TNFX Review 2025: Everything You Need to Know

Executive Summary

This TNFX review looks at a forex broker that works under Seychelles Financial Services Authority (FSA) rules. The broker faces big problems with its legal status in some areas. TNFX calls itself an ECN forex broker that offers complete trading tools, tech support, and advice services to both individual and business clients.

The broker gives leverage up to 1:400. It also supports many trading platforms and targets traders who want different trading tools and higher leverage ratios. However, TNFX faces serious claims of illegal work and fake activities in Middle Eastern areas, which hurts its reputation badly. Reports show that the broker serves clients who want varied trading tools. Still, clear information about account conditions and fee structures stays limited.

Key features include support for many platforms and high leverage offers. Potential users should think carefully about the rule concerns and limited clear information in account details before making any choices.

Important Disclaimer

Regulatory Status Varies by Region: TNFX's rule standing is very different across different areas. The broker claims rules under the Seychelles Financial Services Authority, but serious claims of illegal work in Middle Eastern markets have been reported by different sources.

This review uses public information and user feedback that was available when we wrote it. The review may be limited by how complete and accurate the available data is. Potential traders should check all claims and rule status on their own before working with this broker.

Rating Framework

Broker Overview

TNFX works as an ECN forex broker with headquarters in the Middle East. Specific founding details stay unclear from available sources. The company positions itself as a complete trading solutions provider that offers services to both individual retail traders and institutional business clients. Public information shows that TNFX focuses mainly on forex and CFD trading, putting emphasis on tech support and advice services as key differences in their service offering.

The broker's business model centers on giving access to many trading platforms. It also maintains high leverage ratios to attract traders who seek flexible trading conditions. TNFX claims to serve clients around the world, though rule challenges in certain areas have created big operational problems. The company emphasizes its ECN model, which suggests direct market access and competitive pricing structures, though specific details about execution methods and liquidity providers stay limited in available documentation.

TNFX holds licensing from the Seychelles Financial Services Authority (FSA) for rule oversight. This provides basic rule framework but may not offer the same level of investor protection as major financial centers. The broker supports various asset classes including foreign exchange pairs and other financial instruments, though complete details about the full range of available trading products are not extensively documented in accessible sources. This TNFX review notes that while the broker offers many trading platforms, specific platform names and detailed features require further investigation from potential users.

Regulatory Jurisdiction: TNFX operates under Seychelles Financial Services Authority (FSA) licensing. This provides basic rule oversight though with limited investor protection compared to major financial centers.

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and related fees is not detailed in available sources. This requires direct inquiry with the broker.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in accessible documentation. This creates transparency concerns for potential clients.

Bonus and Promotions: Current promotional offerings, welcome bonuses, or ongoing incentive programs are not detailed in available public information.

Tradeable Assets: The broker offers forex trading and additional financial instruments. Complete asset lists and specific market coverage details require further verification.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not clearly provided in available sources. This limits cost comparison capabilities.

Leverage Ratios: Maximum leverage reaches 1:400. This positions TNFX among higher-leverage brokers in the market.

Platform Options: Multiple trading platforms are supported. Specific platform names, features, and compatibility details are not extensively documented.

Geographic Restrictions: Operations in Middle Eastern regions face legal challenges and claims of illegitimate activities.

Customer Support Languages: Specific language support details are not provided in available documentation.

This TNFX review highlights significant information gaps. Potential traders should address these through direct broker contact before account opening.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

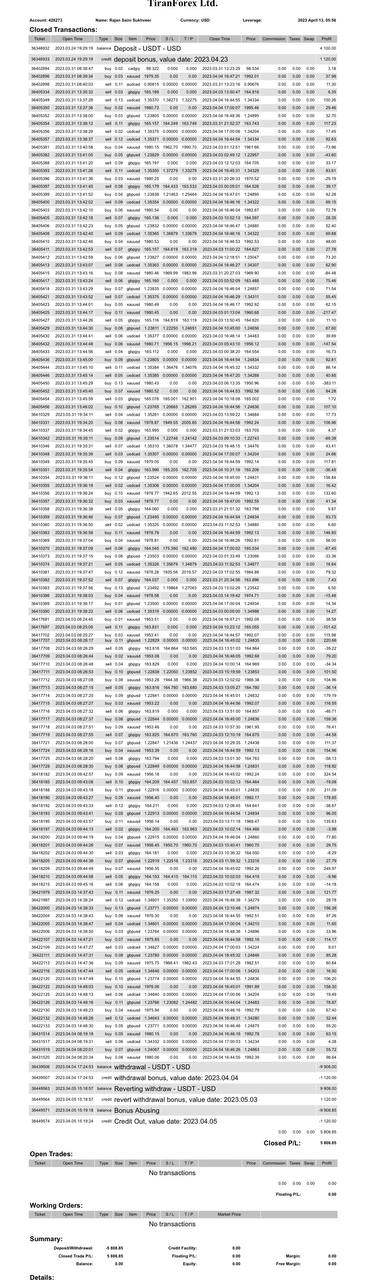

The account conditions evaluation for TNFX shows concerning transparency issues. These significantly impact the overall assessment. Available sources do not provide complete details about account types, their specific features, or the differences between various account tiers. This lack of transparency makes it extremely difficult for potential traders to make informed decisions about which account type might suit their trading needs and financial capabilities.

Minimum deposit requirements remain unspecified across available documentation. This creates uncertainty for traders attempting to budget for account opening. The absence of clear information about account opening procedures, required documentation, and verification timelines further complicates the evaluation process. Additionally, specialized account options such as Islamic accounts, which are crucial for certain trader demographics, are not mentioned in accessible sources.

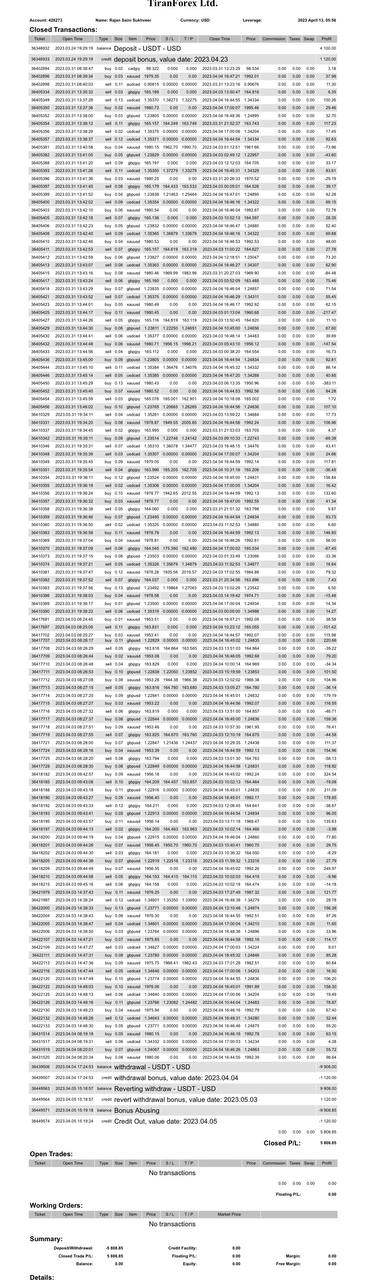

The fee structure transparency is particularly problematic. Limited information exists about account maintenance fees, inactivity charges, or other potential costs that could affect long-term trading profitability. Without clear cost breakdowns, traders cannot accurately assess the total cost of trading with TNFX compared to other brokers in the market.

This TNFX review emphasizes that the lack of detailed account information significantly undermines trader confidence. It also hurts decision-making capabilities, contributing to the below-average rating in this category.

TNFX demonstrates strength in providing multiple trading platforms and tools. Specific details about platform quality and functionality remain limited in available sources. The broker's commitment to supporting various trading platforms suggests an understanding of trader preferences for platform flexibility and choice, which is particularly valuable for traders with specific technical requirements or platform preferences.

The availability of multiple trading tools indicates TNFX's effort to serve both novice and experienced traders. The specific quality, reliability, and comprehensiveness of these tools require further investigation. Advanced trading features, analytical capabilities, and automated trading support are mentioned but not detailed extensively in accessible documentation.

Research and analysis resources, which are crucial for informed trading decisions, are not comprehensively detailed in available sources. The absence of information about market analysis, economic calendars, trading signals, or educational resources limits the ability to fully assess the broker's support for trader development and market understanding.

However, the broker's emphasis on technological support and the provision of multiple platform options demonstrates a positive commitment to trader tools and resources. This justifies a good rating despite information limitations.

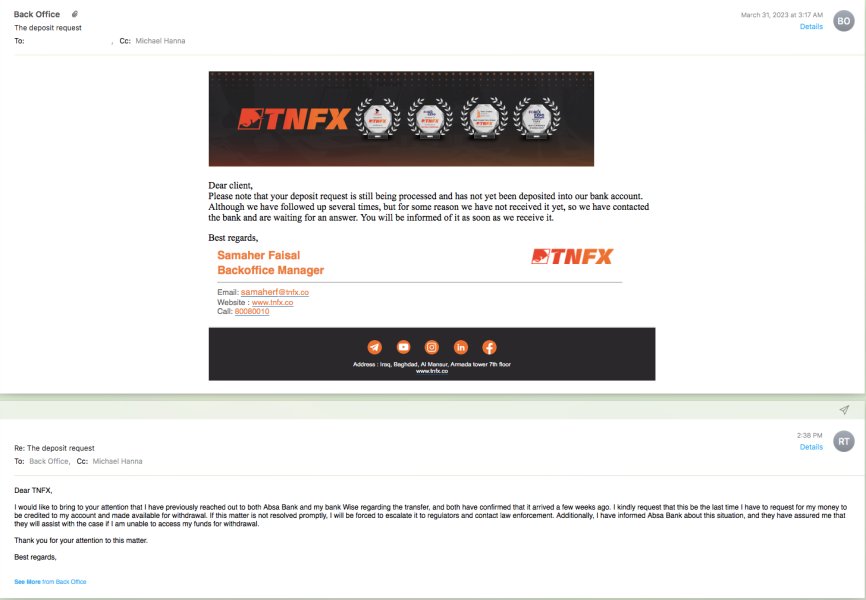

Customer Service and Support Analysis (5/10)

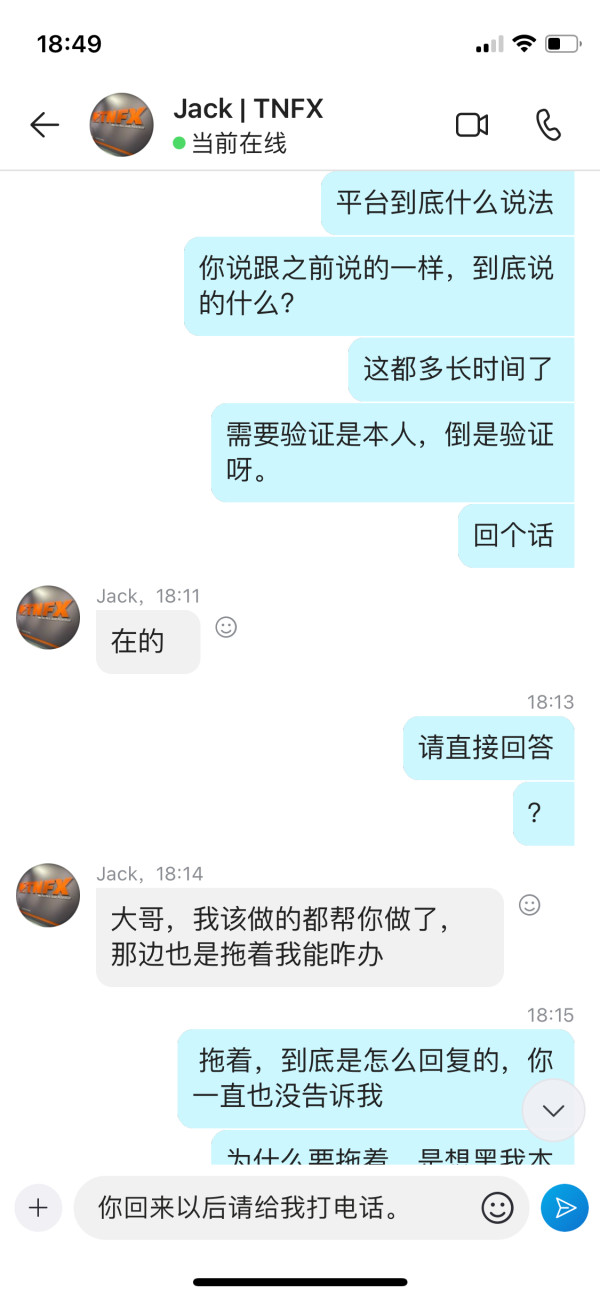

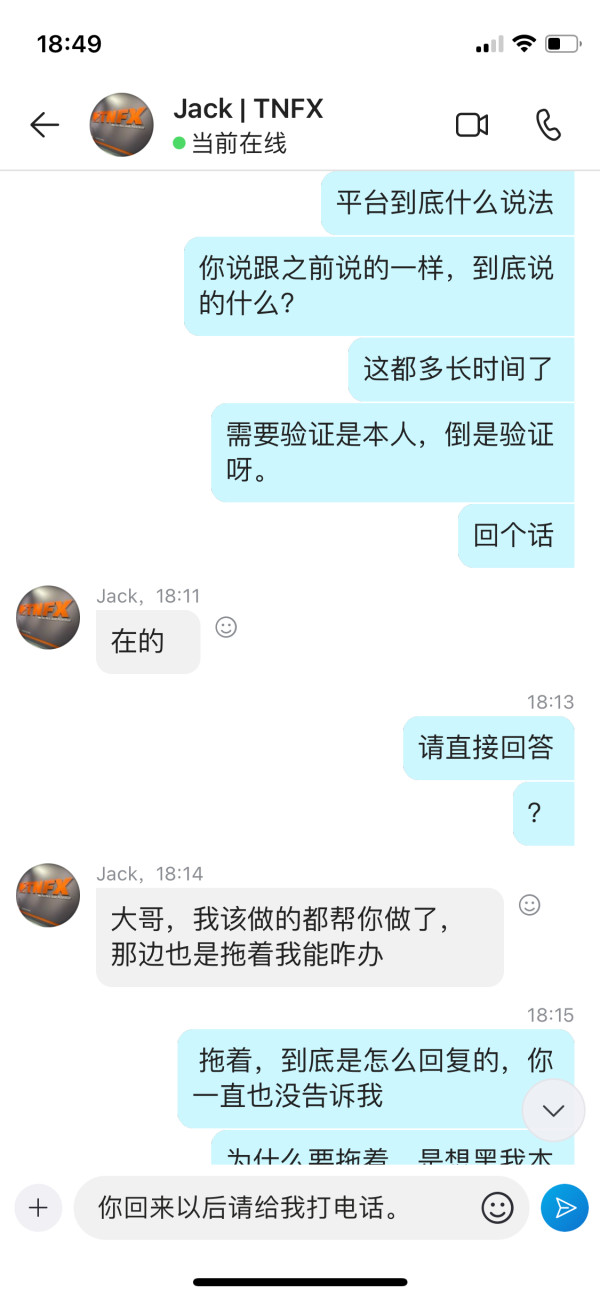

Customer service evaluation for TNFX is significantly hampered by limited available information about support channels, availability, and service quality. The absence of detailed information about customer support methods, including phone, email, live chat availability, or response time expectations, creates uncertainty about the level of support traders can expect.

Language support details are not specified in available sources. This is particularly important for international brokers serving diverse client bases. The lack of information about support hours, timezone coverage, or regional support availability further complicates the assessment of service accessibility for global clients.

User feedback regarding customer service experiences is not extensively documented in available sources. This limits the ability to assess real-world service quality, problem resolution effectiveness, or overall client satisfaction with support interactions. Without concrete user testimonials or service quality metrics, the evaluation relies primarily on the absence of detailed service information rather than positive or negative performance indicators.

The average rating reflects the uncertainty created by limited information rather than definitively poor service. The lack of transparency about support capabilities is concerning for potential clients who may require assistance.

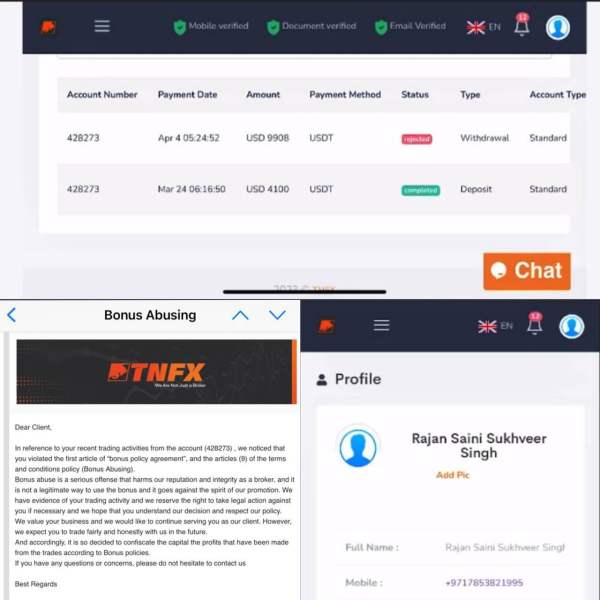

Trading Experience Analysis (6/10)

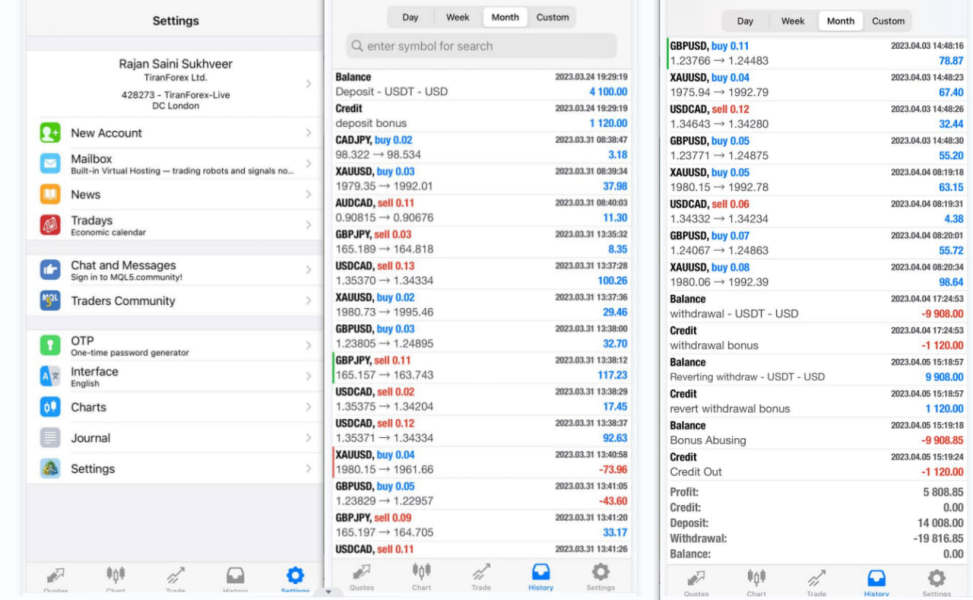

The trading experience assessment for TNFX shows moderate positive indicators despite limited detailed information about platform performance and execution quality. The broker's support for multiple trading platforms suggests flexibility in trading environment choices, which can enhance user experience for traders with specific platform preferences or technical requirements.

Platform stability, execution speed, and order processing quality are not extensively detailed in available user feedback. This limits the ability to assess real-world trading performance. Information about slippage rates, requote frequency, or execution statistics that would provide concrete performance metrics is not available in accessible sources.

The high leverage offering of up to 1:400 provides trading flexibility for experienced traders. This also increases risk exposure and requires careful risk management. The availability of various trading instruments suggests reasonable market access, though specific asset coverage and market depth details require further verification.

Mobile trading capabilities, platform compatibility across devices, and user interface quality are not comprehensively covered in available documentation. The above-average rating reflects the positive aspects of platform variety and leverage options while acknowledging the limitations in detailed performance assessment.

This TNFX review notes that while basic trading infrastructure appears adequate, comprehensive performance evaluation requires additional user feedback and detailed platform testing.

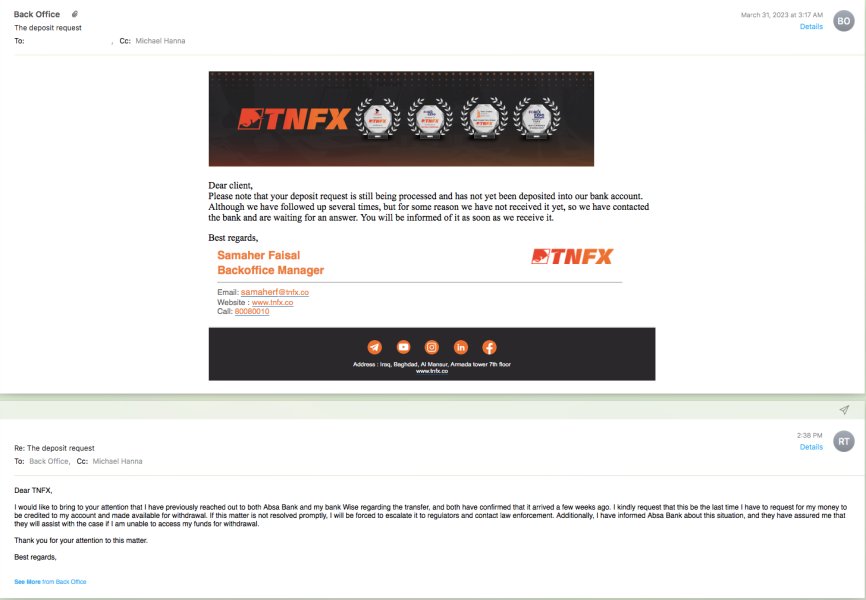

Trustworthiness Analysis (3/10)

Trustworthiness represents the most significant concern in this TNFX evaluation. Serious claims and rule challenges severely impact the broker's credibility. The primary rule license from Seychelles Financial Services Authority provides basic oversight but lacks the comprehensive investor protection mechanisms available through major financial rule bodies.

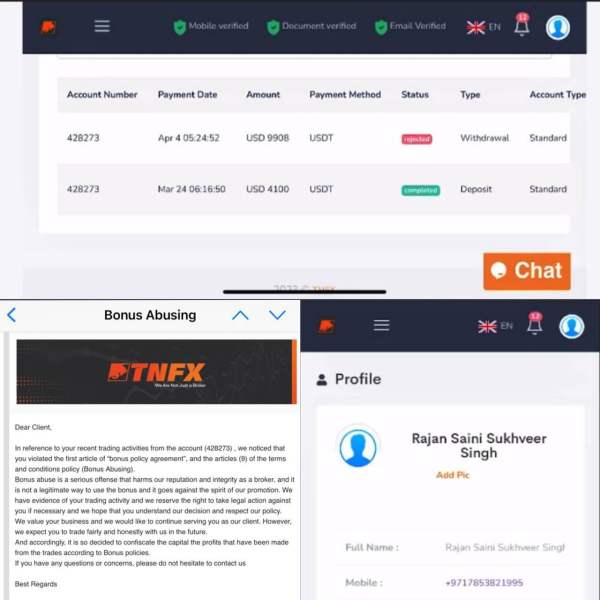

Most concerning are the reported claims of illegal operations and fraudulent activities in Middle Eastern regions. These create substantial red flags for potential clients. These claims, while not definitively proven, represent serious reputation and operational concerns that significantly impact trader confidence and safety considerations.

Fund security measures, client fund segregation policies, and investor compensation schemes are not detailed in available sources. This creates additional uncertainty about client asset protection. The absence of transparent information about company ownership, financial stability, or third-party auditing further complicates trustworthiness assessment.

The broker's handling of negative claims and transparency in addressing rule concerns is not extensively documented. This limits the ability to assess how the company manages reputation and compliance issues. Without clear evidence of robust compliance procedures, transparent operations, or effective dispute resolution mechanisms, the trustworthiness rating remains significantly impacted.

User Experience Analysis (6/10)

User experience evaluation shows mixed results with an overall trust rating of 80/100 reported in some sources. Specific user feedback details are limited. This rating suggests generally acceptable user satisfaction levels, though the basis for this scoring and the sample size of user feedback is not clearly documented in available sources.

Interface design quality, platform navigation ease, and overall user-friendliness are not extensively detailed in accessible documentation. The registration and account verification process efficiency, which significantly impacts initial user experience, lacks specific information about timeframes, required documentation, or potential complications.

Funding operations experience, including deposit and withdrawal processing times, method availability, and associated fees, is not comprehensively covered in available sources. These operational aspects are crucial for overall user satisfaction and trading efficiency.

The broker's responsiveness to user concerns, platform updates, and feature improvements based on user feedback is not documented in accessible sources. Common user complaints or frequently praised features that would provide insight into real-world user experience are not detailed in available information.

The rating reflects the reported 80/100 trust score while acknowledging significant information gaps. These prevent a more comprehensive user experience assessment.

Conclusion

TNFX presents a complex profile as a forex broker offering high leverage ratios and multiple trading platforms while facing significant credibility challenges due to rule concerns and fraud claims in certain regions. The broker may appeal to traders seeking diverse trading tools and higher leverage options, but the serious trust and transparency issues cannot be overlooked.

The primary advantages include competitive leverage up to 1:400 and support for multiple trading platforms. This potentially serves traders with specific leverage and platform requirements. However, the significant disadvantages include lack of transparency in account conditions, limited information about costs and fees, and most critically, the serious claims of illegal operations that substantially impact trustworthiness.

Potential traders should exercise extreme caution and conduct thorough independent verification of all claims, rule status, and operational legitimacy before considering TNFX for their trading needs. The combination of limited transparency and serious rule concerns makes this broker unsuitable for risk-averse traders or those prioritizing security and rule protection.