Regarding the legitimacy of TNFX forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is TNFX safe?

Pros

Cons

Is TNFX markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TNFX LTD

Effective Date:

--Email Address of Licensed Institution:

support@tnfx.coSharing Status:

No SharingWebsite of Licensed Institution:

https://www.tnfx.coExpiration Time:

--Address of Licensed Institution:

CT House, Office 3A, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4374030Licensed Institution Certified Documents:

Is TNFX A Scam?

Introduction

TNFX, a forex broker established in 2019, has garnered attention in the online trading community as a platform that claims to offer competitive trading conditions, a variety of account types, and advanced trading tools. Operating primarily in the Middle East and registered in Seychelles, TNFX presents itself as a promising option for both novice and experienced traders. However, the forex trading landscape is fraught with risks, making it essential for traders to conduct thorough due diligence before selecting a broker. With numerous reports of scams and fraudulent activities in the industry, evaluating the legitimacy and reliability of brokers like TNFX is paramount.

This article aims to provide an objective analysis of TNFX by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The investigation is based on various credible sources, including user reviews, regulatory filings, and industry reports, to give a comprehensive overview of whether TNFX is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in assessing its legitimacy and trustworthiness. TNFX is regulated by the Seychelles Financial Services Authority (FSA), which is considered a tier-3 regulator. While being regulated is a positive aspect, the quality of oversight provided by the Seychelles authority is often questioned due to its lenient regulatory environment compared to top-tier regulators like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Here is a summary of TNFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD133 | Seychelles | Verified |

The FSA's oversight focuses on ensuring that brokers operate within the law, but it lacks the stringent requirements imposed by higher-tier regulators. This situation raises concerns regarding investor protection, as clients may not have access to the same level of recourse in case of disputes or misconduct. Additionally, there have been no significant historical compliance issues reported for TNFX, but the lack of rigorous oversight means traders must exercise caution.

Company Background Investigation

TNFX is owned by TNFX Ltd, which is registered in Seychelles. The company claims to also have a presence in Dubai, where it operates under the Dubai Economic Department. However, there is limited transparency regarding the ownership structure and management team. The company's website does not provide detailed information about its founders or key executives, which is often a red flag for potential investors.

The absence of a well-documented history and clear management profiles can lead to skepticism about the broker's credibility. Furthermore, while TNFX has been recognized in the past for its services—such as being awarded "Best ECN Broker in the Middle East"—these accolades should be viewed with caution, as they do not necessarily indicate regulatory compliance or operational integrity.

The level of transparency regarding company operations and ownership is essential for building trust with clients. Without clear information, potential investors may question the broker's motives and reliability.

Trading Conditions Analysis

TNFX offers a variety of trading accounts, including standard, fixed, zero, and cent accounts, each designed to cater to different trading styles and experience levels. The broker claims to provide competitive spreads, high leverage, and a commission-free trading environment for most account types.

Trading Costs Overview

| Cost Type | TNFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 1.0 pips | 0.5 - 1.0 pips |

| Commission Model | $5 on Zero Account | $0 - $5 |

| Overnight Interest Range | Varies | Varies |

While some accounts offer competitive spreads, such as the zero account with spreads starting at 0 pips, the overall cost structure may still be higher than that of other reputable brokers. The minimum deposit requirement for standard accounts is $100, which is reasonable but may not be accessible for all traders. Additionally, the commission on the zero account, while low, could deter some traders due to the upfront cost.

It is crucial for traders to carefully evaluate the fee structure and understand any potential hidden costs associated with trading on the TNFX platform. Transparency regarding fees is essential to avoid unpleasant surprises that could impact trading profitability.

Client Funds Security

The safety of client funds is a top priority for any forex broker. TNFX claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, which is a standard practice in the industry.

However, the level of investor protection offered by the Seychelles FSA is not as robust as that provided by higher-tier regulators. As such, traders should be aware that in the event of a dispute, their recourse may be limited. There have been no reported incidents of fund mismanagement or significant security breaches at TNFX, but the broker's offshore status raises some concerns about the overall security of client funds.

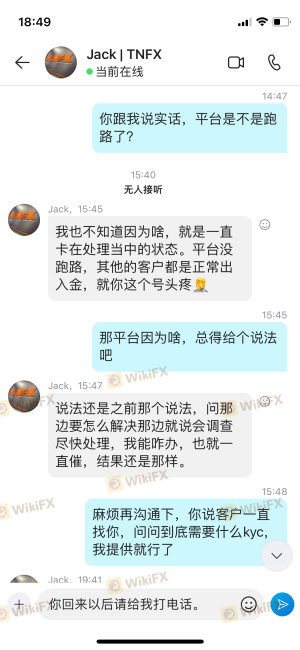

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. TNFX has received a mixed bag of reviews from users, with some praising its competitive trading conditions and customer support, while others have raised significant concerns about withdrawal processes and responsiveness to complaints.

Common Complaint Types

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | Moderate response |

| Transparency Concerns | High | Lacking clarity |

For instance, several users have reported difficulties in withdrawing their funds, with some claiming that their withdrawal requests were delayed or denied without clear explanations. These complaints highlight a potential risk for traders who may find it challenging to access their funds when needed.

One notable case involved a trader who deposited $5,000 but faced repeated delays in accessing his funds. Despite multiple attempts to contact customer support, the trader reported a lack of effective communication and resolution. Such experiences can erode trust and confidence in the broker.

Platform and Execution

TNFX provides access to the popular MetaTrader 4 and MetaTrader 5 platforms, which are well-regarded for their user-friendly interfaces and extensive features. However, the overall performance and stability of the platform are crucial for a positive trading experience.

Traders have reported varying levels of order execution quality, with some experiencing slippage during high volatility periods. While slippage is common in the forex market, excessive slippage or frequent order rejections could indicate underlying issues with the broker's execution capabilities.

Risk Assessment

Using TNFX carries inherent risks that traders should be aware of. The following risk assessment summarizes key risk areas associated with trading on this platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Limited protection under tier-3 regulation. |

| Withdrawal Risk | Medium | Complaints regarding withdrawal delays and issues. |

| Trading Cost Transparency | Medium | Potential hidden fees and unclear cost structure. |

| Platform Stability | Medium | Reports of slippage and execution issues. |

To mitigate these risks, traders should consider starting with a smaller deposit, thoroughly reviewing the fee structure, and maintaining realistic expectations regarding trading outcomes.

Conclusion and Recommendations

Based on the comprehensive analysis of TNFX, it is clear that while the broker offers some attractive features, such as competitive spreads and a variety of account types, there are significant concerns regarding its regulatory status and customer experiences. The lack of robust oversight from a top-tier regulatory authority raises red flags about the safety of client funds and the overall reliability of the broker.

Given the mixed reviews and reports of withdrawal issues, potential traders should exercise caution when considering TNFX as their broker. It is advisable to explore alternative options that are regulated by more reputable authorities and have a proven track record of positive customer experiences.

For traders seeking reliable alternatives, consider brokers such as FP Markets, OANDA, or IG, which are known for their strong regulatory frameworks and positive user feedback. Ultimately, the decision to trade with TNFX should be made with careful consideration of the associated risks and a thorough understanding of the broker's operational practices.

Is TNFX a scam, or is it legit?

The latest exposure and evaluation content of TNFX brokers.

TNFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TNFX latest industry rating score is 3.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.