Regarding the legitimacy of Starling Gold forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Starling Gold safe?

Pros

Cons

Is Starling Gold markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

裕富資產管理有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港灣仔天樂里2-4號金豐商業大廈21樓Phone Number of Licensed Institution:

61226192Licensed Institution Certified Documents:

Is Starling Gold A Scam?

Introduction

Starling Gold is a Hong Kong-based forex broker that has been operational since 2017. It positions itself in the foreign exchange market by offering trading services primarily focused on precious metals, particularly gold and silver. As the forex market continues to grow, traders must exercise caution when selecting a broker, given the prevalence of scams and unreliable platforms that can jeopardize their investments. This article aims to provide a comprehensive analysis of Starling Gold's legitimacy and safety by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation is based on various online sources, user reviews, and regulatory information to form a well-rounded perspective on whether Starling Gold is a safe choice for traders.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its reliability and safety. Starling Gold claims to be regulated by the Hong Kong Gold Exchange (HKGX), which adds a layer of credibility to its operations. However, it is essential to scrutinize the details of this regulation to understand its implications fully.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong Gold Exchange (HKGX) | 234 | Hong Kong | Verified |

The Hong Kong Gold Exchange operates under a membership system that includes several brokers, and Starling Gold is listed as a member. While this regulation suggests that Starling Gold must adhere to certain operational standards, the effectiveness of the HKGX as a regulatory body can vary. Some reviews indicate that the exchange may not enforce regulations as stringently as other global regulatory authorities, which could potentially expose traders to risks. Furthermore, no significant negative regulatory disclosures have been reported against Starling Gold, which is a positive sign. However, traders should remain vigilant, as not all regulatory bodies offer the same level of protection.

Company Background Investigation

Starling Gold is owned by Yufu Asset Management Limited, a company registered in Hong Kong. Established in 2017, the broker is relatively new compared to many other players in the forex market. The management teams background and professional experience are critical factors in assessing the company's credibility. However, detailed information regarding the management team is scarce, which raises questions about transparency.

The company's operational history is also limited, as it has not yet faced significant regulatory scrutiny or legal challenges. This lack of a robust track record may be a red flag for potential investors who prefer to work with well-established firms. The transparency of Starling Golds operations and its willingness to disclose vital information about its management and ownership structure could significantly impact its reputation.

Trading Conditions Analysis

Starling Gold's trading conditions are another critical aspect to consider when evaluating its safety. The broker primarily focuses on trading gold and silver, which are often viewed as safe-haven assets. However, the overall cost structure and any hidden fees associated with trading need to be examined closely.

| Fee Type | Starling Gold | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Currently, specific details about spreads and commissions are not readily available, which may indicate a lack of transparency in its pricing structure. Traders have reported issues regarding the withdrawal of funds, suggesting that there may be hidden fees or complicated withdrawal processes that are not clearly communicated. This lack of clarity could lead to unexpected costs for traders, making it essential to approach trading with Starling Gold with caution.

Client Fund Safety

The safety of client funds is paramount when assessing a broker's reliability. Starling Gold claims to implement various measures to protect client funds, including fund segregation and investor protection policies. However, the effectiveness of these measures remains uncertain due to limited information available on their practices.

Traders should inquire about the specifics of how their funds are managed and whether they are held in segregated accounts to ensure that they are not mixed with the broker's operational funds. Additionally, it is crucial to understand whether Starling Gold offers negative balance protection, which safeguards traders from losing more than their initial investment. Unfortunately, there have been reports of difficulties in withdrawing funds, which raises concerns about the actual safety of client funds.

Customer Experience and Complaints

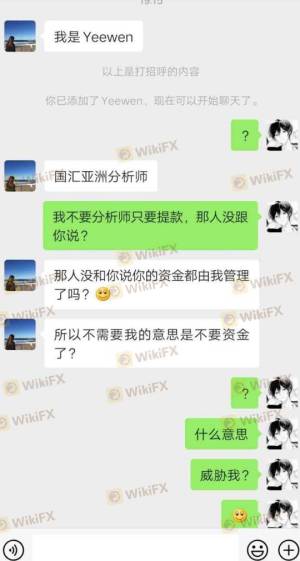

Customer feedback plays a vital role in assessing the overall reputation of a broker. Reviews of Starling Gold indicate a mix of experiences, with some users reporting difficulties in accessing their accounts and withdrawing funds. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Account Access Problems | Medium | Unresolved for weeks |

For instance, one user reported being unable to withdraw profits for nearly five months, highlighting a significant issue with the broker's operations. Such complaints can severely impact a broker's credibility and indicate potential operational weaknesses. The quality of customer service and the responsiveness of the support team are crucial factors for traders, and Starling Gold appears to have room for improvement in this area.

Platform and Execution

The trading platform offered by Starling Gold is another essential aspect to evaluate. The broker supports the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading features. However, reports of technical issues, such as slow loading times and execution delays, have surfaced, which could negatively affect trading performance.

The quality of order execution, including slippage and rejection rates, is critical for traders who rely on precise execution for their strategies. Any indications of platform manipulation or unfair practices would further raise concerns about the broker's integrity.

Risk Assessment

Using Starling Gold presents several risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited enforcement by HKGX |

| Fund Safety Risk | High | Reports of withdrawal issues |

| Transparency Risk | High | Lack of information on fees and management |

| Customer Service Risk | Medium | Slow response times to complaints |

To mitigate these risks, traders should conduct thorough research, maintain a cautious approach, and consider using smaller amounts for initial trades until they are comfortable with the broker's operations.

Conclusion and Recommendations

In conclusion, the evaluation of Starling Gold reveals several concerning aspects. While it is regulated by the Hong Kong Gold Exchange, the effectiveness of this regulation is questionable, and the broker has faced complaints regarding fund withdrawals and customer service. The lack of transparency about trading conditions and management further complicates the assessment of whether Starling Gold is safe.

Traders should exercise caution when considering Starling Gold as their forex broker. If you are a novice trader or someone who values transparency and customer service, it may be wise to explore alternative options. Reliable brokers with a strong regulatory framework, transparent fee structures, and positive customer feedback are recommended for those looking to trade safely in the forex market.

In summary, while Starling Gold may not be outright fraudulent, there are enough red flags to warrant significant caution. Always prioritize safety and conduct thorough research before engaging with any forex broker.

Is Starling Gold a scam, or is it legit?

The latest exposure and evaluation content of Starling Gold brokers.

Starling Gold Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Starling Gold latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.