Regarding the legitimacy of SP MARKETS forex brokers, it provides FSPR and WikiBit, (also has a graphic survey regarding security).

Is SP MARKETS safe?

Business

License

Is SP MARKETS markets regulated?

The regulatory license is the strongest proof.

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

RevokedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

SECURITY PLACEMENTS HOLDING LIMITED

Effective Date:

2017-03-27Email Address of Licensed Institution:

faiznz@hotmail.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2019-11-08Address of Licensed Institution:

18/39 Apollo Drive Rosedale Auckland 0632Phone Number of Licensed Institution:

021180953Licensed Institution Certified Documents:

Is SP Markets A Scam?

Introduction

SP Markets, a forex broker based in New Zealand, positions itself as a platform for trading various financial instruments, including foreign exchange, metals, commodities, and indices. As the forex market continues to grow, traders are increasingly faced with a plethora of options, making it crucial to evaluate brokers carefully. The potential for scams in the trading industry remains high, and choosing an unregulated broker can lead to significant financial loss. This article aims to investigate whether SP Markets is a safe trading option or if it poses risks to potential investors. The evaluation is based on a comprehensive review of regulatory status, company background, trading conditions, client safety, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is critical in determining its legitimacy and safety for traders. SP Markets claims to be registered with the Financial Service Providers Register (FSPR) in New Zealand. However, recent investigations reveal that its regulatory license has been revoked, raising red flags about its operational legitimacy. Below is a summary of the regulatory information regarding SP Markets:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 548547 | New Zealand | Revoked |

The revocation of SP Markets' license indicates a lack of oversight, which is essential for protecting traders' interests. The absence of regulation means that there is no governing body to address disputes or ensure compliance with industry standards. This situation significantly increases the risk for traders, as they may not have any recourse in case of issues arising from their trading activities. Overall, the regulatory quality of SP Markets is questionable, and its history of compliance is non-existent, making it imperative for potential clients to exercise caution.

Company Background Investigation

SP Markets was established in 2017 and is operated by Security Placements Limited. While the company has been in existence for several years, the lack of transparency regarding its ownership structure and management team raises concerns. The absence of detailed information about the management's qualifications and experience diminishes the broker's credibility. Furthermore, the companys website has faced accessibility issues, which can lead to doubts about its operational stability. Transparency is a crucial factor in establishing trust, and SP Markets has not demonstrated a high level of openness regarding its operations or management, contributing to the overall uncertainty surrounding its legitimacy.

Trading Conditions Analysis

Understanding the trading conditions provided by a broker is vital for assessing its attractiveness to traders. SP Markets offers a minimum deposit requirement of $100, which is relatively low compared to other brokers. However, the lack of clarity regarding spreads, commissions, and other fees raises concerns about the overall cost structure. Below is a comparison of core trading costs:

| Fee Type | SP Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific information on trading costs can lead to unexpected expenses for traders, making it difficult to gauge the true cost of trading with SP Markets. This lack of transparency is a significant drawback, as it can affect a trader's profitability and overall trading experience.

Client Funds Safety

The safety of client funds is paramount when selecting a forex broker. SP Markets claims to implement measures for fund safety; however, the lack of regulatory oversight raises questions about the effectiveness of these measures. The broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies. Without these critical safety nets, traders risk losing their investments without any recourse. Moreover, there have been no reported incidents of fund security breaches, but the absence of a regulatory body to oversee transactions leaves clients vulnerable to potential risks.

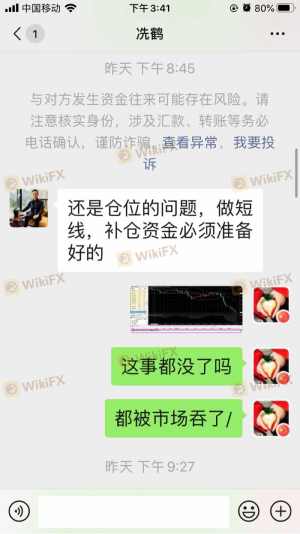

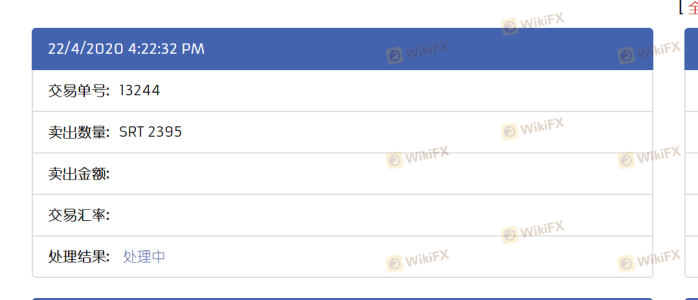

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of SP Markets indicate a mix of experiences, with some users reporting difficulties in accessing their accounts and withdrawal issues. Common complaints include slow customer service responses and a lack of transparency in communication. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Account Access Issues | Medium | Limited Support |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and a loss of trust in the broker. This pattern of complaints suggests that while some traders may have had positive experiences, the overall sentiment leans towards caution.

Platform and Trade Execution

The performance of the trading platform is another crucial factor in determining a broker's reliability. SP Markets utilizes the widely recognized MetaTrader 4 platform, known for its user-friendly interface and advanced trading tools. However, reports of execution issues, such as slippage and order rejections, have emerged. Traders have expressed concerns about the potential for platform manipulation, which can significantly impact their trading outcomes.

Risk Assessment

Using an unregulated broker like SP Markets presents several risks. Below is a summary of key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for traders. |

| Fund Safety Risk | High | Lack of clear fund protection measures. |

| Transparency Risk | Medium | Limited information about fees and operations. |

To mitigate these risks, traders are advised to conduct thorough research, avoid investing more than they can afford to lose, and consider using regulated brokers that offer better protections.

Conclusion and Recommendations

In conclusion, the investigation into SP Markets raises significant concerns regarding its legitimacy and safety for traders. The absence of regulation, coupled with a lack of transparency and mixed customer experiences, suggests that SP Markets may not be a safe option for trading. Potential investors should exercise extreme caution and consider alternative, regulated brokers that provide better security for their funds and a more transparent trading environment. For those seeking reliable trading options, brokers with established regulatory oversight and positive customer feedback should be prioritized to ensure a safer trading experience.

Overall, the question "Is SP Markets safe?" remains unanswered in a positive light, highlighting the need for traders to be vigilant in their broker selection process.

Is SP MARKETS a scam, or is it legit?

The latest exposure and evaluation content of SP MARKETS brokers.

SP MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SP MARKETS latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.