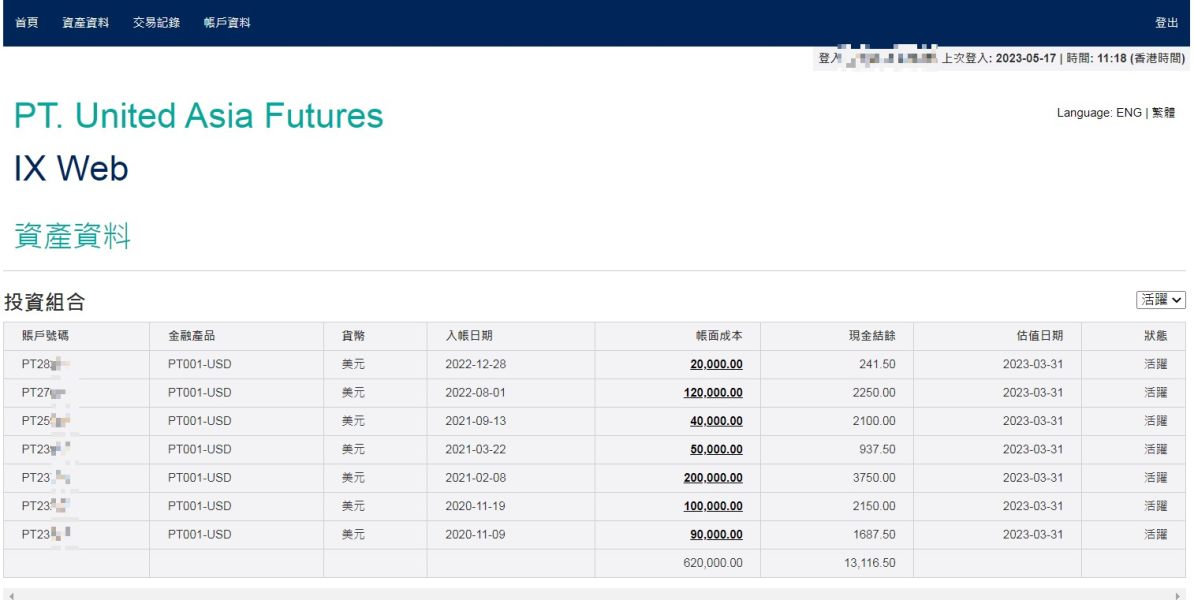

United Asia Futures started in 2018 and is based in Indonesia. The company positions itself as a futures broker that specializes in trading financial products. Its main focus is offering trading services across different types of assets, including forex, stocks, and ETFs. Many user reports show major problems with transparency and regulatory oversight, despite the company's goals to serve investors interested in financial products. This review shows that important information like margin requirements, commission structures, and account types is either unclear or completely missing from public information. These issues have led to ongoing concerns among potential clients about whether the broker can be trusted.

United Asia Futures uses its own trading platform instead of the industry-standard MT4/MT5 systems when it comes to trading technology and business operations. This choice to be different from widely recognized platforms might seem like an attempt to stand out, but it has mostly failed because market feedback shows major problems with execution quality and user-friendly design. The platform's asset categories include risky financial products and are managed under the supervision of regulatory bodies such as the Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan and the Jakarta Futures Exchange. Regulatory oversight seems insufficient in ensuring strong investor protection, however. This united asia futures review highlights a series of unresolved issues that affect every part of the broker's service offerings overall.

United Asia Futures operates under oversight from the Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan and the Jakarta Futures Exchange. These bodies are recognized in Indonesia but may not give the same level of trust as more globally known regulators, leaving many investors exposed to higher risk.

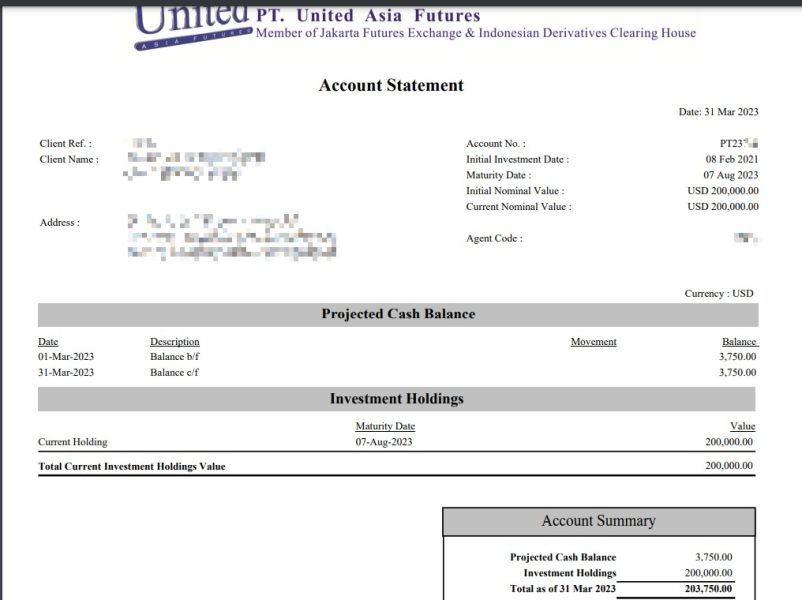

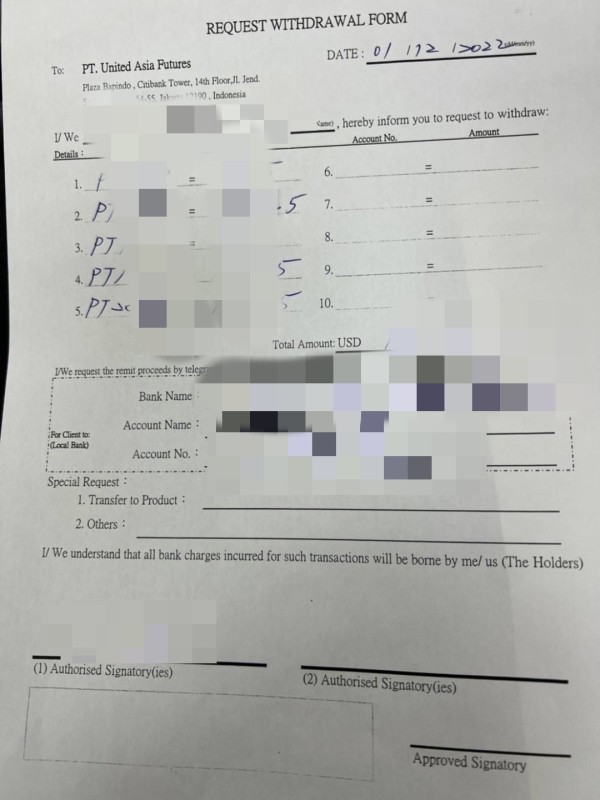

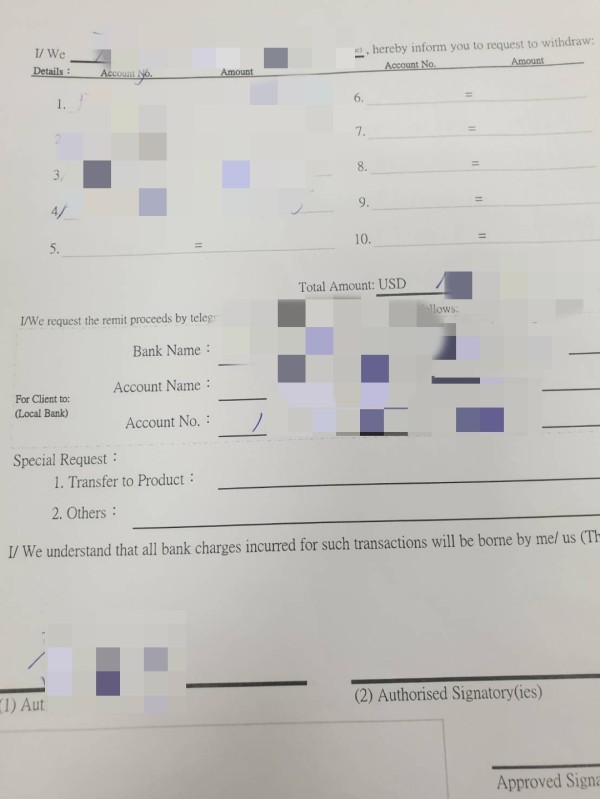

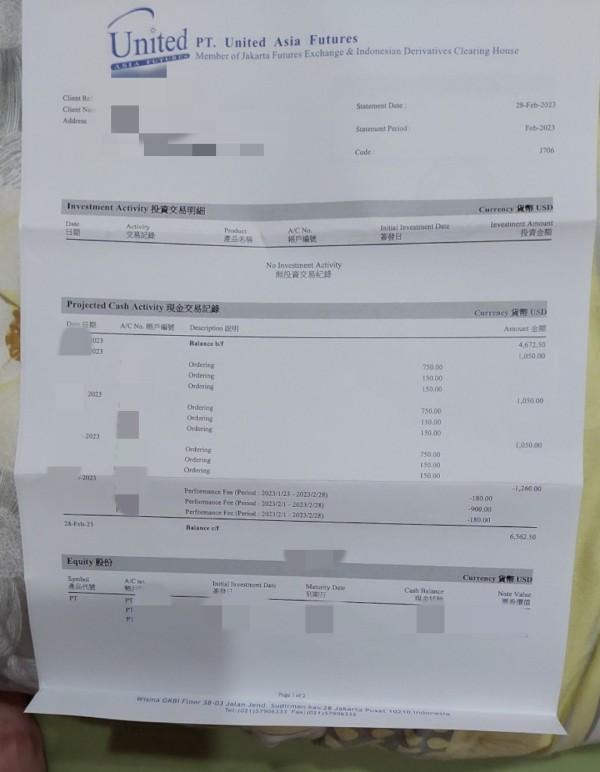

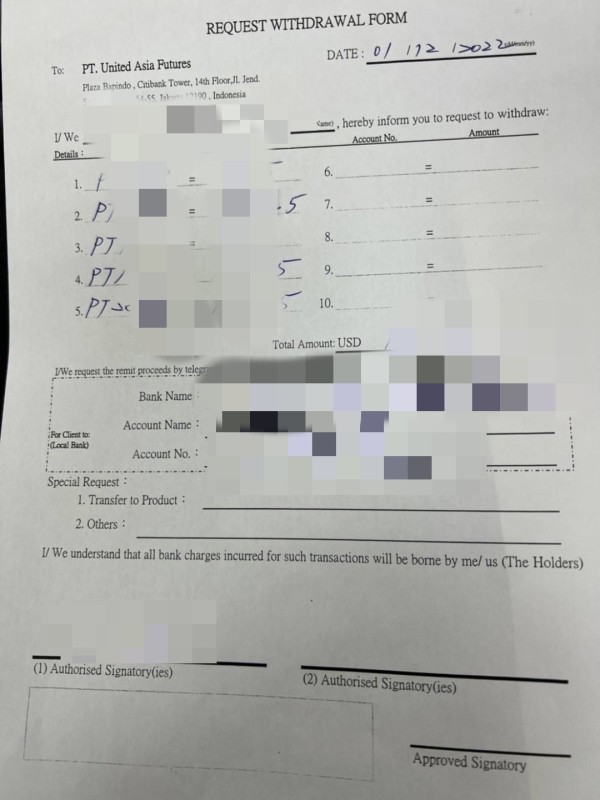

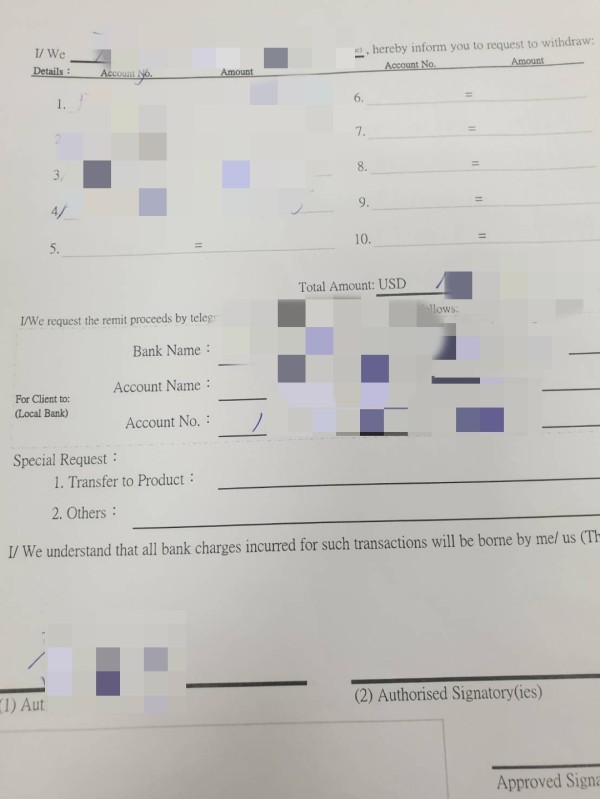

There is not enough public information available to accurately describe the deposit and withdrawal process. The broker has not clearly shared specific details about supported payment methods, so potential investors should be careful. The minimum deposit requirement also remains unknown. This lack of detail extends to bonus and promotional offers, with the broker providing no clarity about any incentives typically available to new or regular traders.

United Asia Futures claims to offer access to various financial products including forex, stocks, and ETFs when it comes to tradable assets. The absence of detailed information on cost structures, such as spreads or commissions, leaves major gaps in understanding the overall trading costs, however. Questions about leverage ratios and other trading parameters also remain unanswered, which may make the trading experience more complicated for prospective clients.

The platform itself does not use the widely utilized MT4/MT5 systems, making its evaluation more difficult. This non-standard approach to platform technology may cause problems for traders used to more mainstream solutions and limits ease-of-use. Regional restrictions and the languages available for customer support are also not clearly defined in available information, additionally. This united asia futures review highlights major transparency issues that contribute to the negative evaluation of this broker overall.

Detailed Scoring Analysis

2.6.1 Account Conditions Analysis

The account conditions at United Asia Futures show a severe lack of detailed information about account types and related features. Important information on minimum deposit requirements, commission structures, or even the details of spread costs is clearly missing. Potential clients are left with more questions than answers when it comes to the actual cost of maintaining or opening an account as a result. The account opening process itself is unclear and lacks clear instructions or a smooth procedure that would typically be expected in a regulated broker environment.

There is no transparent disclosure of any special account features or tiered account types that might work for both beginner and advanced traders, furthermore. The very limited information provided about account conditions significantly contributes to the low rating of 1/10 in this united asia futures review. This evaluation is based on widely shared user reports that point to a frustrating lack of transparency and unclear account management policies.

United Asia Futures offers tools and resources that include a range of financial instruments, such as forex, stocks, and ETFs. The quality and accessibility of these tools fall short when compared to industry standards, however. The broker's own trading platform, which does not use the popular MT4/MT5 systems, has been criticized for its unfamiliar interface and limited functionality. There is no clear information about additional research resources, educational materials, or automation tools that can benefit traders.

The absence of advanced charting software or analytical tools further takes away from the overall value proposition. The broker advertises a broad suite of tradable assets, but the overall user experience is hurt due to the problems with the trading platform and missing additional resources. Such limitations, along with the transparency issues mentioned earlier, contribute to a modest evaluation score of 4/10. Many users have expressed their disappointment in this united asia futures review, emphasizing that the platform's risks and drawbacks are not sufficiently balanced by available tools.

2.6.3 Customer Service and Support Analysis

Customer service and support are critical parts of any trading platform. United Asia Futures appears to be severely lacking in this department, however. There is little publicly available information about the range and quality of customer service channels, leaving prospective users uncertain about how and when they can get reliable help. Response times and the effectiveness of problem resolution have been consistently criticized by users in various online forums.

Without clear details on multi-language support or dedicated customer service hours, it becomes difficult for investors to judge the reliability of continued support. The low score of 3/10 reflects widespread dissatisfaction, as customers have reported difficulties in resolving issues and getting clear, prompt communication. This aspect remains a major problem in the overall evaluation provided in this review, with the lack of comprehensive customer support further reducing investor confidence. Users seeking strong, dependable service may find themselves facing significant hurdles when relying on the available support channels.

2.6.4 Trading Experience Analysis

The trading experience at United Asia Futures is significantly hurt by concerns over transparency and platform performance. The broker offers access to a range of financial products, but the overall trading environment is far from ideal. Users have reported issues with platform stability and execution speeds, which are critical factors in fast-moving financial markets. The proprietary trading system, which is different from well-established platforms like MT4/MT5, is reported to be less intuitive and lacks some essential features, additionally.

This problem not only affects order execution quality but also hurts overall user satisfaction. The negative feelings surrounding the trading experience contribute to a score of 2/10 in this category. In multiple instances, traders have raised concerns about delays and inconsistent performance, showing that the platform may be poorly equipped to handle high-frequency trading conditions. This united asia futures review consistently shows that the problems in the trading system largely undermine the broker's potential offerings.

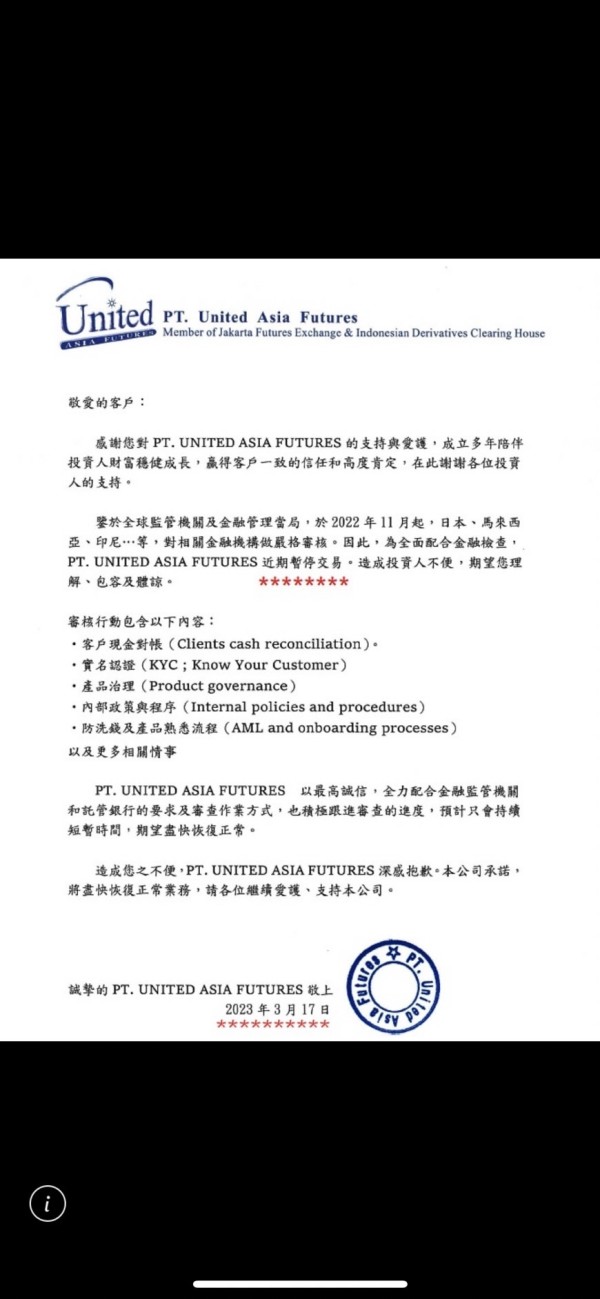

2.6.5 Trust Analysis

Trust remains the single most critical factor for any financial broker. United Asia Futures falls drastically short in this area, however. Despite the regulatory oversight by bodies such as the Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan and the Jakarta Futures Exchange, significant concerns persist about the broker's overall transparency and commitment to investor safety. Many reports and user reviews accuse the company of misleading practices and potential scam activities.

The lack of detailed disclosure on key operational parameters makes investor insecurity even worse. Users have repeatedly highlighted the absence of strong safeguards and are left questioning whether their funds are genuinely secure. In this united asia futures review, the combination of vague information, negative user feedback, and reported controversies contributes to a terrible score of 1/10. The overall industry feeling suggests that the broker's reputation is severely damaged, making it an unsuitable choice for cautious investors seeking reliability and transparency.

2.6.6 User Experience Analysis

The overall user experience provided by United Asia Futures is notably poor, as reflected in a low satisfaction score of 2/10. Many aspects of the platform contribute to this poor rating, including the design and usability of the trading interface, the complexity of the registration and verification processes, and the overall lack of clarity in how funds are managed. Users have frequently voiced their frustration about the unexplained delays, hidden terms, and the absence of clear instructions, which only serve to increase their doubts about the broker.

Rather than offering a smooth and user-friendly experience, the platform seems to have chosen an unconventional approach that ultimately pushes away both novice and experienced traders alike. Common user complaints focus on the unclear operational practices and the difficulty in navigating a system that does not follow familiar industry standards. Investors are left with a poor experience that does little to inspire confidence or build long-term client relationships as a result.

Conclusion

United Asia Futures presents a concerning picture with very low ratings on trust, account conditions, and overall customer experience. The united asia futures review has revealed significant red flags, including a non-standard trading platform, lack of transparency about fees and processes, and a generally negative user sentiment. This broker appears unsuitable for most regular investors and may only slightly appeal to those with an extremely high risk tolerance. Prospective clients are advised to exercise extreme caution and consider more reputable alternatives before committing any capital.