Regarding the legitimacy of SupremeFX forex brokers, it provides FSA and WikiBit, .

Is SupremeFX safe?

Pros

Cons

Is SupremeFX markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Sun Capital Markets Ltd

Effective Date:

--Email Address of Licensed Institution:

sjezzini@supremefxtrading.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.supremefxtrading.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 4E, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+2484373177Licensed Institution Certified Documents:

Is Supreme FX A Scam?

Introduction

Supreme FX is an emerging player in the forex trading market, positioned as an offshore brokerage offering a variety of trading instruments, including forex, commodities, indices, and cryptocurrencies. As with any financial service provider, it is crucial for traders to conduct due diligence before committing their funds. The forex market is rife with both legitimate and fraudulent brokers, making it essential for traders to assess the credibility and safety of their chosen platforms. This article aims to provide a comprehensive evaluation of Supreme FX, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The analysis is based on a review of multiple sources, including regulatory filings, user feedback, and expert opinions.

Regulation and Legitimacy

When evaluating a forex broker, regulatory compliance is one of the most critical factors to consider. Supreme FX operates under the regulatory framework of the Seychelles Financial Services Authority (FSA). While being regulated is a positive sign, the FSA is classified as an offshore regulator, which raises questions about the robustness of its oversight compared to tier-one regulators like the FCA (UK), ASIC (Australia), or BaFin (Germany).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA Seychelles | SD 145 | Seychelles | Verified |

The importance of regulation lies in the protection it offers to traders. Regulated brokers are typically required to adhere to strict financial standards, including maintaining segregated accounts for client funds, providing negative balance protection, and participating in compensation schemes. However, Supreme FX is not licensed by any tier-one authority, which means that traders may not benefit from these critical protections. Furthermore, while the company is listed in the FSA's register of regulated entities, the lack of tier-one regulation may expose traders to potential risks, including issues related to fund withdrawals and overall transparency.

Company Background Investigation

Supreme FX was founded in 2023 and is operated by Sun Capital Markets Ltd, with its headquarters located in Seychelles and a secondary office in Saint Vincent and the Grenadines. The company's relatively young age in the market raises concerns about its stability and reliability. The management team consists of professionals with varying backgrounds in finance, but specific details about their qualifications and experience are limited.

Transparency is a key factor in evaluating a brokerage's credibility. Supreme FX provides basic information about its services, but it lacks comprehensive disclosures regarding its ownership structure and the backgrounds of its management team. This opacity may lead to skepticism among potential clients who prefer brokers with a clear and verifiable history.

In summary, while Supreme FX is regulated by the FSA, its offshore status and limited operational history may raise red flags for potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for traders looking to maximize their profitability. Supreme FX promotes a commission-free trading model, relying on spreads as its primary source of revenue. However, the specifics of its fee structure warrant further examination.

| Fee Type | Supreme FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The spread for major currency pairs starts at 1.2 pips, which is slightly higher than the industry average of 1.0 pips. While commission-free trading may seem appealing, traders should be cautious of potential hidden fees or unfavorable conditions that could affect their overall trading costs. Additionally, the lack of transparency regarding overnight interest charges could lead to unexpected costs for traders who hold positions overnight.

Overall, while the trading conditions at Supreme FX may appear competitive at first glance, the hidden costs and lack of clarity surrounding fees could be a concern for traders, particularly those with tight profit margins.

Customer Fund Security

The security of customer funds is paramount when selecting a forex broker. Supreme FX claims to implement measures to safeguard client funds, but the specifics of these measures require careful analysis. The company does not provide comprehensive details regarding the segregation of client funds or the presence of investor protection schemes.

In the event of financial difficulties or insolvency, the absence of a robust regulatory framework and investor protection could pose significant risks to clients' funds. Furthermore, there have been anecdotal reports of withdrawal issues from some users, raising concerns about the broker's reliability in managing client funds.

To summarize, while Supreme FX may have some basic security measures in place, the lack of detailed information about fund segregation and investor protection raises concerns about the overall safety of customer funds.

Customer Experience and Complaints

User feedback serves as a valuable indicator of a broker's reliability and service quality. Reviews of Supreme FX on platforms like Trustpilot reveal a mix of experiences, with some users praising the platform while others express dissatisfaction, particularly regarding withdrawal processes and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Mixed feedback |

| Customer Service Delays | Medium | Generally responsive |

| Account Verification | Low | Generally efficient |

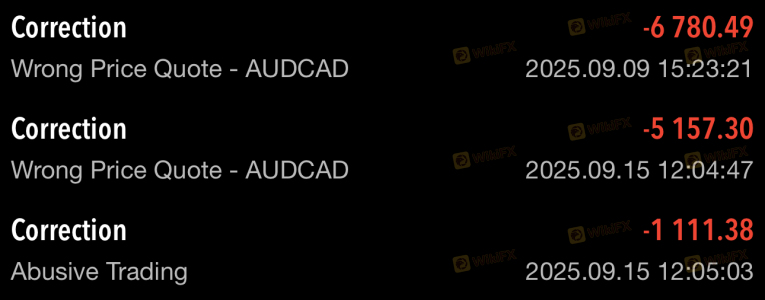

Common complaints include delays in processing withdrawals, which can be a significant red flag for potential investors. While some users report a smooth trading experience, the negative feedback regarding withdrawals raises concerns about the company's operational integrity.

One typical case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and a loss of trust in the broker. This highlights the importance of assessing a broker's withdrawal policies and responsiveness to customer inquiries.

Platform and Trade Execution

The trading platform is a crucial component of any forex trading experience. Supreme FX offers the widely-used MetaTrader 5 (MT5) platform, known for its robust features and user-friendly interface. However, the performance of the platform, including order execution quality and slippage, is essential for traders.

Users have reported generally positive experiences with the MT5 platform, citing its stability and ease of use. However, any signs of manipulation or high slippage rates should be scrutinized. While there have not been widespread reports of platform manipulation, traders should remain vigilant and monitor their execution quality.

Risk Assessment

Trading with Supreme FX carries inherent risks, particularly due to its offshore regulatory status and mixed user feedback.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack oversight. |

| Withdrawal Risk | Medium | Reports of delayed withdrawals raise concerns. |

| Transparency Risk | Medium | Limited information about management and fees. |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and practice trading strategies without financial exposure. Additionally, maintaining a cautious approach and only investing funds that one can afford to lose is advisable.

Conclusion and Recommendations

In conclusion, while Supreme FX is a regulated entity under the Seychelles FSA, its offshore status and mixed reviews raise significant concerns about its reliability and safety. The lack of tier-one regulation, combined with reports of withdrawal issues and limited transparency, suggests that traders should proceed with caution.

For those considering trading with Supreme FX, it may be wise to explore alternative brokers with stronger regulatory oversight and a proven track record of customer satisfaction. Some reliable options include brokers regulated by tier-one authorities like the FCA or ASIC, offering enhanced security and transparency.

Ultimately, thorough research and careful consideration of the risks involved are essential for any trader looking to navigate the forex market successfully.

Is SupremeFX a scam, or is it legit?

The latest exposure and evaluation content of SupremeFX brokers.

SupremeFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SupremeFX latest industry rating score is 4.35, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.35 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.